44B. Carry-bak losses

44B. Carry-bak losses

44B. Carry-bak losses

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

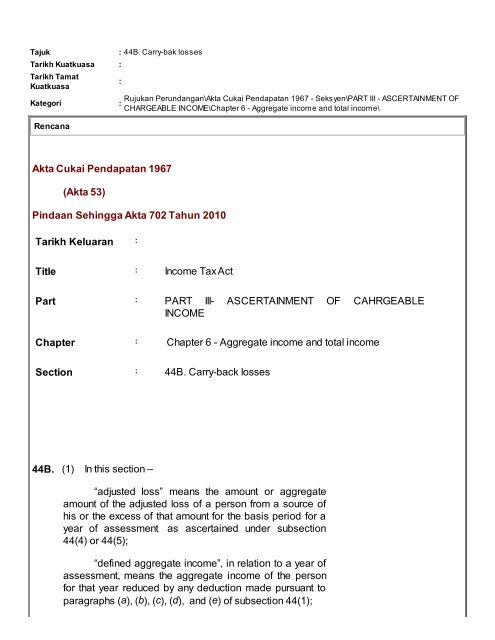

Tajuk: <strong>44B</strong>. <strong>Carry</strong>-<strong>bak</strong> <strong>losses</strong>Tarikh Kuatkuasa :Tarikh TamatKuatkuasa:KategoriRujukan Perundangan\Akta Cukai Pendapatan 1967 - Seksyen\PART III - ASCERTAINMENT OF:CHARGEABLE INCOME\Chapter 6 - Aggregate income and total income\RencanaAkta Cukai Pendapatan 1967(Akta 53)Pindaan Sehingga Akta 702 Tahun 2010Tarikh Keluaran :Title : Income Tax ActPart : PART III- ASCERTAINMENT OF CAHRGEABLEINCOMEChapter : Chapter 6 - Aggregate income and total incomeSection : <strong>44B</strong>. <strong>Carry</strong>-back <strong>losses</strong><strong>44B</strong>. (1) In this section –“adjusted loss” means the amount or aggregateamount of the adjusted loss of a person from a source ofhis or the excess of that amount for the basis period for ayear of assessment as ascertained under subsection44(4) or 44(5);“defined aggregate income”, in relation to a year ofassessment, means the aggregate income of the personfor that year reduced by any deduction made pursuant toparagraphs (a), (b), (c), (d), and (e) of subsection 44(1);

“immediately preceding”, in relation to a year ofassessment, means-(a) for the year of assessment 2009, the yearof assessment 2008; and(b) for the year of assessment 2010, the yearof assessment 2009.(2) Subject to subsection (6), this section shallapply if –(a) the basis period of a person for the year ofassessment 2009 or 2010 and the basisperiod for the year of assessmentimmediately preceding the year ofassessment 2009 or 2010 ends on thesame day; and(b) that person is subject to tax at theappropriate rate as specified inparagraph 1, 1A, 2 or 2A of Part I ofSchedule 1.(3) Subject to this section, where a person hasmade an irrevocable election under subsection (4), theamount of the adjusted loss of that person from a source ofhis for the basis period for a year of assessment 2009 or2010, other than the adjusted loss surrendered by thatperson pursuant to section 44A, shall be allowed as adeduction in ascertaining the total income of that person fora year of assessment immediately preceding the year ofassessment 2009 or 2010, in accordance with subsection44(1).(4) For the purpose of subsection (3), a personshall make an irrevocable election, either for the yearassessment 2009 or 2010, in return furnished for the yearof assessment 2009 or 2010 to deduct an amount of theadjusted loss from a source of his for the basis period forthat year of assessment in ascertaining the total income ofthat person for the year of assessment immediatelypreceding the year of assessment 2009 or 2010.(5) The amount of adjusted loss of a person from a

source of his for the basis period for a year of assessment2009 or 2010 to be deducted pursuant to subsection (3) –(a)shall not exceed one hundred thousandringgit; or(b)where the amount of the definedaggregate income for the year ofassessment immediately preceding theyear of assessment 2009 or 2010 isless than one hundred thousand ringgit,shall not exceed the amount of thedefined aggregate income.(6) The provisions of this section shall notapply to a person if during the basis period for a year ofassessment 2009 or 2010 and the basis period for a yearof assessment immediately preceding the year ofassessment 2009 or 2010, that person –(a)(b)(c)(d)is a pioneer company or has beengranted approval for investment taxallowance under the Promotion ofInvestments Act 1986;is exempt from tax on its incomeunder section 54A, paragraph127(3)(b) or subsection 127(3A), ortax paid or payable by that person forthat year of assessment is remittedunder section 129;has made a claim for a reinvestmentallowance under Schedule 7A;has made a claim for deduction inrespect of an approved foodproduction project under the IncomeTax (Deduction for Investment in anApproved Food Production Project)Rules 2006 [P.U.(A) 55/2006];(e)has made a claim for deduction under

the Income Tax (Deduction for Cost ofAcquisition of Proprietary Rights)Rules 2002 [P.U.(A) 63/2002];(f)(g)has made a claim for deductionunder the Income Tax (Deduction forCost of Acquisition of a ForeignOwned Company) Rules 2003 [P.U.(A) 310/2003];has made a claim for deduction underany rules made under section 154,other than the rules specified inparagraphs (d), (e) and (f), and thoserules made under section 154 providethat this section shall not apply to thatperson;(h) is an investment holding companyunder section 60FA;(i)carries on insurance business undersection 60, inward re-insurancebusiness under section 60A oroffshore insurance business undersection 60B;(j) carries on takaful business undersection 60AA; or(k)in the case of an individual, has nosource consisting of a business.(7) Where in the basis year for a year ofassessment the Director General discovers that theadjusted loss referred to in subsection (3) ought not to havebeen deducted in arriving at the total income of a personfor the year of assessment immediately preceding the yearof assessment 2009 or 2010, the Director General may inthe first-mentioned year or within six years after itsexpiration-(a)(b)make an assessment or additionalassessment in respect of that personin order to make good any loss of tax;andrequire that person to pay a penaltyequal to the amount of tax, which had

or would have been undercharged bythat person, pursuant to anassessment made under paragraph(a).(8) For the avoidance of doubt –(a) the amount of adjusted loss which hasbeen allowed as a deductionpursuant to this section shall bedisregarded for the purpose ofascertaining the aggregate income of aperson for a year of assessmentimmediately following the year ofassessment 2009 or 2010 undersubsection 43(2); and(b) the provisions of this Act shall apply to the balanceof the adjusted loss (if any) of a person which has not beenallowed as a deduction pursuant to this section.HistorySection <strong>44B</strong> is inserted by Act A1349 of 2009, s3, shall haveeffect for the year of assessment 2008, 2009 and 2010.