Severance and Grumman Heritage Retirement ... - Benefits Online

Severance and Grumman Heritage Retirement ... - Benefits Online

Severance and Grumman Heritage Retirement ... - Benefits Online

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The Northrop <strong>Grumman</strong><strong>Severance</strong> Plan<strong>and</strong> <strong>Retirement</strong> OverviewFor <strong>Grumman</strong> <strong>Heritage</strong> Employees

Today’s Agenda• Eligibility• Health <strong>Benefits</strong>• Savings Plan• Retiree Medical• <strong>Retirement</strong> Plan Overview• Resources• Questions2

<strong>Severance</strong> PlanEligibility

<strong>Severance</strong> Eligibility• You are designated as eligible when you receive anindividually addressed letter, signed by an approvedrepresentative, notifying you that you meet the eligibilityrequirements for participation in the <strong>Severance</strong> Plan• You must remain employed in your current position untilyou are laid off by your management; if you voluntarilyquit, retire, or transfer to another position within theCompany, or are terminated for cause before your layoffdate, you will not receive benefits under this plan• You must sign a Confidential Separation Agreement <strong>and</strong>General Release• If you have any questions regarding your eligibility youshould contact HR4

Health <strong>Benefits</strong><strong>and</strong> Savings Plan

<strong>Benefits</strong> Continuation under COBRA• <strong>Benefits</strong> coverage under COBRA, if elected, continues for amaximum of 18 months (extensions are available undercertain circumstances)• Your 18 month COBRA eligibility period begins on the first ofthe month following your last day worked• You may elect benefits continuation under COBRA only forthose health plan options that were in effect on the daybefore your benefits terminated• COBRA is available for eligible dependents covered as ofyour last day of work6

Employee Cost for <strong>Benefits</strong> Continuation –No Cost Period• You will receive an extension of your medical, dental<strong>and</strong> vision benefits, at no cost to you, through the endof the month of your layoff date plus one additionalmonth• If you are not covered by medical, dental <strong>and</strong>/or visionbenefits at the time of your layoff this feature does notapply to you• The period of coverage from your last day of workthrough the end of the following month is fully paid forby the company7

Employee Cost for <strong>Benefits</strong> Continuation –Cost Sharing Period• If you qualify under this Plan, you will receive a companysubsidizedextension of your medical, dental <strong>and</strong> visionbenefits from your layoff date, at active rates, equal to oneweek for each full year of service (counted from your mostrecent hire date)• This coverage continues for a maximum of 26 weeks• Example for an employee with 20 years of service:• Last day of work is October 28, 2011• Eligible for 20 weeks continued coverage (through March 17,2012)• Medical, dental <strong>and</strong> vision benefits would continue at no costthrough November 30, 2011 <strong>and</strong> then at active rates throughMarch 17, 2012• Coverage can then be continued under COBRA throughApril 30, 2013 at full COBRA rates8

Employee Cost for <strong>Benefits</strong>Continuation – Full Cost Period• You pay 100% of the COBRA premium which is basedon the full group rate plus a 2% administrative fee• Coverage continues for the remainder of your 18month COBRA period, as long as premiums are paidon a timely basis• Benefit continuation under the <strong>Severance</strong> Plan isconsidered part of your COBRA continuation9

Example: Employee with 20 YOSLast Day Worked: October 28, 2011No Cost Period Cost Share Period Full Cost Period/COBRAOctober 29 November 30 December 1 March 17, 2012April 30, 2013Start of 18 monthCOBRA periodNovember 1, 2011 – April 30, 2013End of 18 monthCOBRA period10

Paying for your <strong>Benefits</strong>• You will be billed for your continuation of coverageby the Northrop <strong>Grumman</strong> <strong>Benefits</strong> Center• The first bill will be sent shortly after thetermination of your active benefits• Subsequent bills are prepared on the 10 th of eachmonth <strong>and</strong> mailed on the 15 th• Payment is due on the 1 st of the month, inadvance, with a 30-day grace period11

