Paper 8.iii - Royal United Hospital Bath NHS Trust

Paper 8.iii - Royal United Hospital Bath NHS Trust

Paper 8.iii - Royal United Hospital Bath NHS Trust

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Report to: Public <strong>Trust</strong> Board Agenda item: 8. iiiDate of Meeting: 10 November 2010Title of Report:Status:Board Sponsor:Author:AppendicesFinance reportDiscussionCatherine Phillips, Director of FinanceBeverley Goddard, Deputy Director of Finance1 - Income & expenditure summary as at 31 st October 20102 - Income variances as at 30 th September 20103 - Savings position as at 31 st October 20104 - Balance Sheet as at 31 st October 20105 - Cash flow as at 31 st October 20106 - Capital programme as at 31 st October 20107 - Financial risks 2010/118 - Indicative financial risk rating 2010/111. Purpose of Report (Including link to objectives)The purpose of this report is to set out the <strong>Trust</strong>’s financial performance for the periodto 31 st October 2010, including:• Income and expenditure;• Savings plans;• Capital expenditure;• Financial risks.This report is linked to the <strong>Trust</strong>’s priority objective for 2010/11 of improving value formoney and the key standard of delivering financial balance.2. Summary of Key Issues for DiscussionThis report details the current and forecast performance against each of the <strong>Trust</strong>’smain financial duties and the key risks and assumptions in the delivery of thosefinancial targets, and includes recommendations where further action is required.3. Recommendations (Note, Approve, Discuss etc)The Board should note the <strong>Trust</strong>’s financial forecasts including the change to theplanned surplus (see section 1). Action: AllThe Board should note the basis of the <strong>Trust</strong>’s income for October 2010, and theover-performance against plan year to date relating to the <strong>Trust</strong>’s eighteen weekrecovery plan (see section 2.2). Action: AllThe Board should note that the deficit year to date is mainly generated by unachievedAuthor : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 1 of 21

savings and non-pay expenditure, but pay expenditure is also increasing (see section2.3 and 2.4). Action: AllSavings plans need to be fully identified and implemented (sections 2.4). Action –Divisions/Director of OperationsThe Board should note the forecast for capital expenditure, which includes additionalfunding from the Department of Health (section 3). Action – AllTo understand the key risks and the actions being taken to mitigate them (section 4).Action – All.4. Care Quality Commission Regulations (which apply)Care Quality Commission Regulation 13: Financial position‘People can be confident that the provider has the financial resources needed toprovide safe and appropriate services.’5. Legal / Regulatory Implications (<strong>NHS</strong>LA / ALE etc)ALE implications: all themes (Financial Reporting, Financial Management, FinancialStanding, Internal Control and Value for Money)6. Risk (Threats or opportunities link to risk on register etc)See section 5: ‘Financial Risks’7. Resources Implications (Financial / staffing)Not applicable8. Equality and DiversityNot applicable9. CommunicationNot applicable10. References to previous reportsStanding item11. Freedom of InformationAuthor : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 2 of 21

PublicAuthor : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 3 of 21

The <strong>Trust</strong>’s Financial Performance as at 31 st October 2010(Month 7 2010/11)1 Summary Performance – Financial Duties1.1 The table below summarises the current and forecast performance againstthe financial duties of the <strong>Trust</strong>.Financial Duties Target CurrentPerformanceForecastOutturnBalancing Income & Expenditure in0 £1.7m deficit Break evenyearMeeting the planned surplus +£4.2m See sections 1 +4.2m& 2Achieving the External Financing Limit -£8.4m On target -£8.4mAchieve the Capital Resource Limit +£8.5m See section 3 +£8.5mIn addition the <strong>Trust</strong> has subsidiary duties:Capital Cost Absorption Rate 3.5% On target 3.5%Better Payments Practice Code –number of invoices (non <strong>NHS</strong>) 95% 96% 95%Better Payments Practice Code –value of invoices (non <strong>NHS</strong>) 95% 91% 90%1.21.31.41.51.61.71.8The <strong>Trust</strong> is forecasting breakeven against its planned budget in 2010/11.This will enable the <strong>Trust</strong> to meet its control total of £4.2m surplus, asagreed with <strong>NHS</strong> South West.The <strong>Trust</strong>’s control total has been revised following a review of the <strong>Trust</strong>’soutstanding legacy debt by <strong>NHS</strong> South West and the Department of Health.The <strong>Trust</strong> will pay its loan repayment as planned for the year but thesurplus necessary to achieve this has been reassessed as £4.2m. Thereassessment was based on the <strong>Trust</strong>’s balance sheet and the impact ofimpairments in previous years on the <strong>Trust</strong>’s income and expenditurereserve.This technical adjustment to the <strong>Trust</strong>’s control total does not detract fromthe <strong>Trust</strong>’s requirement to break-even against its planned budget in2010/11, nor does it increase the budget available to the <strong>Trust</strong> in year.The External Financing Limit will be achieved through the management ofcash and working balances, and the planned repayment of the loan.The <strong>Trust</strong> will comply with its Capital Resource Limit (see section 3).Author : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 4 of 21

