Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

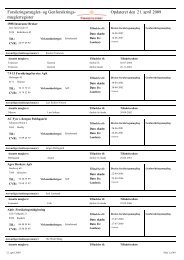

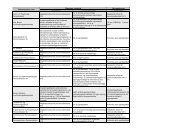

18D. Insurance Companies25. The Danish insurance industry is well developed and its performance hasgenerally improved following the difficulties early in this decade (Table 4). At end-2005,assets of life insurance and general pensi<strong>on</strong> funds amounted to almost 120 percent of GDP.The five largest companies account for about 55 percent of gross premiums and theten largest for 73½ percent. 12 Assets of n<strong>on</strong>-life insurance companies amounted to 9 percentof GDP at end-2005. This market is mainly <strong>on</strong>e of individual business, motor, and householdinsurance, representing approximately 70 percent of the n<strong>on</strong>-life market. In 2005, grosspremiums amounted to 2.9 percent of GDP (Table 5). Life insurance companies and pensi<strong>on</strong>funds are covered by the same legislative framework. Reinsurance is mainly provided fromthe internati<strong>on</strong>al market, although there are five captive Danish reinsurance companies thatprimarily reinsure risks originating from the group.Table 4. Selected <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Indicators for Life Insurance and Pensi<strong>on</strong> Funds, 2001–05(In percent unless indicated otherwise)2001 2002 2003 2004 2005Life insuranceGross premiums to GDP 3.72 4.01 4.23 4.23 4.37Net premiums to GDP 3.67 3.95 4.19 4.21 4.34Return <strong>on</strong> equity before tax -13.65 2.86 14.37 11.74 11.34Return <strong>on</strong> investments before tax <strong>on</strong> pensi<strong>on</strong> returns -1.68 2.98 6.51 9.82 12.98Ratio of operating expenses to gross premiums 7.17 7.31 7.21 6.55 5.79Ratio of expenses to provisi<strong>on</strong>s 0.7 0.7 0.8 0.6 0.6Ratio of equity to provisi<strong>on</strong>s 6.6 7.5 8.7 8.5 8.7Ratio of excess solvency to provisi<strong>on</strong>s 3.2 3.9 4.7 4.6 4.7Solvency indicator 166.8 182.1 201.5 195.0 196.8Pensi<strong>on</strong> fundsGross premiums to GDP 0.9 0.9 1.0 1.0 0.8Return <strong>on</strong> equity before tax -19.04 -30.99 25.5 23.16 23.55Return <strong>on</strong> investments before tax <strong>on</strong> pensi<strong>on</strong> returns -1.5 -1.16 7.72 11.78 17.44Ratio of operating expenses to gross premiums 3.6 3.5 3.4 3.1 3.0Ratio of expenses to provisi<strong>on</strong>s 0.2 0.2 0.2 0.2 0.2Ratio of equity to provisi<strong>on</strong>s 17.21 13.43 17.35 20.41 23.74Ratio of excess solvency to provisi<strong>on</strong>s 9.18 8.75 13.03 15.97 18.97Solvency indicator 433.3 309.5 398.5 460.5 476.7Source: The Danish <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisory Authority.12 In 2003, life insurance penetrati<strong>on</strong> (direct gross premiums in percent of GDP) was in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> 5.17, Finland2.00, Germany 3.90, the Netherlands 5.40, Norway 2.81, Sweden 4.58, and the United Kingdom 9.76 percent.According to the OECD: Insurance Statistics Yearbook 1994–2003, (Paris: OECD).