Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

Denmark: Financial System Stability Assessment with reports on - IMF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

© 2006 Internati<strong>on</strong>al M<strong>on</strong>etary Fund October 2006<strong>IMF</strong> Country Report No. 06/343<str<strong>on</strong>g>Denmark</str<strong>on</strong>g>: <str<strong>on</strong>g>Financial</str<strong>on</strong>g> <str<strong>on</strong>g>System</str<strong>on</strong>g> <str<strong>on</strong>g>Stability</str<strong>on</strong>g> <str<strong>on</strong>g>Assessment</str<strong>on</strong>g>,including Reports <strong>on</strong> Observance of Standards and Codes <strong>on</strong> the following topics,Banking Supervisi<strong>on</strong>, Insurance Supervisi<strong>on</strong>, <str<strong>on</strong>g>System</str<strong>on</strong>g>atically Important Payment<str<strong>on</strong>g>System</str<strong>on</strong>g>s, and Anti-M<strong>on</strong>ey Laundering and Combating the Financing of TerrorismThis <str<strong>on</strong>g>Financial</str<strong>on</strong>g> <str<strong>on</strong>g>System</str<strong>on</strong>g> <str<strong>on</strong>g>Stability</str<strong>on</strong>g> <str<strong>on</strong>g>Assessment</str<strong>on</strong>g> <strong>on</strong> <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> was prepared by a staff team of theInternati<strong>on</strong>al M<strong>on</strong>etary Fund and the World Bank as background documentati<strong>on</strong> for the periodicc<strong>on</strong>sultati<strong>on</strong> <str<strong>on</strong>g>with</str<strong>on</strong>g> the member country. It is based <strong>on</strong> the informati<strong>on</strong> available at the time it wascompleted <strong>on</strong> September 8, 2006. The views expressed in this document are those of the staff teamand do not necessarily reflect the views of the government of <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> or the Executive Board of the<strong>IMF</strong>.The policy of publicati<strong>on</strong> of staff <str<strong>on</strong>g>reports</str<strong>on</strong>g> and other documents by the <strong>IMF</strong> allows for the deleti<strong>on</strong> ofmarket-sensitive informati<strong>on</strong>.To assist the <strong>IMF</strong> in evaluating the publicati<strong>on</strong> policy, reader comments are invited and may besent by e-mail to publicati<strong>on</strong>policy@imf.org.Copies of this report are available to the public fromInternati<strong>on</strong>al M<strong>on</strong>etary Fund ● Publicati<strong>on</strong> Services700 19th Street, N.W. ● Washingt<strong>on</strong>, D.C. 20431Teleph<strong>on</strong>e: (202) 623 7430 ● Telefax: (202) 623 7201E-mail: publicati<strong>on</strong>s@imf.org ● Internet: http://www.imf.orgPrice: $15.00 a copyInternati<strong>on</strong>al M<strong>on</strong>etary FundWashingt<strong>on</strong>, D.C.

INTERNATIONAL MONETARY FUNDDENMARK<str<strong>on</strong>g>Financial</str<strong>on</strong>g> <str<strong>on</strong>g>System</str<strong>on</strong>g> <str<strong>on</strong>g>Stability</str<strong>on</strong>g> <str<strong>on</strong>g>Assessment</str<strong>on</strong>g>Prepared by the M<strong>on</strong>etary and Capital Markets and European DepartmentsApproved by Ulrich Baumgartner and Michael DepplerSeptember 8, 2006This <str<strong>on</strong>g>Financial</str<strong>on</strong>g> <str<strong>on</strong>g>System</str<strong>on</strong>g> <str<strong>on</strong>g>Stability</str<strong>on</strong>g> <str<strong>on</strong>g>Assessment</str<strong>on</strong>g> is based <strong>on</strong> two visits to Copenhagen duringNovember 7-18, 2005 and May 16-22, 2006 as part of the <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Sector <str<strong>on</strong>g>Assessment</str<strong>on</strong>g> Program (FSAP).The FSAP team included: S. Kal Wajid (Missi<strong>on</strong> Chief), T<strong>on</strong>ny Lybek (Deputy Missi<strong>on</strong> Chief), FrancoisHaas, Vassili Prokopenko, Miguel Segoviano, Kalin Tintchev, and Jan Woltjer (all M<strong>on</strong>etary and CapitalMarkets Department); Robert Tchaidze (European Department); and Peter Hayward, Stefan Spamer,Henning Göbel, Kirsten Nordbø Steinberg, and Erik Huitfeldt (all external c<strong>on</strong>sultants). As part of theFSAP, the Fund also c<strong>on</strong>ducted the AML/CFT assessment for <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> during February 27-March 15,2006. The assessment was c<strong>on</strong>ducted by Richard Lal<strong>on</strong>de (Team Leader), Paul Ashin, Margaret Cotter,Giuseppe Lombardo, and Navin Beekarry (all Legal Department). In additi<strong>on</strong> to discussi<strong>on</strong>s <str<strong>on</strong>g>with</str<strong>on</strong>g> officialsand market participants, the FSAP team relied <strong>on</strong> the relevant statutes and regulati<strong>on</strong>s as well as selfassessments prepared by the authorities. Following are the main findings, which were discussed <str<strong>on</strong>g>with</str<strong>on</strong>g> theauthorities <strong>on</strong> May 22, 2006 and during the Article IV c<strong>on</strong>sultati<strong>on</strong> discussi<strong>on</strong>s in June 2006:• The financial system is generally resilient and well supervised, underpinned by an effective legal andfinancial infrastructure. The recent str<strong>on</strong>g performance of the sector, driven by rapidly expanding credit andan exuberant housing market will be difficult to sustain. To forestall any potential problems in the financialsector, supervisors should intensify efforts to m<strong>on</strong>itor risks and use stress testing more effectively inassessing banking system vulnerability. The authorities should also make greater use of their authority torequire additi<strong>on</strong>al capital as appropriate in individual cases.• The missi<strong>on</strong> found generally a high degree of compliance <str<strong>on</strong>g>with</str<strong>on</strong>g> the internati<strong>on</strong>al financial standardsand codes. N<strong>on</strong>etheless, the aut<strong>on</strong>omy and accountability of the DFSA should be entrenched by providingthe agency a statutory basis and granting it greater budgetary aut<strong>on</strong>omy. While the regulatory frameworkhas worked well in the current envir<strong>on</strong>ment, it could benefit from upgrading the guideline <strong>on</strong> internalc<strong>on</strong>trols to an Executive Order and broadening the coverage of fit-and-proper requirements.The main authors of this report are S. Kal Wajid, T<strong>on</strong>ny Lybek, Vassili Prokopenko, Francois Haas, andRobert Tchaidze.FSAPs are designed to assess the stability of the financial system as a whole and not that of individualinstituti<strong>on</strong>s. They have been developed to help countries identify and remedy weaknesses in their financial sectorstructure, thereby enhancing their resilience to macroec<strong>on</strong>omic shocks and cross-border c<strong>on</strong>tagi<strong>on</strong>. FSAPs d<strong>on</strong>ot cover risks that are specific to individual instituti<strong>on</strong>s such as asset quality, operati<strong>on</strong>al or legal risks, orfraud.

2C<strong>on</strong>tentsPageGlossary .....................................................................................................................................4I. Overall <str<strong>on</strong>g>Stability</str<strong>on</strong>g> <str<strong>on</strong>g>Assessment</str<strong>on</strong>g>..................................................................................................6II. Macroec<strong>on</strong>omic Setting, <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Structure and Risks ......................................................8A. Macroec<strong>on</strong>omic Background and Risks ...................................................................8B. <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Structure and Risks..................................................................................10C. Mortgage Credit Banks ...........................................................................................16D. Insurance Companies ..............................................................................................18E. Cross-Border <str<strong>on</strong>g>Financial</str<strong>on</strong>g> C<strong>on</strong>glomerates ..................................................................20III. <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Markets, their Infrastructure, and Safety Nets ...................................................22A. M<strong>on</strong>etary Policy Framework ..................................................................................22B. Safety Nets ..............................................................................................................22C. Payment and Securities Clearing and Settlement <str<strong>on</strong>g>System</str<strong>on</strong>g>s .....................................23D. <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Markets....................................................................................................23IV. <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisi<strong>on</strong> and Standards <str<strong>on</strong>g>Assessment</str<strong>on</strong>g>s ...........................................................26A. The Supervisory and Regulatory Framework .........................................................26B. Standards <str<strong>on</strong>g>Assessment</str<strong>on</strong>g>s............................................................................................28Key Recommendati<strong>on</strong>s to Improve the AML/CFT <str<strong>on</strong>g>System</str<strong>on</strong>g> ....................................................67Tables1. <str<strong>on</strong>g>Financial</str<strong>on</strong>g> <str<strong>on</strong>g>System</str<strong>on</strong>g> Structure, 1995–2005 ..........................................................................112. <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Soundness Indicators of Commercial Banks, 2000–05 ...................................133. <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Soundness Indicators for Mortgage Credit Instituti<strong>on</strong>s, 2000–05 ...................174. Selected <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Indicators for Life Insurance and Pensi<strong>on</strong> Funds, 2001–05 ..............185. <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Soundness Indicators for N<strong>on</strong>-life Insurance Companies, 2001–05................196. Market Shares of Major <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Groups in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>, 2005.........................................217. Nordic Capital Markets, 2001–05....................................................................................258. Nordic Countries: Evoluti<strong>on</strong> of Mutual Funds, 1998-2005.............................................25Figures1. Nordic Countries: Residential Real Estate Prices, March 1995–March 2006...................92. Nordic Stock Exchanges: All Share Indexes, January 2003–June 2006 ...........................9

