Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

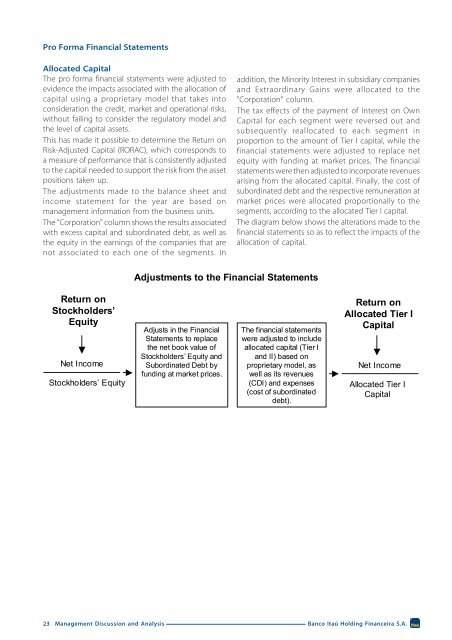

Pro Forma Financial StatementsAllocated CapitalThe pro forma financial statements were adjusted toevidence the impacts associated with the allocation ofcapital using a proprietary model that takes intoconsideration the credit, market and operational risks,without failing to consider the regulatory model andthe level of capital assets.This has made it possible to determine the Return onRisk-Adjusted Capital (RORAC), which corresponds toa measure of performance that is consistently adjustedto the capital needed to support the risk from the assetpositions taken up.The adjustments made to the balance sheet andincome statement for the year are based onmanagement information from the business units.The "Corporation" column shows the results associatedwith excess capital and subordinated debt, as well asthe equity in the earnings of the companies that arenot associated to each one of the segments. Inaddition, the Minority Interest in subsidiary companiesand Extraordinary Gains were allocated to the"Corporation" column.The tax effects of the payment of Interest on OwnCapital for each segment were reversed out andsubsequently reallocated to each segment inproportion to the amount of Tier I capital, while thefinancial statements were adjusted to replace netequity with funding at market prices. The financialstatements were then adjusted to incorporate revenuesarising from the allocated capital. Finally, the cost ofsubordinated debt and the respective remuneration atmarket prices were allocated proportionally to thesegments, according to the allocated Tier I capital.The diagram below shows the alterations made to thefinancial statements so as to reflect the impacts of theallocation of capital.Adjustments to the Financial StatementsReturn onStockholders’EquityNet IncomeStockholders’ EquityAdjusts in the FinancialStatements to replacethe net book value ofStockholders’ Equity andSubordinated Debt byfunding at market prices.The financial statementswere adjusted to includeallocated capital (Tier Iand II) based onproprietary model, aswell as its revenues(CDI) and expenses(cost of subordinateddebt).Return onAllocated Tier ICapitalNet IncomeAllocated Tier ICapital23 <strong>Management</strong> <strong>Discussion</strong> and <strong>Analysis</strong>Banco Itaú Holding Financeira S.A.