Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

a n n u a l r e p o r t 2 0 0 8

ttS <strong>Group</strong><br />

This is <strong>TTS</strong> 4<br />

Financial highlights 6<br />

Key events <strong>2008</strong> 8<br />

report from the ceo<br />

We are level-headed optimists 9<br />

buSineSS areaS<br />

Dry Cargo Handling Division 12<br />

Marine Cranes Division 16<br />

Port and Material Handling Division 20<br />

Deck Machinery Division 24<br />

Drilling Equipment Division 28<br />

Services Division 32<br />

Breakthrough for <strong>TTS</strong> in the market<br />

for trailer-mounted land rigs 36<br />

corporate covernance<br />

information<br />

Shareholder information 38<br />

Corporate governance 41<br />

Senior management 44<br />

Board of Directors 46<br />

d i r e c t o r ’ S r e p o r t a n d<br />

accountS<br />

Director’s report 48<br />

ProFiT anD loSS aCCounT anD noTES<br />

- <strong>Group</strong> 55<br />

- <strong>TTS</strong> Marine aSa 91<br />

auditors report 109<br />

responsibility statement 110<br />

ttS<br />

Companies in the <strong>TTS</strong> <strong>Group</strong> 112<br />

organisation 114<br />

2<br />

ttS – continuously<br />

generating profits<br />

by being the preferred<br />

global supplier for<br />

handling equipment<br />

to the maritime and<br />

oil & gas industry.

Port and<br />

material<br />

handling<br />

equipment<br />

• Yard equipment<br />

• Heavy load<br />

equipment<br />

• Port equipment<br />

Maritime<br />

• roro-equipment<br />

• Hatch covers<br />

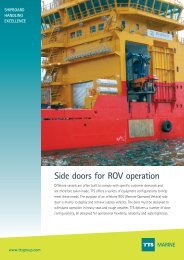

• Side doors<br />

• Cruise- and Yacht<br />

equipment<br />

• Hose handling cranes<br />

• Cargo cranes<br />

• Davits<br />

• anchor- and<br />

mooringwinches<br />

oil & Gas<br />

• offshore cranes<br />

• offshore handling<br />

equipment<br />

• Drilling equipment<br />

• Drilling packages<br />

• HMi & Controls<br />

Services<br />

• Emergency<br />

assistance<br />

• Service agreements<br />

• Modernisation<br />

and conversions<br />

• Simulation<br />

and training<br />

• inspections<br />

and surveys

4-8 t t S G r o u p<br />

9-11 rEPorT FroM THE CEo<br />

12-37 B u S i n E S S a r E a S<br />

38-47 CorPoraTE GoVErnanCE<br />

48-110 DirECTor’S rEPorT anD aCCounTS<br />

this is ttS<br />

eStabliShmentS<br />

1966 <strong>TTS</strong> is established.<br />

1995 <strong>TTS</strong> is listed on oslo Stock Exchange.<br />

2001 <strong>TTS</strong> establishes joint venture in Shanghai, China.<br />

2002 <strong>TTS</strong> establishes rep. office in Pusan, Korea.<br />

2005 <strong>TTS</strong> establishes <strong>TTS</strong> Bohai in Dalian, China.<br />

2005 <strong>TTS</strong> establishes <strong>TTS</strong> Marine inc. in Florida, uSa.<br />

2006 <strong>TTS</strong> establishes <strong>TTS</strong> Marine s.r.l. in Genova, italy.<br />

2006 <strong>TTS</strong> establishes <strong>TTS</strong> Vietnam, Haiphong, Vietnam.<br />

2007 <strong>TTS</strong> establishes Sense Drill Fab aS, norway.<br />

2007 <strong>TTS</strong> establishes Sense EDM Pte ltd, Singapore.<br />

2007 <strong>TTS</strong> establishes <strong>TTS</strong> Keyon Marine, Zhangjiagang, China.<br />

<strong>2008</strong> <strong>TTS</strong> establishes Jiangnan <strong>TTS</strong>, nantong, China.<br />

<strong>2008</strong> <strong>TTS</strong> establishes <strong>TTS</strong> Marine Equipment (Dalian), China.<br />

acquiSitionS/SaleS<br />

1996 <strong>TTS</strong> acquires Mongstad Engineering aS, Bergen, norway.<br />

1997 <strong>TTS</strong> acquires norlift aS, Bergen, norway.<br />

2000 <strong>TTS</strong> acquires aktro aS, Molde, norway.<br />

2001 <strong>TTS</strong> sells <strong>TTS</strong> Construction aS, Bergen, norway.<br />

2001 <strong>TTS</strong> acquires Hamworthy KSE aB, Dry Cargo Division.<br />

2001 <strong>TTS</strong> acquires Hydralift Marine, and sell <strong>TTS</strong>-aktro aS.<br />

2004 <strong>TTS</strong> acquires 100 % of joint venture in Shanghai, China.<br />

2004 <strong>TTS</strong> acquires lMG, lübeck, Germany.<br />

2004 <strong>TTS</strong> acquires liftec oy, Tampere, Finland.<br />

2005 <strong>TTS</strong> acquires navCiv Engineering aB, Gothenburg, Sweden.<br />

2005 <strong>TTS</strong> acquires Kocks GmbH, Bremen, Germany.<br />

2007 <strong>TTS</strong> acquires iCD Projects aS, Ålesund, norway.<br />

2007 <strong>TTS</strong> acquires 100 % of joint venture in Pusan, Korea.<br />

2007 <strong>TTS</strong> acquires Sense EDM aS, Kristiansand, norway.<br />

2007 <strong>TTS</strong> acquires 100% Sense MuD aS, Kristiansand, norway.<br />

<strong>2008</strong> <strong>TTS</strong> acquires Wellquip Holding aS, Kristiansand, norway.<br />

4<br />

annual<br />

turnover<br />

noK mill<br />

4500<br />

4000<br />

3500<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

96 97 98 99 00 01 02 03 04 05 06 07 08<br />

port and material handling equipment<br />

marine equipment<br />

offshore and drilling equipment

companies in the ttS <strong>Group</strong> Sales and service network<br />

<strong>TTS</strong> is an international group which develops and supplies handling equipment<br />

to the marine and oil & gas industry. The operations are divided into six divisions:<br />

marine cranes, dry cargo handling, port & material handling, deck machinery,<br />

drilling equipment and Services. <strong>TTS</strong> is the second largest supplier in the world within<br />

its market segments. <strong>TTS</strong> has a workforce of 1550 employees with main emphasis on<br />

engineering expertise. The group has subsidiaries in norway, Sweden, Finland, Germany,<br />

China, uSa, italy, Czech republic, Korea, Canada, Vietnam and Singapore. <strong>TTS</strong> Marine aSa<br />

is headquartered in Bergen, norway and listed on the oslo Stock Exchange.<br />

5

4-8 t t S G r o u p<br />

9-11 rEPorT FroM THE CEo<br />

12-37 B u S i n E S S a r E a S<br />

38-47 CorPoraTE GoVErnanCE<br />

48-110 DirECTor’S rEPorT anD aCCounTS<br />

financial highlights<br />

ProFiT anD loSS aCCounT (noK 1 000)<br />

6<br />

<strong>2008</strong> 2007 2006 2005 2004<br />

operating income 4 196 482 2 459 964 1 604 030 1 149 831 786 174<br />

operating profit/loss before depresiation (EBiTDa) 145 459 167 767 107 061 73 966 44 822<br />

operating profit/loss (EBiT) 114 616 134 636 98 145 66 402 38 769<br />

Pre-tax profit/loss 36 819 97 568 84 492 56 297 31 251<br />

net profit/loss 36 392 79 041 60 481 40 239 21 630<br />

BalanCE SHEET (noK 1 000)<br />

Fixed assets 1 508 802 1 215 577 460 996 429 629 335 374<br />

Current assets 2 871 919 1 886 377 1 172 135 753 157 465 029<br />

Total assets 4 380 721 3 101 954 1 633 130 1 182 786 800 402<br />

Equity 989 056 933 596 598 061 394 932 260 909<br />

long-term liabilities 532 297 588 878 196 635 77 279 76 294<br />

Current liabilities 2 825 808 1 579 479 838 434 710 574 463 199<br />

Total equity and liabilities 4 380 721 3 101 954 1 633 130 1 182 786 800 402<br />