1.91.10The <strong>Trust</strong>’s Capital Cost Absorption rate (CCA) will be 3.5% in 2010/11.The <strong>Trust</strong> is planning to maintain and improve its Better Payment PracticeCode performance in 2010/11.2. Income and Expenditure2.1 The <strong>Trust</strong> has a deficit against its planned budgets for the year to date of£1.7m as shown in Appendix 1.2.22.2.12.2.22.2.32.2.42.2.52.32.3.12.3.2Income and ActivityThe <strong>Trust</strong>’s planned income (as shown in Appendix 1) is based on theincome and activity contract signed with its commissioners on 17 th May.The actual income shown in Appendix 1 (and in more detail in Appendix 2)is based on the <strong>Trust</strong>’s performance for the six months to 30 th September2010, as income figures for October were not available at the time ofwriting.This shows that the <strong>Trust</strong>’s activity-related income has exceeded its plan inthe year to date by £2.6m, particularly for elective inpatient and day casework.The <strong>Trust</strong> is anticipating payment for elective work undertaken under theterms of the signed contract as part of the eighteen-week recovery plan,whilst working with its commissioners to understand and manage theimpact of further activity increases.The level of over-performance against plan has meant that the <strong>Trust</strong> hasbeen unable to disinvest from operational areas as intended; this costequates to £1.5m for the year to date and has been recognised in theexpenditure position as set out below (see section 2.3).ExpenditureThe <strong>Trust</strong> has an adverse variance against plan of £1.7m as at 31 st October2010.This variance comprises the net impact of additional income anddisinvestment foregone, unmet savings, and expenditure excesses asfollows:Author : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 5 of 21£m

Income over-performance (see section 2.2) -2.7Disinvestment not achieved 1.5Savings unachieved 1.4Pay overspends 0.2Non pay overspends 1.5Other income received (less than planned) 0.2Depreciation (less than planned) -0.4Financial position as at 31 st October 2010 1.72.3.3 The overspend against the planned expenditure budget of £4.8m (includingdisinvestment) is summarised in the table below:Key expenditure variances October 2010Budget –PlannedExpenditureActualExpenditureVariance toplanOctober 2010£m £m £mPayMedical staff establishment 23.6 23.2 -0.4Locum doctors & waiting list initiatives 0.4 1.3 0.9Medical staff savings unmet -0.1 0.0 0.1Nursing establishment 26.3 24.9 -1.4Nurse bank 0.3 2.3 2.0Agency nursing 0.0 0.1 0.1Nursing savings unmet -0.1 0.0 0.1Other pay costs 28.1 27.1 -1.0Other pay savings -0.2 0.0 0.2Total pay variances 0.6Non pay expenditureGeneral non pay 33.3 34.8 1.5Non pay savings unmet -1.0 0.0 1.0Disinvestment foregone -1.5 0.0 1.5Divisional income -20.7 -20.5 0.2Total variance to divisional plans 4.82.3.22.3.32.3.4Unmet savings have been allocated to staff group or non pay category, andtotal £1.4m for the year to date (staffing £0.4m; non pay £1.0m).There are other variances in pay and non pay; the most significant of theseare medical & surgical consumables (£0.5m year to date) and prosthesis(£0.3m).There are also over spends on nursing staff (£0.7m) and medical staffing(£0.5m) year to date which are offset in part by reduced expenditure onother staff groups.Author : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 6 of 21

