southpark homeowners' association number 2 ... - Southpark HOA II

southpark homeowners' association number 2 ... - Southpark HOA II

southpark homeowners' association number 2 ... - Southpark HOA II

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SOUTHPARK HOMEOWNERS' ASSOCIATION NUMBER 2INDEPENDENT AUDITOR'S REPORTAND FINANCIAL STATEMENTSFOR THE YEAR ENDED DECEMBER 31, 2008

January 23, 2009INDEPENDENT AUDITOR'S REPORTTo the Board of Directors and Members<strong>Southpark</strong> Homeowners' Association Number 2Arapahoe County, ColoradoWe have audited the accompanying balance sheet of <strong>Southpark</strong> Homeowners'Association Number 2 as of December 31, 2008, and the related statements ofrevenues, expenses and changes in fund balance and cash flows for the year thenended. These financial statements are the responsibility of the Association'smanagement. Our responsibility is to express an opinion on these financial statementsbased on our audit.We conducted our audit in accordance with auditing standards generally accepted in theUnited States. Those standards require that we plan and perform the audit to obtainreasonable assurance about whether the financial statements are free of materialmisstatement. An audit includes examining, on a test basis, evidence supporting theamounts and disclosures in the financial statements. An audit also includes assessingthe accounting principles used and significant estimates made by management, as wellas evaluating the overall financial presentation. We believe that our audit provides areasonable basis for our opinion.In our opinion, the financial statements referred to above present fairly, in all materialrespects, the financial position of <strong>Southpark</strong> Homeowners' Association Number 2 as ofDecember 31, 2008, and the results of its operations and its cash flows for the yearthen ended in conformity with accounting principles generally accepted in the UnitedStates.The supplementary information on Future Major Repairs and Replacements on pages 11and 12 is not a required part of the basic financial statements but is supplementaryinformation required by the American Institute of Certified Public Accountants. I haveapplied certain limited procedures, which consisted principally of inquiries ofmanagement regarding the methods of measurement and presentation of thesupplementary information. However, we did not audit the information and express noopinion on it.Omeron and Associates, P.C.

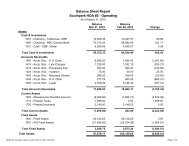

SOUTHPARK HOMEOWNERS’ ASSOCIATION NUMBER 2BALANCE SHEETAS OF DECEMBER 31, 2008Operating ReplacementFund Fund TotalASSETSCash and cash equivalents (Note 2) $ 39,501 $ 138,590 $ 178,091Cash on deposit - water escrow 4,504 4,504Temporary cash investments (Note 2) 465,000 465,000Assessments receivable - members, net ofallowance for doubtful accounts of $8,000 (Note 2) 8,093 8,093Accrued interest receivable 6,277 6,277Prepaid expenses 2,148 2,148Due from operating fund (Note 4) 89,285 89,285Furniture and equipment - at cost - net ofaccumulated depreciation of $20,235 (Note 2) 3,873 3,873TOTAL ASSETS $ 58,119 $ 699,152 $ 757,271LIABILITIESAccounts payable $ 22,689 $ 0 $ 22,689Income taxes payable (Note 5) 451 451Due to replacement fund (Note 4) 89,285 89,285Contingencies (Note 7) - - -Prepaid assessments 31,230 31,230Total liabilities 143,655 0 143,655FUND BALANCES:Restricted 4,504 699,152 703,656Unrestricted (deficit) (90,040) (90,040)Total fund balances (deficit) (85,536) 699,152 613,616TOTAL LIABILITIES AND FUND BALANCES $ 58,119 $ 699,152 $ 757,271The accompanying notes are an integral part of the financial statements.2

SOUTHPARK HOMEOWNERS’ ASSOCIATION NUMBER 2STATEMENT OF REVENUES AND EXPENSESAND CHANGES IN FUND BALANCESFOR THE YEAR ENDED DECEMBER 31, 2008Operating ReplacementFund Fund TotalREVENUESMember assessments (Note 3) $ 532,656 $ 111,792 $ 644,448Other member assessments 11,313 11,313Reduction-allowance for doubtful accounts - net (Note 2) 10,263 10,263Interest and dividend income 20 24,985 25,005Clubhouse rental 2,240 2,240Other income 128 128TOTAL REVENUES 556,620 136,777 693,397EXPENSESGrounds maintenance 145,945 145,945Water and sewer 142,136 142,136Trash removal 45,046 45,046Amenity maintenance and repair 42,589 42,589Snow removal 32,222 32,222Management fee 30,071 30,071Gas and electric 24,514 24,514Bookkeeping expense 19,728 19,728Security services 12,536 12,536Insurance expense 12,317 12,317Postage, printing and other administrative 8,846 8,846Professional fees - net 5,336 5,336Income taxes (Note 5) 4,451 4,451Depreciation expense (Note 2) 1,556 1,556Replacement fund expenses:Grounds improvements, repairs, and mailboxes 73,914 73,914Concrete and asphalt 44,878 44,878Trees and shrubs 20,784 20,784Clubhouse and playground improvements 8,322 8,322TOTAL EXPENSES 527,293 147,898 675,191EXCESS OF REVENUES OVER EXPENSES(EXPENSES OVER REVENUES) 29,327 (11,121) 18,206BEGINNING FUND BALANCE (DEFICIT) (114,863) 710,273 595,410ENDING FUND BALANCE (DEFICIT) $ (85,536) $ 699,152 $ 613,616The accompanying notes are an integral part of the financial statements.3