4GLOSSARYAMLBCPCCPCDCDDCFTCLSCPCPSIPSCPSSCSDCSECVRDBADCCADFSADNDNFBPDVPELESCBEUFBAFBCFIFIUFoPFSAFSAPGFIASICPICSDIFRS<strong>IMF</strong>IOSCOITLOLRMCMAnti–M<strong>on</strong>ey LaunderingBasel Core PrinciplesCentral CounterpartyCertificates of DepositsCustomer due diligenceCombating the Financing of TerrorismC<strong>on</strong>tinuous Linked SettlementCore PrincipleCore Principles for <str<strong>on</strong>g>System</str<strong>on</strong>g>ically Important Payment <str<strong>on</strong>g>System</str<strong>on</strong>g>sCommittee for Payments and Settlement <str<strong>on</strong>g>System</str<strong>on</strong>g>sCentral Securities DepositoryCopenhagen Stock ExchangeCentral Business RegisterDanish Bankers Associati<strong>on</strong>Danish Commerce and Companies AgencyDanish <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisory AuthorityDanmarks Nati<strong>on</strong>albankDesignated n<strong>on</strong>-financial businesses and professi<strong>on</strong>sDelivery-versus-PaymentExpected LossesEuropean <str<strong>on</strong>g>System</str<strong>on</strong>g> of Central BanksEuropean Uni<strong>on</strong><str<strong>on</strong>g>Financial</str<strong>on</strong>g> Business Act<str<strong>on</strong>g>Financial</str<strong>on</strong>g> Business Council<str<strong>on</strong>g>Financial</str<strong>on</strong>g> Instituti<strong>on</strong>s<str<strong>on</strong>g>Financial</str<strong>on</strong>g> Intelligence UnitFree of Payment<str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisory Authority<str<strong>on</strong>g>Financial</str<strong>on</strong>g> Sector <str<strong>on</strong>g>Assessment</str<strong>on</strong>g> ProgramGuarantee Fund for Depositors and InvestorsInternati<strong>on</strong>al Accounting StandardsInsurance Core PrincipleInternati<strong>on</strong>al Central Securities Depository’sInternati<strong>on</strong>al <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Reporting StandardsInternati<strong>on</strong>al M<strong>on</strong>etary FundInternati<strong>on</strong>al Organizati<strong>on</strong> of Securities Commissi<strong>on</strong>s’Informati<strong>on</strong> TechnologyLender-of-Last-ResortM<strong>on</strong>etary and Capital Markets Department

5ML/FTMLAMoEBMoUNAONPOOTCPEPROSCRSSRTGSSMESØKSSESSSSTASTRULUNSCRVPM<strong>on</strong>ey Laundering/Financing of TerrorismMutual Legal AssistanceMinistry for Ec<strong>on</strong>omic and Business AffairsMemorandum of UnderstandingNati<strong>on</strong>al Audit OfficeN<strong>on</strong>-profit Organizati<strong>on</strong>sOver-the-CounterPolitically exposed pers<strong>on</strong>sReport <strong>on</strong> Observance of Standards and CodesRecommendati<strong>on</strong>s for Securities Clearing and Settlement <str<strong>on</strong>g>System</str<strong>on</strong>g>sReal-Time Gross SettlementSmall and Medium-sized EnterprisesSerious Ec<strong>on</strong>omic CrimeStockholm Stock Exchange LtdSecurities Settlement <str<strong>on</strong>g>System</str<strong>on</strong>g>sSecurities Trading ActSuspicious Transacti<strong>on</strong> ReportsUnexpected LossesUN Security Council resoluti<strong>on</strong>sDanish Central Securities Depository

6I. OVERALL STABILITY ASSESSMENT1. The financial system exhibits generally sound fundamentals. The system appearsresilient and is well supervised, underpinned by an effective legal and financialinfrastructure. It is currently enjoying the fruits of robust ec<strong>on</strong>omic growth, lowunemployment and inflati<strong>on</strong>, and fiscal and current account surpluses. Lending c<strong>on</strong>tinues tobe str<strong>on</strong>g, coinciding <str<strong>on</strong>g>with</str<strong>on</strong>g> rising housing prices. Profitability of financial instituti<strong>on</strong>s is atrecord levels and the number of corporate bankruptcies is the lowest in many years.2. The recent str<strong>on</strong>g performance, driven by rapid credit growth and an exuberanthousing market, will be difficult to sustain. The advanced cyclical phase of the ec<strong>on</strong>omy ismost evident in the expansi<strong>on</strong> of m<strong>on</strong>etary and credit aggregates and higher asset prices.Housing prices in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> have outpaced those in the other Nordic countries, underpinnedby the low interest rates, new types of financing, and the property tax freeze. A combinati<strong>on</strong>of c<strong>on</strong>tinued prudent macroec<strong>on</strong>omic policies, structural reforms, and acti<strong>on</strong>s to avoidunbalanced housing market developments will be needed to maintain macroec<strong>on</strong>omic andfinancial stability.3. A key less<strong>on</strong> of the early 1990s when the banking system was in distress, is thefact that financial sector problems tend to incubate in good times. While themacroec<strong>on</strong>omic envir<strong>on</strong>ment is now much better, and banks have improved their riskmanagement techniques, capital cushi<strong>on</strong>s are expected to decline <str<strong>on</strong>g>with</str<strong>on</strong>g> the implementati<strong>on</strong> ofBasel II. Stress test results show that while the system can absorb sizable shocks, a verysevere scenario could entail significant shortfalls in required capital. As large investors inmortgage b<strong>on</strong>ds, banks have benefited in the recent past from revaluati<strong>on</strong> gains fromdeclining interest rates. Prospective interest rate increases would likely have the oppositeeffect in the near term.4. Mortgage finance instituti<strong>on</strong>s are financially sound and risks in their balancesheets are well c<strong>on</strong>tained by design. They issue mortgage b<strong>on</strong>ds that must have cash flowsthat fully match those of the loans they make, thereby allowing individual borrowers accessto low cost financing in the capital market. The impending EU regulati<strong>on</strong> <strong>on</strong> covered b<strong>on</strong>dsis likely to pose significant transiti<strong>on</strong>al issues for the mortgage b<strong>on</strong>d system. When it isamended in accordance <str<strong>on</strong>g>with</str<strong>on</strong>g> the EU regulati<strong>on</strong>s, some of its attractive features would betraded off against the potential l<strong>on</strong>g term benefits of opening up mortgage b<strong>on</strong>d issuance tobanks. To fully realize these benefits, it would be important to ensure c<strong>on</strong>tinued effectivedisclosure and transparency and a level playing field am<strong>on</strong>g market participants.5. The life-insurance and pensi<strong>on</strong> funds industry has largely addressed theproblems stemming from past issuance of c<strong>on</strong>tracts <str<strong>on</strong>g>with</str<strong>on</strong>g> high guaranteed returns. Thishas been helped by higher interest rates, reducti<strong>on</strong>s in guaranteed rates, and some degree ofhedging. However, life-insurance companies and pensi<strong>on</strong> funds c<strong>on</strong>tinue to sell products<str<strong>on</strong>g>with</str<strong>on</strong>g> guaranteed returns that may cause problems later. This requires c<strong>on</strong>tinued m<strong>on</strong>itoringby the Danish <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisory Authority (DFSA) of companies’ ability to meet theirl<strong>on</strong>g-term obligati<strong>on</strong>s under varying interest rate envir<strong>on</strong>ments.

76. The payment and securities clearing and settlement systems are generallyfuncti<strong>on</strong>ing effectively and efficiently. The amendments to the Securities Trading Act(STA), making explicit the oversight resp<strong>on</strong>sibilities of the Danmarks Nati<strong>on</strong>albank (DN),further enhance the system.7. The missi<strong>on</strong> found a high degree of compliance <str<strong>on</strong>g>with</str<strong>on</strong>g> the internati<strong>on</strong>alsupervisory standards it assessed. The DFSA—an aut<strong>on</strong>omous instituti<strong>on</strong> under theMinistry of Ec<strong>on</strong>omic and Business Affairs—c<strong>on</strong>ducts effective risk-oriented supervisi<strong>on</strong>.Going forward, lower capital cushi<strong>on</strong>s of many supervised instituti<strong>on</strong>s, new supervisorytechniques (Basel II), and internati<strong>on</strong>al coordinati<strong>on</strong> pose challenges for the DFSA. Am<strong>on</strong>gthese are building capacity to validate models and identify emerging risks and strengtheningmechanisms for effective coordinati<strong>on</strong> <str<strong>on</strong>g>with</str<strong>on</strong>g> other supervisory authorities in the regi<strong>on</strong>. Box 1summarizes the missi<strong>on</strong>’s main recommendati<strong>on</strong>s.Near-term financial stabilityBox 1: <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> FSAP—Main Recommendati<strong>on</strong>s• Any easing of capital requirements under Basel II should be d<strong>on</strong>e gradually, andsupervisors should make use of their regulatory authority to require additi<strong>on</strong>alcapital as appropriate in individual cases. The missi<strong>on</strong> supports the regulati<strong>on</strong>limiting the decreases in capital requirements in 2007-08 for instituti<strong>on</strong>s thatwould use advanced methods for determining their capital adequacy.• Efforts to better m<strong>on</strong>itor, compile informati<strong>on</strong>, and model the impact of variousshocks should be intensified through strengthened stress testing capacity at theDFSA. The DFSA should c<strong>on</strong>sider more frequent inspecti<strong>on</strong>s as warranted.• Close m<strong>on</strong>itoring of the housing market, strict adherence to supervisory rules,and effective c<strong>on</strong>sumer informati<strong>on</strong> about risks are recommended to avoidunbalanced housing market developments which could adversely affect financialstability.Structural issues• The aut<strong>on</strong>omy and accountability of the DFSA should be entrenched byproviding the agency a statutory basis and granting it greater budgetaryaut<strong>on</strong>omy. With respect to the latter, separati<strong>on</strong> of its legislative and regulatoryactivities and supervisory budgets should be c<strong>on</strong>sidered.• The resources available to the DFSA should be reassessed in light of the need toexpand the agency’s capacity to verify banks’ internal models to calculate liablecapital, undertake stress testing, and ensure an effective framework for antim<strong>on</strong>eylaundering and combating financing of terrorism.• While the regulatory framework has worked well, it would benefit fromupgrading the guideline <strong>on</strong> internal c<strong>on</strong>trols to a more binding Executive Orderand broadening the coverage of fit-and-proper requirements.

