Gas Severance Tax Return - Louisiana Department of Revenue

Gas Severance Tax Return - Louisiana Department of Revenue

Gas Severance Tax Return - Louisiana Department of Revenue

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

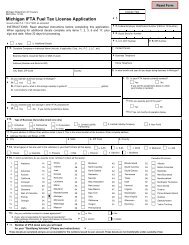

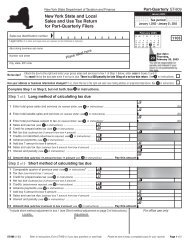

R-9036-L (7/05)<strong>Gas</strong> <strong>Severance</strong> <strong>Tax</strong> <strong>Return</strong> - Lease DetailG-1d<strong>Tax</strong>payer Services Division<strong>Severance</strong> <strong>Tax</strong>es SectionP. O. Box 201Baton Rouge, LA 70821-0201Page _______ <strong>of</strong> _______File original <strong>of</strong> this return only.5903Reporting company nameReporting company address, city, state, ZIPReporting company number <strong>Revenue</strong> Account Number<strong>Tax</strong>able PeriodThis return is due by the 25th day <strong>of</strong> the second month following the taxable period and becomesdelinquent on the first day thereafter. If the due date falls on a weekend or holiday, the return is due on thenext business day and becomes delinquent on the first day thereafter. See special instructions for additionalfiling requirements for taxpayers with liabilities equal to or in excess <strong>of</strong> $15,000. Report allvolumes in MCF (15.025 pounds absolute pressure and 60°F).Field nameProducer nameLease and Well namePlant nameConservation codesParish Field Producer LeasePlantcode<strong>Tax</strong>payercode<strong>Tax</strong>ratecodeGross gas productionExclusionsMCF Code MCF Code MCF Code MCFNet taxable MCF<strong>Tax</strong> and interestTotals (to be entered on last page <strong>of</strong> returnif more than one page is used)

