Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

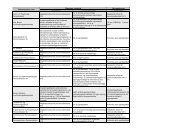

39may be subject to more frequent full scale or focused inspecti<strong>on</strong>s. Based <strong>on</strong> regularevaluati<strong>on</strong>s of risk, insurers may be subject to more frequent full scale or focusedinspecti<strong>on</strong>s.18. The DFSA bases its system to assess the appropriateness of key functi<strong>on</strong>aries <strong>on</strong> theassumpti<strong>on</strong> that it is the core resp<strong>on</strong>sibility of the senior management to ensure adequatepers<strong>on</strong>nel to be assigned to relevant tasks in the supervised companies. There was noevidence that this has led to severe problems so far. This approach, however, may well bejustified by the limited size of the market.19. A requirement that internal audit functi<strong>on</strong>s should be made compulsory for smallercompanies. Guidelines do not define clearly enough what the DFSA requires in the area ofinternal c<strong>on</strong>trol. As guidelines does not expand <strong>on</strong> requirements from secti<strong>on</strong> 71 in the FBA,the subsequent c<strong>on</strong>trol procedure may not cover all relevant issues. The importance of thefuncti<strong>on</strong> requires an executive order.Recommended Acti<strong>on</strong> Plan to Improve Observance of IAIS Insurance Core PrinciplesReference PrincipleC<strong>on</strong>diti<strong>on</strong>s for Effective Insurance Supervisi<strong>on</strong>i.e., CP 1Supervisory authorityi.e., CP 3Licensingi.e., CP 6Recommended Acti<strong>on</strong>While good c<strong>on</strong>diti<strong>on</strong>s for effective supervisi<strong>on</strong> are inplace, some more specific rule-based requirements shouldbe applicable to all companies. All professi<strong>on</strong>al resourcesare available and of high standards. Market infrastructureallows for an efficient management of the sector. A widerange of operati<strong>on</strong>al services are available to insuranceundertakings and allow them to focus <strong>on</strong> technical relatedaspects of the business. The regulati<strong>on</strong> is very principlebased, but allows for a risk based supervisi<strong>on</strong>. Specifically,the requirements <strong>on</strong> organizati<strong>on</strong> of an undertaking inc<strong>on</strong>juncti<strong>on</strong> <str<strong>on</strong>g>with</str<strong>on</strong>g> the relevant guideline 9680 to guide thecompany to c<strong>on</strong>sider measures <str<strong>on</strong>g>with</str<strong>on</strong>g>out defining minimumstandards applicable to all companies.The potential interference of the executive branches in thebudget allocati<strong>on</strong> should ideally be limited or restricted.Finanstilsynet has to agree <strong>on</strong> its budget <str<strong>on</strong>g>with</str<strong>on</strong>g> the Ministryof Ec<strong>on</strong>omic and Business Affairs, although the expensesof the agency are covered by fees of the supervisedentities. Finanstilsynet is also subject to an annual budgetreducti<strong>on</strong> program for the public sector. There is apossibility that resources could be allocated to regulati<strong>on</strong>to the disadvantage of supervisory activity.C<strong>on</strong>siderati<strong>on</strong> should be given to also require that thesuitability of auditors and actuaries be assessed.Finanstilsynet pays specific attenti<strong>on</strong> to the licensingprocess. The risk-based approach requires a tighter andrather rule-based supervisi<strong>on</strong> <str<strong>on</strong>g>with</str<strong>on</strong>g>in the first years of thenewly established businesses. The <strong>on</strong>going supervisoryprocess does not demand comprehensive detailedoperating plans. As Finanstilsynet has distinctive rules forthe supervisi<strong>on</strong> of new entities, c<strong>on</strong>siderati<strong>on</strong>s should begiven to also require that the suitability of auditors andactuaries be assessed.