Key ratioS<br />

FinanCial STrEnGTH<br />

Equity to assets ratio (as a percentage of total capital) 22.6 % 30.1 % 36.6 % 33.4 % 32.6 %<br />

ProFiTaBiliTY<br />

EBiTDa margin 3.5 % 6.8 % 6.7 % 6.4 % 5.7 %<br />

EBiT margin 2.7 % 5.5 % 6.1 % 5.8 % 4.9 %<br />

Profit margin (pre-tax) 0.9 % 4.0 % 5.3 % 4.9 % 4.0 %<br />

Profit margin (after tax) 0.9 % 3.2 % 3.8 % 3.5 % 2.8 %<br />

raTE oF rETurn<br />

return on equity 3.7 % 10.5 % 14.1 % 14.3 % 12.0 %<br />

return on total capital 2.6 % 4.3 % 5.5 % 5.0 % 4.5 %<br />

SHarES<br />

Equity per share 38.18 36.20 26.59 21.39 17.36<br />

Earnings per share (noK) 1.41 3.40 2.92 2.19 1.44<br />

number of shares, end of year 25 908 25 738 22 493 20 116 16 315<br />

average number of shares 25 840 23 250 20 832 18 460 15 029<br />

nominal value, end of year 0.50 0.50 0.50 0.50 0.50<br />

defininitions<br />

Earnings per share: Profit after taxes divided on total number of shares at the end of the fiscal year.<br />

Profitability, equity: Profit before tax as a percentage of equity.<br />

Profitability, total capital: operating profit as a percentage of total capital.

turnover<br />

noK Million<br />

786<br />

1150<br />

2004 2005 2006 2007 <strong>2008</strong><br />

ebitda<br />

noK Million<br />

45<br />

1041<br />

74<br />

1863<br />

1604<br />

107<br />

order bacKloG<br />

noK Million<br />

2273<br />

2460<br />

168<br />

6949<br />

4196<br />

145<br />

2004 2005 2006 2007 <strong>2008</strong><br />

8159<br />

2004 2005 2006 2007 <strong>2008</strong><br />

turnover<br />

<strong>2008</strong><br />

2007<br />

MC<br />

26 %<br />

MC<br />

28 %<br />

DE<br />

25 %<br />

DCH<br />

29 %<br />

order bacKloG<br />

<strong>2008</strong><br />

2007<br />

MC<br />

29 %<br />

MC<br />

35 %<br />

DE<br />

10 %<br />

DE<br />

17 %<br />

DM<br />

12 %<br />

DCH<br />

36 %<br />

DCH<br />

39 %<br />

DE<br />

14 %<br />

DCH<br />

38 %<br />

DM<br />

11 %<br />

PMH<br />

8 %<br />

PMH<br />

14 %<br />

DM<br />

11 %<br />

DM<br />

10 %<br />

PMH<br />

4 %<br />

PMH<br />

3 %<br />

dry carGo handlinG<br />

mnoK <strong>2008</strong> 2007<br />

Turnover 1 239.6 874.4<br />

EBiTDa 85.0 95.7<br />

order backlog per 31.12. 3 151 2 619<br />

marine craneS<br />

mnoK <strong>2008</strong> 2007<br />

Turnover 11 070 687.7<br />

EBiTDa 41.8 34.9<br />

order backlog per 31.12. 2 370 2 433<br />

decK machinery<br />

mnoK <strong>2008</strong> 2007<br />

Turnover 447.8 299.5<br />

EBiTDa 22.3 5.3<br />

order backlog per 31.12. 902 681<br />

port and material handlinG<br />

mnoK <strong>2008</strong> 2007<br />

Turnover 350.5 332.8<br />

EBiTDa 32.5 25.6<br />

order backlog per 31.12. 326 216<br />

drillinG equipment<br />

mnoK <strong>2008</strong> 2007<br />

Turnover 1 057.4 265.1<br />

EBiTDa -24.6 13.9<br />

order backlog per 31.12. 1 410 999<br />

7

4-8 ttS <strong>Group</strong><br />

9-11 rEPorT FroM THE CEo<br />

12-37 B u S i n E S S a r E a S<br />

38-47 CorPoraTE GoVErnanCE<br />

48-110 DirECTor’S rEPorT anD aCCounTS<br />

Key events <strong>2008</strong><br />

For the fifth year running, <strong>TTS</strong> reported a<br />

significant growth in turnover. The result,<br />

however, is somewhat reduced, owing to writedown<br />

of an individual contract. Turnover<br />

increased by 70 percent to noK 4 196 million,<br />

and earnings before depreciation (EBiTDa)<br />

reduced by 13 percent to noK 145.5 million.<br />

at the start of the new year, <strong>TTS</strong> has an order<br />

backlog of noK 8 159 million, a 17 percent<br />

increase since 2007. This includes the downward<br />

revision of approximately noK 600 million<br />

related to confirmed and anticipated cancellations<br />

owing to the international economic<br />

crisis.<br />

in connection with cancellations of agreed orders,<br />

<strong>TTS</strong> has realised losses on currency hedging<br />

contracts and made provisions for potential<br />

losses of about noK 30 million. The financial<br />

crisis, however, has lead to shorter delivery times<br />

and more favourable prices on the raw materials<br />

and components used by <strong>TTS</strong>.<br />

Effective as of 2009, <strong>TTS</strong> has organised service<br />

and after sales in a separate division. The aim<br />

of the Services division is to strengthen <strong>TTS</strong>’<br />

position as consultant and provider of after<br />

sales services following the delivery of new<br />

equipment.<br />

8<br />

<strong>TTS</strong> implemented acquisition of the norwegian<br />

drilling technology company, Wellquip, thereby<br />

strengthening the Drillig Equipment division’s<br />

expertise and capacity to deliver in relation<br />

to complete drilling packages. Wellquip has,<br />

among other things, developed and patented<br />

an automatic multifunctional roughneck.<br />

<strong>TTS</strong> experienced a breakthrough in the market<br />

for trailer-mounted land rigs and will deliver<br />

twelve 150-ton rigs to a total value of about<br />

noK 700 million. The rigs are equipped with<br />

patented technology and advanced solutions<br />

for control and automation.<br />

<strong>TTS</strong> reported strong growth in the market for<br />

deck machinery. in Dalian, China, <strong>TTS</strong> established<br />

a wholly-owned subsidiary company associated<br />

with the Deck Machinery division, producing<br />

winches and other deck machinery.<br />

in order to maintain solid equity in the presently<br />

unstable markets, <strong>TTS</strong> has proposed to the annual<br />

general meeting that there be no dividend paid<br />

out for <strong>2008</strong>.

