LONG FORM 1999 1999 - Departamento de Hacienda

LONG FORM 1999 1999 - Departamento de Hacienda

LONG FORM 1999 1999 - Departamento de Hacienda

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Schedule A IndividualRev. 05.99ITEMIZED AND ADDITIONALDEDUCTIONS19__Taxpayer's nameTaxable year beginning on ______________, ____ and ending on _____________, ____Social Security NumberPart I Itemized Deductions (You must submit evi<strong>de</strong>nce to claim these <strong>de</strong>ductions. See instructions)1. Home mortgage interest:10Name of entity to whom payment was ma<strong>de</strong>MortgageLoan NumberAmountPrincipal resi<strong>de</strong>nce:First00(01)Second00(02)Second resi<strong>de</strong>nce:First00(03)Second00(04)Loan origination fees (See instructions)00(05)Loan discounts (See instructions)00(06)2.Total home mortgage interest paid ...................................................................................................License plates for automobiles used for personal purposes (See instructions)Plate Number Date of Payment Amount $(07)003.4.5.6.7.8.9.10.11.12.13.14.15.16.Total automobile license plates paid ................................................................................................Child care expenses (See instructions. $600 for one child; $1,200 for two or more children) ................Rent paid (Landlord's social security No. _________________________) (10) .................................Property tax on principal resi<strong>de</strong>nce ......................................................................................................Casualty loss on your principal resi<strong>de</strong>nce (See instructions) ...............................................................Medical expenses (Schedule J Individual, line 4) ..............................................................................Charitable contributions (Schedule J Individual, line 8) .....................................................................Loss of personal property as a result of certain casualties (See instructions) .....................................Windmills expenses .............................................................................................................................Orthopedic equipment expenses for handicapped persons:Check: (18) Taxpayer (19) Wife (20) Others .............................q q qDepen<strong>de</strong>nt's education expenses.........................................................................................................Solar equipment expenses...................................................................................................................Interest paid on stu<strong>de</strong>nts loans at university level (See instructions)...................................................Contributions to the Fund for Services Against Remediable Catastrophic Diseases(See instructions)..................................................................................................................................Total itemized <strong>de</strong>ductions (Add lines 1 through 15 and transfer to Part 3, line 7 of the return) .............Part II Additional Deductions (You must submit evi<strong>de</strong>nce to claim these <strong>de</strong>ductions. See instructions)1.2.3.4.5.6.7.8.Contributions to governmental pension or retirement systems ............................................................Contributions to an Individual Retirement Account (Do not exceed from $3,000 or $6,000 if married)Deduction when both spouses work ...............................................................................................Deduction for Veterans ...............................................................................................................Ordinary and necessary expenses (Schedule I Individual, line 8) ........................................................Automobile loan interest (Do not exceed from $1,200):Bank______________________________ Loan Number__________________________________.....Young people who work (See instructions) ....................................................................................Total additional <strong>de</strong>ductions (Add lines 1 through 7 and transfer to Part 3, line 9 of the return) ........(08)(09)(11)(12)(13)(14)(15)(16)(17)(21)(22)(23)(24)(25)(30)(31)(32)(33)(34)(35)(36)(37)(40)0000000000000000000000000000000000000000000000

Schedule B IndividualRev. 05.99RECAPTURE OF INVESTMENT CREDITCLAIMED IN EXCESS, TAX CREDITS ANDOTHER PAYMENTS AND WITHHOLDINGS19__Taxpayer's nameTaxable year beginning on ______________, ____ and ending on _____________, ____Social Security NumberPart IRecapture of Investment Credit Claimed in Excess1. Total investment credit claimed in excess ...............................................................................................202.3.4.1.2.3.4.5.6.7.8.9.10.11.12.Name of entity:Employer's i<strong>de</strong>ntification number:TOURISM INVESTMENT CREDITSOLID WASTE DISPOSAL INVESTMENT CREDITAGRICULTURAL DEVELOPMENT INVESTMENT CREDITOTHER INVESTMENT FUNDS CREDITColumn ARecapture of investment credit claimed in excess paid in previous year .................................Recapture of investment credit claimed in excess paid this year(Transfer to Part 4, line 22 of the return. See instructions) ........................................................................Excess of credit due to next year, if applicable (Subtract line 3 from line 1. See instructions) ...............Part IIPart IIITax Credits (Do not inclu<strong>de</strong> estimated tax payments. Inclu<strong>de</strong> such payments in Part III of this Schedule)Credit for taxes paid to the United States, its possessions and foreign countries(Schedule C Individual, Part IV, line 7) ..................................................................................................Credit for: Section 4(a) of Act 8 of 1987 and/or Section 3(b) of Act 135 of 1997...........................q qCredit for investment in Capital Investment, Tourism or other funds, or direct investments(Submit Schedule Q) .............................................................................................................................Credit attributable to losses in Capital Investment, Tourism or other funds (Submit Schedule Q and Q1)Credit for Contributions to the Educational Foundation for Free Selection of Schools .........................Credit for payments of Membership Certificates by Ordinary and ExtraordinaryMembers of Employees-Owned Special Corporations (See instructions) ...........................................Credit for the purchase of tax credits (Submit <strong>de</strong>tail) ............................................................................Credits carried from previous years (Submit <strong>de</strong>tail) ..............................................................................Total Tax Credits (Add lines 1 through 8) ..............................................................................................Total tax <strong>de</strong>termined (Part 4, line 21 of the return) ................................................................................Credit to be claimed (The smaller of line 9 or 10. Transfer to page 2, Part 4, line 23of the return) ..........................................................................................................................................Carryforward credits (Subtract line 11 from line 9. Submit <strong>de</strong>tail) .........................................................Other Payments and Withholdings1. Estimated tax payments for <strong>1999</strong> ....................................................................................................2. Tax paid in excess in prior years credited to estimated tax ................................................................3. Tax withheld to nonresi<strong>de</strong>nts (Form 480.6C) ....................................................................................4. Tax withheld on elegible interest and interest from financial institutions (Schedule F Individual, Part I, line 7)5. Tax withheld on divi<strong>de</strong>nds from corporations or distributions from partnerships (Schedule F Individual, Part II, line 3A)6. Divi<strong>de</strong>nds from Capital Investment or Tourism Funds (Submit Schedule Q1) ........................................7. Services ren<strong>de</strong>red by individuals (Form 480.6B) .....................................................................................8. Payments for judicial or extrajudicial in<strong>de</strong>mnification (Form 480.6B).......................................................9. Tax withheld on distributable share of net profits to stockhol<strong>de</strong>rs of corporations of individuals (Form 480.6CI)10. Tax withheld on distributable share of net profits to partners of special partnerships (Form 480.6SE) .....11. Other payments and withholdings not inclu<strong>de</strong>d on the preceding lines (Submit <strong>de</strong>tail) ..........................12. Total other payments and withholdings (Add lines 1 through 11. Transfer to page 2,Part 4, line 25C of the return) .................................................................................................................1234qqqq(04)(02)Column B1234qqqq(05)(01)(03)(07)(08)(10)(11)(12)(13)(14)(15)(16)(17)(18)(19)(20)(21)(30)(31)(32)(33)(34)(35)(36)(37)(38)(39)(40)(41)(50)00000000000000000000000000000000000000000000000000000000

