Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

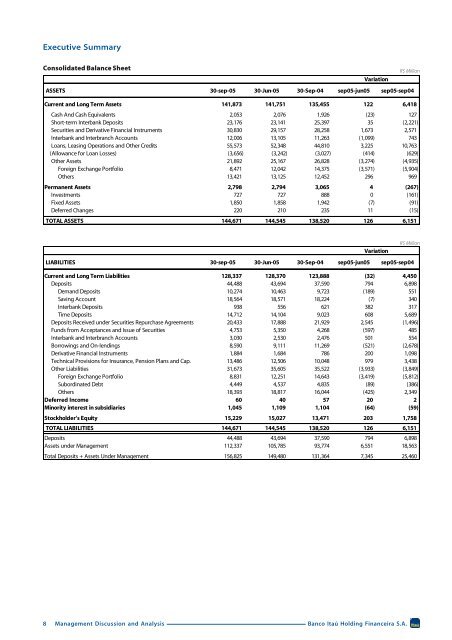

Executive SummaryConsolidated Balance SheetVariationASSETS 30-sep-05 30-Jun-05 30-Sep-04 sep05-jun05 sep05-sep04R$ MillionCurrent and Long Term Assets 141,873 141,751 135,455 122 6,418Cash And Cash Equivalents 2,053 2,076 1,926 (23) 127Short-term Interbank Deposits 23,176 23,141 25,397 35 (2,221)Securities and Derivative Financial Instruments 30,830 29,157 28,258 1,673 2,571Interbank and Interbranch Accounts 12,006 13,105 11,263 (1,099) 743Loans, Leasing Operations and Other Credits 55,573 52,348 44,810 3,225 10,763(Allowance for Loan Losses) (3,656) (3,242) (3,027) (414) (629)Other Assets 21,892 25,167 26,828 (3,274) (4,935)Foreign Exchange Portfolio 8,471 12,042 14,375 (3,571) (5,904)Others 13,421 13,125 12,452 296 969Permanent Assets 2,798 2,794 3,065 4 (267)Investments 727 727 888 0 (161)Fixed Assets 1,850 1,858 1,942 (7) (91)Deferred Changes 220 210 235 11 (15)TOTAL ASSETS 144,671 144,545 138,520 126 6,151VariationLIABILITIES 30-sep-05 30-Jun-05 30-Sep-04 sep05-jun05 sep05-sep04R$ MillionCurrent and Long Term Liabilities 128,337 128,370 123,888 (32) 4,450Deposits 44,488 43,694 37,590 794 6,898Demand Deposits 10,274 10,463 9,723 (189) 551Saving Account 18,564 18,571 18,224 (7) 340Interbank Deposits 938 556 621 382 317Time Deposits 14,712 14,104 9,023 608 5,689Deposits Received under Securities Repurchase Agreements 20,433 17,888 21,929 2,545 (1,496)Funds from Acceptances and Issue of Securities 4,753 5,350 4,268 (597) 485Interbank and Interbranch Accounts 3,030 2,530 2,476 501 554Borrowings and On-lendings 8,590 9,111 11,269 (521) (2,678)Derivative Financial Instruments 1,884 1,684 786 200 1,098Technical Provisions for Insurance, Pension Plans and Cap. 13,486 12,506 10,048 979 3,438Other Liabilities 31,673 35,605 35,522 (3,933) (3,849)Foreign Exchange Portfolio 8,831 12,251 14,643 (3,419) (5,812)Subordinated Debt 4,449 4,537 4,835 (89) (386)Others 18,393 18,817 16,044 (425) 2,349Deferred Income 60 40 57 20 2Minority interest in subsidiaries 1,045 1,109 1,104 (64) (59)Stockholder's Equity 15,229 15,027 13,471 203 1,758TOTAL LIABILITIES 144,671 144,545 138,520 126 6,151Deposits 44,488 43,694 37,590 794 6,898Assets under <strong>Management</strong> 112,337 105,785 93,774 6,551 18,563Total Deposits + Assets Under <strong>Management</strong> 156,825 149,480 131,364 7,345 25,4608 <strong>Management</strong> <strong>Discussion</strong> and <strong>Analysis</strong>Banco Itaú Holding Financeira S.A.