8II. MACROECONOMIC SETTING, FINANCIAL STRUCTURE AND RISKSA. Macroec<strong>on</strong>omic Background and Risks8. <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>’s macroec<strong>on</strong>omic performance has been str<strong>on</strong>g, but the ec<strong>on</strong>omy nowfaces the risk of overheating. 1 Ec<strong>on</strong>omic growth reached 3.2 percent in 2005 and remainedstr<strong>on</strong>g in early 2006, driven in part by rapidly appreciating house prices. Inflati<strong>on</strong>—anchoredby the euro-peg—is close to 2 percent and unemployment reached record low levels in 2006.The general government balance realized a surplus of some 4 percent of GDP in 2005 and theexternal current account surplus reached 3.0 percent of GDP.9. M<strong>on</strong>etary and credit aggregates and asset prices have increased rapidly. In 2005,bank lending grew 21 percent and loans by mortgage credit instituti<strong>on</strong>s increased 12 percent.House prices in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> have outpaced those in the other Nordic countries (Figure 1),increasing by 22 percent <strong>on</strong> average during 2005, underpinned by low interest rates,increased demand, the property tax freeze since 2001, and new and more flexible forms offinancing. 2 To avoid unbalanced housing market developments, close m<strong>on</strong>itoring of themarket, strict adherence to supervisory rules, and effective c<strong>on</strong>sumer informati<strong>on</strong> about therisks of over-borrowing are recommended Since 2002, the Danish stock market hasoutperformed most other Nordic indices (Figure 2).10. Trends in the debt structure of households suggest that they are becoming moresusceptible to interest rate changes. Household indebtedness increased to some 230 percentof disposable income—high by internati<strong>on</strong>al comparis<strong>on</strong>. The build-up largely reflectsfinancing of c<strong>on</strong>sumpti<strong>on</strong>, real estate purchases, investment in pensi<strong>on</strong> funds, and otherfinancial investments. The share of variable interest rate debt in total household debt hasincreased substantially and loans <str<strong>on</strong>g>with</str<strong>on</strong>g> variable rates accounted for about half of totalmortgage loans at the end of January 2006. Low income households are most vulnerable tointerest rate changes. Pockets of vulnerabilities remain in the corporate sector, although <strong>on</strong>the whole the sector has benefited from favorable c<strong>on</strong>diti<strong>on</strong>s and bankruptcies have declined.1 Macroec<strong>on</strong>omic developments and policies are discussed in detail in the accompanying Staff Report for the2006 Article IV C<strong>on</strong>sultati<strong>on</strong> (www.imf.org).2 See also the Selected Issues paper <strong>on</strong> housing market developments in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>.

9Figure 1. Nordic Countries: Residential Real Estate Prices, March 1995–March 2006(March 1995=100)26024022020018016014012010080Mar-95 Mar-96 Mar-97 Mar-98 Mar-99 Mar-00 Mar-01 Mar-02 Mar-03 Mar-04 Mar-05 Mar-06Finland <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> Sweden NorwaySource: Nati<strong>on</strong>al statistical offices, Haver.Figure 2. Nordic Stock Exchanges: All Share Indexes, January 2003–June 2006(January 2003=100)500450400350300250200150100500Jan-03 Apr-03 Aug-03 Nov-03 Mar-04 Jun-04 Sep-04 Jan-05 May-05 Aug-05 Nov-05 Mar-06 Jun-06Stockholm Helsinki Oslo Copenhagen ReykjavikSource: Datastream.

10B. <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Structure and Risks11. The Danish financial sector is deep, diversified, and dynamic, <str<strong>on</strong>g>with</str<strong>on</strong>g> total financialassets close to five times GDP (Table 1). While credit instituti<strong>on</strong>s—commercial banks andmortgage banks—dominate the system, n<strong>on</strong>bank financial instituti<strong>on</strong>s—insurance companiesand pensi<strong>on</strong> funds—and capital markets are also prominent. In particular, the mortgage b<strong>on</strong>dmarket is sizable and its unique features have attracted c<strong>on</strong>siderable internati<strong>on</strong>al interest.C<strong>on</strong>glomerati<strong>on</strong>, cross-border operati<strong>on</strong>s, and c<strong>on</strong>centrati<strong>on</strong> are key characteristics of thefinancial system in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>. A few large groups operate as c<strong>on</strong>glomerates offering a widerange of services and products. The system is highly c<strong>on</strong>centrated despite the presence of alarge number of small instituti<strong>on</strong>s.Commercial Banks12. At end-2005, total assets of commercial banks were around 194 percent of GDP.Commercial banks include savings and cooperative banks, which are governed by the samelegislati<strong>on</strong>. The two largest banking groups—Danske Bank and Nordea Danmark—accountfor about 65 percent of commercial bank lending. The five largest banking groups accountfor approximately 79 percent of total loans and 83 percent of total assets.13. The banking sector is relatively competitive and efficient by internati<strong>on</strong>alcomparis<strong>on</strong> even though it is highly c<strong>on</strong>centrated. Indicators of intermediati<strong>on</strong> efficiencyhave been improving in recent years. In particular, the spread between lending and depositrates and operating costs as a share of total assets have been declining, and banks are quick toadopt new technologies. 3 N<strong>on</strong>etheless, both net interest income and net fee and commissi<strong>on</strong>income as a percent of total assets are higher than the EU-25 average. C<strong>on</strong>centrati<strong>on</strong> in thebanking industry does not seem to have significantly impeded competiti<strong>on</strong>. The standardc<strong>on</strong>centrati<strong>on</strong> ratios—the share of top five banks and the Herfindahl Index—are high butcomparable to those in other countries, such as Belgium, Finland, and the Netherlands.Competiti<strong>on</strong> is intense am<strong>on</strong>g the large instituti<strong>on</strong>s and at the domestic regi<strong>on</strong>al level. Themarket is also quite c<strong>on</strong>testable and an increasing number of instituti<strong>on</strong>s are providing crossborderbanking services. Efforts to promote transparency can further increase competiti<strong>on</strong>and allay reported c<strong>on</strong>sumer c<strong>on</strong>cerns about banks’ fees and charges.3 Based <strong>on</strong> rough comparis<strong>on</strong> of intermediati<strong>on</strong> spreads which may be influenced by the inclusi<strong>on</strong> of mortgagebanks in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> that traditi<strong>on</strong>ally operate <str<strong>on</strong>g>with</str<strong>on</strong>g> low margins.