2.3.52.3.6All expenditure that exceeds planned budgets is investigated and monitoredas part of the <strong>Trust</strong>’s performance regime, and remedial actions are put intoplace to re-gain financial control.The performance against budget for the year to date, compared toexpenditure in 2009/10, is shown in the charts below:Analysis of Pay by month for the <strong>Trust</strong> in totalActual Pay 2010-11 Budgeted Pay 2010-11 Actual Pay 2009-1012,50012,000£(000's)11,50011,00010,500April May June July Aug Sept Oct Nov Dec Jan Feb MarchMonthsAnalysis of non pay by month for the <strong>Trust</strong> in totalActual Non-Pay 2010-11 Budgeted non-Pay 2010-11 Actual Non-Pay 2009-107,5007,0006,5006,000£(000's)5,5005,0004,5004,0003,5003,000April May June July Aug Sept Oct Nov Dec Jan Feb MarchMonthsAuthor : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 7 of 21

2.3.7 Actions to control expenditure must be sustained and extended to ensurethat the <strong>Trust</strong> maintains financial stability in 2010/11.2.4 Savings 2010/112.4.12.4.22.4.32.4.42.4.52.4.6The <strong>Trust</strong> had an initial savings requirement of £11m for the financial yearand is projecting to achieve this target through recurrent cash savings.A further £2.4m savings were met non-recurrently in 2009/10 and havetherefore been brought forward to 2010/11.In order to ensure that savings are achieved in 2010/11 in full, additional‘stretch’ plans have been identified of £1.5m.The <strong>Trust</strong> is therefore aiming for a total savings target of £15m. Appendix 3details the progress to date against the <strong>Trust</strong>’s savings plans for 2010/11.The <strong>Trust</strong> planned to make savings of £8.1m year to date, and achieved£6.7m of this target. There are unachieved savings of £1.4m at 31 st October2010 which have contributed to the <strong>Trust</strong>’s adverse financial position inyear.The <strong>Trust</strong> has risk assessed its savings throughout the year and thechanging risk profile is shown in the following graph:Assurance assessment of 2010/11 CRES projects16,00014,000Value £00012,00010,0008,0006,0004,000No planRedAmberGreenComplete2,0000Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb MarMonth2.4.7 Divisions must ensure that all savings plans are fully identified andimplemented. Plans will be monitored through the financial performancereview process to ensure that they are being delivered.Author : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 8 of 21

2.52.5.12.5.22.5.32.5.42.5.52.5.6Forecast outturn 2010/11The <strong>Trust</strong> is forecasting that it will manage its income and expenditurewithin its planned budgets in order to generate the £4.2m surplus requiredto make its loan repayment in 2010/11 (see section 1 for the change intarget surplus).The main risks to the forecast outturn year to date are unmet savings (see2.4 above) and divisional cost control, particularly in non-pay (see 2.3above).The <strong>Trust</strong>’s savings plans for the year include ‘stretch’ targets which shouldmitigate the unmet savings year to date.Expenditure must be carefully controlled and kept within budgets, includingthe additional costs of meeting targets such as waiting times.The <strong>Trust</strong>’s activity and income contract for 2010/11 includes provisions forreimbursement for additional activity.The <strong>Trust</strong>, however, is planning that it will work with commissioners tomanage the flow of activity, and therefore additional income above planshould not form part of the <strong>Trust</strong>’s forecast outturn. The exceptions to this,as discussed in section 2.2 above are:- The eighteen-week waiting times recovery plan;- The extent to which the <strong>Trust</strong> has been unable to disinvest as planned inresponse to the anticipated Treatment Centre transfers.2.5.7The <strong>Trust</strong>’s forecast financial position for 2010/11 will be updated monthlyand provided as part of future <strong>Trust</strong> Board reports.3. The <strong>Trust</strong>’s Balance Sheet including cash and debt3.1 Appendix 4 details the current and forecast balance sheet for the financialyear. There are currently no significant issues to note.3.23.2.13.2.2Cash positionThe <strong>Trust</strong> is forecasting that it will meet its External Financing Limit (EFL)and planned cash balance at the year-end.The <strong>Trust</strong>’s actual and forecast cash flow for the year is shown in Appendix5, and its movements in cash and working capital (debtors and creditors)are shown in the graph below.Author : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 9 of 21

