managing risk.pdf

managing risk.pdf

managing risk.pdf

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

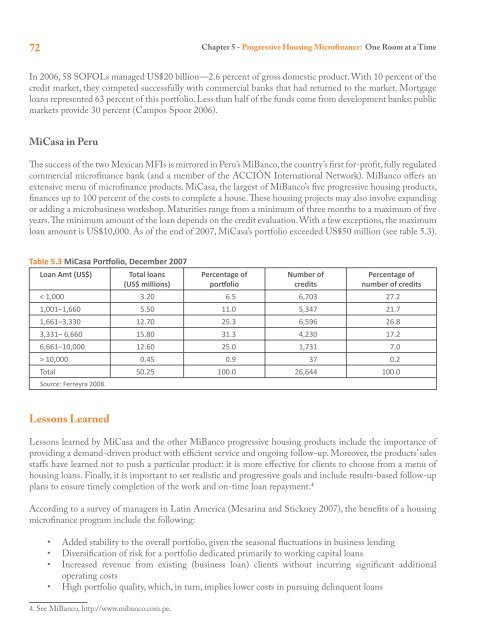

72 Chapter 5 - Progressive Housing Microfinance: One Room at a TimeIn 2006, 58 SOFOLs managed US$20 billion—2.6 percent of gross domestic product. With 10 percent of thecredit market, they competed successfully with commercial banks that had returned to the market. Mortgageloans represented 63 percent of this portfolio. Less than half of the funds come from development banks; publicmarkets provide 30 percent (Campos Spoor 2006).MiCasa in PeruThe success of the two Mexican MFIs is mirrored in Peru’s MiBanco, the country’s first for-profit, fully regulatedcommercial microfinance bank (and a member of the ACCIÓN International Network). MiBanco offers anextensive menu of microfinance products. MiCasa, the largest of MiBanco’s five progressive housing products,finances up to 100 percent of the costs to complete a house. These housing projects may also involve expandingor adding a microbusiness workshop. Maturities range from a minimum of three months to a maximum of fiveyears. The minimum amount of the loan depends on the credit evaluation. With a few exceptions, the maximumloan amount is US$10,000. As of the end of 2007, MiCasa’s portfolio exceeded US$50 million (see table 5.3).Table 5.3 MiCasa Porolio, December 2007Loan Amt (US$)Total loans(US$ millions)Percentage ofporolioNumber ofcreditsPercentage ofnumber of credits< 1,000 3.20 6.5 6,703 27.21,001–1,660 5.50 11.0 5,347 21.71,661–3,330 12.70 25.3 6,596 26.83,331– 6,660 15.80 31.3 4,230 17.26,661–10,000 12.60 25.0 1,731 7.0> 10,000 0.45 0.9 37 0.2Total 50.25 100.0 26,644 100.0Source: Ferreyra 2008.Lessons LearnedLessons learned by MiCasa and the other MiBanco progressive housing products include the importance ofproviding a demand-driven product with efficient service and ongoing follow-up. Moreover, the products’ salesstaffs have learned not to push a particular product: it is more effective for clients to choose from a menu ofhousing loans. Finally, it is important to set realistic and progressive goals and include results-based follow-upplans to ensure timely completion of the work and on-time loan repayment. 4According to a survey of managers in Latin America (Mesarina and Stickney 2007), the benefits of a housingmicrofinance program include the following:• Added stability to the overall portfolio, given the seasonal fluctuations in business lending• Diversification of <strong>risk</strong> for a portfolio dedicated primarily to working capital loans• Increased revenue from existing (business loan) clients without incurring significant additionaloperating costs• High portfolio quality, which, in turn, implies lower costs in pursuing delinquent loans4. See MiBanco, http://www.mibanco.com.pe.