Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf) Quarterly Management Discussion & Analysis (MDA300905.pdf)

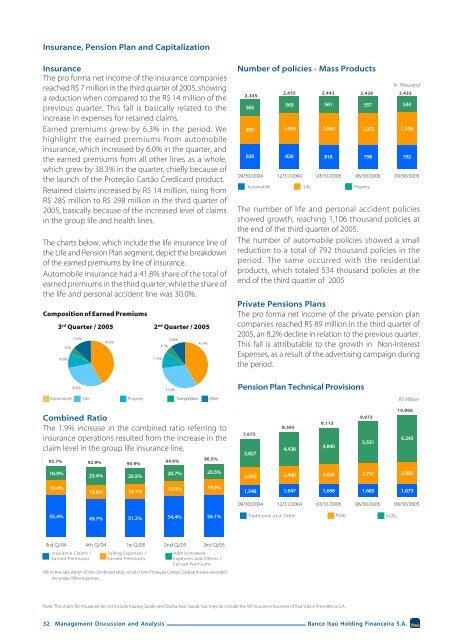

Insurance, Pension Plan and CapitalizationInsuranceThe pro forma net income of the insurance companiesreached R$ 7 million in the third quarter of 2005, showinga reduction when compared to the R$ 14 million of theprevious quarter. This fall is basically related to theincrease in expenses for retained claims.Earned premiums grew by 6.3% in the period. Wehighlight the earned premiums from automobileinsurance, which increased by 6.0% in the quarter, andthe earned premiums from all other lines as a whole,which grew by 38.3% in the quarter, chiefly because ofthe launch of the Proteção Cartão Credicard product.Retained claims increased by R$ 14 million, rising fromR$ 285 million to R$ 298 million in the third quarter of2005, basically because of the increased level of claimsin the group life and health lines.The charts below, which include the life insurance line ofthe Life and Pension Plan segment, depict the breakdownof the earned premiums by line of insurance.Automobile insurance had a 41.8% share of the total ofearned premiums in the third quarter, while the share ofthe life and personal accident line was 30.0%.Composition of Earned Premiums3 rd Quarter / 200510.9%3.9%13.4%41.8%2 nd Quarter / 200511.9%4.7%10.6%41.4%Number of policies - Mass Products2,345565569In Thousand561 557 534953 1,039 1,063 1,072 1,106828 826 818 798 79209/30/2004 12/31/2004 03/31/2005 06/30/2005 09/30/2005Automobile2,435Life2,4432,428 2,433PropertyThe number of life and personal accident policiesshowed growth, reaching 1,106 thousand policies atthe end of the third quarter of 2005.The number of automobile policies showed a smallreduction to a total of 792 thousand policies in theperiod. The same occurred with the residentialproducts, which totaled 534 thousand policies at theend of the third quarter of 2005Private Pensions PlansThe pro forma net income of the private pension plancompanies reached R$ 89 million in the third quarter of2005, an 8.2% decline in relation to the previous quarter.This fall is attributable to the growth in Non-InterestExpenses, as a result of the advertising campaign duringthe period.30.0%31.4%Pension Plan Technical ProvisionsAutomobile Life Property Transportation OtherCombined RatioThe 1.9% increase in the combined ratio referring toinsurance operations resulted from the increase in theclaim level in the group life insurance line.93.7%18.9%92.9%90.9%23.4% 20.5%94.6%96.5%20.7% 20.5%R$ Million10,8669,9739,1138,5657,6756,2435,5314,8404,4383,8272,300 2,480 2,606 2,757 2,95019.4%19.8% 19.1%19.4% 19.9%1,548 1,647 1,668 1,685 1,67309/30/2004 12/31/2004 03/31/2005 06/30/2005 09/30/200555.4%49.7% 51.2% 54.4% 56.1%Traditional and OtherPGBLVGBL3rd Q./04 4th Q./04 1st Q./05 2nd Q./05 3rd Q./05Insurance Claims /Earned PremiumsSelling Expenses /Earned PremiumsAdministrativeExpenses and Others /Earned PremiumsNB: In the calculation of the combined ratio, results from Proteção Cartão Credicard were recordednet under Other Expenses.Note: The charts for Insurance do not include Itauseg Saúde and Gralha Azul Saúde, but they do include the life insurance business of Itaú Vida e Previdência S.A.32 Management Discussion and AnalysisBanco Itaú Holding Financeira S.A.

