Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

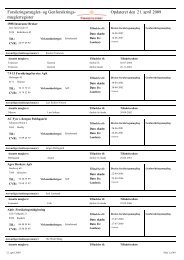

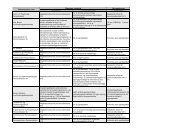

1214. The presence of foreign banks—mainly from other Nordic countries—issubstantial. Foreign ownership of Danish banks is significantly higher than the average forthe EU countries. At end-2005, there were 9 foreign subsidiaries, 26 foreign branches, and271 foreign credit instituti<strong>on</strong>s providing some cross-border banking services into thecountry. 4 Banks <str<strong>on</strong>g>with</str<strong>on</strong>g> Nordic parents accounted for approximately 84 percent of foreignbanks’ total assets. The largest of them, Nordea, is currently c<strong>on</strong>templating transformingitself into a European Company based in Sweden, <str<strong>on</strong>g>with</str<strong>on</strong>g> a branch structure. The Danishbranches will be systemically important and pose a number of supervisory challenges.15. Banks’ report solid financial soundness indicators, but buffers in the system arebeing lowered (Table 2). Capital adequacy and asset quality remains high, <str<strong>on</strong>g>with</str<strong>on</strong>g> the overallcapital adequacy ratio at 13¼ percent and accumulated provisi<strong>on</strong>s at 1.0 percent of total loansoutstanding at end-2005. Banks reported record profits in 2005—21¼ percent return beforetax <strong>on</strong> equity compared <str<strong>on</strong>g>with</str<strong>on</strong>g> 17¾ percent in 2004. Profitability was boosted by growth infees and commissi<strong>on</strong>s, primarily from securities trading and refinancing activity. The systemwideincome to cost ratio improved from 1.7 to 2.0.16. The implementati<strong>on</strong> of the Internati<strong>on</strong>al <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Reporting Standards (IFRS)has allowed banks to revoke previous provisi<strong>on</strong>s and banks intending to use internalmodels under Basel II would likely seek to lower their capital requirements. Ten Danishbanks have indicated that they would use advanced internal ratings under Basel II to beimplemented in 2007-08. Against the backdrop of rapidly expanding bank balance sheets andprospective changes in the interest rate envir<strong>on</strong>ment, the reducti<strong>on</strong> of the capital buffer needsto be approached <str<strong>on</strong>g>with</str<strong>on</strong>g> cauti<strong>on</strong> and implemented gradually. In this c<strong>on</strong>text, the regulati<strong>on</strong>limiting the reducti<strong>on</strong> of capital requirements during 2007-09 for banks using advancedmethods is welcome. The DFSA would need to carefully assess capital adequacy inindividual instituti<strong>on</strong>s and require additi<strong>on</strong>al capital commensurate <str<strong>on</strong>g>with</str<strong>on</strong>g> the risk profile ofeach instituti<strong>on</strong>, c<strong>on</strong>sistent <str<strong>on</strong>g>with</str<strong>on</strong>g> Pillar II of Basel II.Stress Tests17. Credit Risk: Stress tests show that commercial banks can <str<strong>on</strong>g>with</str<strong>on</strong>g>stand sizableshocks, but would experience substantial capital shortfalls if subjected to severe shocks.Results of both top-down and bottom-up stress scenarios (Box 2) that evolve over three yearsshow that by the third year the mandatory capital adequacy ratio of the system is breachedbut manageable, and <strong>on</strong>ly in the worst case scenario is the shortfall substantial.4 For an analysis of foreign ownership of Danish commercial banks, see “Foreign Banks in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>” by JakobWindfeld Lund and Kristine Rasumssen, M<strong>on</strong>etary Review, 1 st Quarter 2006 (Copenhagen: DanmarksNati<strong>on</strong>albank). See:http://www.nati<strong>on</strong>albanken.dk/C1256BE9004F6416/side/M<strong>on</strong>etary_review_2006_1_Quarter!opendocument.