Medicare Eligible Participants• If you <strong>and</strong>/or a dependent are Medicare eligible(because you are 65 or under 65 <strong>and</strong> disabled), youMUST enroll in Medicare Part B as soon as youractive employment ends.• <strong>Severance</strong>/COBRA coverage is not considered activeemployer coverage <strong>and</strong> therefore is secondary toMedicare.– Claims will be processed as though Medicare has paidprimary– Failure to enroll in Medicare B as soon as activeemployment ends may also result in an SSA/Medicareimposed penalty on all future Medicare B premiums12

Miscellaneous Information• If you are currently covered by an HMO <strong>and</strong>you move out of the HMO coverage area,coverage in the HMO will terminate as of thedate the address change is reported– you must contact the NGBC at 1-800-894-4194within 31 days of your change in residence toenroll in a plan option available in your newarea• If your spouse is an NG employee, you mayelect coverage under his/her benefits in lieu ofCOBRA13

Flexible Spending Accounts (FSAs)Health Care Flexible Spending Account• Your before-tax contributions cease as of your layoff date.• Only expenses incurred prior to your layoff date are eligible forreimbursement.• You may choose to continue FSA coverage through COBRA by makingafter-tax contributions. This allows you to file claims for expensesincurred after your layoff date, but no later than the end of the plan year.• Claims must be submitted by December 31 following the end of the planyear.Dependent Day Care Flexible Spending Account• Your before-tax contributions cease as of your layoff date.• Claims may be filed for expenses incurred through the end of the planyear <strong>and</strong> must be submitted by December 31 following the end of theplan year.14

Life <strong>and</strong> Accidental Death & Dismemberment(AD&D) Insurance• Your Company-provided Basic Life <strong>and</strong> AD&D, as wellas your Optional Life <strong>and</strong> AD&D Insurance coverage,ends on your layoff date• Continuation of Life Insurance must be elected within31 days of your layoff date.• Continuation of AD&D Insurance must be electedwithin 90 days of your layoff date.• Conversion/portability forms are available on<strong>Benefits</strong> OnLine or by contacting the Northrop<strong>Grumman</strong> <strong>Benefits</strong> Center at 1-800-894-419415

Other <strong>Benefits</strong>• Short-Term <strong>and</strong> Long-Term Disability– Coverage stops on layoff date.– Conversion coverage is not available• Business Travel Accident Insurance– Coverage stops on layoff date.– Conversion coverage is not available.• Group Legal– Coverage stops on layoff date.– You should call Hyatt Legal Plans (Group Legal carriereffective July 1, 2010) at 1-800-821-6400 with anyquestions about your open or pending issues <strong>and</strong>/or forinformation about porting coverage.16

Northrop <strong>Grumman</strong> Savings Plan• You are 100% vested in your contributions, companycontributions (with the exception of <strong>Retirement</strong> AccountContributions) <strong>and</strong> all earnings. <strong>Retirement</strong> AccountContributions are subject to a 3-year cliff vesting schedule.• If your account balance exceeds $1,000 you may:– Receive payment of your entire account balance (lump sumdistribution)– Receive payment of a portion of your account balance (partialdistribution– Leave your money in the NG Savings Plan <strong>and</strong> delay taking adistribution as late as age 70½– Roll over your account balance to another employer’s qualifiedplan or an IRA– Receive payment over your lifetime (your account is used topurchase an annuity contract from a life insurance company)• If your account balance is $1,000 or less, you willautomatically receive a lump-sum distribution which may berolled over to an IRA or other qualified account.17

Northrop <strong>Grumman</strong> Savings Plan• If your account balance is greater than $1,000 <strong>and</strong> you decideto leave your account balance in the Savings Plan, you maycontinue to transfer <strong>and</strong> reallocate your existing fund balances,request eligible withdrawals <strong>and</strong> continue to make anyoutst<strong>and</strong>ing loan payments• If you have an outst<strong>and</strong>ing loan <strong>and</strong> do not continue makingpayments, the remaining loan amount will be defaulted <strong>and</strong> willbe considered a distribution <strong>and</strong> will be subject to any applicabletaxes <strong>and</strong> penalties.• Once you have terminated from the company, you can no longercontribute to your account• Review the Northrop <strong>Grumman</strong> Savings Plan Summary PlanDescription (SPD) accessible at <strong>Benefits</strong> OnLine for more details18