50 ,0 0 040 ,0 0 030 ,0 0 020 ,0 0 010 ,0 0 0T ru st W o rk in g C a p ita l M o v e m e n tsC a s h a n d C a s hE q u iva le n tsTra d e a nd O th e rR e c eiva b le sInve n torie sTra d e a nd O th e rP a y ab le sB o rro w ing sN e t c u rre nt a s s e ts£ '0 0 00(10 ,0 0 0 )(20 ,0 0 0 )(30 ,0 0 0 )(40 ,0 0 0 )N o v -0 9 D e c -0 9 J a n -1 0 F e b -1 0 M a r-1 0 A p r-1 0 M a y -1 0 J u n -1 0 J u l-1 0 A u g -1 0 S e p -1 0 O c t-1 03.33.3.13.3.2Better Payment Practice PolicyThe <strong>Trust</strong>’s Better Payment Practice percentages over the past twelvemonths are shown in the graph below.The <strong>Trust</strong> has developed an action plan to improve its overall BetterPayment Practice performance within its treasury management constraints.1 0 09 39 59 29 6 9 69 8 9 7 98 9 79 59 6 9 69 0878 28 48 07 27 67 0% 6 06 1P a id w ith in 3 0 d ay sP a id w ith in 1 0 d ay s5 04 0394 23 94 54 33 33 02 0N o v -0 9 D e c -0 9 J a n -10 F e b -1 0 M a r-1 0 A p r-1 0 M a y -1 0 J u n -1 0 J u l-1 0 A u g -1 0 S e p -1 0 O c t-10Author : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 10 of 21

3.43.4.1Outstanding Debts Owed to the <strong>Trust</strong>An analysis of income earned by the <strong>Trust</strong> but unpaid as at 31 st October2010 is shown in the table below:DebtTotal£mNot due£mUp to 30days£mUp to 60days£mUp to 90days£mOlder<strong>NHS</strong> 20.4 15.5 0.6 0.3 0.7 3.3Non-<strong>NHS</strong> 0.7 0.3 0.2 0.0 0.1 0.1Total 21.1 15.8 0.8 0.3 0.8 3.4£m3.4.23.4.34.4.14.24.34.44.54.64.7Of the <strong>NHS</strong> debt outstanding for more than thirty days at 31 st October,£0.4m is owed by the <strong>Royal</strong> National <strong>Hospital</strong> for Rheumatic DiseasesFoundation <strong>Trust</strong> (RNHRD FT); this position is being monitored closely.There was an increase in <strong>NHS</strong> debtors not due in October because of anagreed change to the timetable for raising invoices to the <strong>Trust</strong>’scommissioners for October only.Capital investment in 2010/11Appendix 6 details the current capital programme of the <strong>Trust</strong> andexpenditure to date.The <strong>Trust</strong> has a Capital Resource Limit (CRL) for 2010/11 of £8.5m, withfurther investment plans of £2.5m from charitable funding.There are two major capital schemes planned for the year: the new NICU(£3.6m) and the Linac bunker and equipment (£2.5m). Both of theseschemes are part funded from charitable donations, as shown in Appendix5.Orders have been placed for the NICU development and other schemestotalling £4.0m, and actual expenditure up to 31 st October 2010 amounts to£3.0m.The <strong>Trust</strong> has been notified that it will receive an additional allocation ofcapital funding this year from the Department of Health; £5.1m will be madeavailable to support the <strong>Trust</strong>’s plans to invest in Combined Heat andPower plant.The additional investment is reflected in the chart below and in Appendix 6.Orders will be placed as soon as possible so that capital funding is investedAuthor : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 11 of 21

as planned within the financial year. The forecast trend for capitalexpenditure is shown in the graph below.1 4,0 0 01 2,0 0 01 0,0 0 08,0 0 0£ '0 0 06,0 0 0P la n n e d C a pe x (C u m u la tive)A c tu a l C a pe x (C u m u la tive)4,0 0 02,0 0 00A p r-1 0 M a y -1 0 J u n -1 0 J u l-1 0 A u g -10 S e p -1 0 O c t-1 0 N o v -1 0 D e c -1 0 J a n -1 1 F e b -1 1 M a r-1 15.5.15.25.35.4Financial RisksA summary of the <strong>Trust</strong>’s financial risks which have been highlightedthrough the business planning process are set out in Appendix 7.These risks, comments and actions form part of the <strong>Trust</strong>’s normal planningand risk management processes.The <strong>Trust</strong>’s indicative financial risk rating has been calculated according tothe criteria set out by Monitor for foundation trusts, and is set out inAppendix 8. Based on the <strong>Trust</strong>’s financial plans for 2010/11, the <strong>Trust</strong>’sindicative risk rating is 4.The <strong>Trust</strong> would need a risk rating of at least 3 to become a foundationtrust, whilst a score of 5 would be the equivalent of a high-performingfoundation trust.6. Conclusion6.16.2The <strong>Trust</strong> is forecasting that it will comply with all its statutory financialduties for the financial year (see section 1).The <strong>Trust</strong> has not balanced its income and expenditure year to date, but willredress this during the remainder of the year in order to achieve the £4.2msurplus required to meet its planned loan repayments.Author : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 12 of 21