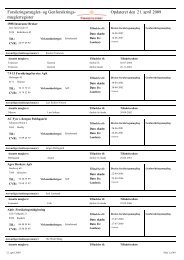

11Table 1. <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>: <str<strong>on</strong>g>Financial</str<strong>on</strong>g> <str<strong>on</strong>g>System</str<strong>on</strong>g> Structure, 1995–2005Dec-95 Dec-00 Dec-01 Dec-02 Dec-03 Dec-04 Dec-05Number of instituti<strong>on</strong>sAll banks 211 197 195 189 185 181 170Commercial banks 200 186 186 180 176 172 161Mortgage banks 10 10 8 8 8 8 8Specialized banks 1 1 1 1 1 1 1Insurance companies 206 199 189 171 165 162 160Life insurance 52 63 58 43 41 37 36N<strong>on</strong>-life insurance 154 136 131 128 124 125 124Pensi<strong>on</strong> funds 104 89 85 82 81 78 77Occupati<strong>on</strong>al pensi<strong>on</strong> funds 32 31 31 31 30 30 29Company pensi<strong>on</strong> funds 72 54 50 47 47 44 44Special pensi<strong>on</strong> funds ... 4 4 4 4 4 4Brokerage houses 5 29 30 29 28 32 31Assets (in percent of GDP)All banks 208.7 250.8 274.3 296.5 305.1 321.2 331.9Commercial banks 103.1 140.3 148.9 164.4 165.5 172.5 193.6Mortgage banks 100.9 106.5 121.1 127.7 135.0 144.5 134.3Specialized banks 4.7 4.1 4.3 4.4 4.6 4.1 4.0Insurance companies 43.9 58.3 56.6 56.7 60.3 63.7 70.2Life insurance 34.8 50.2 48.6 48.7 51.9 55.2 61.3N<strong>on</strong>-life insurance 9.1 8.1 8.0 8.0 8.4 8.5 8.9Pensi<strong>on</strong> funds 35.0 49.2 47.9 46.3 49.9 54.1 58.3Occupati<strong>on</strong>al pensi<strong>on</strong> funds 14.3 20.8 20.4 20.2 21.4 23.1 24.5Company pensi<strong>on</strong> funds 3.3 3.3 3.0 2.7 2.7 2.7 2.7Special pensi<strong>on</strong> funds 17.4 25.0 24.5 23.4 25.8 28.3 31.1Brokerage houses 0.1 0.1 0.1 0.1 0.1 0.1 0.1Number of employeesAll banks 46,263 44,871 44,373 44,140 43,052 42,788 43,879Commercial banks 43,135 40,906 40,933 39,957 38,740 38,685 39,714Mortgage banks 3,128 3,921 3,394 4,134 4,261 4,048 4,111Specialized banks ... 44 46 49 51 55 54Insurance companies 13,959 13,374 13,228 13,046 13,157 13,665 13,553Life insurance 2,064 1,442 1,606 1,709 1,723 2,365 3,248N<strong>on</strong>-life insurance 11,895 11,932 11,622 11,337 11,434 11,300 10,305Pensi<strong>on</strong> funds 1,036 1,289 1,365 776 840 818 1,290Occupati<strong>on</strong>al pensi<strong>on</strong> funds 439 460 464 470 490 516 493Company pensi<strong>on</strong> funds 35 42 39 40 40 38 36Special pensi<strong>on</strong> funds 562 787 862 266 310 264 761Brokerage houses ... 267 316 248 272 320 353Source: The Danish <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisory Authority.

1214. The presence of foreign banks—mainly from other Nordic countries—issubstantial. Foreign ownership of Danish banks is significantly higher than the average forthe EU countries. At end-2005, there were 9 foreign subsidiaries, 26 foreign branches, and271 foreign credit instituti<strong>on</strong>s providing some cross-border banking services into thecountry. 4 Banks <str<strong>on</strong>g>with</str<strong>on</strong>g> Nordic parents accounted for approximately 84 percent of foreignbanks’ total assets. The largest of them, Nordea, is currently c<strong>on</strong>templating transformingitself into a European Company based in Sweden, <str<strong>on</strong>g>with</str<strong>on</strong>g> a branch structure. The Danishbranches will be systemically important and pose a number of supervisory challenges.15. Banks’ report solid financial soundness indicators, but buffers in the system arebeing lowered (Table 2). Capital adequacy and asset quality remains high, <str<strong>on</strong>g>with</str<strong>on</strong>g> the overallcapital adequacy ratio at 13¼ percent and accumulated provisi<strong>on</strong>s at 1.0 percent of total loansoutstanding at end-2005. Banks reported record profits in 2005—21¼ percent return beforetax <strong>on</strong> equity compared <str<strong>on</strong>g>with</str<strong>on</strong>g> 17¾ percent in 2004. Profitability was boosted by growth infees and commissi<strong>on</strong>s, primarily from securities trading and refinancing activity. The systemwideincome to cost ratio improved from 1.7 to 2.0.16. The implementati<strong>on</strong> of the Internati<strong>on</strong>al <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Reporting Standards (IFRS)has allowed banks to revoke previous provisi<strong>on</strong>s and banks intending to use internalmodels under Basel II would likely seek to lower their capital requirements. Ten Danishbanks have indicated that they would use advanced internal ratings under Basel II to beimplemented in 2007-08. Against the backdrop of rapidly expanding bank balance sheets andprospective changes in the interest rate envir<strong>on</strong>ment, the reducti<strong>on</strong> of the capital buffer needsto be approached <str<strong>on</strong>g>with</str<strong>on</strong>g> cauti<strong>on</strong> and implemented gradually. In this c<strong>on</strong>text, the regulati<strong>on</strong>limiting the reducti<strong>on</strong> of capital requirements during 2007-09 for banks using advancedmethods is welcome. The DFSA would need to carefully assess capital adequacy inindividual instituti<strong>on</strong>s and require additi<strong>on</strong>al capital commensurate <str<strong>on</strong>g>with</str<strong>on</strong>g> the risk profile ofeach instituti<strong>on</strong>, c<strong>on</strong>sistent <str<strong>on</strong>g>with</str<strong>on</strong>g> Pillar II of Basel II.Stress Tests17. Credit Risk: Stress tests show that commercial banks can <str<strong>on</strong>g>with</str<strong>on</strong>g>stand sizableshocks, but would experience substantial capital shortfalls if subjected to severe shocks.Results of both top-down and bottom-up stress scenarios (Box 2) that evolve over three yearsshow that by the third year the mandatory capital adequacy ratio of the system is breachedbut manageable, and <strong>on</strong>ly in the worst case scenario is the shortfall substantial.4 For an analysis of foreign ownership of Danish commercial banks, see “Foreign Banks in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>” by JakobWindfeld Lund and Kristine Rasumssen, M<strong>on</strong>etary Review, 1 st Quarter 2006 (Copenhagen: DanmarksNati<strong>on</strong>albank). See:http://www.nati<strong>on</strong>albanken.dk/C1256BE9004F6416/side/M<strong>on</strong>etary_review_2006_1_Quarter!opendocument.

13Table 2. <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>: <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Soundness Indicators of Commercial Banks, 2000–05(In percent, unless indicated otherwise)Dec-00 Dec-01 Dec-02 Dec-03 Dec-04 Dec-05Capital AdequacyRegulatory capital to risk-weighted assets (Tier 1+Tier 2) 12.7 13.0 13.5 14.0 13.5 13.2Tier 1 capital to risk-weighted assets 9.9 9.7 10.2 10.8 10.7 10.2Capital (net worth) to assets 1/ 6.7 6.2 5.7 5.9 5.7 5.7Asset Compositi<strong>on</strong> and QualitySectoral distributi<strong>on</strong> of lending to residentsN<strong>on</strong>financial companies 28.9 32.7 30.9 35.9 36.0 33.8<str<strong>on</strong>g>Financial</str<strong>on</strong>g> instituti<strong>on</strong>s 30.3 27.3 31.8 26.2 22.2 26.1General government 2.3 2.6 2.5 2.9 2.8 2.4Households 37.1 36.1 33.9 34.2 37.8 36.2Other 1.3 1.3 0.8 0.8 1.2 1.6Geographical distributi<strong>on</strong> of lending to n<strong>on</strong>-residentsEuro area 26.7 27.8 24.3 21.1 20.6 20.0Great Britain 26.8 22.8 23.3 26.6 28.4 26.1Sweden 14.6 21.3 24.8 26.4 29.0 29.5Norway 4.9 8.4 10.3 8.4 8.7 10.0USA 5.1 5.4 5.2 5.1 3.2 4.2Other countries 22.0 14.4 12.1 12.3 10.1 10.2N<strong>on</strong>performing loans to gross loans and guarantees 0.5 0.5 0.6 0.6 0.5 0.3N<strong>on</strong>performing loans to gross loans 0.7 0.7 0.9 0.8 0.7 0.4N<strong>on</strong>performing loans net of provisi<strong>on</strong>s to Tier 1 capital 0.9 1.3 2.0 2.0 1.8 0.9Provisi<strong>on</strong>s to n<strong>on</strong>performing loans 81.1 76.5 66.5 63.0 66.0 75.7Stock of total provisi<strong>on</strong>s to total gross loans 2.5 2.3 2.2 2.3 1.5 1.0Loan-loss provisi<strong>on</strong>s made during the year to total gross loans 0.3 0.4 0.3 0.4 0.1 -0.03Sum of large exposures to Tier II capital 2/ 103.2 128.8 133.8 139.1 139.7 146.1Foreign-currency loans to total loans 3/ ... ... ... 35.9 38.9 42.2Loans to assets 73.7 70.0 67.9 68.3 66.4 66.0Credit growth 14.8 7.4 1.5 4.6 14.2 24.7Earnings and ProfitabilityReturn <strong>on</strong> assets before tax ... 1.1 1.0 1.2 1.3 1.3Return <strong>on</strong> assets after tax ... 0.8 0.7 0.9 0.9 1.0Return <strong>on</strong> equity before tax ... 17.3 16.7 20.8 17.7 21.2Return <strong>on</strong> equity after tax ... 12.8 12.1 15.4 13.7 16.3Net interest income to gross income 63.1 69.9 72.1 66.9 64.4 61.9N<strong>on</strong>interest income to gross income 36.9 30.1 27.9 33.1 35.6 38.1N<strong>on</strong>interest expenses to gross income 66.4 61.7 63.3 57.3 61.6 57.4LiquidityLiquid assets to total assets (exclusive of interbank lending) 4.3 5.3 7.7 8.0 6.1 7.4Liquid assets to total assets (inclusive of interbank lending) 4/ 29.6 25.0 28.3 29.3 26.6 30.2Liquid assets to short term liabilities 5/ 110.7 91.6 112.3 117.0 103.3 120.6Gross loans to deposits 114.1 113.8 109.4 103.3 105.4 115.3Liquidity coverage as a percentage of the requirement ... 152.8 153.1 189.5 176.9 140.1Net external liabilities to total liabilities 6/ 2.0 7.4 8.9 12.1 10.5 13.4Sensitivity to Market RiskInterest rate loss exposure to Tier 1 capital 7/ 2.6 3.5 2.6 3.4 1.8 1.5FX exposure to Tier 1 capital 1 8/ 6.4 7.3 8.4 7.6 5.2 5.9FX exposure to Tier 1 capital 2 9/ 0.1 0.1 0.1 0.1 0.1 0.3Net positi<strong>on</strong> in equities to capital 36.9 31.2 24.1 28.1 29.9 19.9Net positi<strong>on</strong> in financial derivatives to capital -3.6 -1.6 -7.7 -7.5 -6.9 0.1Earnings per share 0.7 0.9 0.9 1.2 1.2 1.7Market value to book value ratio ... 0.9 0.9 1.3 1.6 1.9Indicators for other sectorsNumber of corporate bankruptcies 175.0 214.0 188.0 232.0 225.0 226.0Real estate price index (March 1995=100) 165.9 175.5 199.7 194.9 231.6 307.2Sources: The Danish <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisiory Authority, Danmarks Nati<strong>on</strong>albank and Statistics <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>.1/ Shareholders' equity to total assets.2/ Large exposures are defined as the sum of assets and off-balance-sheet items that, after a reducti<strong>on</strong> for secured exposures, exceed 10 percent of the combined Tier II and Tier III capital.3/ 2005 figure corresp<strong>on</strong>ds to July 2005.4/ Included in liquid assets are <strong>on</strong> balance sheet cash, loans to MFIs and b<strong>on</strong>ds <str<strong>on</strong>g>with</str<strong>on</strong>g> original maturity of less than a year.5/ Included in short-term liabilities are deposits available <strong>on</strong> demand and time deposits <str<strong>on</strong>g>with</str<strong>on</strong>g> original maturity of less than a year .