johanneS neteland<br />

PrESiDEnT & CEo<br />

<strong>TTS</strong> MarinE aSa<br />

We are level-headed optimists!<br />

<strong>2008</strong> was an extraordinary year. our clearest<br />

memory is that of the americans electing their first<br />

afro-american president. Barack obama presented<br />

his call for change with a drive and credibility that<br />

captured the hearts of his voters and generated<br />

hope for a better future – not just in the uSa, but<br />

all over the world.<br />

The support for obama increased in line with<br />

the development of the financial crisis and ensuing<br />

upheaval of international economy. Subsequently,<br />

following his inauguration, he had his hands full by<br />

reducing expectations of how swift and efficient<br />

his administration would be able to implement<br />

measures to transform the downturn of the economy<br />

from recession to recovery. The financial<br />

crisis in itself will be overcome in the not too<br />

distant future, but the crisis in the real economy<br />

is serious and severe, striking with brutal force.<br />

Mainly, it will affect countries and people with the<br />

least ability to tolerate such changes to and setbacks<br />

in their subsistence level, but we will nevertheless<br />

all be affected, including us here in <strong>TTS</strong>.<br />

When, during the autumn last year, the financial<br />

crisis was turning into crisis with a capital C,<br />

we in <strong>TTS</strong> warned about letting pessimism get the<br />

upper hand. Based on our third-quarter results,<br />

which for the umpteenth time showed a record<br />

high level in turnover, results and order backlog,<br />

we took the liberty of drawing attention to the<br />

vast gap between the positive development in our<br />

operations and the general picture being painted<br />

by the media of the future development of the<br />

economy. as for <strong>TTS</strong>, we expressed our faith in<br />

continued progress. at the same time, we pointed<br />

out that norwegian authorities and norges Bank<br />

(norwegian State Bank) should do more to curb the<br />

fluctuations of the exchange rate of the norwegian<br />

Krone. our basis was concern for the strong<br />

fluctuations in the value of the norwegian Krone in<br />

relation to the major currencies over a short period<br />

of time. a number of contracts involving exportrelated<br />

operations have exchange rates fixed a<br />

given levels. if these contracts are cancelled, and<br />

the forward currency position accordingly has to<br />

be terminated, norwegian companies such as <strong>TTS</strong><br />

risk considerable losses if cancellation takes place<br />

at a point in time when the currency position is<br />

unfavourable.<br />

Both our faith in continued progress and our<br />

worry regarding currency proved to be valid. The<br />

underlying operation of <strong>TTS</strong> continued along the<br />

same positive path in the fourth quarter, but for<br />

the parts of our group that settle their business<br />

in norwegian Krone, the fluctuations of exchange<br />

resulted a reduction of the result. all the same,<br />

<strong>2008</strong> as a whole proved to be yet another acceptable<br />

year for <strong>TTS</strong>.<br />

Could we, and should we – in hindsight – have<br />

predicted the rather extraordinary currency challenges<br />

that cost <strong>TTS</strong> in all noK 29 million on the<br />

bottom line? let others be the judge of that.<br />

Paradoxically, norwegian politicians and authorities<br />

9<br />

president & ceo

4-8 T T S G r o u P<br />

9-11 report from the ceo<br />

12-37 B u S i n E S S a r E a S<br />

38-47 CorPoraTE GoVErnanCE<br />

48-110 DirECTor’S rEPorT anD aCCounTS<br />

maintained that the weakening of the norwegian<br />

Krone was generally positive for export-related<br />

operations, which in a sense is correct. However,<br />

what they failed to include in the assessment, was<br />

the adverse effect of such strong fluctuations from<br />

one week to another, or even from day to day. For<br />

a small country with an economy primarily aimed<br />

at trade and commercial interfacing with other<br />

nations, having a national currency carries a considerable<br />

risk. it is stability and predictability of external<br />

con ditions that gives industry exposed to compe-<br />

tition the best foundation to navigate through<br />

turbulent times. The conclusion of this autumn’s<br />

unpleasant surprises is obvious; norwegian inclusion<br />

in the European common currency must come<br />

about – sooner rather than later.<br />

an annual report is primarily history of what<br />

has been. Most of us, however, reflect mainly on<br />

what the future will bring. in <strong>TTS</strong>, we are levelheaded<br />

optimists. We have, for a number of years,<br />

informed the stock market of our assessment of<br />

the potential for turnover and results within our<br />

areas of operation, and we have usually been<br />

pretty accurate. <strong>TTS</strong> is and will remain predictable<br />

– even with the constraints that follow from doing<br />

business in 12 countries on three continents.<br />

<strong>TTS</strong> presently constitutes six divisions with a<br />

total of 1 550 employees with vast technical expertise<br />

in the areas of maritime equipment, terminal<br />

and material handling and equipment to the oil and<br />

gas industry. We started 2009 with an order back-<br />

10<br />

– norwegian inclusion<br />

in the european<br />

common currency must<br />

come about – sooner<br />

rather than later<br />

log of noK 8.2 billion. Even taking into account the<br />

substantial number of cancellations toward the end of<br />

last year, we have never had order books as full as<br />

at the start of the new year. a stringent appraisal<br />

of the quality of volume of orders indicates further<br />

cancellations in the region of noK 500 million. The<br />

overall picture indicates that we will have our hands<br />

full endeavouring to complete all deliveries within the<br />

agreed delivery times. This, in turn, means a continued<br />

growth of turnover for the <strong>TTS</strong> <strong>Group</strong>. With regard to<br />

results, there is a higher degree of uncertainty than<br />

in <strong>2008</strong>, but we note that changes to the market<br />

situation have already given us lower prices on steel<br />

and components purchased from suppliers, in addition<br />

to lower transportation cost. <strong>TTS</strong> is making money<br />

and expects this to continue.<br />

But, and this is an important but; we can with a<br />

high degree of certainty state that the order backlog<br />

will not remain at the same high level at the end<br />

of 2009 as at the start of the year. For parts of our

operations, activities will presumably be somewhat<br />

lower in 2010. Some of this is due to natural<br />

fluctuations in our markets, but the primary cause<br />

of a lowered demand is the financial crisis affecting<br />

all countries. it is hard to predict how long the crisis<br />

will last, and what consequences it will have for our<br />

customers and partners, but we do believe that it<br />

will take some time for things to improve.<br />

We will meet these challenges by strengthening<br />

efforts related to services, product development<br />

and sales. <strong>TTS</strong> holds a solid position in many of our<br />

niche markets, but in turbulent times competition<br />

is strong. However, not all of our competitors have<br />

equally favourable premises and financial solidity<br />

to handle the consequences of the economic crisis.<br />

in other words, there is potential for maintaining<br />

a high level of activity through strengthening our<br />

presence in the market, and securing a larger<br />

share of the total volume of contracts. Furthermore,<br />

we will actively work at developing interdivision<br />

co operation in order to increase sales to each<br />

customer, as well as strengthening our position as<br />

consultant and provider of after sales services<br />

following the delivery of new equipment. Moreover,<br />

we will aggressively utilise the opportunities<br />

that this situation offers to acquire new companies<br />

that naturally fall under, and can strengthen, the<br />

<strong>TTS</strong> <strong>Group</strong>.<br />

While seizing the market opportunities, we will<br />

be following a more prudent strategy, which implies<br />

that the organisation’s operations and manning will<br />

be reduced to a lower level for as long as the<br />

markets remain weak. Through its organisation into<br />

26 operative units, <strong>TTS</strong> has the advantage that our<br />

managers are closer to their respective markets,<br />

and are quick to pick up on the need for adjustments.<br />

in other words, it is not someone “far away”<br />

or “high up there” who makes the decision on<br />

how to handle potential surplus capacity in the<br />

organisation.<br />

For <strong>TTS</strong>, it is not a question of either or, but<br />

rather of both doing this and that. We will, in other<br />

words, both strengthen our market efforts and<br />

adapt our organisation to the demand for our<br />

products and services. readjustment is tough, but<br />

our managers and employees are used to such processes.<br />

Handled correctly, both our organisation<br />

and the individual affected will come through<br />

strengthened.<br />

as supplier in competitive markets, we are used<br />

to being met with high expectations by our<br />

customers, and we experience pleasure and satisfaction<br />

at being able to fulfil these expectations.<br />

Expectations to <strong>TTS</strong> as a company should be high,<br />

and we will work hard to meet our performance<br />

measures. We are still level-headed optimists!<br />

Johannes D. neteland<br />

PrESiDEnT & CEo<br />

11

4-8 T T S G r o u P<br />

9-11 rEPorT FroM THE CEo<br />

12-37 b u S i n e S S a r e a S<br />

38-47 CorPoraTE GoVErnanCE<br />

48-110 DirECTor’S rEPorT anD aCCounTS<br />

The Dry Cargo Handling division maintained<br />

a high level of activity throughout <strong>2008</strong>.<br />

The division is well prepared to meet the<br />

challenges resulting from the<br />

financial crisis and economic<br />

downturn in the global markets.<br />

Stellan bernSro<br />

DirECTor DrY CarGo<br />

HanDlinG DiViSion<br />

in recent years, tts has built up a substantial order backlog<br />

in the market for marine cargo access equipment. For the<br />

Dry cargo Handling division, the market at the beginning of<br />

last year was exceptional, however, during the course of the year,<br />

the order intake declined as a result of the impact of the financial<br />

crisis on international shipping. all in all, the division’s turnover<br />

increased by 42 percent to nOK 1 240 million. Operating profit<br />

dropped from nOK 95 million to nOK 85 million, mainly due to<br />

weak growth in the segment for hatch covers.<br />

the Dry cargo Handling division is the largest division of tts,<br />

and in <strong>2008</strong> the division once again consolidated its position as a<br />

leading global supplier. – In <strong>2008</strong>, we received a number of orders<br />

