slides - NABE

slides - NABE

slides - NABE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

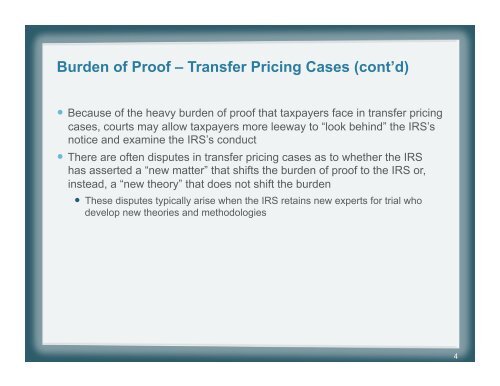

Burden of Proof – Transfer Pricing Cases (cont’d) Because of the heavy burden of proof that taxpayers face in transfer pricingcases, courts may allow taxpayers more leeway to “look behind” the IRS’snotice and examine the IRS’s conduct There are often disputes in transfer pricing cases as to whether the IRShas asserted a “new matter” that shifts the burden of proof to the IRS or,instead, a “new theory” that does not shift the burden These disputes typically arise when the IRS retains new experts for trial whodevelop new theories and methodologies4