Schedule C IndividualRev. 05.99Taxpayer's nameCREDIT FOR TAXES PAID TO THE UNITEDSTATES, ITS POSSESSIONS AND FOREIGNCOUNTRIESTaxable year beginning on ______________, ____ and ending on _____________, ____19__Social Security NumberName of place to which taxes were paid:Part IDetermination of Net Income from Sources Outsi<strong>de</strong> of Puerto Rico1.Adjusted gross income from sources outsi<strong>de</strong> of Puerto Rico (See instructions).................................002.3.4.5.Optional standard or itemized <strong>de</strong>ductions and additional <strong>de</strong>ductions(Part 3, line 10 of the return).........................................................................Adjusted gross income from sources outsi<strong>de</strong> of Puerto Rico(Same as line 1)..........................................................................................Adjusted gross income from all sources (Part 2,line 5 of the return).......................................................................................Divi<strong>de</strong> line 3 by line 4...................................................................................000000%6.Multiply line 2 by line 5.........................................................................................................................007. NET INCOME FROM SOURCES OUTSIDE OF PUERTO RICO (Subtract line 6 from line 1)..............Part II Determination of Net Income from All Sources1. Adjusted gross income from all sources (Part 2, line 5 of the return)..................................................00002.Optional standard or itemized <strong>de</strong>ductions and additional <strong>de</strong>ductions(Part 3, line 10 of the return)................................................................................................................003. NET INCOME FROM ALL SOURCES (Subtract line 2 from line 1)...................................................Part III1. Credit claimed for taxes:Taxes Paid or Accrued to the United States, its Possessions and Foreign Countriesq2. (a) Date paid or accrued(b) Taxes paid or accrued during the yearPaidqAccrued00Part IVDetermination of Credit1.2.3.4.5.6.7.Net income from sources outsi<strong>de</strong> of Puerto Rico (Part I, line 7) ........................................................Net income from all sources (Part II, line 3) .......................................................................................Taxes to be paid in Puerto Rico (Part 4, lines 15,16 and 17 of the return) ........................................Divi<strong>de</strong> line 1 by line 2 .........................................................................................................................CREDIT (Multiply line 3 by line 4) ......................................................................................................Taxes paid to the United States, its possessions and foreign countries (Part III, line 2(b)) ..............CREDIT TO BE CLAIMED (Enter here and on Schedule B Individual, Part II, line 1,the smaller of line 5 or 6) ....................................................................................................................LIMITATION:THE CREDIT SHALL NOT EXCEED THE AMOUNT OF TAXES PAID TO THEUNITED STATES, ITS POSSESSIONS AND FOREIGN COUNTRIES.000000%000000

Schedule ERev. 05.99DEPRECIATION19__Taxpayer's NameTaxable year beginning on ______________, 19__ and ending on _____________, 19___Social Security No. or Employer's I<strong>de</strong>ntification1. Type of property (In the case of a building, 2.specify the material used in theconstruction).Dateacquired.3. Original cost orother basis(exclu<strong>de</strong>cost of land). Basisfor automobilesmay not exceed$25,000 pervehicle.4. Depreciationclaimed inprior years.5. Estimateduseful life tocompute the<strong>de</strong>preciation.6. Depreciationclaimed thisyear.(a) Current Depreciation000000000000000000Total0000000000(b) Flexible Depreciation000000000000000000000000Total0000(c) Accelerated Depreciation000000000000000000000000Total0000(d) Improvements Amortization000000000000000000TotalNOTE: Complete only if you are filing out Form 482.0 (Individual Income Tax Return)TOTAL: (Add total of lines (a) through (d) of column 6. Transfer to Schedules K, L, M and N individual,whichever applies)..................................................................................................................000000000000

Schedule D IndividualRev. 05.99CAPITAL GAINS OR LOSSES19__Taxpayer's nameTaxable year beginning on __________, ____ and ending on __________, ____Social Security NumberDescription of Property(A)DateAcquired(B)DateSold(C)Sales Price(D)Adjusted Basis(E)Selling Expenses(F)Gain or Loss52Part I Short-Term Capital Assets Gains and Losses (Held 6 months or less) NO INCLUYA CENTAVOS0000000000000000001.2.3.4.5.6.Net short-term capital gain (or loss) ............................................................................................................................ (01)Net short-term capital gain from investment funds (Submit Schedule Q1) ..................................................................... (02)Distributable share on net short-term capital gain (or loss) from Estates or Trusts .................................................... (03)Distributable share on net short-term capital gain (or loss) from Special Partnerships .............................................. (04)Distributable share on net short-term capital gain (or loss) from Subchapter N Corporations of Individuals ............. (05)Distributable share on net short-term capital gain (or loss) from Employees-OwnedSpecial Corporations ................................................................................................................................................... (06)7. Net short-term capital gain (or loss) attributable to direct investment and not through a CapitalInvestment Fund (Submit <strong>de</strong>tail) ................................................................................................................................. (07)8.9.Net capital loss carryover (Submit schedule) .............................................................................................................. (08)Net short-term capital gain (or loss) (Add lines 1 through 8) ...................................................................................... (10)Part II Long-Term Capital Assets Gains and Losses (Held more than 6 months)00000000000000000010.11.12.13.14.Net long-term capital gain (or loss) ............................................................................................................................... (11)Distributable share on net long-term capital gain (or loss) from Estates or Trusts ........................................................ (12)Distributable share on net long-term capital gain (or loss) from Special Partnerships................................................... (13)Distributable share on net long-term capital gain (or loss) from Subchapter N Corporations of Individuals.................. (14)Distributable share on net long-term capital gain (or loss) from Employees-OwnedSpecial Corporations ................................................................................................................................................... (15)15. Net long-term capital gain (or loss) attributable to direct investment and not through a CapitalInvestment Fund (Submit <strong>de</strong>tail) ................................................................................................................................. (16)16.17.Lump-Sum distributions from pension plans qualified by the Department of the Treasury ........................................ (17)Net long-term capital gain (or loss) (Add lines 10 through 16) ............................................................................. (20)Part III Net Capital Gains or Losses for Determination of the Adjusted Gross Income18. Net capital gain (or loss) (Add lines 9 and 17) ........................................................................................................... (21)19. If line 18 is more than zero, enter here and in Part 2, line 2 O of the return. If line 18 inclu<strong>de</strong>s long-termcapital gains, see instructions ..................................................................................................................................... (24)20. If line 18 is a net loss, enter here and in Part 2, line 2 O of the return the smaller of the following amounts :a)b)The net loss on line 18, or$1,000.................................................................................................................................................................... (30)0000000000000000000000000000000000000000000000000000

