Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

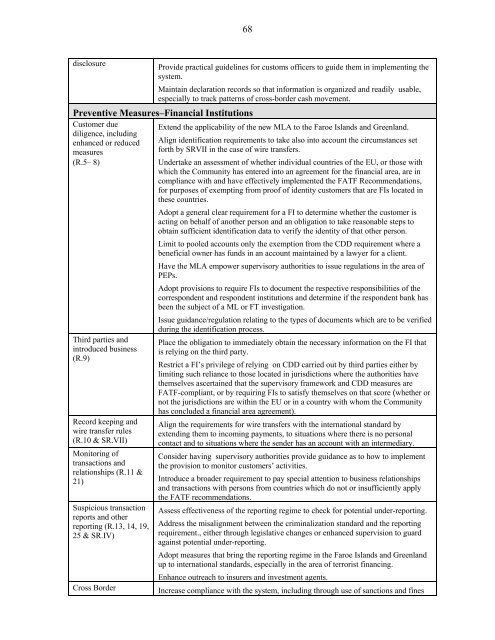

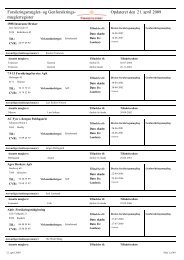

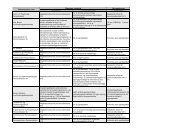

68disclosureProvide practical guidelines for customs officers to guide them in implementing thesystem.Maintain declarati<strong>on</strong> records so that informati<strong>on</strong> is organized and readily usable,especially to track patterns of cross-border cash movement.Preventive Measures–<str<strong>on</strong>g>Financial</str<strong>on</strong>g> Instituti<strong>on</strong>sCustomer duediligence, includingenhanced or reducedmeasures(R.5– 8)Third parties andintroduced business(R.9)Record keeping andwire transfer rules(R.10 & SR.VII)M<strong>on</strong>itoring oftransacti<strong>on</strong>s andrelati<strong>on</strong>ships (R.11 &21)Suspicious transacti<strong>on</strong><str<strong>on</strong>g>reports</str<strong>on</strong>g> and otherreporting (R.13, 14, 19,25 & SR.IV)Cross BorderExtend the applicability of the new MLA to the Faroe Islands and Greenland.Align identificati<strong>on</strong> requirements to take also into account the circumstances setforth by SRVII in the case of wire transfers.Undertake an assessment of whether individual countries of the EU, or those <str<strong>on</strong>g>with</str<strong>on</strong>g>which the Community has entered into an agreement for the financial area, are incompliance <str<strong>on</strong>g>with</str<strong>on</strong>g> and have effectively implemented the FATF Recommendati<strong>on</strong>s,for purposes of exempting from proof of identity customers that are FIs located inthese countries.Adopt a general clear requirement for a FI to determine whether the customer isacting <strong>on</strong> behalf of another pers<strong>on</strong> and an obligati<strong>on</strong> to take reas<strong>on</strong>able steps toobtain sufficient identificati<strong>on</strong> data to verify the identity of that other pers<strong>on</strong>.Limit to pooled accounts <strong>on</strong>ly the exempti<strong>on</strong> from the CDD requirement where abeneficial owner has funds in an account maintained by a lawyer for a client.Have the MLA empower supervisory authorities to issue regulati<strong>on</strong>s in the area ofPEPs.Adopt provisi<strong>on</strong>s to require FIs to document the respective resp<strong>on</strong>sibilities of thecorresp<strong>on</strong>dent and resp<strong>on</strong>dent instituti<strong>on</strong>s and determine if the resp<strong>on</strong>dent bank hasbeen the subject of a ML or FT investigati<strong>on</strong>.Issue guidance/regulati<strong>on</strong> relating to the types of documents which are to be verifiedduring the identificati<strong>on</strong> process.Place the obligati<strong>on</strong> to immediately obtain the necessary informati<strong>on</strong> <strong>on</strong> the FI thatis relying <strong>on</strong> the third party.Restrict a FI’s privilege of relying <strong>on</strong> CDD carried out by third parties either bylimiting such reliance to those located in jurisdicti<strong>on</strong>s where the authorities havethemselves ascertained that the supervisory framework and CDD measures areFATF-compliant, or by requiring FIs to satisfy themselves <strong>on</strong> that score (whether ornot the jurisdicti<strong>on</strong>s are <str<strong>on</strong>g>with</str<strong>on</strong>g>in the EU or in a country <str<strong>on</strong>g>with</str<strong>on</strong>g> whom the Communityhas c<strong>on</strong>cluded a financial area agreement).Align the requirements for wire transfers <str<strong>on</strong>g>with</str<strong>on</strong>g> the internati<strong>on</strong>al standard byextending them to incoming payments, to situati<strong>on</strong>s where there is no pers<strong>on</strong>alc<strong>on</strong>tact and to situati<strong>on</strong>s where the sender has an account <str<strong>on</strong>g>with</str<strong>on</strong>g> an intermediary.C<strong>on</strong>sider having supervisory authorities provide guidance as to how to implementthe provisi<strong>on</strong> to m<strong>on</strong>itor customers’ activities.Introduce a broader requirement to pay special attenti<strong>on</strong> to business relati<strong>on</strong>shipsand transacti<strong>on</strong>s <str<strong>on</strong>g>with</str<strong>on</strong>g> pers<strong>on</strong>s from countries which do not or insufficiently applythe FATF recommendati<strong>on</strong>s.Assess effectiveness of the reporting regime to check for potential under-reporting.Address the misalignment between the criminalizati<strong>on</strong> standard and the reportingrequirement., either through legislative changes or enhanced supervisi<strong>on</strong> to guardagainst potential under-reporting.Adopt measures that bring the reporting regime in the Faroe Islands and Greenlandup to internati<strong>on</strong>al standards, especially in the area of terrorist financing.Enhance outreach to insurers and investment agents.Increase compliance <str<strong>on</strong>g>with</str<strong>on</strong>g> the system, including through use of sancti<strong>on</strong>s and fines