SOUTHPARK HOMEOWNERS’ ASSOCIATION NUMBER 2STATEMENT OF CASH FLOWSFOR THE YEAR ENDED DECEMBER 31, 2008Operating ReplacementFund Fund TotalCASH FLOWS FROM OPERATING ACTIVITIES:Member assessments collected $ 574,316 $ 111,792 $ 686,108Interest and dividends received 20 23,985 24,005Other income received 2,368 2,368Cash paid for:operating expenditures (565,790) (565,790)replacement expenditures (147,898) (147,898)Income taxes paid (5,452) (5,452)Temporary loan from Replacement Fund (Note 4) 35,000 (35,000) 0Replacement Fund expenses not reimbursed to Operating Fund (33,974) 33,974 0Net cash provided (used) by operating activities 6,488 (13,147) (6,659)CASH FLOWS FROM INVESTING ACTIVITIES:Purchase of property (1,026) (1,026)Net investment in temporary investments 33,000 33,000NET INCREASE (DECREASE) IN CASHAND CASH EQUIVALENTS 5,462 19,853 25,315Cash and cash equivalents at beginning of year 38,543 118,737 157,280Cash and cash equivalents at end of year $ 44,005 $ 138,590 $ 182,595RECONCILIATION OF EXCESS OF REVENUES OVER EXPENSES (EXPENSES OVER REVENUES)TO NET CASH PROVIDED (USED) BY OPERATING ACTIVITIES:Excess of revenues over expenses(expenses over revenues) $ 29,327 $ (11,121) $ 18,206Adjustments to reconcile excess of revenues over expenses (expensesover revenues) to net cash provided (used) by operating activities:Increase (decrease) in interfund balances 1,026 (1,026) 0Non-cash depreciation expense 1,556 1,556Increase in assessments receivable (4,858) (4,858)Increase in interest receivable (1,000) (1,000)Decrease in accounts payable (25,504) (25,504)Decrease in income taxes payable (1,001) (1,001)Increase in prepaid assessments 5,942 5,942Total adjustments (22,839) (2,026) (24,865)Net cash provided (used) by operating activities $ 6,488 $ (13,147) $ (6,659)The accompanying notes are an integral part of the financial statements.4

SOUTHPARK HOMEOWNERS' ASSOCIATION NUMBER 2NOTES TO FINANCIAL STATEMENTSDECEMBER 31, 2008NOTE 1. ORGANIZATIONThe <strong>Southpark</strong> Homeowners' Association Number 2 is an <strong>association</strong> organized as a notfor-profitcorporation for the purposes of maintaining and preserving its commonproperty. The development consists of 548 lots and various common areas. TheAssociation began its operations in 1982.NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIESFUND ACCOUNTING. The Association uses fund accounting, which requires that funds,such as operating funds and funds designated for future major repairs and replacements,be classified separately for accounting and reporting purposes. Disbursements from theoperating fund are generally at the discretion of the Board and property manager.Disbursements from the replacement fund generally may be made only for designatedpurposes.INTEREST EARNED. The Board's policy is to not allocate interest earned betweenfunds, but rather report such interest in the fund in which it was earned.ALLOWANCE FOR DOUBTFUL ACCOUNTS. The Association's policy is to enforcecollection of assessments by retaining legal counsel and by placing liens on theproperties of delinquent members. It is the opinion of the Association's Board that, inthe absence of foreclosure or personal bankruptcy proceedings of the delinquentmembers, the Association will ultimately prevail in most instances. However, theAssociation has adopted the allowance for doubtful accounts method of providing forassessments which may not be collected.RECOGNITION OF ASSETS AND DEPRECIATION POLICY. The Association's policy forrecognizing common property as assets in its balance sheet is to recognize (a) commonpersonal property and (b) real property to which it has title and that it can dispose of forcash while retaining the proceeds or that is used to generate significant cash flows frommembers on the basis of usage or from nonmembers. The Association has notrecognized any such property. The Association recognizes personal property assets atcost.5