for cargo access equipment for numerous series of car carriers, one<br />

of tts’s areas of expertise. Our systems for cargo handling were<br />

the preferred choice to the world’s largest roro vessels, which are<br />

currently under construction at a Japanese shipyard, says stellan<br />

Bernsro. He has been Head of the Dry cargo Handling division<br />

since 2006. Bernsro is trained as a naval officer and holds a master<br />

in industrial engineering and management, and he is also Managing<br />

Director of tts ships equipment aB.<br />

the Dry cargo Handling division has a broad range of products<br />

within cargo access equipment, such as hatch covers, roro equipment,<br />

side-loading systems and purpose-built equipment for cruise<br />

ships and mega yachts. the division has furthermore contributed<br />

to tts’ successful targeting deliveries of equipment to offshore<br />

vessels. In the market for service and after sales support, the Dry<br />

cargo Handling division has seen a considerable level of activity,<br />

strongly contributing to the development and upgrading of expertise<br />

in the tts <strong>Group</strong>’s joint targeting of this segment.<br />

the Dry cargo Handling division is managed from Gothenburg,<br />

sweden, and has operations in Germany, norway, Italy, Usa and<br />

Vietnam. tts’ acquisition of the Dry cargo Handling division in<br />

2002 opened the door to the market in china, through the division’s<br />

50 percent ownership interest in the joint venture company tts<br />

Hua Hai ships equipment, shanghai, in partnership with the stateowned<br />

shipbuilding group china state shipbuilding corporation<br />

(cssc). through its Dry cargo Handling division, tts is furthermore<br />

owner of 50 percent of the manufacturing company tts<br />

12<br />

dry cargo handling

– the organisation has solid<br />

expertise and a documented<br />

capacity for implementing<br />

high-quality projects.<br />

13

turnover<br />

noK Million<br />

484<br />

649<br />

728<br />

874<br />

1240<br />

order bacKloG<br />

noK Million<br />

1035<br />

1063<br />

2619<br />

3100<br />

2004 2005 2006 2007 <strong>2008</strong> 2004 2005 2006 2007 <strong>2008</strong><br />

Keyon Marine equipment, which manufactures steel structures for<br />

hatch covers, ro-ro equipment and cranes. In addition to this, the<br />

joint venture company tts Hua Hai ships equipment participates<br />

with an ownership interest of 40 percent in the company Jiangnan<br />

tts Marine equipment, which focuses on manufacturing of hatch<br />

covers.<br />

the Dry cargo Handling division has 197 employees, whereof<br />

90 are based in sweden, 58 in Germany, 24 in norway, eight in<br />

Italy, 11 in Usa and six in Vietnam. the joint venture companies in<br />

china employ around 300 people. In <strong>2008</strong>, the management of this<br />

global operation was strengthened by the appointment of a new<br />

managing director to tts ships equipment GmbH in Germany, as<br />

well as the addition of an associate with extensive experience from<br />

operations in sweden to the sales and representative office in<br />

Vietnam. effective as of this year, the Dry cargo Handling Division<br />

transferred its activities within service and after sales support in<br />

Usa and Vietnam to the tts <strong>Group</strong>’s newly established service<br />

division.<br />

operations<br />

the Dry cargo Handling division is a provider of services within<br />

design and engineering of equipment for marine cargo access systems.<br />

through ownership interests in operations manufacturing steel<br />

structures in china, tts has gained control of major parts of the<br />

value chain through to completed deliveries of, among others,<br />

hatch covers and roro equipment.<br />

In recent years, an increasingly larger part of the Dry cargo<br />

Handling deliveries constitute equipment for purpose-built vessels<br />

for transportation of cars within, as well as between, continents.<br />

tts is among the world’s leading suppliers in this niche of the roro<br />

market.<br />

Furthermore, the Dry cargo Handling division has made extensive<br />

deliveries of hatch covers to dry bulk carriers, container vessels<br />

and dry cargo carriers. another speciality is side-loading systems for<br />

various ship types, and in addition to this, specialised equipment for<br />

cruise ships and yachts is an important business segment.<br />

each of the six wholly owned companies that form the Dry cargo<br />

Handling division has built up special competence within the various<br />

parts of their product repertoire, from which products and systems<br />

are delivered to all major shipbuilding nations worldwide. Product<br />

806<br />

ebitda<br />

noK Million<br />

48<br />

61<br />

90<br />

95<br />

85<br />

2004 2005 2006 2007 <strong>2008</strong><br />

development is organised internally and in teams formed crosscompany.<br />

the joint venture company, tts Hua Hai ships equipment<br />

co. Ltd. in shanghai, china, designs and manufactures hatch covers<br />

and some roro equipment for chinese shipyards.<br />

ship design today is to a large extent concerned with giving ships<br />

a design that minimises their impact on the environment and reduces<br />

fuel consumption. this, in turn, places new demands on the equipment<br />

for cargo handling equipment. tts is in close cooperation with<br />

shipping companies and shipyards regarding development of products<br />

and solutions that will be environmentally sound both short term and<br />

in the long run.<br />

market outlook<br />

the global shipbuilding market is cyclical, and subsequent to a<br />

number of exceptional years, tts is prepared to face a decline in<br />

the contracting of new vessels. the Dry cargo Handling division<br />

has for this reason strengthened its focus on service and after sales<br />

support, in order to compensate the anticipated reduction in the<br />

demand for new cargo handling equipment.<br />

the financial crisis and unforeseen rapid decline in the world<br />

economy has affected tts’ order intake. However, at the start of<br />

2009, the Dry cargo Handling had a sound order backlog of nOK<br />

3 100 million, including half of the joint venture company in<br />

china’s order backlog. risk and security of the order backlog is<br />

subject to continuous evaluation. the order intake is expected to<br />

be somewhat lower in 2009 than last year, affecting turnover and<br />

operations in the coming years.<br />

Strategy<br />

the Dry cargo Handling division’s organisation has solid expertise<br />

and a documented capacity for implementing high-quality projects.<br />

On this basis, the division will continue to have a strong focus on<br />

marketing and sales in all established markets. In light of the current<br />

market situation, the division will concentrate on adapting its organisation<br />

to a lower level of activity in respect of deliveries to new<br />

vessels, and further strengthen its operations in other markets segments,<br />

as well as in new market segments. Development of new<br />

products will be given high priority, and the division will place<br />

more emphasis on consulting and assisting shipping companies in<br />

the process of upgrading and modernising their tonnage.<br />

15<br />

dry cargo handling

4-8 T T S G r o u P<br />

9-11 rEPorT FroM THE CEo<br />

12-37 b u S i n e S S a r e a S<br />

38-47 CorPoraTE GoVErnanCE<br />

48-110 DirECTor’S rEPorT anD aCCounTS<br />

in <strong>2008</strong>, the Marine Cranes Division experienced<br />

the full effect of its restructuring to the production<br />

of cranes for the offshore market. Yet again,<br />

the division reported a strong<br />

growth in turnover; however,<br />

currency losses weakened an<br />

otherwise solid result.<br />

ivar K. hanSon<br />

DirECTor MarinE CranES<br />

DiViSion<br />

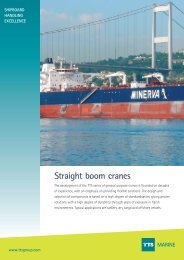

tHe MarIne cranes DIVIsIOn develops and supplies<br />

cranes to ships as well as to vessels and installations offshore.<br />

the division resumed its operation in the offshore market<br />

in 2007, and during that year the division’s turnover increased by<br />

a whole 56 percent. In <strong>2008</strong>, the growth was even higher, at 61<br />

percent, yielding a turnover of nOK 1 107 million. the offshore<br />

sector made up 63 percent of this turnover. the division’s operating<br />

profit before depreciation was nOK 42 million, compared to nOK<br />

35 million in 2007. the operating profit includes actual currency<br />

losses of nOK 10 million.<br />

the Marine cranes Division is managed from Bergen, norway,<br />

and has branch offices in Kristiansand and Ålesund, as well as<br />

Os outside Bergen. Furthermore, the division has operations in<br />

Lübeck in Germany, in shanghai and Dalian in china, and a sales<br />

and representative office in Busan, south Korea. In shanghai, tts<br />

has a wholly-owned subsidiary company, while in Dalian tts participates<br />

in a joint venture company together with the state-owned<br />

shipbuilding group Dalian shipbuilding Industry corporation<br />

(DsIc).<br />

the Marine cranes division has 576 employees, whereof 231 are<br />

based in norway, 271 in china (including the JV company), 67 in<br />

Germany and seven in south Korea. Ivar K. Hanson has headed the<br />

Marine cranes division since 2004. He holds a Masters in Business<br />

and economics, as well as a degree in mechanical engineering, and<br />

has worked for tts for a total of 14 years.<br />

– We have succeeded in our strategy of building up a global<br />

corporation for the development and production of a wide range<br />

of cranes to various types of vessels and handling equipment to the<br />

offshore industry. In <strong>2008</strong>, underlying operations yielded margins<br />

