Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

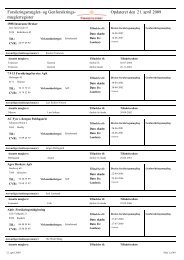

60we would like to emphasize that the participants generally have far more eligible collateralthan needed for their daily net payments not <strong>on</strong>ly in VP settlement, but also in theSumclearing and CLS. 37Supervisi<strong>on</strong> of c<strong>on</strong>centrati<strong>on</strong> risks that may stem from indirect participati<strong>on</strong> <str<strong>on</strong>g>with</str<strong>on</strong>g> regard topayments in the VP-system is already part of the supervisi<strong>on</strong> of the “indirect participants”and the payment providers by the DFSA. However, based <strong>on</strong> the recommendati<strong>on</strong>s of the<strong>IMF</strong>, steps will be taken to further formalize supervisi<strong>on</strong> in this area.Central bank resp<strong>on</strong>sibilitiesThe recommendati<strong>on</strong>s to further strengthen the oversight of the Danish payment andsettlement systems are c<strong>on</strong>sistent <str<strong>on</strong>g>with</str<strong>on</strong>g> the self-assessment d<strong>on</strong>e by Danmarks Nati<strong>on</strong>albank.It should be noted though that important steps towards full observance of the internati<strong>on</strong>alstandards <strong>on</strong> central bank oversight have already been taken. The legal basis, for instance,has been strengthened by an amendment to the STA, which has become effective fromMarch 1, 2006. Following this amendment, the “MoU between Danmarks Nati<strong>on</strong>albank andthe Danish <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisory Authority c<strong>on</strong>cerning Payment <str<strong>on</strong>g>System</str<strong>on</strong>g>s and ClearingCenters” will be revised <str<strong>on</strong>g>with</str<strong>on</strong>g> a view to further enhance the cooperati<strong>on</strong> between the twoauthorities. In additi<strong>on</strong>, Danmarks Nati<strong>on</strong>albank will take the necessary steps to broaden theoversight of the retail payment system (Sumclearingen) <str<strong>on</strong>g>with</str<strong>on</strong>g> a view to cover all majorcomp<strong>on</strong>ents of the system, including different payment instruments and sub-clearings. Highpriority will be assigned to formalize the oversight task through written procedures andguidelines. Thus, full observance is expected to be achieved in 2006.37 In a study triggered by this assessment, it was dem<strong>on</strong>strated that in 2005, all larger banks’ eligible collateralsignificantly exceeded their total net payment obligati<strong>on</strong>s in all systems—even when the participant <str<strong>on</strong>g>with</str<strong>on</strong>g> thelargest net payment obligati<strong>on</strong> was <str<strong>on</strong>g>with</str<strong>on</strong>g>drawn from the settlement <strong>on</strong> every day during 2005 and all theremaining participant's net positi<strong>on</strong>s were recalculated. Am<strong>on</strong>g the minor banks, however, <strong>on</strong>ly a handful ofbanks had recalculated net positi<strong>on</strong>s, which <strong>on</strong> very few days surpassed the value of their eligible collateral.However, this reflects flaws in the methodology used in the study that tends to exaggerate the effects <strong>on</strong> smallbanks and does not include the fact that banks can pledge securities for intraday credit already in the settlementcycle in which the securities are received. The study “Protecti<strong>on</strong> of Settlement in Danish Payment <str<strong>on</strong>g>System</str<strong>on</strong>g>s” canbe found in <str<strong>on</strong>g>Financial</str<strong>on</strong>g> <str<strong>on</strong>g>Stability</str<strong>on</strong>g> 2006 published by Danmarks Nati<strong>on</strong>albank (Copenhagen). It is available <strong>on</strong>:http://www.nati<strong>on</strong>albanken.dk/.