6.3 The adverse variance compared to expenditure plans for the seven monthsto 31 st October 2010 is mainly due to unachieved savings and non payexpenditure.7. Recommendations7.17.27.37.47.57.6The Board should note the <strong>Trust</strong>’s financial forecasts including the changeto the planned surplus (see section 1). Action: AllThe Board should note the basis of the <strong>Trust</strong>’s income for October 2010,and the over-performance against plan year to date relating to the <strong>Trust</strong>’seighteen week recovery plan (see section 2.2). Action: AllThe Board should note that the deficit year to date is mainly generated byunachieved savings and non-pay expenditure, but pay expenditure is alsoincreasing (see section 2.3 and 2.4). Action: AllSavings plans need to be fully identified and implemented (sections 2.4).Action – Divisions/Director of OperationsThe Board should note the forecast for capital expenditure, which includesadditional funding from the Department of Health (section 3). Action – AllTo understand the key risks and the actions being taken to mitigate them(section 4). Action – All.Author : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 13 of 21

Appendix 1: Income and expenditure summary for the seven months to 31 st October 2010Variance Year-to Actual VarianceAnnual In Month In Month In Month Date Year-to Year-toBudget Budget Expend(Favourable) /adverse Budget Date(Favourable) /adverse£000s £000s £000s £000s £000s £000s £000sINCOME FROM ACTIVITIES (175,920) (14,849) (15,088) (240) (102,674) (105,281) (2,606)OTHER INCOME (7,364) (807) (791) 15 (4,635) (4,746) (111)EDUCATION, TRAINING AND RESEARCH (8,334) (788) (788) (0) (5,622) (5,622) (0)NON-PATIENT CARE SERVICES TO OTHER BODIES (197) (16) (16) 0 (115) (109) 6INTER TRUST INCOME (9,309) (775) (762) 12 (5,436) (5,406) 30PRIVATE & OVERSEAS PATIENTS (1,344) (112) (112) (0) (784) (494) 290DIRECT CREDITS (9,037) (772) (758) 14 (5,604) (5,672) (68)TRUST REVENUE = TOTAL INCOME (211,505) (18,118) (18,316) (198) (124,870) (127,330) (2,459)OPERATING EXPENSESPAY 133,612 11,094 11,296 202 78,342 78,942 600NON PAY 63,068 4,759 5,086 328 32,341 34,824 2,483DISINVESTMENT (3,350) (110) 0 110 (1,550) 0 1,550EBITDA * (18,175) (2,375) (1,934) 441 (15,737) (13,563) 2,174Capital ChargesINTEREST PAYABLE 1,030 86 72 (14) 601 599 (2)INTEREST RECEIVABLE (34) (3) (3) 0 (20) (18) 2PDC 4,699 392 356 (36) 2,741 2,654 (87)DEPRECIATION 8,280 690 629 (61) 4,830 4,512 (318)Capital Charges 13,975 1,165 1,054 (110) 8,152 7,748 (404)NET (SURPLUS) / DEFICIT (4,200) (1,211) (880) 331 (7,585) (5,815) 1,770* Earnings before, interest, taxation, depreciation and amortisationAuthor : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 14 of 21

Appendix 2: Activity-related income variances for the six months to 30 th September 2010By division By commissioner By patient typeVarianceto plan£mVarianceto plan£mVarianceto plan£mDisinvestment foregone - 1.5 <strong>NHS</strong> B&NES - 0.9 A&E attendances -Other - 1.2 <strong>NHS</strong> Wiltshire - 1.1 Day cases - 0.9<strong>NHS</strong> Somerset - 0.9 Elective - 0.6Other associate commissioners 0.2 Non-elective - 0.3Non contractual activity - Outpatients 0.1Other - 1.0Total variance - 2.7 Total variance - 2.7 Total variance - 2.7Author : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 15 of 21

