Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

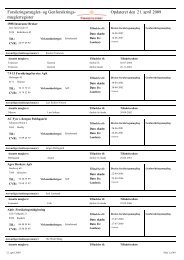

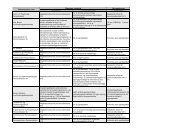

16C. Mortgage Credit Banks22. Danish mortgage financing system is profitable, transparent, and effective indelivering low cost mortgage financing to borrowers. Specific legislati<strong>on</strong>, allowsspecialized mortgage credit instituti<strong>on</strong>s to issue mortgage b<strong>on</strong>ds <strong>on</strong> behalf of the borrowers.The framework is supported by an effective system of land registrati<strong>on</strong> as well as clearlydefined procedures for foreclosures. With total assets close to 135 percent of GDP, mortgagecredit instituti<strong>on</strong>s are slightly smaller than the commercial banks and their reportedsoundness indicators are good (Table 3). Mortgage b<strong>on</strong>ds as well as the mortgage creditinstituti<strong>on</strong>s are highly rated by internati<strong>on</strong>al rating agencies, and mortgage b<strong>on</strong>ds areaccepted by the Nati<strong>on</strong>albank as collateral.23. The mortgage credit system faces significant challenges. In recent years mortgagefinancing has underg<strong>on</strong>e several changes and new products have emerged, including variableinterest rates, deferred amortizati<strong>on</strong>, and capped adjustable rate loans. Variable rate mortgageloans now account for about half of all such loans. New types of loans necessitate new typesof b<strong>on</strong>ds to observe the balance principle. The wider range of mortgage products couldnegatively impact the overall pricing and liquidity of the mortgage market if it results in aless homogeneous mortgage market <str<strong>on</strong>g>with</str<strong>on</strong>g> a series of smaller and less liquid b<strong>on</strong>ds. This couldaffect the appetite of investors—mostly instituti<strong>on</strong>al investors—for Danish mortgage b<strong>on</strong>ds. 1024. The impending EU regulati<strong>on</strong> <strong>on</strong> covered b<strong>on</strong>ds is likely to pose a transiti<strong>on</strong>alchallenge for the Danish mortgage system. As covered b<strong>on</strong>ds, the loan to value <strong>on</strong>mortgage b<strong>on</strong>ds will need to be observed c<strong>on</strong>tinuously instead of <strong>on</strong>ly at the originati<strong>on</strong> ofthe loan. Besides mortgage credit instituti<strong>on</strong>s, banks would be allowed to issue such coveredb<strong>on</strong>ds. This would allow more funding flexibility, but would tend to limit the direct access tothe capital market provided to the borrower under the current system. In principle,competiti<strong>on</strong> should ensure efficient pricing of covered b<strong>on</strong>ds. However, the two largest banksand regi<strong>on</strong>al banks as a group would be in a more advantageous positi<strong>on</strong> to issue coveredb<strong>on</strong>ds because of their branch networks and greater proximity to customers. With a broaderrange of available collateral and possibilities to provide additi<strong>on</strong>al capital, banks would be ina better positi<strong>on</strong> to adapt to loan to value fluctuati<strong>on</strong>s compared to mortgage financeinstituti<strong>on</strong>s. Realizati<strong>on</strong> of the potential l<strong>on</strong>g run benefits of covered b<strong>on</strong>ds would place aheavy premium <strong>on</strong> effective disclosure and transparency and a level playing field am<strong>on</strong>gmarket participants.10 See “Trends in Mortgage-Credit Financing: the Market and its Players,” by Lars Jul Hansen, in M<strong>on</strong>etaryReview, 1 st Quarter, 2006, Danmarks Nati<strong>on</strong>albank, Copenhagen.