PT Ciputra Development Tbk And Subsidiaries

PT Ciputra Development Tbk And Subsidiaries PT Ciputra Development Tbk And Subsidiaries

PT CIPUTRA DEVELOPMENT Tbk AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)For Nine Months Ended 30 September 2006 and 2005(In Rupiah)The term period of the loan is 4.5 years or up to 20 June 2009, bears annual interest of 11% for the first 6months and subsequently will be reviewed on monthly basis (in 2006: 15.80% and 2005: 12.60%). Therepayment of the principal and interest are in quarterly basis.The loan repayment schedule is as follows:PeriodPercentage ToTotal Facility2005 10.50%2006 23.50%2007 28.00%2008 31.00%2009 7.00%Total 100.00%These loans are secured by land owned by CSM with total area approximately 16,453 sqm, which located inPekunden Village, Semarang, Central Java, including the related building and irremovable assets which areknown as Ciputra mall and hotel Semarang (see Note 10), fiduciary pledge on accounts receivable to thirdparties and personal guarantee by Mr. Cakra Ciputra.c. Syndicated Loans – CSOn 19 June 2003, CS, a subsidiary, obtained syndicated loans facility. These loans were used to refinancehouses and residential facilities/infrastructure, which had been previously financed by the bonds payable.Details of the loans are as follows:Plafond 2006 2005Bukopin 45,000,000,000 415,600,000 10,363,850,000PT Bank Negara Indonesia (Persero) Tbk (BNI) 45,000,000,000 415,600,000 10,363,850,000BCA 20,000,000,000 168,800,000 4,622,300,000PT Bank Bumiputera Tbk (Bumiputera) 10,000,000,000 - -Total 120,000,000,000 1,000,000,000 25,350,000,000Bukopin and BNI act as the facility and security agents, respectively. This syndicated loans facility will bedue in June 2006 (for Bumiputera) and June 2008 (for Bukopin, BNI and BCA). In 2005, CS had fully paid itsobligation to Bumiputera.These loans are secured by certain property and equipment owned by CS and its subsidiaries (see Note10), and unearned revenue from customers based on land and/or land and building purchase order madebetween CS and its subsidiaries with the customers (future collection). These loans bear annual interest at17.92% for the first month and subsequently will be adjusted to the respective market interest rate (in 2006:15.61%% - 16.02% and in 2005: 13.12% - 13.20%).Regarding to these loans, CS is required to comply with several restrictions, among others, CS is required toobtained prior written consent to:• amend its article of association/ the composition of directors and commissioners;• pledge its assets to others parties;• act as a guarantor of liabilities to other parties;• change its legal status; and• perform merger or acquisition.d. PT Bank Tabungan Negara (Persero)In 2002, PT Ciputra Residence (CR), a subsidiary, obtained working capital loan facility from PT BankTabungan Negara (Persero) (BTN) amounting to Rp 46.5 billion and bears annual interest at 19.5% for thefirst month and subsequently will be adjusted to the respective market interest rate (in 2006: 13% and 2005:13.5%). This loan will be due in April 2009 and secured by Building Use Rights of land with total areaapproximately 54 hectares, located at Cikupa District, Tangerang Regency, owned by CR (see Note 9).21