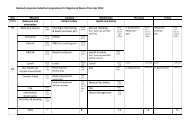

Appendix 3: Savings 2010/11 as at 31 st October 2010DivisionSavings by Division – year to dateNote (negative figures) denote an adverse varianceYTD planYTDachievementYTDvariance£’000s £’000s £’000sMedicine 1,632 1,284 (348)Surgery 1,775 1,138 (637)Specialty 1,428 1,117 (311)Facilities 605 619 14Corporate 828 737 (90)Central Schemes 1,818 1,818 0TOTAL 8,086 6,713 (1,373)By theme – <strong>Trust</strong> totalSavings by theme – year to dateCYEPlanYTDplanYTDachievementYTDvariance£000s £000s £000s £000sIncome 484 282 278 (5)Procurement 1,735 908 629 (280)Medicines Management 840 511 340 (171)Staff Productivity 3,149 1,725 1,614 (111)Service reviews and activitycontrols 3,761 2,016 1,707 (309)Length of stay projects 1,353 668 659 (9)Back office reviews 791 498 400 (98)Further workstreams 2,228 1,122 1,087 (35)Gap 630 354 0 (354)TOTAL 14,970 8,086 6,713 (1,373)Author : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 16 of 21

Appendix 4: Balance Sheet as at 31 st October 2010Statement of Financial Position as at 31 October 201031 March 2010 31 October 2010 31 March 2011£'000 £'000 £'000NON-CURRENT ASSETSProperty, Plant and Equipment 145,836 143,799 149,615Intangible Assets 760 659 101Other Financial Assets 121 121 55Trade and Other Receivables 1,762 1,762 1,300TOTAL NON-CURRENT ASSETS 148,479 146,341 151,071CURRENT ASSETSInventories 3,139 3,022 2,600Trade and Other Receivables 11,026 29,536 13,594Other Financial Assets 61 61 55Cash and Cash Equivalents 690 3,865 2,000TOTAL CURRENT ASSETS 14,916 36,484 18,249CURRENT LIABILITIESTrade and Other Payables -10,858 -28,892 -17,321Other Liabilities -24 0 -24DH Working Capital Loan -7,000 -7,000 -7,200Borrowings -233 -93 -217Provisions for Liabilities and Charges -1,844 -1,302 -950TOTAL CURRENT LIABILITIES -19,959 -37,287 -25,712NET CURRENT ASSETS/(LIABILITIES) -5,044 -803 -7,463TOTAL ASSETS LESS CURRENT LIABILITIES 143,436 145,538 143,608NON-CURRENT LIABILITIESBorrowings -497 -497 -276DH Working Capital Loan -13,700 -10,200 -6,500Provisions for Liabilities and Charges -903 -903 -52Other Liabilities 0TOTAL NON-CURRENT LIABILITIES -15,100 -11,600 -6,828TOTAL ASSESTS EMPLOYED 128,336 133,938 136,780FINANCED BY TAXPAYERS EQUITY:Public Dividend Capital -130,445 -130,445 -136,045Prior Year Retained Earnings 44,425 44,425 40,230Current Year Retained Earnings 0 -5,815 0Revaluation Reserve -37,256 -37,256 -35,023Donated Asset Reserve -5,060 -4,848 -5,942TOTAL TAXPAYERS EQUITY -128,336 -133,938 -136,780Author : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 17 of 21

