Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

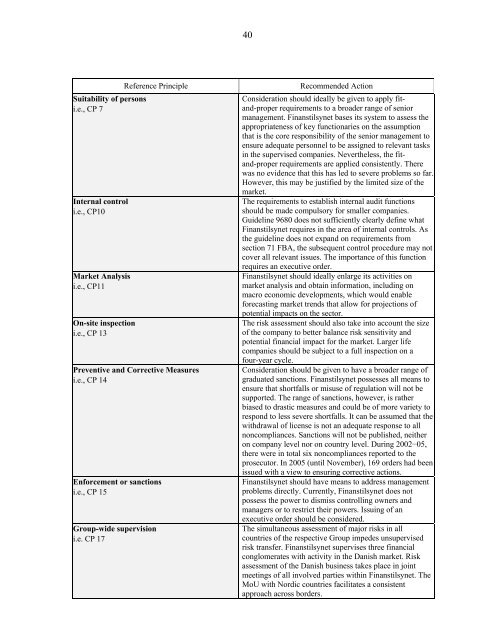

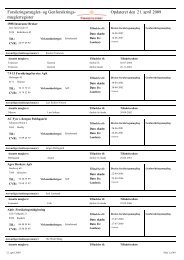

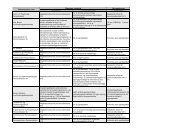

40Suitability of pers<strong>on</strong>si.e., CP 7Internal c<strong>on</strong>troli.e., CP10Market Analysisi.e., CP11On-site inspecti<strong>on</strong>i.e., CP 13Reference PrinciplePreventive and Corrective Measuresi.e., CP 14Enforcement or sancti<strong>on</strong>si.e., CP 15Group-wide supervisi<strong>on</strong>i.e. CP 17Recommended Acti<strong>on</strong>C<strong>on</strong>siderati<strong>on</strong> should ideally be given to apply fitand-properrequirements to a broader range of seniormanagement. Finanstilsynet bases its system to assess theappropriateness of key functi<strong>on</strong>aries <strong>on</strong> the assumpti<strong>on</strong>that is the core resp<strong>on</strong>sibility of the senior management toensure adequate pers<strong>on</strong>nel to be assigned to relevant tasksin the supervised companies. Nevertheless, the fitand-properrequirements are applied c<strong>on</strong>sistently. Therewas no evidence that this has led to severe problems so far.However, this may be justified by the limited size of themarket.The requirements to establish internal audit functi<strong>on</strong>sshould be made compulsory for smaller companies.Guideline 9680 does not sufficiently clearly define whatFinanstilsynet requires in the area of internal c<strong>on</strong>trols. Asthe guideline does not expand <strong>on</strong> requirements fromsecti<strong>on</strong> 71 FBA, the subsequent c<strong>on</strong>trol procedure may notcover all relevant issues. The importance of this functi<strong>on</strong>requires an executive order.Finanstilsynet should ideally enlarge its activities <strong>on</strong>market analysis and obtain informati<strong>on</strong>, including <strong>on</strong>macro ec<strong>on</strong>omic developments, which would enableforecasting market trends that allow for projecti<strong>on</strong>s ofpotential impacts <strong>on</strong> the sector.The risk assessment should also take into account the sizeof the company to better balance risk sensitivity andpotential financial impact for the market. Larger lifecompanies should be subject to a full inspecti<strong>on</strong> <strong>on</strong> afour-year cycle.C<strong>on</strong>siderati<strong>on</strong> should be given to have a broader range ofgraduated sancti<strong>on</strong>s. Finanstilsynet possesses all means toensure that shortfalls or misuse of regulati<strong>on</strong> will not besupported. The range of sancti<strong>on</strong>s, however, is ratherbiased to drastic measures and could be of more variety toresp<strong>on</strong>d to less severe shortfalls. It can be assumed that the<str<strong>on</strong>g>with</str<strong>on</strong>g>drawal of license is not an adequate resp<strong>on</strong>se to alln<strong>on</strong>compliances. Sancti<strong>on</strong>s will not be published, neither<strong>on</strong> company level nor <strong>on</strong> country level. During 2002−05,there were in total six n<strong>on</strong>compliances reported to theprosecutor. In 2005 (until November), 169 orders had beenissued <str<strong>on</strong>g>with</str<strong>on</strong>g> a view to ensuring corrective acti<strong>on</strong>s.Finanstilsynet should have means to address managementproblems directly. Currently, Finanstilsynet does notpossess the power to dismiss c<strong>on</strong>trolling owners andmanagers or to restrict their powers. Issuing of anexecutive order should be c<strong>on</strong>sidered.The simultaneous assessment of major risks in allcountries of the respective Group impedes unsupervisedrisk transfer. Finanstilsynet supervises three financialc<strong>on</strong>glomerates <str<strong>on</strong>g>with</str<strong>on</strong>g> activity in the Danish market. Riskassessment of the Danish business takes place in jointmeetings of all involved parties <str<strong>on</strong>g>with</str<strong>on</strong>g>in Finanstilsynet. TheMoU <str<strong>on</strong>g>with</str<strong>on</strong>g> Nordic countries facilitates a c<strong>on</strong>sistentapproach across borders.