14Box 2. Stress Tests—Credit RiskThe FSAP missi<strong>on</strong> c<strong>on</strong>ducted top down and bottom up stress tests. Severe, but plausible, single factor shocks andmacroec<strong>on</strong>omic scenarios were developed in c<strong>on</strong>sultati<strong>on</strong> <str<strong>on</strong>g>with</str<strong>on</strong>g> the DN and DFSA. The size of the shocks were based <strong>on</strong>historical informati<strong>on</strong> covering at least an entire ec<strong>on</strong>omic cycle and encompassing episodes of financial distress. In the bottomupapproach the DFSA requested the banks to run the scenarios and shocks through their internal models. The top downapproach was based <strong>on</strong> a portfolio credit risk based methodology implemented by staff. The scenarios were as follows:Scenario 1—boom-bust in real estate prices and credit. Under this scenario, decreases in asset returns—resulting from thesharp increase in asset prices and high levels of indebtedness in the ec<strong>on</strong>omy—lead ec<strong>on</strong>omic agents to revise their expectati<strong>on</strong>sabout asset prices turning the boom into a bust. Asset prices fall and credit growth decreases (down by 14.2 percent). Withreverse wealth effects, c<strong>on</strong>sumpti<strong>on</strong>, aggregate demand, and GDP falls, and unemployment increases (relative to baseline).Depressed collateral prices (down by 27 percent), higher unemployment (up by 3.8 percent) and decreasing GDP (down by6.8 percent) have a negative impact <strong>on</strong> banks’ assets, increasing the proporti<strong>on</strong> of n<strong>on</strong>-performing loans.Scenario 2—foreign shock stemming from an abrupt correcti<strong>on</strong> in global imbalances. Under this scenario, the Danishkr<strong>on</strong>er, in line <str<strong>on</strong>g>with</str<strong>on</strong>g> the euro, appreciates against the U.S. dollar and other currencies (up to 29 percent), leading to a loss ofcompetitiveness and lower demand for Danish goods. The trade balance deteriorates, GDP falls (down by 4.1 percent), andunemployment rises (up by 3.2 percent), relative to baseline. There is a shift in expectati<strong>on</strong>s, negatively affecting privatec<strong>on</strong>sumpti<strong>on</strong> and depressing ec<strong>on</strong>omic activity further. This, in turn, negatively affects n<strong>on</strong>-performing loans, increasing banks’losses.Scenario 3—boom-bust in real estate prices and credit plus a str<strong>on</strong>g increase in European interest rates. This scenario issimilar to scenario 1 above, but also assumes that the c<strong>on</strong>tinuati<strong>on</strong> of high oil prices increases inflati<strong>on</strong>ary pressures in Europe,prompting the European Central Bank to significantly increase interest rates. Danmarks Nati<strong>on</strong>albank follows suit and policyinterest rates rise (250 bp). The reassessment of asset values is reinforced by higher interest rates and higher debt servicing,turning the boom into a bust. Asset prices start falling, c<strong>on</strong>sumpti<strong>on</strong> decreases, aggregate demand c<strong>on</strong>tracts, GDP falls, creditgrowth decreases (down to 19.5 percent), and unemployment increases relative to baseline. Higher interest rates, depressedcollateral prices (down by 41.9 percent), higher unemployment (up by 5.1 percent), and decreasing GDP (down by 9.2 percent)negatively impact banks’ assets and n<strong>on</strong>-performing loans.The impact of the scenarios <strong>on</strong> capital adequacy ratio are summarized below.Stress Test: Resulting Capital Adequacy Ratios (percent)Scenario 1 Scenario 2 Scenario 3Top-down2006 8.5 8.5 8.62007 8.3 8.3 8.02008 6.7 8.1 5.7Bottom-up2006 10.5 10.1 9.32007 9.0 9.2 7.42008 6.6 7.7 4.5Source: Banks’ staff estimates.

1518. Stress test results need to be interpreted <str<strong>on</strong>g>with</str<strong>on</strong>g> cauti<strong>on</strong>. The most severe scenarioattempts to simulate hypothetical extreme events <str<strong>on</strong>g>with</str<strong>on</strong>g> a low likelihood. The model also doesnot take into account the sec<strong>on</strong>d round portfolio adjustments aimed at limiting the impact <strong>on</strong>profitability which is, typically, the first line of defense. 5 In additi<strong>on</strong>, the results are based <strong>on</strong>the average banking system but will effect individual banks differently.19. The cumulative effects of the macroec<strong>on</strong>omic shocks are reflected in theincreasing probabilities of default and expected and unexpected losses over thethree-year period. 6 Credit risk could materialize if the accelerated and acute increase inhouse prices and levels of leverage in the ec<strong>on</strong>omy later led to a collapse in real estate prices.The results suggest that recent developments, which appear to increase the vulnerability ofhouseholds to interest rate fluctuati<strong>on</strong>s, in combinati<strong>on</strong> <str<strong>on</strong>g>with</str<strong>on</strong>g> an external shock (scenario 3)could reinforce the stress <strong>on</strong> the banking system. Credit risk thus remains a major risk factorfor the banking system.20. Market Risk: On average, exposure to market risk seems relatively modest, butmay vary significantly am<strong>on</strong>g instituti<strong>on</strong>s. The impact of individual shocks to interestrates, equity prices, real estate prices, and the exchange rate <strong>on</strong> capital of banks is modest(see Appendix). Most loans in banks’ portfolios have flexible interest rates, so that the effectsof the single factor shocks are transmitted primarily through credit risk. These shocks canpotentially result in losses <strong>on</strong> banks’ holdings of financial instruments, mainly mortgageb<strong>on</strong>ds. However, banks dynamically hedge most of this porti<strong>on</strong> of their portfolio, adjusting itin resp<strong>on</strong>se to changes in interest rates so as to maintain a matched durati<strong>on</strong>. Banks’ net openpositi<strong>on</strong> in foreign exchange (including the euro) is also modest, so that even a substantialexchange rate shock results in <strong>on</strong>ly limited impact <strong>on</strong> banks’ capital adequacy.21. Liquidity and C<strong>on</strong>tagi<strong>on</strong> Risks: Analysis of banks’ holdings of large amounts ofgovernment and mortgage b<strong>on</strong>ds acceptable as collateral to the Nati<strong>on</strong>albank indicatethat these risks are not significant. At end-2005 banks’ holdings of b<strong>on</strong>ds, of which mostare collaterable assets, represented 19.5 percent of total assets and 49.5 percent of alldeposits. The DN’s analysis of uncollateralized bilateral exposures in the interbank marketindicates the risk of interbank c<strong>on</strong>tagi<strong>on</strong> is insignificant and manageable. 75 Banks’ baseline projecti<strong>on</strong>s indicate an upward trend in profits. The stress testing model assumes thatprofitability remains at the 2005 level which may be difficult to sustain under the stressed scenarios. To thisextent the negative impact <strong>on</strong> capital may be understated.6 Expected losses (EL) are defined as EL= PoD x Exposure x LGD, where PoD is the probability of default andLGD is the loss-given-default of each loan in a bank’s portfolio. While it is important to estimate ELs,estimating “unexpected losses” (ULs) is fundamental to the effective management of credit risk. Ec<strong>on</strong>omiccapital should be available to cover ULs.7 The approach and results are presented in Danmarks Nati<strong>on</strong>albank’s <str<strong>on</strong>g>Financial</str<strong>on</strong>g> <str<strong>on</strong>g>Stability</str<strong>on</strong>g> Report, 2005 and inC<strong>on</strong>tagi<strong>on</strong> Risk in the Danish Interbank Market by Elin Amundsen and Henrik Arnt, Danmarks Nati<strong>on</strong>albankWorking Papers 2005–29, Danmarks Nati<strong>on</strong>albank, Copenhagen. Liquidity in the payment systems is discussedin “Protecti<strong>on</strong> of Settlement in Danish Payment <str<strong>on</strong>g>System</str<strong>on</strong>g>s” in Danmarks Nati<strong>on</strong>albank’s <str<strong>on</strong>g>Financial</str<strong>on</strong>g> <str<strong>on</strong>g>Stability</str<strong>on</strong>g>Report, 2006.

