Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

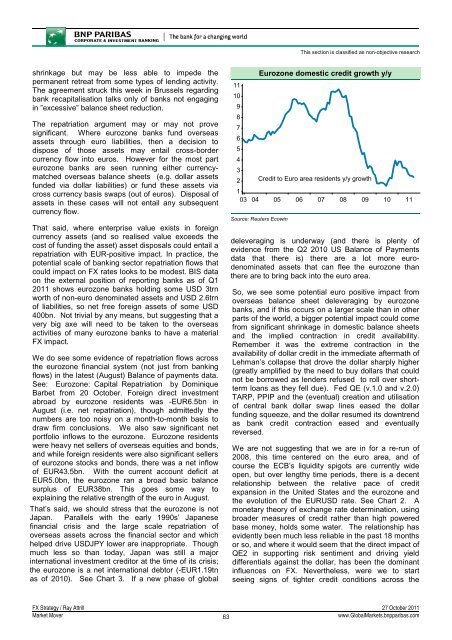

This section is classified as non-objective researchshrinkage but may be less able to impede thepermanent retreat from some types of lending activity.The agreement struck this week in Brussels regardingbank recapitalisation talks only of banks not engagingin ”excessive” balance sheet reduction.The repatriation argument may or may not provesignificant. Where eurozone banks fund overseasassets through euro liabilities, then a decision todispose of those assets may entail cross-bordercurrency flow into euros. However for the most parteurozone banks are seen running either currencymatchedoverseas balance sheets (e.g. dollar assetsfunded via dollar liabilities) or fund these assets viacross currency basis swaps (out of euros). Disposal ofassets in these cases will not entail any subsequentcurrency flow.That said, where enterprise value exists in foreigncurrency assets (and so realised value exceeds thecost of funding the asset) asset disposals could entail arepatriation with EUR-positive impact. In practice, thepotential scale of banking sector repatriation flows thatcould impact on FX rates looks to be modest. BIS dataon the external position of reporting banks as of Q12011 shows eurozone banks holding some USD 3trnworth of non-euro denominated assets and USD 2.6trnof liabilities, so net free foreign assets of some USD400bn. Not trivial by any means, but suggesting that avery big axe will need to be taken to the overseasactivities of many eurozone banks to have a materialFX impact.We do see some evidence of repatriation flows acrossthe eurozone financial system (not just from bankingflows) in the latest (August) Balance of payments data.See: Eurozone: Capital Repatriation by DominiqueBarbet from 20 October. Foreign direct investmentabroad by eurozone residents was -EUR6.5bn inAugust (i.e. net repatriation), though admittedly thenumbers are too noisy on a month-to-month basis todraw firm conclusions. We also saw significant netportfolio inflows to the eurozone. Eurozone residentswere heavy net sellers of overseas equities and bonds,and while foreign residents were also significant sellersof eurozone stocks and bonds, there was a net inflowof EUR43.5bn. With the current account deficit atEUR5.0bn, the eurozone ran a broad basic balancesurplus of EUR38bn. This goes some way toexplaining the relative strength of the euro in August.That’s said, we should stress that the eurozone is notJapan. Parallels with the early 1990s’ Japanesefinancial crisis and the large scale repatriation ofoverseas assets across the financial sector and whichhelped drive USDJPY lower are inappropriate. Thoughmuch less so than today, Japan was still a majorinternational investment creditor at the time of its crisis;the eurozone is a net international debtor (-EUR1.19tnas of 2010). See Chart 3. If a new phase of globalEurozone domestic credit growth y/y111098765432 Credit to Euro area residents y/y growth103 04 05 06 07 08 09 10 11Source: Reuters Ecowindeleveraging is underway (and there is plenty ofevidence from the Q2 2010 US Balance of Paymentsdata that there is) there are a lot more eurodenominatedassets that can flee the eurozone thanthere are to bring back into the euro area.So, we see some potential euro positive impact fromoverseas balance sheet deleveraging by eurozonebanks, and if this occurs on a larger scale than in otherparts of the world, a bigger potential impact could comefrom significant shrinkage in domestic balance sheetsand the implied contraction in credit availability.Remember it was the extreme contraction in theavailability of dollar credit in the immediate aftermath ofLehman’s collapse that drove the dollar sharply higher(greatly amplified by the need to buy dollars that couldnot be borrowed as lenders refused to roll over shorttermloans as they fell due). Fed QE (v.1.0 and v.2.0)TARP, PPIP and the (eventual) creation and utilisationof central bank dollar swap lines eased the dollarfunding squeeze, and the dollar resumed its downtrendas bank credit contraction eased and eventuallyreversed.We are not suggesting that we are in for a re-run of2008, this time centered on the euro area, and ofcourse the ECB’s liquidity spigots are currently wideopen, but over lengthy time periods, there is a decentrelationship between the relative pace of creditexpansion in the United States and the eurozone andthe evolution of the EURUSD rate. See Chart 2. Amonetary theory of exchange rate determination, usingbroader measures of credit rather than high poweredbase money, holds some water. The relationship hasevidently been much less reliable in the past 18 monthsor so, and where it would seem that the direct impact ofQE2 in supporting risk sentiment and driving yielddifferentials against the dollar, has been the dominantinfluences on FX. Nevertheless, were we to startseeing signs of tighter credit conditions across theFX Strategy / Ray Attrill 27 October 2011<strong>Market</strong> <strong>Mover</strong>63www.Global<strong>Market</strong>s.bnpparibas.com