Schedule D2 IndividualRev. 05.99SPECIAL TAX ON NET <strong>LONG</strong> TERMCAPITAL GAINS19__Taxable year beginning on _____________, _____ and ending on _____________, _____Taxpayer's name Social Security NumberPart I Computation of Special Tax on Net Long-term Capital Gains NO INCLUYA CENTAVOS561.2.Adjusted Gross Income (Part 2, line 5 of the return) .........................................................................Less:(01)00(a)(b)(c)(d)Excess of net long-term capital gain over the net short-termcapital loss (See instructions) ............................................................... (02)Excess of net long-term capital gain over the net short-term capitalloss attributable to the investments in Tourism Development and CapitalInvestment Funds (Part 2, line 2P of the return) ...................................... (03)Excess of net long-term capital gain over the net short-term capitalloss attributable to the sale of shares from an elegible corporation orpartnership (See instructions) ............................................................... (04)Total (Add lines 2(a) through 2(c))..........................................................................................000000(05)003.4.Adjusted Gross Income (Subtract line 2(d) from line 1) .....................................................................Note:Calculate your <strong>de</strong>ductions for charitable contributions and medical expensesagain (if any) based on your adjusted gross income from line 3 of this schedule.Do not change any of the amounts already entered on other schedules.Deductions and exemptions:(06)00(a)(b)(c)(d)(e)Enter the larger of standard or itemized <strong>de</strong>ductions (Calculate again,if necessary. See instructions) .............................................................. (07)Total additional <strong>de</strong>ductions (Part 3, line 9 of the return) ............................ (08)Personal exemption (Part 3, line 11 of the return) .................................... (09)Total exemption for <strong>de</strong>pen<strong>de</strong>nts (Part 3, line 12D of the return) ................. (10)Total <strong>de</strong>ductions and exemptions (Add lines 4(a) through 4(d)) ................................................00000000(11)005.Net Taxable Income (Subtract line 4(e) from line 3. If it is less than zero, enter zero) ..............................(12)006.Determine the tax upon your income shown on line 5 according to tax tablesand enter here ..............................................................................................................................(13)007.8.9.Multiply line 2(a) by 20% ...............................................................................................................Multiply line 2(b) by 10% ...............................................................................................................Multiply line 2(c) by 7% ..................................................................................................................(14)(15)(16)00000010.11.Total tax un<strong>de</strong>r the alternate method (Add lines 6 through 9) ........................................................Part II Computation of Regular Tax over Net Taxable Income as per ReturnNet taxable income (Part 3, line 14 of the return) .............................................................................(17)(18)000012.13.Tax on the amount on line 11 according to tax tables ......................................................................Determined tax (Enter here and on page 2, Part 4, line 15 of the return,the smaller of line 10 or 12 and check(X) Special tax on capital gains) ................................................(19)(20)0000

Schedule D1 IndividualRev. 05.99SALE OR EXCHANGE OF PRINCIPALRESIDENCE19__Taxable year beginning on ______________, _____ and ending on _____________, _____Taxpayer's name Social Security NumberPart I1. Date in which the old resi<strong>de</strong>nce was sold (day, month, year) .............................................................................................2. Were funds from an Individual Retirement Account (IRA) used to acquire the old resi<strong>de</strong>nce? Yes No3.4.5.6.7.8.9.Part II10.11.12.13.14.15.16.17.18.19.20.21.22.23.If the answer is "Yes", enter here and in Part V of Schedule F Individual the amount of the withdrawn contributionsHave you bought or built a new resi<strong>de</strong>nce?Bought: Yes No Built: Yes NoIf you bought or built, enter date ...................................................Selling price of the old resi<strong>de</strong>nce (Do not inclu<strong>de</strong> personal property items sold with your resi<strong>de</strong>nce) ......................Expenses of sale (Inclu<strong>de</strong> sales commissions, advertising, legal fees, etc.) ...............................................................Total realized (Subtract line 5 from line 4) ...............................................................................................................................Adjusted basis of resi<strong>de</strong>nce sold (See instructions) ...........................................................................................................Gain realized on sale (Subtract line 7 from line 6). If it is zero or less, enter zero and do not complete therest of the form. If line 3 is "Yes", continue with Part II or III, whichever applies.If line 3 is "No", continue with line 9 .....................................................................................................................................If you haven't replaced your resi<strong>de</strong>nce, do you plan to do so during the replacement period?....................................If your answer is "Yes", see instructions.If your answer is "No", continue with Part II or III, whichever applies.Who was age 60 or ol<strong>de</strong>r on the date of sale? ......................................................................Did the person who was age 60 or ol<strong>de</strong>r own and use theproperty sold as his or her principal resi<strong>de</strong>nce for a total of at least 3 years(except for short absences) of the 5 year period en<strong>de</strong>d at thetime of sale? If the answer is "No", go to Part III ................................................................If line 11 is "Yes", do you elect to take the once in a lifetime exclusion fromthe gain on the sale? ..................................................................................................................At the time of sale, who owned the resi<strong>de</strong>nce? ....................................................................Exclusion: Enter the smaller of line 8 or $50,000 ($25,000 ifRecognized gain. If line 14 is zero, enter here the amount of line 8. Otherwise,. If line 15 is zero, do not complete the rest of the form and attach the same to your return.. If line 15 is more than zero and line 3 is "Yes" , go to line 16.. If line 15 is more than zero and line 9 is "No", enter the gain in Part I or IIof Schedule D Individual, whichever applies.qYesq Taxpayer q Spouse qmarried filing separate returns) ..................................................................................................................................................Part IIIComputation of GainOne-Time Exclusion for Taxpayers Age 60 or Ol<strong>de</strong>r (See instructions)Adjusted Sales Price, Taxable Gain and Adjusted Basis of New Resi<strong>de</strong>ncesubtract line 14 from line 8 and enter here ..........................................................................................................................Fixing - up expenses of the old resi<strong>de</strong>nce (See instructions) .........................................................................................Add lines 14 and 16 ....................................................................................................................................................................Adjusted sales price (Subtract line 17 from line 6) ............................................................................................................(a) Enter date you moved into new resi<strong>de</strong>nce ............. / / (b) Cost of new resi<strong>de</strong>nce ................Subtract line 19(b) from line 18. If it is zero or less, enter zero .......................................................................................Taxable gain (Enter the smaller of line 15 or 20. If it is zero or less, enter zero.If it is a gain, enter the amount from this line in Part I or II, Schedule D Individual, whichever applies) .....................Gain to be postponed (Subtract line 21 from line 15) ............................................................................................................Adjusted basis of new resi<strong>de</strong>nce (Subtract line 22 from line 19(b)) ..............................................................................qqqqqYesqqqNoq Yes q Noq q q/ // /BothTaxpayer Spouse Bothq000000000000No00000000000000000000