as expected, but with regard to results we were unfortunately hit<br />

by cancellations of orders with a loss on exchange. this as a result<br />

of abnormal fluctuations in the currencies that we deal in, says Ivar<br />

K. Hanson, head of the Marine cranes division.<br />

In <strong>2008</strong>, the Marine cranes division experienced a breakthrough<br />

in the market for anchor handling winches through orders for five<br />

16<br />

marine cranes

marine cranes<br />

sets with a first delivery in June of this year. In <strong>2008</strong>, the division<br />

furthermore secured its first two orders for 250-ton offshore<br />

cranes with active heave compensation for operation of heavy loads<br />

at great depths, of which the first is to be delivered in 2010.<br />

operations<br />

the operation of the Marine cranes division is based around several<br />

centres of expertise on product segments and solutions. For our<br />

customers within the maritime sector, product development and<br />

sale of cylinder cranes are primarily based in Bergen, while product<br />

development and sale of wire luffing cranes take place in Lübeck,<br />

Germany. after-sales support, service and industrial products to<br />

the shipping companies are handled by our office in Kristiansand.<br />

the development and sale of purpose-built cranes for offshore<br />

vessels and installations is managed from Bergen. the branch office<br />

in Ålesund, with the support of related centres of technologies in<br />

Os and Kristiansand, develops control systems and software for<br />

winches for deep-sea cranes. tts is known for delivering advanced<br />

systems that ensure efficient cargo handling, even in very rough<br />

seas, active heave compensation.<br />

the wholly-owned company in shanghai carries out engineering,<br />

project management, assembly and follow-up of deliveries to<br />

ship-owners and shipyards in asian markets outside of china.<br />

Moreover, the company functions as purchasing office for the<br />

division. the joint venture company, tts Bohai Machinery, in<br />

Dalian, carries out engineering, project management, assembly and<br />

testing of standard marine cranes to shipyards in china. Both in<br />

18<br />

turnover<br />

noK Million<br />

236<br />

309<br />

440<br />

688<br />

1107<br />

2004 2005 2006 2007 <strong>2008</strong> 2004 2005 2006 2007 <strong>2008</strong><br />

– 2009 will see<br />

a turnover at the same<br />

level as in <strong>2008</strong>.<br />

order bacKloG<br />

noK Million<br />

159<br />

390<br />

600<br />

2433<br />

2371<br />

ebitda<br />

noK Million<br />

-11,2<br />

2004 2005 2006 2007 <strong>2008</strong><br />

shanghai and Dalian, cranes and related equipment are assembled<br />

for customers in the offshore sector of asia, while offshore customers<br />

in europe get their deliveries from Bergen.<br />

market outlook<br />

at the start of 2009, the total order backlog of the Marine cranes<br />

division had reached nOK 2 370 million, including the joint venture<br />

company in china, which is at the same level as last year. as a result<br />

of the financial crisis, the order backlog was reduced in the fourth<br />

quarter, owing to received and anticipated cancellations. a large<br />

number of these cancellations were made by customers who had<br />

placed orders for cranes to bulk carriers. so far, the offshore market<br />

has been less sensitive to the crisis, however, one must reckon on<br />

postponements in the building schedules that in turn will affect<br />

tts. the unexpected downturn in international economy has,<br />

since October last year, resulted in a weakened demand for<br />

products from the Marine cranes division in both the maritime<br />

sector and the offshore sector.<br />

the sizeable order backlog, however, means that the division in<br />

2009 will see a turnover at the same level as in <strong>2008</strong>. With regard<br />

to results, this year looks to be another good year, provided that<br />

financial matters do not have unexpected negative effects. the<br />

order intake in 2009 is expected to be substantially lower than in<br />

<strong>2008</strong>, affecting turnover and operation in the coming years.<br />

as a consequence of changes to the market situation, the Marine<br />

cranes division will intensify its sales efforts to consolidate tts’<br />

position as leading supplier of cranes to ships and offshore vessels,<br />

as well as other handling equipment to the offshore industry. the<br />

challenges that follow in the wake of the financial crisis demand<br />

particular attention to follow-up of customers and commitments.<br />

cooperation with other divisions in tts will be strengthened, both<br />

with regard to service and after sales support to existing customers,<br />

and in relation to development and marketing of new concepts.<br />

Product development focusing on technology and equipment to the<br />

deepwater industry will continue to remain a priority.<br />

0,2<br />

13<br />

35<br />

42

4-8 T T S G r o u P<br />

9-11 rEPorT FroM THE CEo<br />

12-37 b u S i n e S S a r e a S<br />

38-47 CorPoraTE GoVErnanCE<br />

48-110 DirECTor’S rEPorT anD aCCounTS<br />

The Port and Material Handling division<br />

continued its success in <strong>2008</strong>. The division<br />

is well equipped to handle challenges<br />

following the international<br />

economic crisis.<br />

lennart SvenSSon<br />

D i r E C T o r P o r T a n D M a T E r i a l<br />

HanDlinG DiViSion<br />

in recent years, tts has built up terminal and material<br />

handling equipment to become a considerable business domain<br />

of the tts <strong>Group</strong>. the Port and Material Handling division near<br />

doubled its turnover in 2007, and last year the turnover increased<br />

by a further 5 percent to nOK 350 million. Operating profit went<br />

up by 20 percent to nOK 32.5 million.<br />

the Port and Material Handling division’s primary products are<br />

shipyard equipment and equipment for handling containers in<br />

port. the division is managed from Gothenburg, sweden, and has<br />

operations in Finland and norway. In all, the division has 63<br />

employees, whereof 15 are based in sweden, 19 in norway and<br />

29 in Finland. On 1 October last year, Lennart svensson took over<br />

as head of the Port and Material Handling division after Göran<br />

Johansson. svensson is a naval architect and Mechanical engineer,<br />

and has been Managing Director of tts Port equipment aB in<br />

Gothenburg since its establishment in 2005. Prior to this, he was<br />

Marketing Director of tts ships equipment aB, and svensson<br />

has for most of his working career been involved in marine cargo<br />

handling.<br />

tts Handling systems again reported a high level of activity<br />

related to production lines for shipyards in china and India. as a<br />

consequence of the development in the shipbuilding market, the<br />

division has had fewer deliveries to shipyards focusing on newbuildings,<br />

while the demand from shipyards concentrating on<br />

repairs and maintenance has increased.<br />

In <strong>2008</strong>, tts Port equipment delivered an advanced passenger<br />

gangway for the new terminal at risavika in stavanger. Furthermore,<br />

the division successfully completed a major project for<br />

transfer and reconstruction of linkspan, a special ramp linking<br />

vessel and quay, from ports in the netherlands and england to<br />

Belfast in northern Ireland. this year, tts will deliver linkspan to<br />

rotterdam in the netherlands, Harwich in england and ystad<br />

in sweden. the division will moreover focus strongly on sale of<br />

consultancy services to ports that are working on projects to increase<br />

the efficiency of cargo handling.<br />

20<br />

port and material handling

– We expect a strong growth<br />

in the market for systems<br />

that contribute to a more<br />

efficient cargo handling.<br />

21

turnover<br />

noK Million<br />

66<br />

141<br />

179<br />

333<br />

350<br />

2004 2005 2006 2007 <strong>2008</strong> 2004 2005 2006 2007 <strong>2008</strong><br />

again, <strong>2008</strong> saw an increase in the demand for systems for transport<br />