Insurance, Pension Plan and CapitalizationThe table below shows the technical provisions byproduct and by guaranteed yield for participants.Technical Reserves by product/guarantee in 09/30/2005R$ MillionVGBL 6,243 - - 6,243 57.5%PGBL 2,950 - - 2,950 27.1%TRADITIONAL - 1,556 85 - 1,641 15.1%DEFINED BENEFIT - - 27 27 0.2%ACCESSORIES - - - 5 5 0.0%At the end of the third quarter of 2005, technicalprovisions added up to approximately R$ 11 billion, up9.0% on the previous quarter.At September 30, 2005, VGBL products and PGBLproducts accounted for 57.5% and 27.1% of totalpension plan technical provisions, respectively.Offering the customer greater transparency than theformer pension plan products with a definedcontribution or a defined benefit, VGBL and PGBL hadtheir resources invested in exclusive funds during theaccumulation phase, and do not constitute a risk forthe company, which merely passes on the yieldachieved in the fund.The Traditional and Defined Benefit plans, which haveceased to be marketed by Itaú, offered the customerthe guarantee of a minimum yield, tied to an index (IGP-M or TR). At the end of the third quarter of 2005, theirshare in the technical provisions was 15.4%.It should be mentioned that on July 4, 2005, the OfficialGazette of the Union published Provisional Measure no.255/05, which extends the time limit for opting forDefinitive Regressive Taxation. Now, customers whocontracted an Itaú Private Pension Plano or Itaú FAPIbefore December 31, 2004 have until December 30, 2005to opt for Definitive Regressive Taxation. Customerscontracting new plans have until the last business dayof the month subsequent to the contract date tochoose the form of taxation.CapitalizationThe pro forma net income of the capitalization companiesreached R$ 23 million in the third quarter of 2005, decreasingby 36.5% compared to the prior quarter. Such result is dueto lower securities revenues in relation to the previousquarter, coupled with corporate restructuring processes.This quarter, we ran the sales campaign for PIC Natureza,which is a premium bond with monthly payments of R$35.00 or R$ 50.00. Under this campaign, approximately 114.5thousand bonds were sold, which contributed towardsthe portfolio reaching 3.9 million active bonds,corresponding to R$ 1,101 million in technical provisions.In the past 12 months, cash prizes amounting to R$ 32million were distributed to 833 customers whose bondswere drawn at random.The following table shows the changes in the portfolio ofcapitalization bonds with monthly payments (PIC) andthose with a single payment (Super PIC).Number of capitalization bonds3,686Super PIC3,596398 413PIC3,7333,735409 425In Thousand3,9343,289 3,182 3,324 3,311 3,49409/30/2004 12/31/2004 03/31/2005 06/30/2005 09/30/200543933 Management Discussion and AnalysisBanco Itaú Holding Financeira S.A.

