Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

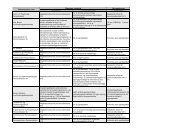

53 ANNEX VREPORT ON THE OBSERVANCE OF THE RECOMMENDATIONS FOR SECURITIESSETTLEMENT SYSTEMSGeneral1. The assessment of the observance of the Committee for Payments and Settlement<str<strong>on</strong>g>System</str<strong>on</strong>g>s (CPSS) and the Internati<strong>on</strong>al Organizati<strong>on</strong> of Securities Commissi<strong>on</strong>s’ (IOSCO)Recommendati<strong>on</strong>s for Securities Settlement <str<strong>on</strong>g>System</str<strong>on</strong>g>s dated November 2001 was carried outas part of the first FSAP missi<strong>on</strong> to <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>, November 7–18, 2005. 322. Værdipapircentralen (VP) is the sole CSD in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> and registers the ownership ofsecurities issued in the country, clears, and settles securities transacti<strong>on</strong>s in the regulatedmarkets and in the OTC market. In 2005, 10.2 milli<strong>on</strong> transacti<strong>on</strong>s were settled in VP <str<strong>on</strong>g>with</str<strong>on</strong>g> amarket value of DKr 30,924 billi<strong>on</strong> (around US$5,012 billi<strong>on</strong>), made up of DKr27,485 billi<strong>on</strong> in b<strong>on</strong>ds and DKr 3,439 billi<strong>on</strong> in shares.3. Prior to the missi<strong>on</strong>, Danmarks Nati<strong>on</strong>albank, the central bank, and the DFSA, asoverseers of VP, prepared a comprehensive and thorough self-assessment, which was used asthe basis for this assessment.Scope of the <str<strong>on</strong>g>Assessment</str<strong>on</strong>g>4. VP registers, clears, and settles a broad range of securities, such as treasury bills, allother negotiable m<strong>on</strong>ey market instruments, b<strong>on</strong>ds issued by the public and private sector,including mortgage b<strong>on</strong>ds, equities, and investment certificates issued by mutual funds.5. Derivatives trades in Danish securities are c<strong>on</strong>ducted through OMX DerivativesMarkets, a sec<strong>on</strong>dary name to Stockholm Stock Exchange Ltd (SSE), used for the derivativestrading and clearing operati<strong>on</strong>s. When OMX clears derivatives transacti<strong>on</strong>s, this means thatOMX Derivatives Markets acts as the central counterparty (CCP) for all derivatives tradesc<strong>on</strong>ducted in this market. The size of the derivatives market in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> has so far beenrelatively small (in mid-2005, around 700,000 c<strong>on</strong>tracts were outstanding <str<strong>on</strong>g>with</str<strong>on</strong>g> an averagedaily settlement of DKr 1.5 milli<strong>on</strong>). Futures and opti<strong>on</strong>s <strong>on</strong> Danish securities havepreviously been listed <strong>on</strong> the FUTOP (CSE) but have recently been transferred to SSE inc<strong>on</strong>necti<strong>on</strong> <str<strong>on</strong>g>with</str<strong>on</strong>g> the merger of the Nordic and Baltic stock exchanges into the OMX GroupAB. 3332 The assessment was performed by Jan Woltjer, M<strong>on</strong>etary and Capital Markets Department (MCM),Internati<strong>on</strong>al M<strong>on</strong>etary Fund (<strong>IMF</strong>), formerly the De Nederlandsche Bank.33 For informati<strong>on</strong> <strong>on</strong> the OMX Group, see: http://www.omxgroup.com/en/index.aspx .