Schedule G IndividualRev. 05.99SALE OR EXCHANGE OF ALL TRADE ORBUSINESS ASSETSOF A SOLE PROPRIETORSHIP BUSINESS19__Taxable year beginning on ______________ , _____ and ending on _____________, _____Taxpayer's name Social Security NumberPart I Questionnaire1. Did you elect to <strong>de</strong>fer the gain from the sale of the first sole proprietorship? ..................................................................Taxable year .........................................................................................................................................................................Amount of <strong>de</strong>ferred gain .....................................................................................................................................................2. Adjusted basis of the new sole proprietorship ......................................................................................................................3. Did you sell your sole proprietorship during this year? ........................................................................................................◆ If the answer is "Yes", continue with the form.◆ If the answer is "No", do not complete the rest of the form and attach the same to your return.4.5.Date in which the first sole proprietorship was sold (day, month, year)............................................................................(a) Did you buy a new sole proprietorship? Yes No (b) If you answered "Yes", enter date ................Part II Computation of GainqqqqYesYesqq/ // /No0000No6.7.8.9.Selling price of the first sole proprietorship ............................................................................................................................Expenses of sale (Inclu<strong>de</strong> sales commissions, advertising, legal fees, etc.) .....................................................................Total realized (Subtract line 7 from line 6) ...............................................................................................................................Adjusted basis of the first sole proprietorship (See instructions).......................................................................................0000000010.Gain realized on sale (Subtract line 9 from line 8). If it is zero or less, enter zero and do not complete the11.rest of the form. If line 5 is "Yes", continue with Part III.If line 5 is "No", go to line 11 .................................................................................................................................................If you haven't replaced your first sole proprietorship, do you plan to do so within the replacement period? ............If you answered "Yes", see instructions.qYesq00NoIf you answered "No", continue with Part III, line 12.Part III Adjusted Sales Price, Taxable Gain and Adjusted Basis of New Sole Proprietorship12. Recognized gain. Enter the amount of line 10 here .............................................................................................................◆ If line 12 is zero, do not complete the rest of the form and attach the same to your return.◆ If line 12 is more than zero and line 5 is "Yes", go to line 13.◆ If line 12 is more than zero and line 11 is "No", enter the gain on Schedule D Individual, Part I or II,whichever applies.13. Selling price of the first sole proprietorship (Enter the amount of line 6) ..........................................................................14. (a) Enter date you acquired the new sole proprietorship / / (b) Cost of new sole proprietorship15.16.17.18.Purchasing commissions and expenses incurred in the new sole proprietorship .......................................................Reinvested total (Add lines 14 (b) and 15) ............................................................................................................................Subtract line 16 from line 13. If it is zero or less, enter zero .............................................................................................Taxable gain (Enter the smaller of line 12 or 17. If line 18 is zero or less, enter zero.If it is a gain, enter on Schedule D Individual, Part I or II, whichever applies) ..................................................................19.20.Postponed gain (Subtract line 18 from line 12) ....................................................................................................................Adjusted basis of the new sole proprietorship (Subtract line 19 from line 16) ............................................................000000000000000000

Schedule F IndividualRev. 05.99OTHER INCOME19__Taxable year beginning on _________________, ____ and ending on _________________, ____Taxpayer's name Social Security NumberPart I Interest 31Column 31AColumn BColumn CColumn DPayer's nameAccount NumberElegible interest subjectto withholdingInterest subject towithholding fromfinancial institutionsInterest not subject towithholding fromfinancial institutionsOther interest1. Subtotal of interest......................................... (01)2. Less: Interest exclusion(See instructions).....................................................000000000000000000(05)(06)000000000000000000 (10) 00 (14)00 (11)0000000000000000000000000000000000003. Total interest................................................ (02)00(07)00(12)00(15)004. Add line 3, Columns C and D..............................(16)5. 17% tax of line 3, Columns A and B(Enter in Part 4, line18 of the return)............... (03)6. Tax withheld(Submit Form 480.6B).................................... (04)00 (08)00 (09)00007. Total tax withheld (Add line 6, Columns A and B. Enter on Schedule B Individual,00Part IIl, line 4)........................................................................................................................(13)8. Option to pay taxes from interest in Column A and/or B as ordinary income(Enter here the amount from line 3, Columns A and/or B)........................................................................................(17)9. Total interest (Add lines 4 and 8. Transfer to Part 2, line 2A of the return)............................................................(20)Part IICorporate Divi<strong>de</strong>nds and Partnerships DistributionsPayer's name and addressLess: Exempt amount from divi<strong>de</strong>nds distributed un<strong>de</strong>r Act No. 26 of 1978Account Number1. Total distributed amount (Transfer the total of Column B to Part 2, line 2E of thereturn)..................................................................................................................................... (01)2. Special tax: 10% of Column A (Enter in Part 4, line 19 of thereturn)..................................................................................................................................... (02)3. Tax withheld (Submit Form 480.6B. Enter on Schedule B Individual,Part III, line 5).......................................................................................................................... (03)34Column ASubject to withholding00 (04)0000000000000000000000000000000000( 00)0000Column BNot subject to withholdingNOTE: If you elected to inclu<strong>de</strong> the distribution indicated in Column A as ordinary income, do not consi<strong>de</strong>r line 2 and transferthe total of line 1, Column A to Part 2, line 2D of the return.00

Rev. 05.99Schedule F Individual - Page 2Part III Special Partnerships Profits (SUBMIT SCHEDULE R - SEE INSTRUCTIONS)40Payer's name and addressAccount Number Profits0000000000000000000000000000Total Profits (Transfer to Part 2, line 2B of the return) ........................................................................................................ (01)00Part IV Profits from Subchapter N Corporations of IndividualsPart VMiscellaneous IncomePayer's name and addressPayer's name and addressGains or Losses000000000000000000000000Net Profit00Less: Losses from previous years (Submit Schedule)( 00)Total Profits (Transfer to Part 2, line 2F of the return. If it is less than zero, enter zero) ....................................................... (03)00TotalAccount Number(04)Account NumberColumn A Column B Column CWithdrawals fromAccountIRAMiscellaneous Incomeand Judicial orExtrajudicialIn<strong>de</strong>mnification0000000000000000000000000000000000000000000000000000000000 (05) 00 (06)Total miscellaneous income (Add Total Columns A through C. Enter here and in Part 2, line 2G of the return) ........ (10)Income fromPrizes and Contests00000000000000000000000000000000