16C. Mortgage Credit Banks22. Danish mortgage financing system is profitable, transparent, and effective indelivering low cost mortgage financing to borrowers. Specific legislati<strong>on</strong>, allowsspecialized mortgage credit instituti<strong>on</strong>s to issue mortgage b<strong>on</strong>ds <strong>on</strong> behalf of the borrowers.The framework is supported by an effective system of land registrati<strong>on</strong> as well as clearlydefined procedures for foreclosures. With total assets close to 135 percent of GDP, mortgagecredit instituti<strong>on</strong>s are slightly smaller than the commercial banks and their reportedsoundness indicators are good (Table 3). Mortgage b<strong>on</strong>ds as well as the mortgage creditinstituti<strong>on</strong>s are highly rated by internati<strong>on</strong>al rating agencies, and mortgage b<strong>on</strong>ds areaccepted by the Nati<strong>on</strong>albank as collateral.23. The mortgage credit system faces significant challenges. In recent years mortgagefinancing has underg<strong>on</strong>e several changes and new products have emerged, including variableinterest rates, deferred amortizati<strong>on</strong>, and capped adjustable rate loans. Variable rate mortgageloans now account for about half of all such loans. New types of loans necessitate new typesof b<strong>on</strong>ds to observe the balance principle. The wider range of mortgage products couldnegatively impact the overall pricing and liquidity of the mortgage market if it results in aless homogeneous mortgage market <str<strong>on</strong>g>with</str<strong>on</strong>g> a series of smaller and less liquid b<strong>on</strong>ds. This couldaffect the appetite of investors—mostly instituti<strong>on</strong>al investors—for Danish mortgage b<strong>on</strong>ds. 1024. The impending EU regulati<strong>on</strong> <strong>on</strong> covered b<strong>on</strong>ds is likely to pose a transiti<strong>on</strong>alchallenge for the Danish mortgage system. As covered b<strong>on</strong>ds, the loan to value <strong>on</strong>mortgage b<strong>on</strong>ds will need to be observed c<strong>on</strong>tinuously instead of <strong>on</strong>ly at the originati<strong>on</strong> ofthe loan. Besides mortgage credit instituti<strong>on</strong>s, banks would be allowed to issue such coveredb<strong>on</strong>ds. This would allow more funding flexibility, but would tend to limit the direct access tothe capital market provided to the borrower under the current system. In principle,competiti<strong>on</strong> should ensure efficient pricing of covered b<strong>on</strong>ds. However, the two largest banksand regi<strong>on</strong>al banks as a group would be in a more advantageous positi<strong>on</strong> to issue coveredb<strong>on</strong>ds because of their branch networks and greater proximity to customers. With a broaderrange of available collateral and possibilities to provide additi<strong>on</strong>al capital, banks would be ina better positi<strong>on</strong> to adapt to loan to value fluctuati<strong>on</strong>s compared to mortgage financeinstituti<strong>on</strong>s. Realizati<strong>on</strong> of the potential l<strong>on</strong>g run benefits of covered b<strong>on</strong>ds would place aheavy premium <strong>on</strong> effective disclosure and transparency and a level playing field am<strong>on</strong>gmarket participants.10 See “Trends in Mortgage-Credit Financing: the Market and its Players,” by Lars Jul Hansen, in M<strong>on</strong>etaryReview, 1 st Quarter, 2006, Danmarks Nati<strong>on</strong>albank, Copenhagen.

17Table 3. <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>: <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Soundness Indicators for MortgageCredit Instituti<strong>on</strong>s, 2000–05Dec-00 Dec-01 Dec-02 Dec-03 Dec-04 Dec-05Capital AdequacyRegulatory capital to risk-weighted assets (Tier 1+Tier 2) 12.6 11.5 11.7 11.6 12.4 12.7Tier 1 capital to risk-weighted assets 11.5 11.1 11.2 11.0 11.6 11.3Capital (net worth) to assets 1/ 5.3 4.8 4.8 4.9 4.7 5.3Asset compositi<strong>on</strong> and qualityResidential real estate loans to total loans 2/ 76.1 76.7 76.7 77.0 77.0 77.8Commercial real estate loans to total loans 2/ 22.3 21.6 21.7 21.4 21.4 20.8Other loans to total loans 1.6 1.7 1.6 1.6 1.5 1.5Adjustable rate lending to total lending 8.7 19.2 26.7 33.2 41.3 45.8Stock of total provisi<strong>on</strong>s to total loans and provisi<strong>on</strong>s 0.3 0.3 0.2 0.2 0.2 0.1Write offs and loan loss provisi<strong>on</strong>s made during the year -0.03 0.01 0.01 0.01 0.02 0.0FX loans to total loans 1.4 4.6 6.4 6.1 5.7 4.8Credit growth 3.8 9.2 7.7 8.4 6.5 11.1Loans to capital ratio 3/ 15.1 15.7 15.8 15.4 14.8 15.4Earnings and ProfitabilityROA before tax ... 0.4 0.4 0.5 0.5 0.6ROA after tax ... 0.3 0.3 0.4 0.3 0.4ROE before tax 9.1 8.7 8.6 10.5 9.3 10.9ROE after tax 6.4 6.5 6.1 8.0 7.1 8.4Operating income to operating expenses ratio 4/ 2.7 2.6 2.5 2.9 3.1 3.6Net interest income to gross income 94.1 97.0 94.9 85.8 91.9 95.0Net n<strong>on</strong>-interest income to gross income -1.2 2.3 2.4 4.8 2.0 5.0N<strong>on</strong>interest expenses to gross income 39.2 37.5 38.0 34.7 36.5 35.2LiquidityLiquid assets to total assets 5/ 15.8 22.6 23.0 23.2 26.6 28.9FX liabilities to total liabilities 6/ 2.0 5.1 7.5 7.7 7.6 6.7Sensitivity to market riskFX exposure to Tier I capital 7/ 2.9 5.0 1.5 3.1 1.1 1.2Sources: FSA and Danmark's Nati<strong>on</strong>al Bank.1/ Shareholders' equity to total assets.2/ Included in residential lending are lending for owner-occupied dwellings, private rental housing, subsidized housing. Commercial real estate lending includes lending for trade, industry,offices and agriculture.3/ Defined as "gearing" by the FSA.4/ Income <strong>on</strong> core activities including value adjustments for changes in current prices as a percentage of expenses <strong>on</strong> core activities including provisi<strong>on</strong>s. The indicator c<strong>on</strong>tains all profitand loss items except extraordinary items and tax.5/ Included in liquid assets are items due from credit instituti<strong>on</strong>s and b<strong>on</strong>ds.6/ B<strong>on</strong>d liabilities in foreign currency to total liabilities.7/ Calculated as the largest amount of the short-term currency exposures and the l<strong>on</strong>g-term currency exposures.

18D. Insurance Companies25. The Danish insurance industry is well developed and its performance hasgenerally improved following the difficulties early in this decade (Table 4). At end-2005,assets of life insurance and general pensi<strong>on</strong> funds amounted to almost 120 percent of GDP.The five largest companies account for about 55 percent of gross premiums and theten largest for 73½ percent. 12 Assets of n<strong>on</strong>-life insurance companies amounted to 9 percentof GDP at end-2005. This market is mainly <strong>on</strong>e of individual business, motor, and householdinsurance, representing approximately 70 percent of the n<strong>on</strong>-life market. In 2005, grosspremiums amounted to 2.9 percent of GDP (Table 5). Life insurance companies and pensi<strong>on</strong>funds are covered by the same legislative framework. Reinsurance is mainly provided fromthe internati<strong>on</strong>al market, although there are five captive Danish reinsurance companies thatprimarily reinsure risks originating from the group.Table 4. Selected <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Indicators for Life Insurance and Pensi<strong>on</strong> Funds, 2001–05(In percent unless indicated otherwise)2001 2002 2003 2004 2005Life insuranceGross premiums to GDP 3.72 4.01 4.23 4.23 4.37Net premiums to GDP 3.67 3.95 4.19 4.21 4.34Return <strong>on</strong> equity before tax -13.65 2.86 14.37 11.74 11.34Return <strong>on</strong> investments before tax <strong>on</strong> pensi<strong>on</strong> returns -1.68 2.98 6.51 9.82 12.98Ratio of operating expenses to gross premiums 7.17 7.31 7.21 6.55 5.79Ratio of expenses to provisi<strong>on</strong>s 0.7 0.7 0.8 0.6 0.6Ratio of equity to provisi<strong>on</strong>s 6.6 7.5 8.7 8.5 8.7Ratio of excess solvency to provisi<strong>on</strong>s 3.2 3.9 4.7 4.6 4.7Solvency indicator 166.8 182.1 201.5 195.0 196.8Pensi<strong>on</strong> fundsGross premiums to GDP 0.9 0.9 1.0 1.0 0.8Return <strong>on</strong> equity before tax -19.04 -30.99 25.5 23.16 23.55Return <strong>on</strong> investments before tax <strong>on</strong> pensi<strong>on</strong> returns -1.5 -1.16 7.72 11.78 17.44Ratio of operating expenses to gross premiums 3.6 3.5 3.4 3.1 3.0Ratio of expenses to provisi<strong>on</strong>s 0.2 0.2 0.2 0.2 0.2Ratio of equity to provisi<strong>on</strong>s 17.21 13.43 17.35 20.41 23.74Ratio of excess solvency to provisi<strong>on</strong>s 9.18 8.75 13.03 15.97 18.97Solvency indicator 433.3 309.5 398.5 460.5 476.7Source: The Danish <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisory Authority.12 In 2003, life insurance penetrati<strong>on</strong> (direct gross premiums in percent of GDP) was in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> 5.17, Finland2.00, Germany 3.90, the Netherlands 5.40, Norway 2.81, Sweden 4.58, and the United Kingdom 9.76 percent.According to the OECD: Insurance Statistics Yearbook 1994–2003, (Paris: OECD).