Northrop <strong>Grumman</strong> Savings Plan – Taxes• If you elect to receive a distribution, your tax-deferredcontributions, company contributions <strong>and</strong> all investment earningsare taxed as ordinary income. Unless you elect to directly roll overyour account balance to an IRA or other qualified plan, current lawrequires:- 20% Federal Income Tax withholding on the taxable portion of thedistribution- Distribution may be subject to an additional 10% Federal penalty- State penalties may also apply in some cases• Your Savings Plan account distribution will not be assessed a 10%Federal Penalty Tax if you are age 59 ½ or older or:- You are age 55 or older when you terminate employment or- You roll over your distribution to an IRA or another employer’s qualifiedplan within 60 days of the date you receive it• Special provisions may apply if you have Roth 401(k) or Roth401(k) Rollover money in the Savings Plan.19

Retiree Medical

Retiree Medical – <strong>Heritage</strong> Eligibility• Eligibility for <strong>Heritage</strong> retiree medical was frozen as of6/30/2003- 1/1/2004 for Newport News- 1/1/2005 for TRW• If you were hired prior to the freeze date, you may beeligible for a subsidized <strong>Heritage</strong> plan. You must contactthe Northrop <strong>Grumman</strong> <strong>Benefits</strong> Center (NGBC) todetermine your eligibility.21

Retiree Medical – Access Only Eligibility• If you were hired after the freeze date, or your heritagecompany did not offer a retiree medical plan, you areeligible for Access Only Retiree Medical coverage if youmeet the following requirements:– At least age 55 with a minimum of 10 Years ofService– At least age 65 with a minimum of 5 Years of Service• Access Only offers the same retiree medical planoptions but the costs are not subsidized by Northrop<strong>Grumman</strong>22

Retiree Medical – Special Layoff Provision• If you do not currently meet the age <strong>and</strong> servicerequirements for a <strong>Heritage</strong> or Access Only plan youmay still qualify for Retiree Medical if you are:– At least 53 on the layoff date with a minimum of 10 yearsof service– Under age 53 but have 75 points (age + years of service)• Those employees who meet the criteria above maycommence Retiree Medical coverage the first of anymonth after attaining age 55 by contacting the Northrop<strong>Grumman</strong> <strong>Benefits</strong> Center23

Retiree Medical – Enrollment Options• If you are immediately eligible for retiree medical youmay:– Immediately elect retiree medical– Defer coverage until after the free period– Defer coverage until after the cost sharing period– Defer coverage until after the COBRA period– Defer retiree medical indefinitely• Dental <strong>and</strong>/or vision can be continued through COBRAeven after you commence retiree medical.24

<strong>Retirement</strong> Plan OverviewFor <strong>Grumman</strong> <strong>Heritage</strong> Employees

Northrop <strong>Grumman</strong>Pension Program• Effective 7/1/03 most historical pension plans wereamended to incorporate a cash balance feature.• Your benefit at retirement may consist of up to 3 partsdepending on your historical plan (if any) <strong>and</strong> when youbecame eligible to participate.– Part A: the historical benefit earned prior to the Programeffective date– Parts B or C: transition benefits– Part D: the benefit earned under the cash balance featureonly26

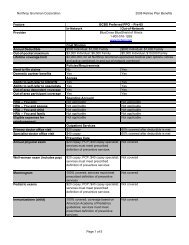

<strong>Heritage</strong> <strong>Grumman</strong> <strong>Retirement</strong> <strong>Benefits</strong>Part APart B5-Year TransitionBenefitPart DYour benefitunder yourhistoricalplanformulathrough6/30/03Your benefitunder thecash balanceformulabeginning07/01/08Your benefit based on a+formula similar to the+ =one under your historicalplan from07/01/03 – 06/30/08orWhichever is greaterPart C5-Year Transition BenefitYour benefit underthe cash balanceformula from07/01/03 – 06/30/08Yourpensionbenefit27