SOUTHPARK HOMEOWNERS' ASSOCIATION NUMBER 2NOTES TO FINANCIAL STATEMENTSDECEMBER 31, 2008NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)RECOGNITION OF ASSETS AND DEPRECIATION POLICY. (Continued)Such property is depreciated using an accelerated method of depreciation over thefollowing useful lives:Furniture and equipment 7 yearsCASH AND CASH EQUIVALENTS POLICY. For purposes of the statement of cashflows, the Association considers all highly liquid debt instruments purchased with amaturity of three months or less to be cash equivalents.ESTIMATES. The preparation of financial statements in conformity with generallyaccepted accounting principles requires management to make estimates andassumptions that affect the reported amounts of assets and liabilities and disclosure ofcontingent assets and liabilities at the date of the financial statements and the reportedamounts of revenues and expenses during the reporting period. Actual results coulddiffer from those estimates.NOTE 3. OWNERS' ASSESSMENTSMonthly assessments to members were $98.00 for the year ended December 31,2008, of which approximately 17% was designated to the replacement fund.The Board determines the annual budget and assessments of owners. The Associationretains excess operating funds at the end of the operating year, if any, for use in futureoperating periods.NOTE 4. FUTURE MAJOR REPAIRS AND REPLACEMENTSThe Association's governing documents require that funds be accumulated for futuremajor repairs and replacements. Accumulated funds are held in separate investmentaccounts and generally are not available for expenditures for normal operations.6

SOUTHPARK HOMEOWNERS' ASSOCIATION NUMBER 2NOTES TO FINANCIAL STATEMENTSDECEMBER 31, 2008NOTE 4. FUTURE MAJOR REPAIRS AND REPLACEMENTS (continued)The Board conducted a study in December 2003, which has not been subsequentlyupdated, to estimate the remaining useful lives and the replacement costs of thecomponents of common property. The estimates were obtained from an independentengineering company which inspected the property. The table included in the unauditedsupplementary information on Future Major Repairs and Replacements is based on thestudy. The Board expects to update the study during 2009.The Board has been funding for major repairs and replacements over the remaininguseful lives of the components based on such study's estimates of current replacementcosts and considering amounts previously accumulated in the replacement fund, amongother factors.The determination of whether the Association has adequate funds to meet its needs forfuture major repairs and replacements is subject to several factors. The actual futureexpenditures and remaining useful lives may vary significantly from the estimates. Dueto operating fund needs and other factors, the Association may not be able to set asidefunds for future major repairs and replacements. Further, the rates of inflation andreturn on investments may significantly vary from expectations. Therefore, amountsaccumulated in the replacement fund may not be adequate to meet all future needs formajor repairs and replacements. If additional funds are needed, the Association has theright to increase regular assessments, pass special assessments, or delay major repairsand replacements until funds are available. The effect on future member assessmentsand the ability to fund future repairs and replacements is unknown at this time.During 2008, the Board authorized a loan of $35,000 from the Replacement Fund to theOperating Fund. By December 31, 2008, such loan had not been repaid.As of December 31, 2008, the cumulative budgeted Replacement Fund assessments,less expenditures, were more than the funds specifically allocated assets by $89,285.Subject to available cash balances, the Board intends to repay that amount to theReplacement Fund during 2009 and has, therefore, reflected it as an interfund receivableand payable.7

SOUTHPARK HOMEOWNERS' ASSOCIATION NUMBER 2NOTES TO FINANCIAL STATEMENTSDECEMBER 31, 2008NOTE 5. FEDERAL AND STATE CORPORATE INCOME TAXESThe Association may elect annually to file its income tax return as a regular corporationor as a homeowners <strong>association</strong> in accordance with Code Section 528.For the current year, as in recent years, the Association filed its income tax return as aregular corporation. In certain prior years, the Association had an excess of expensesfor the maintenance of the common property over membership source income. Thatexcess, in the amount of $121,092, was carried over to future periods to offset futureincome when it files as a regular corporation. Such loss carryover, after a partial 2008utilization, totals $95,835 at December 31, 2008.The Association's investment income and other non-exempt income were subject to tax,resulting in a liability of $4,451 as of December 31, 2008.NOTE 6. REAL PROPERTYAlthough this is not a title report or opinion, based on information provided, theAssociation appears to own the following properties:(a) Filing 7 Tract A: all land and improvements thereon which surroundLots 1-21 and Lots 68-146(b) Filing 7 Tract B: all land and improvements thereon which surroundLots 22-67(c) Filing 9 Tract A: all land and improvements thereon which surroundLots 1-190(d) Filing 9 Tract B: all land and improvements thereon which surround Lots191-293(e) Filing 9 Tract C: includes all open space/greenbelt area which isdesignated as a drainage easement and storm detention pond area(f) Filing 10 Tract A: all land and improvements thereon which surroundLots 1-56(g) Filing 3 Tract D: clubhouse, pool and tennis court(h) Private drives and parking areas between buildingsThe disposition and use of that property is restricted by the Association's governingdocuments. Each member of the Association has a beneficial or undivided interest insuch property.Additionally, West Long Drive, West Long Avenue, West Long Circle, and West LongCourt have been dedicated to the city.8