Schedule H IndividualRev 05.99Taxpayer's nameINCOME FROM ANNUITIESOR PENSIONSTaxable year beginning on ______________, ____ and ending on _____________, ____19__Social Security NumberRecipient of pension (check one): 1 Taxpayer 2 SpouseDate in which you began receiving the pension: Day____Month_____Year____Place where the service was performed: Puerto Rico United States Others _____________Pension granted by (check one):qq q qq 1 ELA q 2 Fe<strong>de</strong>ral q 3Part IDetermination of Cost to be Recovered (See instructions)1.Cost of annuity (amount paid). If it is zero, enter zero on line 10 and go to Part II.................................qPrivate Business Employer(01)35002.3.Pension received in previous years..................................................................................................Less:(02)00(a) Taxable pension received in previous years.............................................(b) Tax exempt pension received in previous years.......................................(03)(04)00004.5.6.Total (Add lines 3(a) and 3(b))...........................................................................................................Cost of pension tax exempt recovered in previous years(Subtract line 4 from line 2)..............................................................................................................Cost to be recovered (Subtract line 5 from line 1)..............................................................................(05)(06)(07)000000Part IITaxable Income (See instructions)7.Total amount received in the year.....................................................................................................(08)008.Tax exempt amount (If you are age 60 or ol<strong>de</strong>r, submit copy of birth certificate)..................................(09)009.Pension income less the exempt amount (Subtract line 8 from line 7. If it is less than zero,go to line 13).................................................................................................................................(10)0010. Cost to be recovered (Same as line 6).............................................................................................(11)0011. Pension income in excess of the cost to be recovered (Subtract line 10 from line 9)............................(12)0012. Taxable pension income (Enter here the amount of line 11 or 3% of line 1, whichever is larger(but not larger than the amount of line 9). Enter this amount in Part 2, line 2 I of the Long Formor in Part 2, line 3 of the Short Form)..............................................................................................(13)0013. Tax withheld on annuity or pension for the taxable year (Enter this amount in Part 4, line 25Bof the Long Form or in Part 4, line 14B of the Short Form).................................................................(14)00

Schedule J IndividualRev. 05.99MEDICAL EXPENSES ANDCHARITABLE CONTRIBUTIONS19__Taxpayer's nameTaxable year beginning on ______________, _____ and ending on _____________, _____Social Security NumberName and address of person or institution to whom payment was ma<strong>de</strong>46(A) Medical Expenses (B) Other (C) Contributions toContributions Municipalities0000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000001. Totals: Add Columns A, B and C ..................................................(01)2. Multiply medical expenses by 50% an<strong>de</strong>nter here .........................................................................................(02)3. Multiply the adjusted gross income (Part 2, line 5of the return) by 3% and enter here (See instructions)............. (03)4. Allowable <strong>de</strong>duction for medical expenses (Subtractline 3A from line 2. Enter here and on Schedule AIndividual, Part I, line 7).................................................................... (04)00 (05)0000 (06)0000 (10)00005. Deduction for other contributions (Subtract line 3B from line 1B)........................................ (07)006. Multiply the adjusted gross income (Part 2, line 5 of the return)by 15% and enter here (Limit)...................................................................................................................(08)7. Allowable <strong>de</strong>duction for other contributions (Enter the smaller of lines 5 and 6) ............ (09)00008. Total allowable <strong>de</strong>duction for contributions (Add lines 1C and 7.Enter here and on Schedule A Individual, Part I, line 8)....................................................................................................................... (20)00

Schedule I IndividualRev. 05.99ORDINARY AND NECESSARY EXPENSES19__Taxpayer's nameTaxable year beginning on ______________, ____ and ending on _____________, ____Social Security NumberPart IDetail of Expenses (See instructions)581. Meals and entertainmentA. Total expenses incurred or paid ............................................................................................... (01)00B.C.D.Reimbursed expenses (meals and entertainment)..................................................................... (02)Difference (If line 1B exceeds line 1A, enter the excess here and in Schedule F Individual, Part V)... (03)If line 1A exceeds line 1B, enter 50% of line 1C (See instructions)............................................. (04)0000002. Other ExpensesA. Cost and maintenance of uniforms......................................................... (11)00B.Union dues, college memberships and professional associations...........(12)00C.D.E.Purchase of educational materials by teachers..................................... (13)Purchase of technical books related to professional or technical work..... (14)Educational and improvement expenses of your profession or occupation. (15)000000F.Depreciation (Part II of this Schedule)...................................................(16)00G.Other expenses related to your profession or occupation....................... (17)00H.I.J.K.Total other expenses (Add lines 2A through 2G. Enter total here)............................................. (18)Reimbursement of other expenses.......................................................................................... (19)Difference (If the amount on line 2 I exceeds the amount on line 2H, enter the excesshere and on Schedule F Individual, Part V. Otherwise, go to line 2K)........................................If line 2H exceeds line 2 I, enter the excess on this line........................................................... (30)(20)000000003.Total ordinary and necessary expenses (Add lines 1D and 2K. Enter the amount on this line).........(31)004.Wages, Commissions, Allowances and Tips (Part 2, line 1B of the Long Form or Short Form)........(32)005.Fe<strong>de</strong>ral Government Wages (Part 2, line 1C of the Long Form or Part 2, line 2 of the Short Form)........(33)006.Total wages (Add lines 4 and 5)..................................................................................................(34)007.Multiply line 6 by 3% and enter here............................................................................................(35)008.Deduction for ordinary and necessary expenses (Enter here and in Part 3, line 7E of theShort Form or in Schedule A Individual, Part II, line 5 the smaller of the following amounts:line 3, line 7, or up to the limit of $1,500 ($750 if you are married filing separate returns))................(40)00

Rev. 05.99 Schedule I Individual - Page 2Part II Detail of Depreciation591. Property classification (In the2. Datecase of a building, specify theacquiredmaterial used in the construction).3. Is Cost or otherbasis (exclu<strong>de</strong>cost of land).Basis forautomobiles maynot exceed from$25,000 pervehicle. )Parte4. Depreciationclaimed in prioryears.5.Estimateduseful life tocompute the<strong>de</strong>preciation.6. Depreciationclaimed this year.Current <strong>de</strong>preciation00 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 0000 00 00Total (Transfer this amount to Part I, line 2F of this Schedule).................................................................(10)00