Appendix 5: Cash flow as at 31 st October 2010Statement of Cash Flows as at 31 October 20102010/112010/11Plan2010/11Year to dateForecastM7 to M12 November December January February March£000s £000s £000s £000s £000s £000s £000s £000sCASH FLOWS FROM OPERATING ACTIVITIESOperating surplus 11,500 9,051 839 95 128 109 71 436Depreciation and Amortisation 8,475 4,512 3,770 754 754 754 754 754Interest Paid -1,200 -527 -431 0 0 0 0 -431Dividend Paid -4,400 -2,298 -2,344 0 0 0 0 -2,344(Increase)/Decrease in Inventories 539 117 422 78 78 78 78 110(Increase)/Decrease in Trade and Other Receivables -2,568 -18,510 15,942 15,653 144 0 0 145Increase/(Decrease) in Trade and Other Payables 4,695 18,034 -11,571 -15,738 1,200 0 0 2,967Increase/(Decrease) in Provisions -1,115 -542 -1,203 -28 -54 -28 -28 -1,065Adjustment to accrued interest and dividend payable and other -36 -367 403 -463 -463 -463 -463 2,255Net Cash Inflow/(Outflow) from Operating Activities 15,890 9,470 5,827 351 1,787 450 412 2,827CASH FLOWS FROM INVESTING ACTIVITIESInterest received 100 18 10 2 2 2 2 2(Payments) for Property, Plant and Equipment -7,500 -2,813 -9,212 -937 -828 -709 -1,607 -5,131Net Cash Inflow/(Outflow)from Investing Activities -7,400 -2,795 -9,202 -935 -826 -707 -1,605 -5,129NET CASH INFLOW/(OUTFLOW) BEFORE FINANCING 8,490 6,675 -3,375 -584 961 -257 -1,193 -2,302CASH FLOWS FROM FINANCING ACTIVITIESAdditional Public Dividend Capital 0 0 5,600 0 5,100 0 0 0Working Capital Loans Repayment of Principal -7,000 -3,500 -3,500 0 0 0 0 -3,500Capital Element of Finance Leases and PFI -180 0 -90 0 0 -90 0 0Net Cash outflow from Financing -7,180 -3,500 1,510 0 5,100 -90 0 -3,500Net increase/(decrease) in Cash and Cash Equivalents 1,310 3,175 -1,865 -584 6,061 -347 -1,193 -5,802Cash and Cash Equivalents at the Beginning of the Period 690 690 3,865 3,865 3,281 9,342 8,995 7,802Cash and Cash Equivalents at the End of the Period 2,000 3,865 2,000 3,281 9,342 8,995 7,802 2,000Author : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 18 of 21

Appendix 6: Capital investment plans and expenditure for 2010/11as at 31 st October 2010Capital Expenditure as at 31 October 2010Annual budget 2010/11Exchequer funding year to date positionTotal Donated Exchequer Spend Commitments Outstandingunder/(over)Description £'000 £'000 £'000 £'000 £'000 £'000OPERATIONAL CAPITALEstates 5 year programme 1,702 1,702 434 538 730Information Management & TechnologyprogrammeServers 100 100 72 28 0PCs rolling replacemt 320 320 67 69 184Millennium, incl Ward Hardware 125 125 1 124Digital Dictation 150 150 150Wireless <strong>Hospital</strong> 200 200 200Power Management 50 50 50Total IM&T 945 0 945 139 98 708Medical Equipment Committee programmeMedical Equipment Committee rolllingreplacement (see note) 800 500 300 222 77 1Linac machine including installation 2,405 1,000 1,405 1,182 223Cath Lab 1,000 1,000 1,000Total Medical Equipment Committee 4,205 1,500 2,705 222 1,259 1,224LEASED ASSETS 50 50 50TOTAL OPERATIONAL CAPITAL 6,902 1,500 5,402 795 1,895 2,712STRATEGIC CAPITALNICU 3,744 1,000 2,744 1,204 1,540 0CHP scheme 1,500 1,500 8 1,492Windows 500 500 500Corridor upgrades 390 390 390Linac Bunker 364 364 361 3 0Theatre Upgrade 350 350 67 283Shared Front Door - SAU 296 296 155 269 (128)Mini CHP plants 250 250 250Hamilton 128 128 66 8 54Wayfinding 126 126 13 113Ward kitchens, bathrooms, showers 125 125 3 122CPU 100 100 100 0External Lighting 100 100 100DSSA compliance 75 75 75Waste Upgrades 53 53 24 16 13Demolition 50 50 50Estates Masterplan 32 32 24 2 6Qulturum 10 10 10Other Strategic Projects 26 26 26 0Strategic Project Management 157 157 34 123 0TOTAL STRATEGIC CAPITAL 8,376 1,000 7,376 2,018 2,028 3,330Planned (deferral)/underspend (178) (178) (178)TOTAL CAPITAL REQUIREMENT 15,100 2,500 12,600 2,813 3,923 5,864CAPITAL FUNDINGDepreciation (Purchased Assets) 8,500 8,500Loan Repayment (1,000) (1,000)Additional DH capital 5,100 5,100TOTAL EXCHEQUER FUNDING 12,600 12,600 2,813 3,923 5,864Charitable Funding 2,500 2,500TOTAL CAPITAL FUNDING 15,100 2,500 12,600 2,813 3,923 5,864Note: Charitable funding figure for medical equipment is provisional, subject to case by case applicationsAuthor : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 19 of 21