- Page 5: Executive SummaryConsolidated State

- Page 10 and 11: Executive Summary - Third Quarter o

- Page 12 and 13: Analysis of the Consolidated Net In

- Page 14 and 15: Analysis of the Consolidated Net In

- Page 16 and 17: Analysis of the Consolidated Perfor

- Page 18 and 19: Analysis of the Consolidated Net In

- Page 20 and 21: Analysis of the Consolidated Net In

- Page 22 and 23: 22 Management Discussion and Analys

- Page 24 and 25: Pro Forma Financial Statements by S

- Page 26 and 27: Pro Forma Financial Statements by S

- Page 28 and 29: Itaubanco - Branch BankingThe state

- Page 30 and 31: Insurance, Pension Plan and Capital

- Page 34 and 35: Investment Funds and Managed Portfo

- Page 36 and 37: ItaucredThe following tables are ba

- Page 38 and 39: ItaucredVehiclesThe Vehicle segment

- Page 40 and 41: Risk ManagementMarket RiskBanco Ita

- Page 42 and 43: Risk ManagementCredit RiskCredit Op

- Page 44 and 45: Analysis of the Consolidated Balanc

- Page 46 and 47: Activities AbroadTrade Lines Raisin

- Page 48 and 49: Ownership StructureOwnership Struct

- Page 50: PricewaterhouseCoopersAv. Francisco

Insurance, Pension Plan and CapitalizationInsuranceThe pro forma net income of the insurance companiesreached R$ 7 million in the third quarter of 2005, showinga reduction when compared to the R$ 14 million of theprevious quarter. This fall is basically related to theincrease in expenses for retained claims.Earned premiums grew by 6.3% in the period. Wehighlight the earned premiums from automobileinsurance, which increased by 6.0% in the quarter, andthe earned premiums from all other lines as a whole,which grew by 38.3% in the quarter, chiefly because ofthe launch of the Proteção Cartão Credicard product.Retained claims increased by R$ 14 million, rising fromR$ 285 million to R$ 298 million in the third quarter of2005, basically because of the increased level of claimsin the group life and health lines.The charts below, which include the life insurance line ofthe Life and Pension Plan segment, depict the breakdownof the earned premiums by line of insurance.Automobile insurance had a 41.8% share of the total ofearned premiums in the third quarter, while the share ofthe life and personal accident line was 30.0%.Composition of Earned Premiums3 rd Quarter / 200510.9%3.9%13.4%41.8%2 nd Quarter / 200511.9%4.7%10.6%41.4%Number of policies - Mass Products2,345565569In Thousand561 557 534953 1,039 1,063 1,072 1,106828 826 818 798 79209/30/2004 12/31/2004 03/31/2005 06/30/2005 09/30/2005Automobile2,435Life2,4432,428 2,433PropertyThe number of life and personal accident policiesshowed growth, reaching 1,106 thousand policies atthe end of the third quarter of 2005.The number of automobile policies showed a smallreduction to a total of 792 thousand policies in theperiod. The same occurred with the residentialproducts, which totaled 534 thousand policies at theend of the third quarter of 2005Private Pensions PlansThe pro forma net income of the private pension plancompanies reached R$ 89 million in the third quarter of2005, an 8.2% decline in relation to the previous quarter.This fall is attributable to the growth in Non-InterestExpenses, as a result of the advertising campaign duringthe period.30.0%31.4%Pension Plan Technical ProvisionsAutomobile Life Property Transportation OtherCombined RatioThe 1.9% increase in the combined ratio referring toinsurance operations resulted from the increase in theclaim level in the group life insurance line.93.7%18.9%92.9%90.9%23.4% 20.5%94.6%96.5%20.7% 20.5%R$ Million10,8669,9739,1138,5657,6756,2435,5314,8404,4383,8272,300 2,480 2,606 2,757 2,95019.4%19.8% 19.1%19.4% 19.9%1,548 1,647 1,668 1,685 1,67309/30/2004 12/31/2004 03/31/2005 06/30/2005 09/30/200555.4%49.7% 51.2% 54.4% 56.1%Traditional and OtherPGBLVGBL3rd Q./04 4th Q./04 1st Q./05 2nd Q./05 3rd Q./05Insurance Claims /Earned PremiumsSelling Expenses /Earned PremiumsAdministrativeExpenses and Others /Earned PremiumsNB: In the calculation of the combined ratio, results from Proteção Cartão Credicard were recordednet under Other Expenses.Note: The charts for Insurance do not include Itauseg Saúde and Gralha Azul Saúde, but they do include the life insurance business of Itaú Vida e Previdência S.A.32 <strong>Management</strong> <strong>Discussion</strong> and <strong>Analysis</strong>Banco Itaú Holding Financeira S.A.