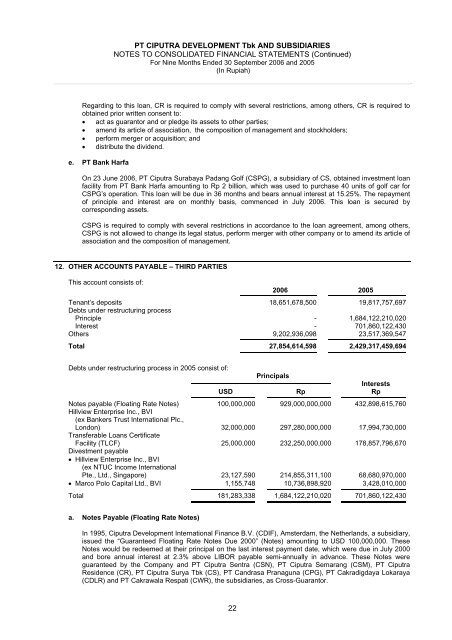

PT CIPUTRA DEVELOPMENT Tbk AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)For Nine Months Ended 30 September 2006 and 2005(In Rupiah)Regarding to this loan, CR is required to comply with several restrictions, among others, CR is required toobtained prior written consent to:• act as guarantor and or pledge its assets to other parties;• amend its article of association, the composition of management and stockholders;• perform merger or acquisition; and• distribute the dividend.e. PT Bank HarfaOn 23 June 2006, PT Ciputra Surabaya Padang Golf (CSPG), a subsidiary of CS, obtained investment loanfacility from PT Bank Harfa amounting to Rp 2 billion, which was used to purchase 40 units of golf car forCSPG’s operation. This loan will be due in 36 months and bears annual interest at 15.25%. The repaymentof principle and interest are on monthly basis, commenced in July 2006. This loan is secured bycorresponding assets.CSPG is required to comply with several restrictions in accordance to the loan agreement, among others,CSPG is not allowed to change its legal status, perform merger with other company or to amend its article ofassociation and the composition of management.12. OTHER ACCOUNTS PAYABLE – THIRD PARTIESThis account consists of:2006 2005Tenant’s deposits 18,651,678,500 19,817,757,697Debts under restructuring processPrinciple - 1,684,122,210,020Interest - 701,860,122,430Others 9,202,936,098 23,517,369,547Total 27,854,614,598 2,429,317,459,694Debts under restructuring process in 2005 consist of:PrincipalsInterestsUSD Rp RpNotes payable (Floating Rate Notes) 100,000,000 929,000,000,000 432,898,615,760Hillview Enterprise Inc., BVI(ex Bankers Trust International Plc.,London) 32,000,000 297,280,000,000 17,994,730,000Transferable Loans CertificateFacility (TLCF) 25,000,000 232,250,000,000 178,857,796,670Divestment payable• Hillview Enterprise Inc., BVI(ex NTUC Income InternationalPte., Ltd., Singapore) 23,127,590 214,855,311,100 68,680,970,000• Marco Polo Capital Ltd., BVI 1,155,748 10,736,898,920 3,428,010,000Total 181,283,338 1,684,122,210,020 701,860,122,430a. Notes Payable (Floating Rate Notes)In 1995, Ciputra Development International Finance B.V. (CDIF), Amsterdam, the Netherlands, a subsidiary,issued the “Guaranteed Floating Rate Notes Due 2000” (Notes) amounting to USD 100,000,000. TheseNotes would be redeemed at their principal on the last interest payment date, which were due in July 2000and bore annual interest at 2.3% above LIBOR payable semi-annually in advance. These Notes wereguaranteed by the Company and PT Ciputra Sentra (CSN), PT Ciputra Semarang (CSM), PT CiputraResidence (CR), PT Ciputra Surya Tbk (CS), PT Candrasa Pranaguna (CPG), PT Cakradigdaya Lokaraya(CDLR) and PT Cakrawala Respati (CWR), the subsidiaries, as Cross-Guarantor.22

