Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

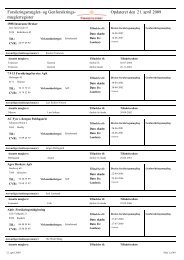

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6I. OVERALL STABILITY ASSESSMENT1. The financial system exhibits generally sound fundamentals. The system appearsresilient and is well supervised, underpinned by an effective legal and financialinfrastructure. It is currently enjoying the fruits of robust ec<strong>on</strong>omic growth, lowunemployment and inflati<strong>on</strong>, and fiscal and current account surpluses. Lending c<strong>on</strong>tinues tobe str<strong>on</strong>g, coinciding <str<strong>on</strong>g>with</str<strong>on</strong>g> rising housing prices. Profitability of financial instituti<strong>on</strong>s is atrecord levels and the number of corporate bankruptcies is the lowest in many years.2. The recent str<strong>on</strong>g performance, driven by rapid credit growth and an exuberanthousing market, will be difficult to sustain. The advanced cyclical phase of the ec<strong>on</strong>omy ismost evident in the expansi<strong>on</strong> of m<strong>on</strong>etary and credit aggregates and higher asset prices.Housing prices in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> have outpaced those in the other Nordic countries, underpinnedby the low interest rates, new types of financing, and the property tax freeze. A combinati<strong>on</strong>of c<strong>on</strong>tinued prudent macroec<strong>on</strong>omic policies, structural reforms, and acti<strong>on</strong>s to avoidunbalanced housing market developments will be needed to maintain macroec<strong>on</strong>omic andfinancial stability.3. A key less<strong>on</strong> of the early 1990s when the banking system was in distress, is thefact that financial sector problems tend to incubate in good times. While themacroec<strong>on</strong>omic envir<strong>on</strong>ment is now much better, and banks have improved their riskmanagement techniques, capital cushi<strong>on</strong>s are expected to decline <str<strong>on</strong>g>with</str<strong>on</strong>g> the implementati<strong>on</strong> ofBasel II. Stress test results show that while the system can absorb sizable shocks, a verysevere scenario could entail significant shortfalls in required capital. As large investors inmortgage b<strong>on</strong>ds, banks have benefited in the recent past from revaluati<strong>on</strong> gains fromdeclining interest rates. Prospective interest rate increases would likely have the oppositeeffect in the near term.4. Mortgage finance instituti<strong>on</strong>s are financially sound and risks in their balancesheets are well c<strong>on</strong>tained by design. They issue mortgage b<strong>on</strong>ds that must have cash flowsthat fully match those of the loans they make, thereby allowing individual borrowers accessto low cost financing in the capital market. The impending EU regulati<strong>on</strong> <strong>on</strong> covered b<strong>on</strong>dsis likely to pose significant transiti<strong>on</strong>al issues for the mortgage b<strong>on</strong>d system. When it isamended in accordance <str<strong>on</strong>g>with</str<strong>on</strong>g> the EU regulati<strong>on</strong>s, some of its attractive features would betraded off against the potential l<strong>on</strong>g term benefits of opening up mortgage b<strong>on</strong>d issuance tobanks. To fully realize these benefits, it would be important to ensure c<strong>on</strong>tinued effectivedisclosure and transparency and a level playing field am<strong>on</strong>g market participants.5. The life-insurance and pensi<strong>on</strong> funds industry has largely addressed theproblems stemming from past issuance of c<strong>on</strong>tracts <str<strong>on</strong>g>with</str<strong>on</strong>g> high guaranteed returns. Thishas been helped by higher interest rates, reducti<strong>on</strong>s in guaranteed rates, and some degree ofhedging. However, life-insurance companies and pensi<strong>on</strong> funds c<strong>on</strong>tinue to sell products<str<strong>on</strong>g>with</str<strong>on</strong>g> guaranteed returns that may cause problems later. This requires c<strong>on</strong>tinued m<strong>on</strong>itoringby the Danish <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisory Authority (DFSA) of companies’ ability to meet theirl<strong>on</strong>g-term obligati<strong>on</strong>s under varying interest rate envir<strong>on</strong>ments.