Schedule K IndividualRev. 05.99Taxpayer's nameINDUSTRY OR BUSINESS INCOMETaxable year beginning on ______________________, ______ and ending on ______________________, ______19__Social Security NumberPart I65Employer's I<strong>de</strong>ntification NumberTaxpayer SpouseIndustry or Business Income (check one): q 1 q 2Case or concession number Location of Industry or Business - Number, Street and CityNumber of employeesIndustrial Co<strong>de</strong> Co<strong>de</strong> Nature of industry or business (i.e. hotel, rent of equipment, etc.)Part II Determination of Gain or LossDate operations began:Day____ Month____ Year____Fully TaxablePartially Exempt:Act No. 26 of 1978Act No. 8 of 1987Act No. 78 of 1993Act No. 14 of 1996Act No. 135 of 199771qqqqqq(01)(02)(03)(04)(05)(06)1.2.3.4.5.6.7.8.9.Net sales .......................................................................................................................................................... (01)Cost of goods sold or direct costs of production:a)b)c)d)e)f)Beginning inventory ..........................................................................................(02)Plus: Purchases ................................................................................................ (03)Direct salaries .................................................................................................. (04)Other direct costs ............................................................................................ (05)Total (Add lines 2(a) through 2(d)) .................................................................. (06)Less: Ending inventory .................................................................................... (07)000000000000g) TOTAL COST OF GOODS SOLD (Subtract line 2(f) from line 2(e)) ................................................... (08)Gross income (Subtract line 2(g) from line 1)................................................................................................ (09)Less: Operating expenses and other costs (Detail in Part III).......................................................................... (10)Net income ...................................................................................................................................................... (11)Less: Net operating loss from previous years (Submit schedule, see instructions) ....................................... (12)Adjusted net income ......................................................................................................................................... (13)Less: Exempt amount % of line 7 (See instructions)......................................................................... (14)Gain (or loss) (If is a gain, transfer to page 1, Part 2, line 2K of the return. If is a loss,see instructions) ............................................................................................................................................... (20)Part IIIOperating Expenses and Other Costs1. Salaries, commissions and allowances to employees .......................................................................................... (01)2. Commissions to businesses ....................................................................................................................................... (02)3. Payroll expenses ............................................................................................................................................................. (03)4. Contributions to pension plans .................................................................................................................................... (04)5. Contributions to <strong>de</strong>ferred income plans ..................................................................................................................... (05)6. Medical or hospitalization insurance ........................................................................................................................... (06)7. Interest on business <strong>de</strong>bts ............................................................................................................................... (07)8. Rent paid .......................................................................................................................................................... (08)9. Property taxes .................................................................................................................................................. (09)10. Other taxes, patents and licenses .................................................................................................................... (10)11. Repairs ............................................................................................................................................................. (11)12. Motor vehicles expenses .................................................................................................................................. (12)13. Utilities ............................................................................................................................................................. (13)14. Insurance ......................................................................................................................................................... (14)15. Advertising ....................................................................................................................................................... (15)16. Travel expenses .............................................................................................................................................................. (16)17. Meal and entertainment expenses (Total expenses $_______________) (See instructions) ........................ (17)18. Professional services........................................................................................................................................ (18)19. Materials and supplies ..................................................................................................................................... (19)20. Depreciation and amortization (Submit Schedule E) ............................................................................................... (20)21. Bad <strong>de</strong>bts ......................................................................................................................................................... (21)22. Other expenses (Submit <strong>de</strong>tailed schedule) .................................................................................................... (22)23. Total (Transfer to Part II, line 4 of this Schedule) ............................................................................................ (30)810000000000000000000000000000000000000000000000000000000000000000

Schedule L IndividualRev. 05.99FARMING INCOME19__Taxable year beginning on ______________, _____ and ending on _____________, _____Taxpayer's name Social Security NumberPart I66Farming Income (check one): Taxpayer 1 SpouseqEmployer's I<strong>de</strong>ntification Number Location of Farming Business - Number, Street and CityIndustrial Co<strong>de</strong> Co<strong>de</strong> Nature of farming business (i.e. milk-dairy,breeding of chicken, etc.)q2EXEMPT:Date operations began:Day___ Month___ Year___Act No. 225 of 1995Section 1023(s) Co<strong>de</strong>Number of employeesqq(01)(02)1.2.3.4.5.6.7.8.9.10.11.1.2.3.4.5.6.7.8.9.10.11.12.13.14.15.16.17.18.19.20.21.22.23.Part IIDetermination of Gain or LossNet sales ...........................................................................................................................................Other income related to farming business ........................................................................................Total income (Add lines 1 and 2) ......................................................................................................Cost of goods sold or direct costs of production:a)b)c)d)e)f)Beginning inventory .................................................................................... (04)Plus: Purchases ......................................................................................... (05)Direct salaries ............................................................................................ (06)Other direct costs ....................................................................................... (07)Total (Add lines 4(a) through 4(d)) ............................................................ (08)Less: Ending inventory .............................................................................. (09)TOTAL COST OF GOODS SOLD (Subtract line 4(f) from line 4(e)) ...........................................g)Gross income (Subtract line 4(g) from line 3) ......................................................................................Less: Operating expenses and other costs (Detail in Part III) .............................................................Net income ........................................................................................................................................Less: Net operating loss from previous years (Submit schedule, see instructions) ............................Adjusted net income ..........................................................................................................................Less: Exempt amount (90% of line 9) .......................................................................................Gain (or loss) (If is a gain, transfer to page 1, Part 2, line 2L of the return. If is a loss,see instructions) ....................................................................................................................................................................................................................................................Part III Operating Expenses and Other Costs 83Salaries, commissions and allowances to employees ......................................................................Commissions to businesses ....................................................................................................Payroll expenses ....................................................................................................................Contributions to pension plans ................................................................................................Contributions to <strong>de</strong>ferred income plans ......................................................................................Medical or hospitalization insurance .........................................................................................Interest on business <strong>de</strong>bts ......................................................................................................Rent paid ...............................................................................................................................Property taxes ........................................................................................................................Other taxes, patents and licenses ..............................................................................................Repairs ..................................................................................................................................Motor vehicles expenses .........................................................................................................Utilities ..................................................................................................................................Insurance ...............................................................................................................................Advertising .............................................................................................................................Travel expenses ......................................................................................................................Meal and entertainment expense (Total expenses $_______________) (See instructions) ..............Professional services ........................................................................................................................Materials and supplies .......................................................................................................................Depreciation and amortization (Submit Schedule E) ...................................................................Bad <strong>de</strong>bts ..........................................................................................................................................Other expenses (Submit <strong>de</strong>tailed schedule) .....................................................................................Total (Transfer to Part II, line 6 of this Schedule) ...........................................................................73(01)(02)(03)000000000000(10)(11)(12)(13)(14)(15)(16)(20)(01)(02)(03)(04)(05)(06)(07)(08)(09)(10)(11)(12)(13)(14)(15)(16)(17)(18)(19)(20)(21)(22)(30)00000000000000000000000000000000000000000000000000000000000000000000