- Page 1: PT Ciputra Development TbkAnd Subsi

- Page 5 and 6: PT CIPUTRA DEVELOPMENT Tbk AND SUBS

- Page 8: PT CIPUTRA DEVELOPMENT Tbk AND SUBS

- Page 11 and 12: PT CIPUTRA DEVELOPMENT Tbk AND SUBS

- Page 13 and 14: PT CIPUTRA DEVELOPMENT Tbk AND SUBS

- Page 15 and 16: PT CIPUTRA DEVELOPMENT Tbk AND SUBS

- Page 17: PT CIPUTRA DEVELOPMENT Tbk AND SUBS

- Page 20 and 21: PT CIPUTRA DEVELOPMENT Tbk AND SUBS

- Page 24 and 25: PT CIPUTRA DEVELOPMENT Tbk AND SUBS

- Page 26 and 27: PT CIPUTRA DEVELOPMENT Tbk AND SUBS

- Page 28 and 29: PT CIPUTRA DEVELOPMENT Tbk AND SUBS

- Page 30 and 31: PT CIPUTRA DEVELOPMENT Tbk AND SUBS

- Page 32 and 33: PT CIPUTRA DEVELOPMENT Tbk AND SUBS

- Page 34 and 35: PT CIPUTRA DEVELOPMENT Tbk AND SUBS

<strong>PT</strong> CIPUTRA DEVELOPMENT <strong>Tbk</strong> AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)For Nine Months Ended 30 September 2006 and 2005(In Rupiah)Regarding to this loan, CR is required to comply with several restrictions, among others, CR is required toobtained prior written consent to:• act as guarantor and or pledge its assets to other parties;• amend its article of association, the composition of management and stockholders;• perform merger or acquisition; and• distribute the dividend.e. <strong>PT</strong> Bank HarfaOn 23 June 2006, <strong>PT</strong> <strong>Ciputra</strong> Surabaya Padang Golf (CSPG), a subsidiary of CS, obtained investment loanfacility from <strong>PT</strong> Bank Harfa amounting to Rp 2 billion, which was used to purchase 40 units of golf car forCSPG’s operation. This loan will be due in 36 months and bears annual interest at 15.25%. The repaymentof principle and interest are on monthly basis, commenced in July 2006. This loan is secured bycorresponding assets.CSPG is required to comply with several restrictions in accordance to the loan agreement, among others,CSPG is not allowed to change its legal status, perform merger with other company or to amend its article ofassociation and the composition of management.12. OTHER ACCOUNTS PAYABLE – THIRD PARTIESThis account consists of:2006 2005Tenant’s deposits 18,651,678,500 19,817,757,697Debts under restructuring processPrinciple - 1,684,122,210,020Interest - 701,860,122,430Others 9,202,936,098 23,517,369,547Total 27,854,614,598 2,429,317,459,694Debts under restructuring process in 2005 consist of:PrincipalsInterestsUSD Rp RpNotes payable (Floating Rate Notes) 100,000,000 929,000,000,000 432,898,615,760Hillview Enterprise Inc., BVI(ex Bankers Trust International Plc.,London) 32,000,000 297,280,000,000 17,994,730,000Transferable Loans CertificateFacility (TLCF) 25,000,000 232,250,000,000 178,857,796,670Divestment payable• Hillview Enterprise Inc., BVI(ex NTUC Income InternationalPte., Ltd., Singapore) 23,127,590 214,855,311,100 68,680,970,000• Marco Polo Capital Ltd., BVI 1,155,748 10,736,898,920 3,428,010,000Total 181,283,338 1,684,122,210,020 701,860,122,430a. Notes Payable (Floating Rate Notes)In 1995, <strong>Ciputra</strong> <strong>Development</strong> International Finance B.V. (CDIF), Amsterdam, the Netherlands, a subsidiary,issued the “Guaranteed Floating Rate Notes Due 2000” (Notes) amounting to USD 100,000,000. TheseNotes would be redeemed at their principal on the last interest payment date, which were due in July 2000and bore annual interest at 2.3% above LIBOR payable semi-annually in advance. These Notes wereguaranteed by the Company and <strong>PT</strong> <strong>Ciputra</strong> Sentra (CSN), <strong>PT</strong> <strong>Ciputra</strong> Semarang (CSM), <strong>PT</strong> <strong>Ciputra</strong>Residence (CR), <strong>PT</strong> <strong>Ciputra</strong> Surya <strong>Tbk</strong> (CS), <strong>PT</strong> Candrasa Pranaguna (CPG), <strong>PT</strong> Cakradigdaya Lokaraya(CDLR) and <strong>PT</strong> Cakrawala Respati (CWR), the subsidiaries, as Cross-Guarantor.22