Appendix 7: Financial Risks 2010/11Issue Description of Risk Controls in Place Healthcare Core organisationalStandard Domain objective affectedaffectedLikelihoodof RiskSeverity ofRiskPotentialvalueRisk ScoreDelivery of savingsAs a result of the divisions not meeting their savings targets there is arisk that the <strong>Trust</strong>'s surplus for the year will not be achieved whichmeans that <strong>Trust</strong>'s expenditure would exceed its plan and the <strong>Trust</strong>may not achieve its planned surplus of £6.0m and the scheduledrepayment of the legacy debt resulting in a breach of statutory dutyDetailed savings plans have beendeveloped by the divisions which will bemonitored throughout the yearGovernance Business health Possible Moderate £3m LowFinalising contract andbusiness rules<strong>NHS</strong> TC transfers anddisinvestmentAs a result of <strong>Trust</strong>'s contract with commissioners for 2010/11 notbeing finalised before the start of the financial year, including'business rules' proposals, there is a risk that the <strong>Trust</strong> may not earnenough income to make its planned surplus of £6.0m and thescheduled repayment of its legacy debt resulting in a breach ofstatutory dutyAs a result of unplanned changes in the activity flow to otherproviders there is a risk that the <strong>Trust</strong> will incur additional costs orlose additional income which means that the <strong>Trust</strong> may not achieveits planned surplus and the scheduled repayment of its legacy debtresulting in a breach of statutory dutyThe contract was signed on 17th May 2010 Governance Business health Unlikely Moderate £3m Lowwith income at the level set out in the 'most(waslikely' financial management plan'Possible')Divisions have developed disinvestmentplans to reduce their cost base in responseto activity transfers to <strong>NHS</strong> TC which willbe monitored throughout the year.Processes set up to ensure that activitytransfers to treatment centres as planned.Governance Business health Likely Moderate £1m MediumFines within final contract As a result of the terms of the final contract there is a risk that the The contract was signed on 17th May 2010 Governance Business health Possible Moderate £3m Medium<strong>Trust</strong> may incur fines which will result in unplanned expenditure which without excessive fining; the <strong>Trust</strong> is alsomeans that the <strong>Trust</strong> may not achieve its planned surplus of £6.0mand the scheduled repayment of its legacy debt resulting in a breachplanning to meet its performance targetand minimise exposure to fines.of statutory dutyAuthor : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 20 of 21

Appendix 8: Indicative Financial Risk Ratings (based on financial plan 2010/11)Financial CriteriaWeight% Metric to be scored CalculationIndicativerating 2010/11Indicativescores2010/11Achievement of plan 10 EBITDA, % achieved E / PE 4 91%Underlying performance 25 EBITDA margin E / R 4 9%Financial efficiency 20 Return on Assets (ROA) Ret / A 4 6%20 I&E surplus margin (NS + FAI) / R 4 2%Liquidity 25 Liquid ratio (NCE + assumed WCF) / TC x days in period 3 19Weighted indicative score 4Data Code DescriptionFinancial Plan2010/11£mRevenue R Total income 212EBITDA E Earnings before interest, taxation, depreciation and amortisation 18.2Planned EBITDA PE As set out in operating plans for the year 20.0Net surplus NS Surplus or deficit for the period 4.2Fixed asset impairments FAI Impairments written off to the I&E account -Return Ret Net surplus plus PDC dividend payable plus impairments 8.9Assets A Average assets over period: fixed assets + stock + current debtors + cash + less current creditors 143.6Net cash equivalents NCE Cash + debtors + accrued income less trade creditors less other creditors less accruals -Working Capital Facility WCF Arrangement between bank & FT similar to an overdraft - estimated for this <strong>Trust</strong> 10.0Total costs TC Total costs excluding impairments, interest, taxation, depreciation and amortisation 193.4Author : Deputy Director of FinanceDate: 10 th November 2010Document Approved by: Director of FinanceVersion: 1Agenda Item: <strong>8.iii</strong> Page 21 of 21