Schedule M IndividualRev. 05.98PROFESSIONS AND COMMISSIONSINCOME19__Taxpayer's nameTaxable year beginning on ______________ 19___ and ending on _____________ 19___Social Security NumberPart I67(You should fill out one schedule for each source of income)Income from (check one):1 Taxpayer 2 Spouse Check one: 3 Professions 4 CommissionsEmployer's I<strong>de</strong>ntification NumberIndustrial Co<strong>de</strong>Location of Principal Office - Number, Street and CityNature of profession (i.e. lawyer, accountant, commission agent, etc.)Date operations began:Day____ Month____ Year____Number of employeesPart IIDetermination of Profit or Loss751.Income ..........................................................................................................................................(01)002.3.Less: Operating expenses and other costs (Detail in Part III) .....................................................Net income ....................................................................................................................................(10)(11)00004.Less: Net operating loss from previous years (Submit schedule, see instructions) ...................(12)005.Profit (or loss) (If it is a profit, transfer to page 1, Part 2, line 2M of the return. If it is a loss,see instructions) ............................................................................................................................(20)00Part III Operating Expenses and Other Costs 851.2.3.4.5.6.7.8.9.10.11.12.13.14.15.16.17.18.19.20.21.22.Salaries, commissions and allowances to employees ....................................................................Commissions to other businesses ..................................................................................................Payroll expenses ...........................................................................................................................Contributions to pension plans .......................................................................................................Contributions to <strong>de</strong>ferred income plans .........................................................................................Medical or hospitalization insurance ..............................................................................................Interest on business <strong>de</strong>bts .............................................................................................................Rent paid .......................................................................................................................................Property taxes ...............................................................................................................................Other taxes, patents and licenses ...................................................................................................Repairs ..........................................................................................................................................Motor vehicles expenses ...............................................................................................................Utilities ...........................................................................................................................................Insurance ......................................................................................................................................Advertising ....................................................................................................................................Travel expenses ............................................................................................................................Meals and entertainment expenses (Total expenses) $________________ (See instructions) ....Professional services .....................................................................................................................Materials and supplies ...................................................................................................................Depreciation and amortization (Submit Schedule E Individual) ......................................................Bad <strong>de</strong>bts .......................................................................................................................................Other expenses (Submit <strong>de</strong>tailed schedule) ...................................................................................(01)(02)(03)(04)(05)(06)(07)(08)(09)(10)(11)(12)(13)(14)(15)(16)(17)(18)(19)(20)(21)(22)0000000000000000000000000000000000000000000023.Total (Transfer to Part II, line 2 of this Schedule) ..........................................................................(30)00

Schedule N IndividualRev. 05.98RENTAL INCOME19__Taxpayer's nameTaxable year beginning on ______________ 19___ and ending on _____________ 19___Social Security NumberPart I 68Rental Income (check one):1Taxpayer2SpouseLocation of rented property - Number, Street and CityNature of rented property (i.e. resi<strong>de</strong>nce, apartment, etc.)Fully Taxable(01)Partially Exempt:Act No. 78 of 1993 (02)Act No. 52 of 1983 (03)Act 8 of 1987(04)Case or concession number Number of EmployeesPart IIDetermination of Profit or Loss771.2.3.4.5.6.7.Income ........................................................................................................................................................... (01)Less: Operating expenses and other costs (Detail in Part III) ..................................................................... (10)Net income .....................................................................................................................................................(11)Less: Net operating loss from previous years (Submit schedule, see instructions) .................................... (12)Adjusted net income ...................................................................................................................................... (13)Less: Exempt amount ________________ % of line 5 (See instructions) ...................................................... (14)Profit (or loss) (If it is a profit, transfer to page 1, Part 2, line 2N of the return. If it is a loss,see instructions) .............................................................................................................................................(20)00000000000000Part IIIOperating Expenses and Other Costs871.2.3.4.5.6.7.8.9.10.11.12.13.14.15.16.17.18.19.Salaries, commissions and allowances to employees .................................................................................. (01)Payroll expenses ........................................................................................................................................... (02)Contributions to pension plans ...................................................................................................................... (03)Contributions to <strong>de</strong>ferred income plans ........................................................................................................ (04)Medical or hospitalization insurance ............................................................................................................. (05)Interest on business <strong>de</strong>bts ............................................................................................................................ (06)Property taxes ............................................................................................................................................... (07)Other taxes, patents and licenses .................................................................................................................Repairs ..........................................................................................................................................................Motor vehicles expenses ...............................................................................................................................(10)Utilities ........................................................................................................................................................... (11)Insurance ....................................................................................................................................................... (12)Advertising ..................................................................................................................................................... (13)Travel expenses ............................................................................................................................................ (14)Professional services .................................................................................................................................... (15)Maintenance .................................................................................................................................................. (16)Depreciation and amortization (Submit Schedule E Individual) ....................................................................Other expenses (Submit <strong>de</strong>tailed schedule) ................................................................................................Total (Transfer to Part II, line 2 of this Schedule) .........................................................................................(08)(09)(17)(18)(30)00000000000000000000000000000000000000

Schedule O IndividualRev. 05.99ALTERNATE BASIC TAX19__Taxpayer's nameTaxable year beginning on ______________, _____ and ending on _____________, _____Social Security Number1.Adjusted Gross Income (Enter the amount fromPart 2, line 5 of the return).............................................................................................................002.Less:00(a) Ordinary and necessary expenses......................(b) Long-term capital gain........................................00(c) Total...................................................................................................................003.Adjusted Gross Income for purposes of the Alternate Basic Tax(Subtract line 2(c) from line 1).......................................................................................................004.5.6.Regular Tax (The sum of lines 15 and 16 from Part 4 of the return,or the sum of the tax <strong>de</strong>termined on line 6 of Schedule D2 Individual, if applicable,and line 16 from Part 4 of the return)............................................................................................Determine the Alternate Basic Tax as follows:If the Adjusted Gross Income (line 3) is:(a)(b)(c)$75,000 but not over $125,000 ($37,500 to $62,500, if married filingseparate return), multiply line 3 by 10%.Over $125,000 but not over $175,000 (over $62,500 but not over$87,500, if married filing separate return),multiply line 3 by 15%.Over $175,000 (over $87,500, if married filing separate return),multiply line 3 by 20%.This is your Alternate Basic Tax (Enter the corresponding amount on this line).........................Excess of Alternate Basic Tax over Regular Tax (Subtract line 4 from line 5.If line 4 is larger than line 5, enter zero. If line 5 is larger than line 4,enter the difference here and transfer to Part 4, line 17 of the return).........................................000000

