Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

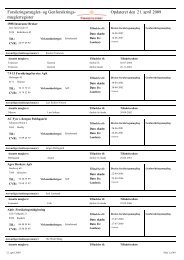

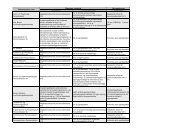

2439. In c<strong>on</strong>trast to the other Nordic countries, the Danish capital market isdominated by mortgage b<strong>on</strong>ds (Table 7). With public debt declining, mortgage b<strong>on</strong>ds nowaccount for about two thirds of the total b<strong>on</strong>d market capitalizati<strong>on</strong>. The market forgovernment securities is quite liquid and benefits from the setup of electr<strong>on</strong>ic tradingplatforms, and a sound issuance policy.40. The medium-size Danish equity market faces a number of structural issues. Untilrecently, the market has outperformed the major internati<strong>on</strong>al markets, but has low turnover.In recent years the Copenhagen Stock Exchange has also experienced significant delistingsand difficulties in attracting new listings. The structure of the market, where small- andmedium-size enterprises (SMEs) c<strong>on</strong>stitute the vast majority of listed companies, but activityis c<strong>on</strong>centrated am<strong>on</strong>g a handful of large corporati<strong>on</strong>s, including the dominant globalc<strong>on</strong>tainer shipping c<strong>on</strong>cern, Maersk, adds to the difficulty of maintaining adequate marketliquidity. The c<strong>on</strong>centrati<strong>on</strong> of liquidity and activity in a limited number of shares canultimately be seen as a major obstacle by investors, in particular instituti<strong>on</strong>al investors.41. Initiatives have been launched by the Exchange to address these issues, but theireffectiveness remains to be seen. The launch of the alternative market place, FirstNorth,aiming at small companies and imposing reduced listing requirements, is too recent to allowto draw meaningful c<strong>on</strong>clusi<strong>on</strong>s. However, similar experiences in other European countriesappear to c<strong>on</strong>firm the potential for such organized but unregulated markets to attract newcategories of companies to the stock market. A potential risk, however, is that more opaquemarkets would ultimately weaken investor protecti<strong>on</strong> and reduce the benefits of the newtransparency and corporate governance frameworks.42. The creati<strong>on</strong> of a comm<strong>on</strong> regi<strong>on</strong>al market place <str<strong>on</strong>g>with</str<strong>on</strong>g> comm<strong>on</strong> trading would bean important step toward integrati<strong>on</strong> in the broader European capital market. Thestrategic alliance (Norex) and the c<strong>on</strong>solidati<strong>on</strong> of OMX have resulted in the creati<strong>on</strong> of anincreasingly homogeneous regi<strong>on</strong>al trading envir<strong>on</strong>ment offering investors, issuers, andexchange members cost-effective access to an increased range of investment opportunitiesand increased liquidity, thereby increasing the attractiveness and visibility of the regi<strong>on</strong> tointernati<strong>on</strong>al investors. However, the integrati<strong>on</strong> of clearing and settlement infrastructureshas lagged developments <strong>on</strong> the trading side, primarily due to cost c<strong>on</strong>siderati<strong>on</strong>s.43. The investment fund industry has experienced steady growth and significanttransformati<strong>on</strong> in recent years (Table 8). However, assets in relati<strong>on</strong> to GDP are still lowerthan in Sweden and the average of the EU-12. Hedge fund-type investment vehicles haveprogressively been allowed in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>. Effective July 2005, a new regulatory regime hasbeen introduced, setting the ground for the development of regulated <strong>on</strong>shore hedge funds(hedge associati<strong>on</strong>s). Rather than imposing specific c<strong>on</strong>straints <strong>on</strong> the investment policy ofthe funds, the regulati<strong>on</strong>s establish extensive informati<strong>on</strong> obligati<strong>on</strong>s and frequentredempti<strong>on</strong> windows and rely primarily <strong>on</strong> investors to c<strong>on</strong>trol the fund managers. It isimportant, that the supervisory authority establishes a clear jurisprudence in key areas such asasset valuati<strong>on</strong> practices, which remains under the resp<strong>on</strong>sibility of the funds.