with loading cassettes. tts made deliveries of such systems<br />

to steelworks and operations within the paper industry, as well as<br />

to ports in spain and north africa. tts Liftec has developed an<br />

advanced trailer for this purpose, called Durion, with a remotely<br />

controlled drive unit.<br />

operations<br />

the Port and Material Handling division’s activities are built<br />

around three centres of excellence, in which each unit has its area<br />

of expertise. In addition to linkspans, passenger gangways and<br />

automatic mooring systems, the product portfolio for cargo<br />

handling has expanded to include a unique system for the handling<br />

of containers through the use of cassettes. the cassettes were<br />

originally developed to handle special transport requirements for<br />

industries such as the steel and paper. Moreover, the division’s<br />

recent innovation in developing c-aGVs (cassette- automated<br />

Guided Vehicles) for the transport of containers in ports and<br />

terminals world-wide. a manual version of the cassette system,<br />

using translifters, was put into operation for the first time in a<br />

container terminal in 2007 at aPMt Virginia, Usa. In collaboration<br />

with a swiss supplier, tts has further developed the automated<br />

– the port and material<br />

handling division is less<br />

sensitive to general<br />

fluctuations in the level<br />

of economic activity.<br />

order bacKloG<br />

noK Million<br />

76<br />

72<br />

148<br />

216<br />

326<br />

ebitda<br />

noK Million<br />

4<br />

7<br />

13<br />

26<br />

32<br />

2004 2005 2006 2007 <strong>2008</strong><br />

version of the cassette system to include a wireless energy transfer<br />

technology that adopts inductive energy.<br />

– We are hopeful that 2009 will see the first contract for<br />

delivery of such an automated system, which in that case would be<br />

operational in four years, says Lennart svensson, head of the Port<br />

and Material Handling division.<br />

– In general, we expect a strong growth in the market for<br />

systems that contribute to a more efficient cargo handling in ports,<br />

and tts has products and solutions that fulfil this requirement. By<br />

increasing the loading and discharging capacity in existing ports,<br />

one may to an extent avoid costly development of new port<br />

facilities, svensson emphasises.<br />

market outlook<br />

at the start of 2009, the Port and Material Handling division had an<br />

order backlog of nOK 325 million, compared to nOK 216 million<br />

the year before. We still except to see a growth in turnover this<br />

year. the anticipated decline in the sale of production lines and<br />

special equipment for heavy load handling to shipyards will likely<br />

be compensated by a higher volume of sales of port equipment.<br />

– Our deliveries are to a greater extent than in other parts of<br />

the tts <strong>Group</strong> aimed at public market players, and as such, the<br />

Port and Material Handling division is less sensitive to general<br />

fluctuations in the level of economic activity, svensson maintains.<br />

Strategy<br />

the primary strategy of the Port and Material Handling Division is<br />

to further develop good cooperation between the units in sweden,<br />

Finland and norway with regard to product development and<br />

sales. Furthermore, the division will focus on the development of<br />

solutions that are efficient, as well as environmentally friendly.<br />

the division will continue its long-term marketing efforts to<br />

customers in europe, north-africa, Usa and asia, and is working<br />

alongside other divisions to introduce tts to geographically new<br />

markets, such as Brazil.<br />

23<br />

port & material handling

4-8 T T S G r o u P<br />

9-11 rEPorT FroM THE CEo<br />

12-37 b u S i n e S S a r e a S<br />

38-47 CorPoraTE GoVErnanCE<br />

48-110 DirECTor’S rEPorT anD aCCounTS<br />

in <strong>2008</strong>, the Deck Machinery division reported<br />

significant progress with regard to both<br />

turnover and results. The division has established<br />

extensive operations in China<br />

and is currently targeting, and<br />

has gained a foothold, in the<br />

offshore market.<br />

edGar bethmann<br />

DirECTor DECK MaCHinErY<br />

DiViSion<br />

SInce tHe acqUIsItIOn of Kocks in Germany in the<br />

autumn of 2005, tts has made deck machinery one of its<br />

target areas. the first two years saw the implementation of<br />

a major organisational restructuring, which strengthened the<br />

division’s sales force and ability to deliver high-quality products. In<br />

<strong>2008</strong>, this restructuring yielded results by increasing turnover with<br />

50 percent to nOK 448 million, while operating profit increased<br />

from nOK 5.3 million to nOK 22.3 million.<br />

the Deck Machinery division is managed from Bremen in<br />

Germany, and the division has operations in Ostrava in the czech<br />

republic, Busan in south Korea and Dalian in china. the operations<br />

in china started out as a division for deck machinery in the joint<br />

venture company tts Bohai Machinery in 2007, which in <strong>2008</strong> was<br />

reorganised to become a fully owned subsidiary company. In total,<br />

the Deck Machinery division has 162 employees, whereof 44 are<br />

based in Germany, 33 in the czech republic, 44 in south Korea<br />

and 41 in china. edgar Bethmann is Head of the Deck Machinery<br />

division and Managing Director of tts Kocks GmbH. He holds<br />

an engineering degree in machine construction, and was Managing<br />

Director of tts ships equipment GmbH prior to being appointed<br />

Head of the Deck Machinery division in 2005.<br />

operations<br />

the Deck Machinery division supplies various types of winches and<br />

other deck machinery to the maritime and offshore industries. In<br />

principle, these winches are utilised by all types of vessels, and tts<br />

holds a particularly favourable position in the market for supplying<br />

winches to LnG ships. the level of activity within service and after<br />

sales support is increasing.<br />

the division has developed and extended their product range<br />

by smaller electric and frequency controlled electric winches. 36<br />

electric winches have been delivered in <strong>2008</strong> and the number of<br />

deliveries for 2010 will increase up to 560. tts further offers a<br />

broad range of larger, and technically advanced hydraulic winches,<br />

with either centralised hydraulic supply or self contained.<br />

24<br />

deck machinery<br />

We will focus<br />

on recruitment<br />

of highly qualified<br />

personnel, who<br />

will serve our<br />

customers world<br />

wide.

deck machinery<br />

– Our focus is on the development of new products, in order<br />

to deliver efficient and environmentally sound winches to our<br />

traditional markets, as well as to various niche markets. We have an<br />

extensive level of expertise within the division, and a functional<br />

cooperation between our operations in europe and asia, says<br />

edgar Bethmann, Head of the Deck Machinery division.<br />

collaborating with the Marine cranes division, the Deck<br />

Machinery division has taken part in tts’ general targeting of<br />

the offshore market, achieving favourable results. the division has<br />

developed tailor-made winches for use at great ocean depths, and<br />

participates in the development of packages of technologically<br />

advanced handling equipment for use on special-purpose vessels<br />

dedicated to deep-sea operations.<br />

the Deck Machinery division focuses strongly on service and<br />

after sales support. – now that tts has established its own service<br />

division, we will continue to strengthen our efforts in this area. We<br />

will focus on recruitment of highly qualified personnel, who will<br />

serve our customers world wide. Proximity to the market and<br />

market participants is essential in order to develop and strengthen<br />

our position as provider of service and after sales support,<br />

Bethmann points out.<br />

market outlook<br />

at the start of 2009, the Deck Machinery division had an order<br />

backlog of about nOK 900 million, compared to nOK 681 million<br />

at the start of <strong>2008</strong>. the order intake in <strong>2008</strong> was particularly<br />

26<br />

turnover<br />

noK Million<br />

50<br />

257<br />

300<br />

448<br />

order bacKloG<br />

noK Million<br />

2005 2006 2007 <strong>2008</strong> 2005 2006 2007 <strong>2008</strong><br />

– ttS delivered its first winches<br />

to offshore vessels in <strong>2008</strong>.<br />

366<br />

462<br />

681<br />

902<br />

ebitda<br />

noK Million<br />

2,5*<br />

-5,4<br />

2005 2006 2007 <strong>2008</strong><br />

*) Q4. only<br />

high at shipyards in south Korea, while the growth in the chinese<br />

market has stagnated.<br />

the healthy order backlog results in the division increasing<br />

its turnover yet again in 2009. Long term, the development in<br />

turnover will depend on the duration of the global economic crisis.<br />

the division is dealing aggressively with the situation; through<br />

targeting of new geographical markets, such as Brazil, as well as<br />

niche markets that have not yet been introduced to this part of<br />

tts’ products and expertise.<br />

Strategy<br />

the organisation of the Deck Machinery division is well equipped to<br />

continue the work of developing new products and increasing sales<br />

efforts in established, as well as new markets. In china, tts will set<br />

up a separate sales operation for winches and other deck machinery.<br />

as a result of the anticipated lower level of activity in the maritime<br />

segment, the division’s targeting of the offshore sector will be intensified.<br />

