Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

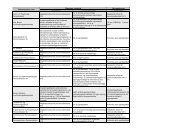

2029. The performance in the n<strong>on</strong>-life sector has also improved. The five largest n<strong>on</strong>lifecompanies accounted for almost 67 percent of gross premiums and the ten largest foralmost 83 percent in 2005. During the last five years, two n<strong>on</strong>-life insurers experiencedserious difficulties (<strong>on</strong>e due to September 11), including <strong>on</strong>e company that failed. No directlosses for customers were observed, but in <strong>on</strong>e case the costs for the guarantee fund has beenestimated at €16 milli<strong>on</strong>.30. Effective January 1, 2007, the minimum capital requirement will increase to theequivalent of the requirements in EU Solvency I Directive. Market participants are alsoanticipating increases in the capital levels in future years, when the EU c<strong>on</strong>tinues to makeprogress <strong>on</strong> the insurance capital adequacy (Solvency II).E. Cross-Border <str<strong>on</strong>g>Financial</str<strong>on</strong>g> C<strong>on</strong>glomerates31. Substantial exposures to n<strong>on</strong>-residents and the presence of large c<strong>on</strong>glomeratesthat are active in the Nordic regi<strong>on</strong> poses a number of challenges (Table 6). In particular,the increasing divergence in the legal and business structure of such instituti<strong>on</strong>s, <str<strong>on</strong>g>with</str<strong>on</strong>g>centralizati<strong>on</strong> of key functi<strong>on</strong>s such as risk management abroad places a premium <strong>on</strong>coordinati<strong>on</strong> and informati<strong>on</strong> sharing am<strong>on</strong>g regi<strong>on</strong>al supervisors. While the sectorallyintegrated supervisory structure of the DFSA facilitates effective c<strong>on</strong>solidated supervisi<strong>on</strong> ofinstituti<strong>on</strong>s incorporated in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>, close coordinati<strong>on</strong> am<strong>on</strong>g the Nordic supervisors andcentral banks is equally important. The systemic importance of some of the instituti<strong>on</strong>s alsorequires effective coordinated arrangements for provisi<strong>on</strong> of liquidity and crisis management.32. Arrangements for cross border coordinati<strong>on</strong> and informati<strong>on</strong> sharing are inplace but remain to be tested. The supervisory agencies in the regi<strong>on</strong> have forged a generalmemorandum of understanding (MoU) and there is a similar MoU at the EU level. Inadditi<strong>on</strong>, there is a special agreement regarding the Nordea Group headquartered in Sweden.The Swedish <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisory Authority (FSA) is the lead supervisor for Nordea, whichis inspected by joint teams. Most of the financial groups are sizable and systemicallyimportant in at least <strong>on</strong>e of the Nordic countries. It remains to be seen whether, given theirlegally n<strong>on</strong>-binding nature, the MOUs would be effective in the event of a crisis involving<strong>on</strong>e of the larger instituti<strong>on</strong>s <str<strong>on</strong>g>with</str<strong>on</strong>g> substantial cross-border operati<strong>on</strong>s. The MOUs also do notinvolve the Ministries of Finance that ultimately may need to be involved in any crisisresoluti<strong>on</strong>.