Vesting Requirements• Vesting means you have earned a non-forfeitableright to your Pension benefit.• Once you are vested, you will be eligible for aPension benefit even if you leave the companyprior to retirement age.• Employees who terminate on or after January 1,2008 are vested after completing 3 years ofvesting service– you accrue one year of vesting service for eachyear you work <strong>and</strong> are paid for 1000 or morehours28

<strong>Retirement</strong> Eligibility – <strong>Grumman</strong> <strong>Heritage</strong>• <strong>Grumman</strong> Corporation Pension Benefit (pre-95)- Early <strong>Retirement</strong> – age 50 with at least 20 years of service or age 60 with 1 yearof service (benefit may be reduced).• NG Pension Benefit (post-94)- Normal <strong>Retirement</strong> - first day of the month coincident with your 65 thbirthday- Early <strong>Retirement</strong> – age 55 with at least 10 years of service (benefit maybe reduced)• NG Pension Program Benefit (Cash Balance Plan 7-1-03)-Normal <strong>Retirement</strong>:-The later of age 65 or-Your age on the fifth anniversary of your participation in the Plan or the dateyou complete three years of vesting service, whichever is earlier- Early <strong>Retirement</strong> :age 55 with at least 10 years of service (benefitmay be reduced)29

Early <strong>Retirement</strong> Factors – <strong>Heritage</strong> <strong>Grumman</strong> (Pre-95)• Your age when payments begin– Age 50– Age 51– Age 52– Age 53– Age 54– Age 55– Age 56– Age 57– Age 58– Age 59– Age 60• Percentage of your accrued benefitthat you receive– 51.0304%– 54.1471%– 57.5417%– 61.2474%– 65.3024%– 69.7509%– 74.6437%– 80.0400%– 86.0087%– 92.6305%– 100%30

Northrop <strong>Grumman</strong> Pension Plan –Early <strong>Retirement</strong> Factors (Post 94)Your age or pointswhen payments begin55 years or 75 points56 years or 76 points57 years or 77 points58 years or 78 points59 years or 79 points60 years or 80 points61 years or 81 points62 years or 82 points63 years or 83 points64 years or 84 points65 years or 85 pointsPercentage of benefitthat you receive75.0%77.5%80.0%82.5%85.0%87.5%90.0%92.5%95.0%97.5%100%DeferredVested benefit46%49%53%57%62%67%72%78%85%92%100%31

Cost-of-Living-Adjustment (COLA) Optionsat <strong>Retirement</strong> (pre-93 only)• With COLA• Without COLA- Automatically receive an adjustment on April 1 of every year- Also referred to as “Annual Adjustment”- Receive the present value of your COLA converted to a flatdollar amount, which is then added to your Pre-93 accruedbenefit amount.- Determined at retirement, <strong>and</strong> is based on:- Your life expectancy- Current interest rates- Established Consumer Price Index (CPI) in effect atretirement (maximum 3%)- Also referred to as “COLA Buy-out”32

Special Layoff Provision*• If you are laid off before reaching age 55, you mayelect an early retirement benefit to begin at age 55,or the first of any subsequent month, if you have:– Attained age 53 with 10 or more years of vestingservice at the time of your layoff or– Have 75 points or higher on the date of your layoff(age + service)• Early retirement factors will be used for benefitcalculation if you meet the requirements of thisprovision*Does not apply to pre-95 benefit33

<strong>Benefits</strong> OnLine Home PageYou canlog intoyour My<strong>Benefits</strong>Accesspageherehttp://benefits.northropgrumman.comAccessible via the Internet34

Northrop <strong>Grumman</strong> <strong>Benefits</strong> Center (NGBC)A call center staffed by knowledgeable representativesAvailable Monday through Friday(excluding holidays)9:00 a.m. to 6:00 p.m. ETCall1-800-894-419435

Questions?36