acquisition of companies that possess interesting and relevant<br />

technology is continuously being evaluated, in addition to expanding<br />

existing operations and strengthening collaboration with other<br />

divisions of the tts <strong>Group</strong>. service and after sales support will be<br />

further prioritised in order to enhance customer satisfaction and<br />

strengthen the total earnings of the Deck Machinery Division.<br />

5<br />

22

4-8 T T S G r o u P<br />

9-11 rEPorT FroM THE CEo<br />

12-37 b u S i n e S S a r e a S<br />

38-47 CorPoraTE GoVErnanCE<br />

48-110 DirECTor’S rEPorT anD aCCounTS<br />

The Drilling Equipment division reported a high<br />

level of activity in <strong>2008</strong>. The market for <strong>TTS</strong>’<br />

land rigs has shown strong growth, while<br />

the development in the market<br />

for drilling equipment to the<br />

offshore sector remains uncertain<br />

as a result of the financial crisis.<br />

tom fedoG<br />

DirECTor DrillinG EquiPMEnT<br />

DiViSion<br />

ttHrOUGH tHe acqUIsItIOn of sense eDM as in 2007,<br />

tts made drilling equipment a separate business domain.<br />

the company, now tts sense as, has its head office in<br />

Kristiansand, norway and a branch office in stavanger, norway, as<br />

well as a subsidiary company in edmonton, canada. sense was<br />

founded in 1999. In 2005, sense merged with stavanger-based<br />

eDM, a company with a history dating back to 1996.<br />

tts sense as has a wholly-owned sales and service company in<br />

singapore, and a sales office in Houston, Usa. tts sense Mud as<br />

is a wholly-owned subsidiary company in Kristiansand, focusing on<br />

the handling of drilling mud. tts sense eDM has a 49.9 percent<br />

ownership interest in tts sense DrillFab as, a company located in<br />

Kristiansand that carries out testing and assembly of equipment. In<br />

2007, tts acquired the drilling technology company Wellquip<br />

Holding as in Kristiansand, to be merged with tts sense in 2009.<br />

Wellquip has developed and patented an automatic multifunctional<br />

roughneck, which constitutes part of two complete drilling<br />

packages currently under development by tts sense.<br />

In <strong>2008</strong>, the Drilling equipment division reported a turnover of<br />

nOK 1 057 million, compared to nOK 265 million in the period<br />

of tts’ ownership in 2007. the turnover in <strong>2008</strong> is divided into<br />

50 percent from the offshore sector and 50 percent from the<br />

onshore sector. Operating profit before depreciation was nOK<br />

-24.6 million, compared to nOK 13.9 million under tts’ ownership<br />

in 2007. the basis of the weak result was write downs in relation to<br />

the ability contract. Without the write downs, the result would<br />

have been nOK 38.6 million.<br />

all in all, the Drilling equipment division has 318 employees,<br />

whereof 221 are based in Kristiansand, 21 in stavanger, 55 in<br />

edmonton, ten in singapore and one in Houston. the Drilling<br />

equipment division is headed by tom Fedog, who is Managing<br />

Director of tts sense. He has worked for the company since its<br />

establishment in 1999. Fedog has an advanced degree in business<br />

administration and extensive experience from aker Kværner<br />

Maritime Hydraulics.<br />

– In <strong>2008</strong>, the division worked on equipment packages for two<br />

advanced jack-up rigs, to be delivered in the course of 2009 and<br />

28<br />

drilling equipment

turnover<br />

noK Million<br />

265<br />

1057<br />

order bacKloG<br />

noK Million<br />

2010. Furthermore, the division delivered two land rigs and two<br />

work-over rigs out of a total delivery of nine larger land rigs<br />

and two maintenance rigs to ability Drilling asa. Our targeting<br />

of the market for deliveries of smaller land rigs has had very<br />

promising results, and we have signed contracts with schlumberger<br />

and Weatherford, says tom Fedog.<br />

operations<br />

the Drilling equipment division develops and supplies advanced<br />

drilling equipment and drilling systems to the international oil<br />

and gas industry, including complete drilling packages, drilling<br />

equipment and pipe handling equipment. Furthermore, the division<br />

supplies patented technology for rigs that combine drilling,<br />

maintenance and service. these rigs are used for drilling operations<br />

both on land and at sea.<br />

tts sense will deliver a complete drilling equipment package<br />

to Jurong shipyard in singapore. the equipment constitutes part<br />

of the shipyard’s delivery of a highly advanced jack-up rig for<br />

production in the north sea. the rig has been contracted by the<br />

company Petroprod, owned by Larsen Oil & Gas in Bergen.<br />

Furthermore, the division will deliver yet another drilling package<br />

to Keppel FeLs in singapore, to be used on a mobile jack-up rig<br />

currently under construction in Kristiansand for skeie Drilling<br />

and Production (sKDP).<br />

as previously mentioned, tts sense has signed a contract for the<br />

delivery of altogether nine large land-based drilling rigs to ability<br />

Drilling. the first two rigs were delivered in <strong>2008</strong>, and two rigs will<br />

be delivered in 2009. Delivery of the remaining five drilling rigs<br />

– our targeting of the<br />

market for deliveries of<br />

smaller land rigs has had<br />

very promising results.<br />

999<br />

1410<br />

2007 <strong>2008</strong> 2007 <strong>2008</strong><br />

ebitda<br />

noK Million<br />

13,9<br />

-24,6<br />

2007 <strong>2008</strong><br />

has been postponed by agreement until 2011. as the marked has<br />

shown a downward trend, uncertainty has increased with regard to<br />

whether the final 5 rigs will be delivered or not. consequently, we<br />

have chosen to terminate the total contract evaluation of the 9 rigs,<br />

and charged capitalised costs for 2007 as an expence in the <strong>2008</strong><br />

accounts. this has entailed a reduction of the Drilling equipment<br />

division’s eBItDa result of nOK 63.1 million. In <strong>2008</strong>, tts<br />

has an accounted loss on the ability deliveries caused by delays<br />

related to development and testing.<br />

In the space of <strong>2008</strong> and 2009, tts sense will deliver 11<br />

Ultrasingle drilling rigs to schlumberger and Weatherford.<br />

In addition to the major contracts, the Drilling equipment<br />

division has signed a number of contracts for single deliveries of<br />

equipment to various operators within the oil and gas industry.<br />

market outlook<br />

at the start of 2009, the Drilling equipment division had an order<br />

backlog of nOK 1 410 million, compared to nOK 999 million<br />

twelve months previously.<br />

since last autumn, the market for drilling equipment has been at<br />

stand-still owing to financial unrest and the crisis in international<br />

economy. this situation is expected to continue in 2009. In 2009,<br />

tts sense will focus on areas where investment into the oil and gas<br />

industry will continue despite the challenges in the financial market<br />

and relative low energy prices.<br />

Strategy<br />

tts sense will continue its strategy concerning deliveries of<br />

high end/high performance drilling equipment to the onshore and<br />

offshore industry. acquisitions will be evaluated in order to develop<br />

and strengthen tts’ position in the global market for rigs and<br />

drilling equipment. through its global presence, the division is<br />

well-positioned to challenge major competitors in the market.<br />

Development of cooperation with relevant centres in the group will<br />

be intensified in order to utilise synergistic effects, including lowcost<br />

production.<br />

In 2009, the division will focus on implementation of signed<br />

contracts and targeting of niche markets that have been less affected<br />

by the global economic crisis.<br />

31<br />

drilling equipment

4-8 T T S G r o u P<br />

9-11 rEPorT FroM THE CEo<br />

12-37 b u S i n e S S a r e a S<br />

38-47 CorPoraTE GoVErnanCE<br />

48-110 DirECTor’S rEPorT anD aCCounTS<br />

as of 1 January 2009, <strong>TTS</strong> has organised service<br />

and after sales support in a separate division.<br />

our aim is to strengthen the group’s position as<br />

consultant and provider of services following<br />

the delivery of new equipment,<br />

and this will be ascertained<br />

through global presence.<br />

marGrethe hauGe<br />

DirECTor<br />

SErViCES DiViSion<br />

h<br />

IstOrIcaLLy, tts has based its portfolio of service and<br />

follow-up of customers on a network of agents. the<br />

reasoning behind this was that the “critical mass” has been<br />

too small to build up a separate organisation for operation in the<br />

market for afters sales support. a service organisation primarily<br />

based on independent agents, however, has the weakness that the<br />

agents’ competence regarding various parts of tts’ product range<br />

has been limited. Furthermore, the agents have to little degree<br />

re-allocated turnover to tts, and accordingly, the company has<br />

given away an important share of the market to others. customers<br />

often choose other suppliers to handle more complete and efficient<br />

services related to maintenance of their equipment and other<br />

follow-up, and tts would now like to seize a larger share of this<br />

segment.<br />

the market for sale of new equipment within tts’ business<br />

areas has, in the recent years, been characterised by formidable<br />

growth, which in turn is reflected in the group’s growth in turnover<br />

and order backlog. the company’s divisions have focused on<br />

delivering in line with increased demand, which has affected their<br />

capacity to offer services on complete equipment deliveries. all the<br />

same, the turnover within after sales support has had a substantial<br />

growth. this market is less sensitive to economic fluctuations than<br />

the sale of new equipment, and the profit margins are usually<br />

higher.<br />

Margrethe Hauge has been appointed head of the services division.<br />

she started in tts in <strong>2008</strong>, in a newly established position as group<br />

