Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

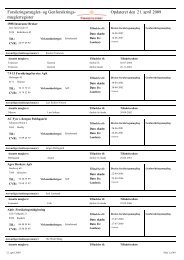

4615. A key characteristic of the Danish payment system infrastructure is the high degree ofco-operati<strong>on</strong> <str<strong>on</strong>g>with</str<strong>on</strong>g>in the financial sector in relati<strong>on</strong> to the technical infrastructure. The mainparts of the infrastructure for the clearing of retail payments and securities are owned by thebanks collectively. This cooperati<strong>on</strong> has resulted in unified systems handling all types ofretail payments. All banks have access to the comm<strong>on</strong> infrastructure and also the smallerbanks can offer their clients a full range of payment services. The comm<strong>on</strong> infrastructure ishighly automated. The governance framework is well arranged and all banks can influencethe decisi<strong>on</strong> taking process <strong>on</strong> development, pricing, and other relevant issues. Collusivepractices and discriminati<strong>on</strong> in payment systems are not allowed. The Danish Competiti<strong>on</strong>Authority is resp<strong>on</strong>sible for the enforcement of these rules laid down in the DanishCompetiti<strong>on</strong> Act.16. <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> has a sound legal infrastructure for payment and securities settlementtransacti<strong>on</strong>s in which key issues as finality, netting, delivery-versus-payment (DVP) and theenforceability of collateral arrangements are well regulated. Electr<strong>on</strong>ic signatures and the useof electr<strong>on</strong>ic data is recognized by the court and all c<strong>on</strong>tractual relati<strong>on</strong>ships are enforceable.A zero hour rule does not exist. Finality of payments is ensured in case of bankruptcy. Thereare separate laws for the provisi<strong>on</strong> of payment instruments that also regulate c<strong>on</strong>sumerprotecti<strong>on</strong> <str<strong>on</strong>g>with</str<strong>on</strong>g> respect to electr<strong>on</strong>ic payments and card payments. Accounting practices areup to internati<strong>on</strong>al standards.17. Payment systems are overseen by the DFSA and Danmarks Nati<strong>on</strong>albank, whichcooperate closely. The oversight powers of the two instituti<strong>on</strong>s are regulated in the STA. Thecooperati<strong>on</strong> and c<strong>on</strong>sultative arrangements between the two overseers are laid down in aMoU that is publicly available. The STA was amended effective March 1, 2006, whichfurther clarifies the oversight authority. There is a narrow cooperati<strong>on</strong> between central banksand banking supervisory authorities <str<strong>on</strong>g>with</str<strong>on</strong>g> respect to crisis management in the Scandinaviancountries and in the EU.18. There are efficient procedures for the resoluti<strong>on</strong>s of problems in case of fraud, errors,delays, and failures. However, the procedures in case of a bankruptcy in VP and in theSumclearing to reduce replacement cost risk, credit risk, liquidity, and possible systemiccould be strengthened. The Act <strong>on</strong> certain payment means, applicable <strong>on</strong> electr<strong>on</strong>ic paymentinstruments, protects c<strong>on</strong>sumer <strong>on</strong> excessive risks due to fraud. Due the design of theinfrastructure for debit card transacti<strong>on</strong>, the system might be vulnerable to fraud (use ofmagnetic stripe cards, no centralized check <strong>on</strong> availability of sufficient balances in theaccount, part of the infrastructure is still signature based instead of pin-based). Theintroducti<strong>on</strong> of EMV-chip cards to replace the magnetic stripe card <str<strong>on</strong>g>with</str<strong>on</strong>g> a view to reduce thevulnerability encounters resistance from the retail sector, since the upgrade of their terminalsis costly for them. A comprehensive cost benefit analysis for the different paymentinstrument for all the parties involved, as well as a thorough comparis<strong>on</strong> of the costs and feesstructure in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> <str<strong>on</strong>g>with</str<strong>on</strong>g> costs and fees in other similar countries, is not yet available. Aclear analysis of the incentives to use the most efficient payment in certain situati<strong>on</strong>s wouldbe useful to gauge the macro-ec<strong>on</strong>omic efficiency and reduce the overall level of costs.