Financial Management: Providing a Foundation for Transition - AGA

Financial Management: Providing a Foundation for Transition - AGA

Financial Management: Providing a Foundation for Transition - AGA

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

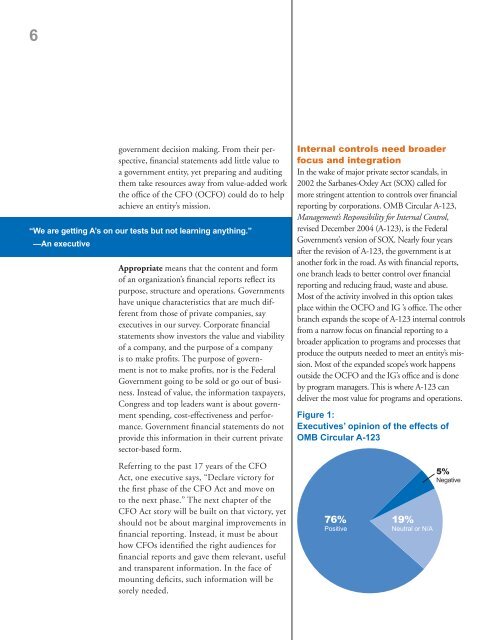

6government decision making. From their perspective,financial statements add little value toa government entity, yet preparing and auditingthem take resources away from value-added workthe office of the CFO (OCFO) could do to helpachieve an entity’s mission.“We are getting A’s on our tests but not learning anything.”—An executiveAppropriate means that the content and <strong>for</strong>mof an organization’s financial reports reflect itspurpose, structure and operations. Governmentshave unique characteristics that are much differentfrom those of private companies, sayexecutives in our survey. Corporate financialstatements show investors the value and viabilityof a company, and the purpose of a companyis to make profits. The purpose of governmentis not to make profits, nor is the FederalGovernment going to be sold or go out of business.Instead of value, the in<strong>for</strong>mation taxpayers,Congress and top leaders want is about governmentspending, cost-effectiveness and per<strong>for</strong>mance.Government financial statements do notprovide this in<strong>for</strong>mation in their current privatesector-based <strong>for</strong>m.Referring to the past 17 years of the CFOAct, one executive says, “Declare victory <strong>for</strong>the first phase of the CFO Act and move onto the next phase.” The next chapter of theCFO Act story will be built on that victory, yetshould not be about marginal improvements infinancial reporting. Instead, it must be abouthow CFOs identified the right audiences <strong>for</strong>financial reports and gave them relevant, usefuland transparent in<strong>for</strong>mation. In the face ofmounting deficits, such in<strong>for</strong>mation will besorely needed.Internal controls need broaderfocus and integrationIn the wake of major private sector scandals, in2002 the Sarbanes-Oxley Act (SOX) called <strong>for</strong>more stringent attention to controls over financialreporting by corporations. OMB Circular A-123,<strong>Management</strong>’s Responsibility <strong>for</strong> Internal Control,revised December 2004 (A-123), is the FederalGovernment’s version of SOX. Nearly four yearsafter the revision of A-123, the government is atanother <strong>for</strong>k in the road. As with financial reports,one branch leads to better control over financialreporting and reducing fraud, waste and abuse.Most of the activity involved in this option takesplace within the OCFO and IG ’s office. The otherbranch expands the scope of A-123 internal controlsfrom a narrow focus on financial reporting to abroader application to programs and processes thatproduce the outputs needed to meet an entity’s mission.Most of the expanded scope’s work happensoutside the OCFO and the IG’s office and is doneby program managers. This is where A-123 candeliver the most value <strong>for</strong> programs and operations.Figure 1:Executives’ opinion of the effects ofOMB Circular A-12376%Positive19%Neutral or N/A5%Negative