director for after sales, and has been responsible for establishing a<br />

new direction for tts services, and consequently for the planning of<br />

operations of the new division. she holds a Master of Business and<br />

economics, and has previously worked for Hydro seafood and for<br />

Kverneland, a manufacturer of agricultural machines.<br />

– Our aim is to build up an organisation that will form an integral<br />

part of tts, with a target turnover of nOK 1 billion. the most<br />

important key to success will be the establishment of a global sales<br />

and service network in prime locations, and having colleagues<br />

32<br />

Services

Services<br />

present to the market a uniform profile, says Margrethe Hauge.<br />

customers have high expectations of what a good service provider<br />

should be able to offer, and our employees will endeavour to fulfil<br />

these expectations through a more uniform representation of<br />

tts services.<br />

operations<br />

right from the start, the services division has been provided with<br />

operations and employees from the established divisions. as such,<br />

the sales and representative office in Vietnam, with its seven<br />

employees, and the office in south Korea, with eight employees,<br />

have both been formally transferred to the services division. the<br />

same applies to the service organisation that tts set up in Usa,<br />

with 11 employees. Furthermore, tts has established a matrix<br />

organisation toward those responsible for service and aftersales in<br />

the product companies. they report on a technical level to the<br />

services division. In all, the combination of local representatives<br />

and co-workers in centres of excellence of services will constitute<br />

about 175 persons in the tts <strong>Group</strong>.<br />

– We plan on expanding the global representation based on<br />

where our customers have the greatest need for our presence. In<br />

that respect, singapore stands out at this phase, as well as the<br />

Middle east and south america. It is furthermore natural to include<br />

china in the global service network, Margrethe Hauge points out.<br />

activities within the service area are at present primarily<br />

reactive to customer inquiries, and concentrated on repairs and<br />

maintenance of existing equipment. tts will increasingly arrange<br />

34<br />

for agreements that ensure continuous service for our customers,<br />

and will further actively seek to come up with solutions that may<br />

fulfil our customers’ requirements. this means an increased focus<br />

on training as support for the customers’ operators, in order for<br />

them to implement efficient use of advanced equipment more<br />

swiftly. For tts, it is important to obtain a higher degree of standardisation<br />

related to purchasing of parts and components used in<br />

our service work.<br />

market outlook<br />

In tts, the activities in the market for after sales support and<br />

service constitute about 10 percent of the total turnover. In comparable<br />

operations, this share is often more than 20 percent. tts’<br />

long-term goal is for after sales and service to make up 20 percent<br />

of the group’s total turnover. this means that tts must be present<br />

with its expertise where service is conducted, and come up with<br />

service solutions that help the customer achieve efficient operation.<br />

We are entering a challenging period, in which the customers are<br />

assessing how much of their service can be postponed while the<br />

world economy remains unstable. nevertheless,tts view the<br />

possibilites in service and aftersales positively, as there are a lot of<br />

service opportunities to be seized in merely increasing the market<br />

share of our own already installed equipment!<br />

– this market is less sensitive to economic fluctuations<br />

than the sale of new equipment, and the profit margins<br />

are usually higher.

4-8 T T S G r o u P<br />

9-11 rEPorT FroM THE CEo<br />

12-37 b u S i n e S S a r e a S<br />

38-47 CorPoraTE GoVErnanCE<br />

48-110 DirECTor’S rEPorT anD aCCounTS<br />

Breakthrough in<br />

the market for trailermounted<br />

land rigs<br />

Through the Drilling Equipment division,<br />

<strong>TTS</strong> is supplier of land rigs of various sizes<br />

and categories. in the course of only a few<br />

years, Edmonton in Canada has seen the<br />

build-up of extensive operations relating<br />

to development, production and assembly<br />

of trailer-mounted land rigs. The unique<br />

technology has made these rigs a <strong>TTS</strong><br />

bestseller.<br />

eDMonTon in alBErTa has more to offer than<br />

its excellent ice hockey team. With just over<br />

1 million inhabitants, the city is home to a major<br />

university at the forefront of engineering education. The<br />

infrastructural premises for the company, which today<br />

constitutes <strong>TTS</strong> Sense (Canada) ltd., were consequently<br />

excellent. The company has seen an exceptional transformation<br />

from tired old building to state-of-the-art rig<br />

Shop. Presently, the company has 100 employees and is<br />

managed by Michael Symchuk. He holds a degree in<br />

Mechanical Engineering Technology, and has been on<br />

board since the incorporation of the company in alberta<br />

in october 2005.<br />

We have a conciderable time focused on implementing<br />

our concept for mobile land rigs with the most progressive<br />

36<br />

our land rigs are unique;<br />

based on offshore solutions<br />

with regard to safety<br />

and environment.<br />

and advanced technology on the market. During the<br />

course of <strong>2008</strong>, we experienced a breakthrough in the<br />

market as a result of two major contracts worth a total of<br />

noK 700 million, says Michael Symchuk.<br />

patented technology<br />

The land rigs, which have become a Canadian speciality,<br />

have 125 to 150 tons of hook load capacity, while <strong>TTS</strong><br />

Sense, norway, delivers 250-ton rigs. The rigs are based on<br />

patented rack and pinion technology, combined with an<br />

efficient mast design where the Top Drive is mounted on<br />

rails located on the front face of the mast. a mechanical<br />

pipe handling machine ensures safe and efficient handling<br />

of all types of drill pipes. With its compact design and low<br />

weight, this rig is perfect for fast and efficient well-to-

well relocation. The rig is usually mounted on a trailer,<br />

with two hydraulic cylinders that are used to swiftly<br />

swing the mast up into a vertical position in preparation<br />

for drilling operations.<br />

- our land rigs are unique; based on offshore solutions<br />

with regard to safety and environment. This, coupled with<br />

the advanced solutions for control systems and automation,<br />

results in a high level of reliability, even under<br />

extreme weather conditions, Michael maintains.<br />

prestigious contracts<br />

last year, <strong>TTS</strong> Sense Canada entered into contracts with<br />

two of the worlds largest oilfield service companies,<br />

Sclumberger and Weatherford to deliver in total 11 150-ton<br />

mobile land rigs in <strong>2008</strong> and 2009. These contracts<br />

represent a great recognition of the company’s technolgy.<br />

in January this year, <strong>TTS</strong> Sense Canada signed yet another<br />

major contract for 150-ton mobile land rigs, this time for<br />

the Mexican company Maquinaia, ingenieria y Proyectos<br />

del Puerto (MiPPSa).<br />

intensifying market efforts<br />

- These contracts, of which one is with a major market<br />

player within the oil industry, helps strengthen <strong>TTS</strong>’s<br />

position as a global supplier of land rigs. on the basis of<br />

these deliveries, we will intensify the marketing of our<br />

concept for land rigs, as well as the expertise that we<br />

represent, says Michael Symchuk.<br />

37

4-8 T T S G r o u P<br />

9-11 rEPorT FroM THE CEo<br />

12-37 B u S i n E S S a r E a S<br />

38-47 corporate Governance<br />

48-110 DirECTor’S rEPorT anD aCCounTS<br />

Shareholder information<br />

Share price performance<br />

in March 1995, <strong>TTS</strong> Marine aSa completed a public share issue,<br />

and 3 May 1995, the company was listed on the SMB list of<br />

the oslo Stock Exchange.<br />