managing risk.pdf

managing risk.pdf

managing risk.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

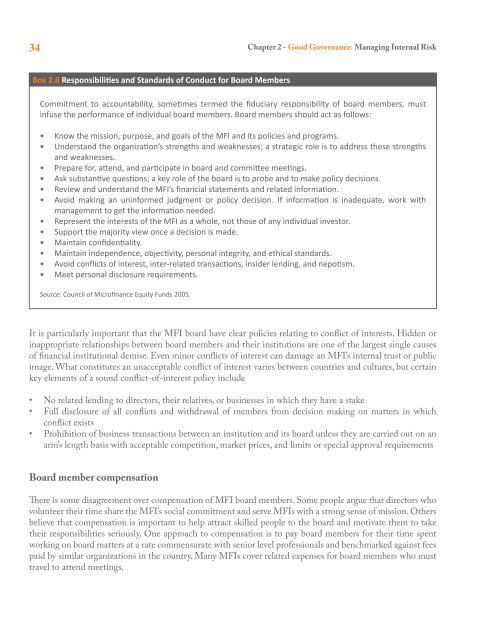

34 Chapter 2 - Good Governance: Managing Internal RiskBox 2.8 Responsibilies and Standards of Conduct for Board MembersCommitment to accountability, somemes termed the fiduciary responsibility of board members, mustinfuse the performance of individual board members. Board members should act as follows:• Know the mission, purpose, and goals of the MFI and its policies and programs.• Understand the organizaon’s strengths and weaknesses; a strategic role is to address these strengthsand weaknesses.• Prepare for, aend, and parcipate in board and commiee meengs.• Ask substanve quesons; a key role of the board is to probe and to make policy decisions.• Review and understand the MFI’s financial statements and related informaon.• Avoid making an uninformed judgment or policy decision. If informaon is inadequate, work withmanagement to get the informaon needed.• Represent the interests of the MFI as a whole, not those of any individual investor.• Support the majority view once a decision is made.• Maintain confidenality.• Maintain independence, objecvity, personal integrity, and ethical standards.• Avoid conflicts of interest, inter-related transacons, insider lending, and neposm.• Meet personal disclosure requirements.Source: Council of Microfinance Equity Funds 2005.It is particularly important that the MFI board have clear policies relating to conflict of interests. Hidden orinappropriate relationships between board members and their institutions are one of the largest single causesof financial institutional demise. Even minor conflicts of interest can damage an MFI’s internal trust or publicimage. What constitutes an unacceptable conflict of interest varies between countries and cultures, but certainkey elements of a sound conflict-of-interest policy include• No related lending to directors, their relatives, or businesses in which they have a stake• Full disclosure of all conflicts and withdrawal of members from decision making on matters in whichconflict exists• Prohibition of business transactions between an institution and its board unless they are carried out on anarm’s length basis with acceptable competition, market prices, and limits or special approval requirementsBoard member compensationThere is some disagreement over compensation of MFI board members. Some people argue that directors whovolunteer their time share the MFI’s social commitment and serve MFIs with a strong sense of mission. Othersbelieve that compensation is important to help attract skilled people to the board and motivate them to taketheir responsibilities seriously. One approach to compensation is to pay board members for their time spentworking on board matters at a rate commensurate with senior level professionals and benchmarked against feespaid by similar organizations in the country. Many MFIs cover related expenses for board members who musttravel to attend meetings.