Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

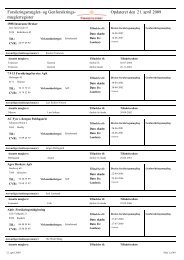

445. The assessor did not face any problem limiting the assessment process. During themissi<strong>on</strong>, the assessor also carried out an assessment of the observance of the CPSS/IOSCORecommendati<strong>on</strong>s for Securities Settlement <str<strong>on</strong>g>System</str<strong>on</strong>g>s of VP, the Danish Central SecuritiesDepository (CSD).Instituti<strong>on</strong>al and market structure6. KRONOS is the RTGS system used to settle m<strong>on</strong>etary policy transacti<strong>on</strong>s and largevalueinterbank transacti<strong>on</strong>s. It is a multicurrency system that settles transacti<strong>on</strong>s in Danishkr<strong>on</strong>er and euro. For the settlement of euros KRONOS is linked to TARGET, the RTGSsystem of the ESCB. In additi<strong>on</strong>, the system settles transacti<strong>on</strong>s in Swedish kr<strong>on</strong>er andIcelandic kr<strong>on</strong>er, however, <strong>on</strong>ly in c<strong>on</strong>necti<strong>on</strong> <str<strong>on</strong>g>with</str<strong>on</strong>g> the settlement in VP of securitiesdenominated in these currencies. KRONOS also settles the kr<strong>on</strong>er leg of foreign exchangetransacti<strong>on</strong>s that are cleared via the C<strong>on</strong>tinuous Linked Settlement (CLS) system. TheSumclearing (retail payment system) and VP (securities settlement system) settle via clearingaccounts that their participants have opened <str<strong>on</strong>g>with</str<strong>on</strong>g> Danmarks Nati<strong>on</strong>albank.7. The payment system infrastructure in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> is highly developed andtechnologically well advanced. A broad variety of payment instruments are processedvarying from checks and paper-based credit transfers to card transacti<strong>on</strong>s. In 2005, around1.1 billi<strong>on</strong> payments <str<strong>on</strong>g>with</str<strong>on</strong>g> a value of DKr 5,027 billi<strong>on</strong> were processed in the Sumclearinginfrastructure. With around 670 milli<strong>on</strong> payments by cards in 2005, <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> had the highestnumber of card transacti<strong>on</strong>s per capita in Europe. Especially the use of Dankort, a comm<strong>on</strong>debit card product of the Danish banks, is very popular and widely accepted by Danishretailers. Credit cards have <strong>on</strong>ly a minor market share due to the differences in price policy.A large amount of recurrent bills for teleph<strong>on</strong>e, utilities, and other services (168 milli<strong>on</strong>in 2005) are paid via direct debits, <str<strong>on</strong>g>with</str<strong>on</strong>g> 9 out of 10 households using the services of PaymentBusiness Services (PBS). A similar service is developed for private and public businessenterprises for paying for goods and services bought from other firms.8. E-banking is intensively used in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>, while the use of checks is declining.About 2.7 milli<strong>on</strong> Danish citizens have opened an e-banking account and send in theirpayment orders via the internet. Checks are especially used for fulfillment of larger paymentobligati<strong>on</strong>s (average value per transacti<strong>on</strong> cleared through the Sumclearing in 2005 wasDKr 22.850). The number and value of payments by checks have been halved since theintroducti<strong>on</strong> of more modern payment instruments as the direct debit and Dankort in thebeginning of the 1980s. It is likely to decline further. Recent initiatives have made it possiblefor government agencies to increase their use of electr<strong>on</strong>ic credit transfers at the expense ofchecks, when making payments to citizens, since all citizens are obliged to have a bankaccount.