SOUTHPARK HOMEOWNERS' ASSOCIATION NUMBER 2NOTES TO FINANCIAL STATEMENTSDECEMBER 31, 2008NOTE 7. CONTINGENCIESThe Association is a party to various legal actions normally associated with homeowners<strong>association</strong>s, such as the collection of delinquent assessments and covenant compliancematters, the aggregate effect of which, in management’s opinion, would not be materialto the future financial condition of the Association.9

Independent Accountant's Reporton Supplementary InformationBoard of Directors and Members<strong>Southpark</strong> Homeowners' Association Number 2Arapahoe County, ColoradoThe supplementary information on Future Major Repairs and Replacements on pages 11and 12 is not a required part of the basic financial statements but is supplementaryinformation required by the American Institute of Certified Public Accountants. We haveapplied certain limited procedures, which consisted principally of inquiries ofmanagement regarding the methods of measurement and presentation of thesupplementary information. However, we did not audit the information and express noopinion on it.Omeron and Associates, P.C.January 23, 200910

SOUTHPARK HOMEOWNERS’ ASSOCIATION NUMBER 2SUPPLEMENTARY INFORMATION ON FUTURE MAJOR REPAIRS AND REPLACEMENTSDECEMBER 31, 2008(UNAUDITED)The Board updated a prior study in December 2003, which has not been subsequentlyupdated, to establish a stable level of reserve funding and to estimate the remaininguseful lives and the replacement costs of the components of common property. Theestimates were obtained from an independent engineering company which inspected theproperty.To provide sufficient funds when needed for such repairs and replacements, the studyrecommended the replacement fund component of the monthly assessment be set at$10.00 per unit, or $65,760 per year, effective 2004, and be increased by 4% annuallythereafter. Replacement Fund’s assessments were $111,792 for 2008. If suchassessment increases are implemented, the 2003 study anticipated sufficient funds tomeet its anticipated expenditures through the year 2017, and is based on a 4% annualrate of investment income.The tables below and on the following page are based on the study and presentsignificant information about the costs of repair and replacement of the Association’scommon property.UNAUDITED - AS OF DECEMBER 2003Average Per Unit Replacement Fund Replacement FundMonthly Total TotalReplacement Fund Assessment AnnualYear Beginning Assessment Income ExpensesJanuary 2004 $10.00 $65,760 $84,538January 2005 10.40 68,390 102,726January 2006 10.82 71,152 74,544January 2007 11.25 73,980 114,922January 2008 11.70 76,939 83,616January 2009 12.17 80,030 145,286January 2010 12.65 83,186 97,974January 2011 13.16 86,540 139,956January 2012 13.69 90,025 78,624January 2013 14.23 93,576 302,710January 2014 14.80 97,325 121,142January 2015 15.39 101,205 96,531January 2016 16.01 105,282 116,299January 2017 16.65 109,490 114,532Total $1,202,880 $1,673,40011

SOUTHPARK HOMEOWNERS’ ASSOCIATION NUMBER 2SUPPLEMENTARY INFORMATION ON FUTURE MAJOR REPAIRS AND REPLACEMENTSDECEMBER 31, 2008(UNAUDITED)(Continued from page 11)FutureCost forOneCategory of expenseCycle ofRepair *Parking & curbing, excluding streets $68,355Concrete replacement, including pool deck 34,182Fencing, retaining walls, lighting and irrigation system 182,930Clubhouse exterior, including roof 9,015Clubhouse interior, including carpet 46,778Pool, tennis court, and playground 121,270Clubhouse equipment 6,600Pool equipment 35,900Total $505,030Net cash in Replacement Fund, December 31, 2008 $609,867* without adjustment for inflation12