19Table 5. <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Soundness Indicators for N<strong>on</strong>-life Insurance Companies, 2001–05(In percent unless indicated otherwise)Dec-01 Dec-02 Dec-03 Dec-04 Dec-05Gross premiums to GDP 2.3 2.9 3.1 3.1 2.9Net premiums to GDP 2.0 2.4 2.6 2.7 2.6Return <strong>on</strong> assets 0.6 0.1 5.8 5.9 6.4Return <strong>on</strong> equity 5.6 0.9 14.2 14.6 17.1Operating expenses to gross premiums 23.5 22.8 21.7 17.5 17.3Loss ratio gross of reinsurance 78.8 80.3 71.2 74.5 80.1Solvency ratio 3.4 3.7 4.2 3.9 4.7Source: The Danish <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisory Authority.26. While several measures have been implemented to increase the buffers in theindustry, the overall risk in the pensi<strong>on</strong> sector still needs to be closely m<strong>on</strong>itored. At thebeginning of this decade, the Danish life insurance and pensi<strong>on</strong> industry, like in many othercountries, experienced problems due to minimum guaranteed returns offered to customers ina low yield envir<strong>on</strong>ment. Although the minimum yield had been reduced over time, asubstantial share of older c<strong>on</strong>tracts <str<strong>on</strong>g>with</str<strong>on</strong>g> a guaranteed annual return of 4.5 percent is stilloutstanding. Many companies have bought derivatives to cover these risks. Better returns in2004 and 2005 have limited the problem, but if returns <strong>on</strong> investments were to declinesubstantially, this problem will remerge.27. Stress tests c<strong>on</strong>ducted for the FSAP show that much of the impact of shockswould be absorbed by the collective b<strong>on</strong>us pool comp<strong>on</strong>ent (retained earnings) ofcompanies’ reserves. The exercise covered the largest companies which were asked by theDFSA to estimate the c<strong>on</strong>sequences of the single factor shocks <str<strong>on</strong>g>with</str<strong>on</strong>g> magnitudes c<strong>on</strong>sistent<str<strong>on</strong>g>with</str<strong>on</strong>g> those applied for the banks for market risk. The sizable collective b<strong>on</strong>us pool, l<strong>on</strong>g termnature of the investment portfolios, and some degree of hedging cushi<strong>on</strong>s the impact of theshocks.28. The DFSA’s own m<strong>on</strong>itoring system also suggests a generally resilient insurancesector. The DFSA maintains a “traffic light” system based <strong>on</strong> two scenarios—red and yellowlight. The red light scenario assumes a combinati<strong>on</strong> of a decline of 12 percent in the price ofstocks and 8 percent in the price of real estate, and an increase in the interest rate level of 0.7percentage points. The yellow light scenario assumes a decline of 30 percent in the price ofstocks and 12 percent in the price of real estate, and an increase in the interest rate level of1.0 percentage point. The system complements the required capital margin. If a companycannot meet the red scenario, the DFSA may use measures such as require m<strong>on</strong>thly reportingand the company in questi<strong>on</strong> will not be allowed to increase its overall risk. 13 As of end-2005,the system flagged <strong>on</strong>ly <strong>on</strong>e company (n<strong>on</strong>life company) as being under the red light andthus warranted closer m<strong>on</strong>itoring by the DFSA. Six companies were signaled as being underyellow light, suggesting that they could better <str<strong>on</strong>g>with</str<strong>on</strong>g>stand the combinati<strong>on</strong> of shocks.13 All life insurers and pensi<strong>on</strong> funds have to estimate the c<strong>on</strong>sequences of the changes in the assumed levels ofmortality and disability used in the annual report. The test assumes both a decrease and an increase in themortality intensity of 10 percent. It corresp<strong>on</strong>ds roughly to change in l<strong>on</strong>gevity of <strong>on</strong>e year. Further, the testassumes an increase in the disability intensity of 10 percent. The result of these stress tests is required to bedisclosed in the annual report.

2029. The performance in the n<strong>on</strong>-life sector has also improved. The five largest n<strong>on</strong>lifecompanies accounted for almost 67 percent of gross premiums and the ten largest foralmost 83 percent in 2005. During the last five years, two n<strong>on</strong>-life insurers experiencedserious difficulties (<strong>on</strong>e due to September 11), including <strong>on</strong>e company that failed. No directlosses for customers were observed, but in <strong>on</strong>e case the costs for the guarantee fund has beenestimated at €16 milli<strong>on</strong>.30. Effective January 1, 2007, the minimum capital requirement will increase to theequivalent of the requirements in EU Solvency I Directive. Market participants are alsoanticipating increases in the capital levels in future years, when the EU c<strong>on</strong>tinues to makeprogress <strong>on</strong> the insurance capital adequacy (Solvency II).E. Cross-Border <str<strong>on</strong>g>Financial</str<strong>on</strong>g> C<strong>on</strong>glomerates31. Substantial exposures to n<strong>on</strong>-residents and the presence of large c<strong>on</strong>glomeratesthat are active in the Nordic regi<strong>on</strong> poses a number of challenges (Table 6). In particular,the increasing divergence in the legal and business structure of such instituti<strong>on</strong>s, <str<strong>on</strong>g>with</str<strong>on</strong>g>centralizati<strong>on</strong> of key functi<strong>on</strong>s such as risk management abroad places a premium <strong>on</strong>coordinati<strong>on</strong> and informati<strong>on</strong> sharing am<strong>on</strong>g regi<strong>on</strong>al supervisors. While the sectorallyintegrated supervisory structure of the DFSA facilitates effective c<strong>on</strong>solidated supervisi<strong>on</strong> ofinstituti<strong>on</strong>s incorporated in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>, close coordinati<strong>on</strong> am<strong>on</strong>g the Nordic supervisors andcentral banks is equally important. The systemic importance of some of the instituti<strong>on</strong>s alsorequires effective coordinated arrangements for provisi<strong>on</strong> of liquidity and crisis management.32. Arrangements for cross border coordinati<strong>on</strong> and informati<strong>on</strong> sharing are inplace but remain to be tested. The supervisory agencies in the regi<strong>on</strong> have forged a generalmemorandum of understanding (MoU) and there is a similar MoU at the EU level. Inadditi<strong>on</strong>, there is a special agreement regarding the Nordea Group headquartered in Sweden.The Swedish <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisory Authority (FSA) is the lead supervisor for Nordea, whichis inspected by joint teams. Most of the financial groups are sizable and systemicallyimportant in at least <strong>on</strong>e of the Nordic countries. It remains to be seen whether, given theirlegally n<strong>on</strong>-binding nature, the MOUs would be effective in the event of a crisis involving<strong>on</strong>e of the larger instituti<strong>on</strong>s <str<strong>on</strong>g>with</str<strong>on</strong>g> substantial cross-border operati<strong>on</strong>s. The MOUs also do notinvolve the Ministries of Finance that ultimately may need to be involved in any crisisresoluti<strong>on</strong>.

