managing risk.pdf

managing risk.pdf

managing risk.pdf

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

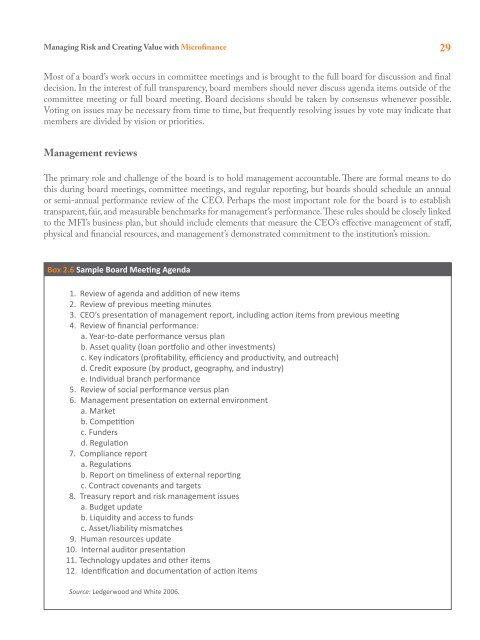

Managing Risk and Creating Value with Microfinance29Most of a board’s work occurs in committee meetings and is brought to the full board for discussion and finaldecision. In the interest of full transparency, board members should never discuss agenda items outside of thecommittee meeting or full board meeting. Board decisions should be taken by consensus whenever possible.Voting on issues may be necessary from time to time, but frequently resolving issues by vote may indicate thatmembers are divided by vision or priorities.Management reviewsThe primary role and challenge of the board is to hold management accountable. There are formal means to dothis during board meetings, committee meetings, and regular reporting, but boards should schedule an annualor semi-annual performance review of the CEO. Perhaps the most important role for the board is to establishtransparent, fair, and measurable benchmarks for management’s performance. These rules should be closely linkedto the MFI’s business plan, but should include elements that measure the CEO’s effective management of staff,physical and financial resources, and management’s demonstrated commitment to the institution’s mission.Box 2.6 Sample Board Meeng Agenda1. Review of agenda and addion of new items2. Review of previous meeng minutes3. CEO’s presentaon of management report, including acon items from previous meeng4. Review of financial performance:a. Year-to-date performance versus planb. Asset quality (loan porolio and other investments)c. Key indicators (profitability, efficiency and producvity, and outreach)d. Credit exposure (by product, geography, and industry)e. Individual branch performance5. Review of social performance versus plan6. Management presentaon on external environmenta. Marketb. Compeonc. Fundersd. Regulaon7. Compliance reporta. Regulaonsb. Report on meliness of external reporngc. Contract covenants and targets8. Treasury report and <strong>risk</strong> management issuesa. Budget updateb. Liquidity and access to fundsc. Asset/liability mismatches9. Human resources update10. Internal auditor presentaon11. Technology updates and other items12. Idenficaon and documentaon of acon itemsSource: Ledgerwood and White 2006.