Schedule RRev. 05.99Taxpayer's NameSPECIAL PARTNERSHIPTaxable year beginning on ______________, 19__ and ending on ______________, 19____19__Social Security or Employer's I<strong>de</strong>ntification No.Part IAdjusted Basis Determination of a Partner in one or more Special PartnershipsName of entity ...............................................................................................................................Column A Column B Column CEmployer's i<strong>de</strong>ntification number ......................................................................................................1.2.Adjusted basis at the end of the previous taxable year ................................................................Basis increase:000000(a)(b)(c)(d)(e)(f)(g)Partner's distributable share on income and profits claimed on previous year (See instructions)Contributions ma<strong>de</strong> during the year .....................................................................................Special partnership's capital assets gain..............................................................................Exempt income .................................................................................................................Farming income <strong>de</strong>duction granted by Section 1023(s) of the Co<strong>de</strong> ........................................Other income or gains (See instructions)..............................................................................Total basis increase (Add lines 2(a) through 2(f)) ..................................................................0000000000000000000000000000000000000000003. Basis <strong>de</strong>crease:(a)(b)(c)(d)(e)(f)(g)(h)Partner's distributable share on partnership's loss claimed on previous year ............................Special partnership's capital assets loss .............................................................................Distributions during the year ...............................................................................................Credits claimed the preceding year (See instructions) ..............................................................Withholding at source during the year ..................................................................................No admissible expenses for the year ..................................................................................Distributable share on losses from exempt operations during the year ....................................Total basis <strong>de</strong>crease (Add lines 3(a) through 3(g)) .................................................................0000000000000000000000000000000000000000000000004. Adjusted Basis (Add lines 1 and 2(g) less line 3(h). Transfer this amount to line 6(a)) ...................0000 00Part II Determination of Partner's Allowable Losses in one or more Special Partnerships5.6.(a)(b)(c)(a)(b)(c)Partner's distributable share on partnership's loss for the year ...............................................Loss carryover from previous years (See instructions) ...........................................................Total losses (Add lines 5(a) and 5(b)) ...................................................................................Adjusted Basis (Part I, line 4) .............................................................................................Partnership's <strong>de</strong>bts un<strong>de</strong>r Tourism Incentives Act or Tourism Development Act attributable to partnerTotal partner's adjusted basis (Add lines 6(a) and 6(b))............................................................0000000000000000000000000000000000007. Distributable share on partnership's net income for the year (See instructions) ..............................0000008. Excess of net income (or loss) on distributable share (Subtract line 5(c) from line 7) .......................000000If line 8 is zero or more than zero, do not complete the rest of the form (Transfer this amount to Schedule F Individual, Part III or Form 480.10 or 480.20, Part IV, line 15). If line 8 is less than zero, continue with line 9.9. Available losses (The smaller of lines 6(c) or 8) ..........................................................................00000010. Total losses (Add losses <strong>de</strong>termined on line 9, Columns A through C) .........................................................................................................0011. Partner's net income without consi<strong>de</strong>ring losses from special partnerships (See instructions) ..........................................................................0012. 50% of line 11 ..........................................................................................................................................................................................0013. Allowable Loss (Enter the smaller of line 10 or 12. Enter this amount on Form 482, Part 2, line 2C or Form 480.10 or 480.20, Part IV, line 16)....0014. Loss carryforward for next year (Add lines 7 and 13 and subtract this amount from line 5(c)) ...........................................................................00

Schedule CHRev. 05.98RELEASE OF CLAIM TO EXEMPTIONFOR CHILD (CHILDREN) OF DIVORCEDOR SEPARATED PARENTS19__Name of parent claiming the exemptionTaxable year beginning on ______________ 19___ and ending on _____________ 19___Social Security NumberPart IRelease of Claim to Exemption for Depen<strong>de</strong>nts for Current Year (See instructions)I, _______________________________________________________ , agree not to claim an exemption for <strong>de</strong>pen<strong>de</strong>nts forName of parent releasing claim to exemptionthe taxable year 19__ for (enter the name(s) of child(or children)):(1)___________________________________________________________________(2)___________________________________________________________________(3)___________________________________________________________________(4)___________________________________________________________________(5)_______________________________________________________________________________________________________________ _________________________ ________________Signature of parent releasing claim to exemptionSocial Security NumberIf you choose not to claim an exemption for this child(or children) for future taxable years, complete Part II.DatePart IIRelease of Claim to Exemption for Depen<strong>de</strong>nts for Future Years (See instructions)I, _______________________________________________________ , agree not to claim an exemption for <strong>de</strong>pen<strong>de</strong>nts forName of parent releasing claim to exemptionthe taxable year(s)_______________________ for (enter the name(s) of child(or children)):(Specify)(1)___________________________________________________________________(2)___________________________________________________________________(3)___________________________________________________________________(4)___________________________________________________________________(5)_______________________________________________________________________________________________________________ _________________________ ________________Signature of parent releasing claim to exemptionSocial Security NumberDate

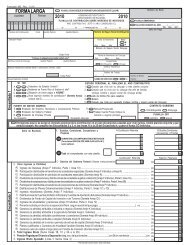

FormularioFormRev. 05. 97480-EDECLARACION DE CONTRIBUCION ESTIMADAPARA USO OFICIALFOR OFFICIAL USENúmero <strong>de</strong> SerieSerial NumberESTIMATED TAX DECLARATIONNúmero <strong>de</strong> Seguro Social o I<strong>de</strong>ntificaciónPatronal - Social Security Number orEmployer In<strong>de</strong>ntification NumberDeclaración OriginalOriginal DeclarationDECLARACION ENMENDADAAmen<strong>de</strong>d DeclarationIndividuoIndividualCorporaciónCorporationSociedadPartnershipAño que termina enTaxable year ending onDíaDayMesMonthAñoYearNombre y dirección <strong>de</strong>l contribuyente - Taxpayer's name and addressSello <strong>de</strong> ReciboReceipt Stamp1.2.3.Total Contribución EstimadaTotal Estimated TaxCrédito Estimado Por Cantida<strong>de</strong>s RetenidasEstimated Credit for Amounts WithheldContribución Estimada Ajustada (Línea 1 menos línea 2)Adjusted Estimated Tax (Subtract line 2 from line 1)0000004.5.6.7.8.Crédito por Contribución Pagada en ExcesoCredit for Tax Paid in ExcessContribución Estimada a Pagar (Línea 3 menos línea 4)Estimated Tax to be Paid (Subtract line 4 from line 3)Importe <strong>de</strong> cada PlazoAmount of each InstallmentCrédito por Contribución Pagada en Exceso No Reclamado en línea 4Credit for Tax Paid in Excess not Claimed on line 4Balance a Pagar:Balance to be paid:(a)(b)(c)(d)Primer PlazoFirst InstallmentSegundo PlazoSecond InstallmentTercer PlazoThird InstallmentCuarto PlazoFourth InstallmentJURAMENTO - OATH0000000000000000Declaro bajo penalidad <strong>de</strong> perjurio que esta <strong>de</strong>claración ha sido examinada por mí y que según mi mejor informacióny creencia es cierta, correcta y completa.I hereby <strong>de</strong>clare un<strong>de</strong>r penalty of perjury that this <strong>de</strong>claration has been examined by me and to the best of my knowledge andbelief is true, correct and complete._________________________________________________Firma <strong>de</strong>l Contribuyente o Representante AutorizadoTaxpayer's or Duly Authorized Agent's SignaturePeríodo <strong>de</strong> Conservación: Diez (10) años - Conservation Period: Ten (10) years________________________________Título - TitleFecha - Date ___________________________________