21Table 6. Market Shares of Major <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Groups in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>, 2005(In percent unless indicated otherwise)Groupheadquarteredin:Banking1/Mortgagebanking2/Lifeinsurance3/N<strong>on</strong>-lifeinsurance4/Large Nordic financial groups in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> 65.7 85.7 30.9 36.6Danske Bank Group <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> 38.0 33.4 17.1 --Danske Bank and BG Bank 38.0 -- -- --Realkredit Danmark -- 33.4 -- --Danica Pensi<strong>on</strong> -- -- 17.1 --Nordea Group Sweden 20.0 10.7 8.1 --Nordea Bank 20.0 -- -- --Nordea Kredit -- 10.7 -- --Nordea Pensi<strong>on</strong> -- -- 8.1 --Nykredit Group <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> 3.0 41.2 -- 2.8Nykredit -- 27.1 -- --Totalkredit -- 14.1 -- --Nykredit Bank 3.0 -- -- --Nykreditforsikring -- -- -- 2.8Kaupthing Bank Iceland 4.0 0.4 -- --FIH Group 4.0 0.4 -- --Svenska Handelsbanken Sweden 0.4 -- -- --Midtbank 0.4 -- -- --SEB Sweden 0.3 -- 5.7 --Amagerbanken 0.3 -- -- --Codan Life -- -- 5.7 --TrygVesta <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> -- -- -- 20.9Royal and Sun Alliance UK -- -- -- 12.9Codan -- -- -- 12.9Other large Danish financial instituti<strong>on</strong>s 9.7 14.2 22.7 28.4Jyske Bank <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> 5.0 -- -- --Sydbank <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> 4.0 -- -- --PFA Pensi<strong>on</strong> <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> -- -- 17.0 --Topdanmark Group <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> -- -- 4.7 19.0BRF Kredit <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> 0.2 9.4 -- --DLR Kredit <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> -- 4.8 -- --Alm Brand <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> 0.6 -- 1.0 9.4Total market share in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> 75.4 99.9 53.6 65.0Source: The Danish <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Supervisory Authority and the groups' annual <str<strong>on</strong>g>reports</str<strong>on</strong>g>.1/ Market shares are in percent of total banking system assets, adjusted for foreign subsidiaries andbranches. Latest available 2005 figures.2/ Market shares are in percent of loans granted as of the sec<strong>on</strong>d quarter of 2005.3/ Market shares are in percent of the total insurance and pensi<strong>on</strong> balance sheet assets.4/ Market shares are in percent of total n<strong>on</strong>-life insurance gross premiums.

22III. FINANCIAL MARKETS, THEIR INFRASTRUCTURE, AND SAFETY NETSA. M<strong>on</strong>etary Policy Framework33. M<strong>on</strong>etary policy is firmly anchored <strong>on</strong> maintaining the Danish kr<strong>on</strong>er <str<strong>on</strong>g>with</str<strong>on</strong>g>in itsERM2 band of ±2.25 percent vis-à-vis the euro. There seems to be a str<strong>on</strong>g commitment toobserve the c<strong>on</strong>vergence criteria for membership of the European M<strong>on</strong>etary Uni<strong>on</strong>, whichhas helped anchor inflati<strong>on</strong> expectati<strong>on</strong>s. Policy interest rates generally follow ECB rates.34. The m<strong>on</strong>etary policy framework is transparent. The Nati<strong>on</strong>albank’s authority hasbeen governed by the Nati<strong>on</strong>albank of <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> Act and the By-laws of the Nati<strong>on</strong>albank of<str<strong>on</strong>g>Denmark</str<strong>on</strong>g> since 1936 <str<strong>on</strong>g>with</str<strong>on</strong>g> four minor amendments. Although <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> opted out of theEuropean M<strong>on</strong>etary Uni<strong>on</strong>, some of the Articles included in the Statutes of the European<str<strong>on</strong>g>System</str<strong>on</strong>g> of Central Banks also apply to the Nati<strong>on</strong>albank, hence strengthening its aut<strong>on</strong>omy.The Board of Governors solely determines key interest rates to support the peg. While theMinister of Ec<strong>on</strong>omic and Business Affairs has the final authority to determine the exchangerate regime, this is d<strong>on</strong>e in coordinati<strong>on</strong> <str<strong>on</strong>g>with</str<strong>on</strong>g> the Nati<strong>on</strong>albank according to the Act <strong>on</strong>Foreign Exchange. Danmarks Nati<strong>on</strong>albank clarifies its mandates in its differentpublicati<strong>on</strong>s.Lender of last resortB. Safety Nets35. The authorities’ approach to their lender-of-last-resort role is sound but places apremium <strong>on</strong> prompt decisi<strong>on</strong>-making. The DN functi<strong>on</strong>s as lender-of-last-resort to solventbanks facing liquidity pressures <strong>on</strong> a case-by-case basis. Banks are encouraged to meet theirliquidity needs first from the m<strong>on</strong>ey market which is quite liquid. Banks typically carry alarge portfolio of certificates of deposits issued by the DN, government securities, andmortgage b<strong>on</strong>ds that can be used as collateral for repo transacti<strong>on</strong>s. For solvent banks unableto obtain liquidity in the market, collateralized loans may be granted. There are noestablished rules for such loans, but they would involve views of the DFSA <strong>on</strong> the solvencyof the instituti<strong>on</strong>s and stringent c<strong>on</strong>diti<strong>on</strong>s. Any bank rescue operati<strong>on</strong> involving taxpayers’m<strong>on</strong>ey requires prior approval of the Finance Committee of the legislature. This approachemerged after the experience in the late 1980s and early 1990s. To be effective, it requiresthat decisi<strong>on</strong>s in situati<strong>on</strong>s of bank distress, involving the DN, the Ministry of Ec<strong>on</strong>omic andBusiness Affairs, the DFSA, and the Finance Committee, can be made promptly.Deposit Insurance36. The Guarantee Fund for Depositors (GF)—the mandatory deposit insurancescheme—has worked well in the past, but it seems insufficient for dealing <str<strong>on</strong>g>with</str<strong>on</strong>g> thefailure of a large instituti<strong>on</strong>. Deposits are covered up to DKK 300,000 (about €40,250) perdepositor after deducti<strong>on</strong> of loans but certain special deposits are fully covered. The coverage

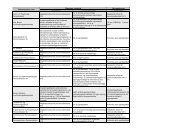

23is hence higher than the EU minimum requirement of €20,000. 14 Foreign branches must “topup”to the Danish level through the GF if their coverage is less than required in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g>.The GF also covers losses caused by the failure of a bank, mortgage credit instituti<strong>on</strong>, orinvestment company not being able to return securities owned by an investor, but <strong>on</strong>ly up to€20,000. Since 1987, it has covered 10,520 clients in nine different instituti<strong>on</strong>s and paid outDKr 528.4 milli<strong>on</strong>. Clients are typically repaid <str<strong>on</strong>g>with</str<strong>on</strong>g>in six m<strong>on</strong>ths after the closure. The GFhas a reserve of DKr 3.2 billi<strong>on</strong> derived from a fee set as a percentage of covered deposits. Atend-2004, this represented 0.9 percent of insured deposits, which seems insufficient to coverdepositors in the event of failure of a large instituti<strong>on</strong> <str<strong>on</strong>g>with</str<strong>on</strong>g>out resort to a governmentguarantee. The discreti<strong>on</strong> to issue such guarantee may be seen as a way of limiting moralhazard.C. Payment and Securities Clearing and Settlement <str<strong>on</strong>g>System</str<strong>on</strong>g>s37. The payment system infrastructure in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> is highly developed andtechnologically well advanced and risks in the system are well c<strong>on</strong>tained. 15 There isgenerally a high degree of compliance <str<strong>on</strong>g>with</str<strong>on</strong>g> internati<strong>on</strong>al standards (see Annex IV and V).The interbank real-time gross settlement (RTGS) system—KRONOS—and Sumclearing forretail payments are systemically important. 16 KRONOS is the channel for the executi<strong>on</strong> ofm<strong>on</strong>etary policy transacti<strong>on</strong>s and large-value interbank transacti<strong>on</strong>s and is linked toTARGET—the RTGS system of the European <str<strong>on</strong>g>System</str<strong>on</strong>g> of Central Banks (ESCB). 17 Theclearing and settlement of listed securities are handled by VP Securities Services. Thetransacti<strong>on</strong>s settled in VP have been increasing rapidly. In 2005, 10.2 milli<strong>on</strong> transacti<strong>on</strong>swere settled in VP <str<strong>on</strong>g>with</str<strong>on</strong>g> a market value of DKr 30,924 billi<strong>on</strong> (around US$5,012 billi<strong>on</strong>). Anumber of technical enhancements are suggested, including risk c<strong>on</strong>trol measures inSumclearing and in VP to ensure timely settlement in the event of a bankruptcy of aparticipant.D. <str<strong>on</strong>g>Financial</str<strong>on</strong>g> Markets38. The m<strong>on</strong>ey and foreign exchange markets are well functi<strong>on</strong>ing and liquid. In2005, the average daily uncollateralized interbank exposure increased by 35 percent toDKr 10.4 billi<strong>on</strong>. While this may indicate potential for c<strong>on</strong>tagi<strong>on</strong>, these exposures arem<strong>on</strong>itored by the DN and occasi<strong>on</strong>ally stress tested. Banks also maintain a sizable stock ofcollateralizable assets. The m<strong>on</strong>ey market is closely linked <str<strong>on</strong>g>with</str<strong>on</strong>g> the foreign exchange market,anchored by the euro peg, which is also quite efficient.14 The coverage in Sweden is SKK 250,000 (about €26,500) and in Norway is NKK 2 milli<strong>on</strong> (about €252,500).15 For details, see Payment <str<strong>on</strong>g>System</str<strong>on</strong>g>s in <str<strong>on</strong>g>Denmark</str<strong>on</strong>g> published by Danmarks Nati<strong>on</strong>albank, Copenhagen, 2005(available <strong>on</strong>: http://www.nati<strong>on</strong>albanken.dk/).16 In 2005, around 1.1 billi<strong>on</strong> payments <str<strong>on</strong>g>with</str<strong>on</strong>g> a value of DKr 5,027 billi<strong>on</strong> were processed in the Sumclearinginfrastructure. Sumclearing hence processed transacti<strong>on</strong>s amounting to 3¼ times nominal GDP.17 In 2005, KRONOS turned over nominal GDP about 57¼ times.