R-9036-L (7/05)Instructions for Form Sev. G-1dReporting company name and addressSelf-explanatory.<strong>Revenue</strong> Account NumberThis is your 10-digit <strong>Louisiana</strong> <strong>Tax</strong> NumberReporting company numberProducer code number assigned by the <strong>Louisiana</strong> Office <strong>of</strong>Conservation, or number assigned by the <strong>Department</strong> <strong>of</strong><strong>Revenue</strong>, <strong>Severance</strong> <strong>Tax</strong> Division, to taxpayers who are notproducers.<strong>Tax</strong>able periodPeriod for which tax is due. Volumes and taxes for morethan one taxable period are not to be combined; they areto be reported separately.Field, producer, lease, plant namesSelf-explanatory.Parish, field, producer, lease codesCodes assigned by the <strong>Louisiana</strong> Office <strong>of</strong> Conservation.Plant codeCode assigned by the <strong>Louisiana</strong> Office <strong>of</strong> Conservation.<strong>Tax</strong>payer codeProducer code assigned by the <strong>Louisiana</strong> Office <strong>of</strong>Conservation, or number assigned by the <strong>Department</strong> <strong>of</strong><strong>Revenue</strong> to taxpayers who are not producers.<strong>Tax</strong> rate codeCode assigned by the <strong>Department</strong> <strong>of</strong> <strong>Revenue</strong> to designateapplicable tax rate per MCF by category. (See <strong>Tax</strong> RateCodes at right.)Gross gas productionProducer must report all production for each property asreported on the OGP to the <strong>Louisiana</strong> Office <strong>of</strong>Conservation. Responsible taxpayers, if other than producer,must report gross volumes for which they are to account.Exclusions<strong>Gas</strong> volume lawfully exempt from tax.1. Code: Code assigned by the <strong>Department</strong> <strong>of</strong><strong>Revenue</strong> at right.2. MCF: Volume <strong>of</strong> gas claimed for preceding exclusioncode.Net taxable MCFet taxable MCFGross production plus and/or minus exclusions reported.<strong>Tax</strong> and interestNet taxable MCF times applicable tax rate equals amount<strong>of</strong> tax due. Delinquent penalty is 5 percent <strong>of</strong> tax liability foreach 30 days or fraction there<strong>of</strong>, not to exceed 25 percent.Interest accrues at the rate <strong>of</strong> 1.25 percent per month onunpaid tax from due date to date <strong>of</strong> payment. <strong>Tax</strong>, penalty,and interest must be reported as separate items.TotalsTo be entered only on last page <strong>of</strong> G-1d if multiple pagesare used.Special Instructions1. In any case where a taxpayer’s average monthly tax liabilityfor the preceding calendar year equals or exceeds$15,000, payment must be made by one <strong>of</strong> the followingmethods:a. By electronic funds transfer to be received by the<strong>Department</strong> <strong>of</strong> <strong>Revenue</strong> on or before the twenty-fifthday <strong>of</strong> the second month following the month towhich the tax is applicable. A separate transfer mustbe made for each return.b. By delivery <strong>of</strong> the tax return and full payment ininvestible funds <strong>of</strong> the amount shown on the return,in person, or by courier to the <strong>Department</strong> <strong>of</strong><strong>Revenue</strong> on or before the twenty-fifth day <strong>of</strong> the secondmonth following the month to which the tax isapplicable. Such payment must be received beforethe end <strong>of</strong> the business day.2. A taxpayer who is not complying with the provisions <strong>of</strong><strong>Louisiana</strong> Revised Statute 47:1519 will be considereddelinquent and will be subject to penalties and interestas provided in R.S. 47:1601 and 1602.NoteA parish summary (G-1s) must accompany this return.<strong>Tax</strong> Rate Codes<strong>Tax</strong>able gas categoryFull rate – capable gas7/01 – 6/027/02 – 6/037/03 – 6/047/04 – 6/057/05 – 6/06<strong>Tax</strong> rateper MCF19.9¢12.2¢17.1¢20.8¢25.2¢<strong>Tax</strong> ratecodeIncapable rate – oil well gas 3¢ 2Incapable rate – gas well gas 1.3¢ 3Penalty and interest — 6Approved contracts at less than52¢ per MCFDeep well. Production from a welldrilled to a true vertical depth <strong>of</strong>more than 15,000 feet and commencesafter July 31, 1994. This wellmust be approved as a deep well bythe Office <strong>of</strong> Conservation.Horizontal well. Production from anapproved horizontal well or horizontallyrecompleted well from whichproduction commences after July 31,1994. This well must be approved bythe Office <strong>of</strong> Conservation.Inactive well. Production from anapproved well that has been inactivefor two or more years or having 30days or less <strong>of</strong> production during thelast two years. Application must bemade to the Office <strong>of</strong> Conservationprior to production, during the periodbeginning July 31, 1994, and endingJune 30, 2000, for a 5 year severancetax exemption; for the period beginningJuly 1, 2002, and ending December31, 2004 for a 2 year severance taxexemption, and for the period beginningJanuary 1, 2005 and ending June30, 2010, for a 5 year severance taxexemption. This well must beapproved by the Office <strong>of</strong>Conservation.Tertiary recovery projects approvedby the Office <strong>of</strong> Conservation.17¢ 7— D— H— I— TExclusion CodesNature <strong>of</strong> exclusionInjected into the formation in the State <strong>of</strong><strong>Louisiana</strong>Produced without the State <strong>of</strong> <strong>Louisiana</strong> andwhich has been injected into the earth in theState <strong>of</strong> <strong>Louisiana</strong>Produced Water InjectionIncentive <strong>Tax</strong> Rate Code Legend–Approved Projects Only<strong>Tax</strong>able gas categoryProduced water – Full rate7/01 – 6/027/02 – 6/037/03 – 6/047/04 – 6/057/05 – 6/06Produced water – Incapable rate –Oil well gas.Produced water – Incapable rate –<strong>Gas</strong> well gas.<strong>Tax</strong> rateper MCF15.9¢9.8¢13.7¢16.6¢20.2¢ExclusioncodeVented or flared from oil and gas wells 3Used for fuel in connection with the operationand development for the production <strong>of</strong>oil or gas in the field where producedUsed in the manufacture <strong>of</strong> carbon black 7United States Government royalty 8<strong>Gas</strong> to be accounted for by working interestowner or purchaser or others (Identify taxpayerin taxpayer code column.)Measurement difference (not to includeover/short delivery accounts)<strong>Gas</strong> used for the production <strong>of</strong> naturalresources in the State <strong>of</strong> <strong>Louisiana</strong>1249XN<strong>Tax</strong> ratecode1P2.4¢ 2P1.04¢ 3P