Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

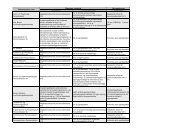

30 ANNEX IIREPORT ON THE OBSERVANCE OF THE BASEL CORE PRINCIPLES FOR EFFECTIVEBANKING SUPERVISION1. The assessment of the observance of the Basel Core Principles for Effective BankingSupervisi<strong>on</strong> (BCP) developed by the Basel Committee <strong>on</strong> Banking Supervisi<strong>on</strong> was carriedout as part of the first <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Sector <str<strong>on</strong>g>Assessment</str<strong>on</strong>g> Program (FSAP) missi<strong>on</strong> to <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>during November 7–18, 2005. 24 The assessment of observance of each of the Core Principleswas based <strong>on</strong> the Core Principles Methodology Document of October 1999. The DFSA hadprepared a self-assessment <strong>on</strong> which this assessment is based. Supplemental informati<strong>on</strong> wasprovided to the assessors as necessary.Instituti<strong>on</strong>al and macroprudential setting, market structure—overview2. The Danish financial sector is deep (total assets are close to five times GDP) andsophisticated, <str<strong>on</strong>g>with</str<strong>on</strong>g> some internati<strong>on</strong>ally unique financial instruments (mortgage b<strong>on</strong>ds).Since the deregulati<strong>on</strong> of the 1970–80s, the business areas in the financial sector haveoverlapped. While some financial activities may not be carried out <str<strong>on</strong>g>with</str<strong>on</strong>g>in a bank (forexample, insurance activities), it is possible for a bank to enter the insurance and otherbusiness through subsidiaries and associated companies. Banks may also form holdingcompanies and other group structures As a result, there have been a number of mergers, andgroup formati<strong>on</strong>s, as well as some break-ups in the last two decades.Credit instituti<strong>on</strong>s3. At end-2005, total assets of credit instituti<strong>on</strong>s were around 332 percent of GDP.Currently, there are 170 credit instituti<strong>on</strong>s registered in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>, of which 161 arecommercial banks, 8 are mortgage banks, and 1 is a specialized bank. The two largestbanking groups—Danske Bank and Nordea Danmark—account for more than 50 percent ofthe commercial bank lending. The five largest banking groups account for about 80 percentof total loans (71 percent if foreign branches are excluded). There is thus a substantialc<strong>on</strong>centrati<strong>on</strong> in spite of the high number of credit instituti<strong>on</strong>s.4. Commercial banks are profitable. In 2005 (2004), the return <strong>on</strong> equity before tax forthe sector as a whole was 21¼ (17¾) percent. The average capital adequacy ratio was13¼ (13½) percent, <str<strong>on</strong>g>with</str<strong>on</strong>g> the smaller banks typically having a larger ratio. During 2004 and2005, bank lending increased rapidly (14 percent and 25 percent, respectively) while the loanto deposit ratio was 115 percent at end-2005.24 This assessment was carried out by Peter Hayward (formerly, Bank of England and the M<strong>on</strong>etary and CapitalMarkets Department (MCM) of the Internati<strong>on</strong>al M<strong>on</strong>etary Fund (<strong>IMF</strong>)) and Stefan Spamer (DeutscheBundesbank).