Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

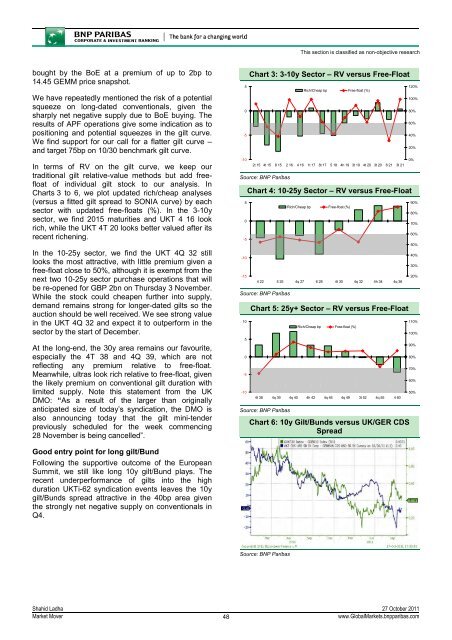

This section is classified as non-objective researchbought by the BoE at a premium of up to 2bp to14.45 GEMM price snapshot.We have repeatedly mentioned the risk of a potentialsqueeze on long-dated conventionals, given thesharply net negative supply due to BoE buying. Theresults of APF operations give some indication as topositioning and potential squeezes in the gilt curve.We find support for our call for a flatter gilt curve –and target 75bp on 10/30 benchmark gilt curve.In terms of RV on the gilt curve, we keep ourtraditional gilt relative-value methods but add freefloatof individual gilt stock to our analysis. InCharts 3 to 6, we plot updated rich/cheap analyses(versus a fitted gilt spread to SONIA curve) by eachsector with updated free-floats (%). In the 3-10ysector, we find 2015 maturities and UKT 4 16 lookrich, while the UKT 4T 20 looks better valued after itsrecent richening.In the 10-25y sector, we find the UKT 4Q 32 stilllooks the most attractive, with little premium given afree-float close to 50%, although it is exempt from thenext two 10-25y sector purchase operations that willbe re-opened for GBP 2bn on Thursday 3 November.While the stock could cheapen further into supply,demand remains strong for longer-dated gilts so theauction should be well received. We see strong valuein the UKT 4Q 32 and expect it to outperform in thesector by the start of December.At the long-end, the 30y area remains our favourite,especially the 4T 38 and 4Q 39, which are notreflecting any premium relative to free-float.Meanwhile, ultras look rich relative to free-float, giventhe likely premium on conventional gilt duration withlimited supply. Note this statement from the UKDMO: “As a result of the larger than originallyanticipated size of today’s syndication, the DMO isalso announcing today that the gilt mini-tenderpreviously scheduled for the week commencing28 November is being cancelled”.50-5-10Chart 3: 3-10y Sector – RV versus Free-Float2t 15 4t 15 8 15 2 16 4 16 1t 17 8t 17 5 18 4h 19 3t 19 4t 20 3t 20 8 21 3t 21Source: <strong>BNP</strong> Paribas50-5-10-15Rich/Cheap bp Free-float (%)Chart 4: 10-25y Sector – RV versus Free-Float4 22 5 25 4q 27 6 28 4t 30 4q 32 4h 34 4q 36Source: <strong>BNP</strong> Paribas1050-5-10Rich/Cheap bp Free-float (%)Chart 5: 25y+ Sector – RV versus Free-Float4t 38 4q 39 4q 40 4h 42 4q 46 4q 49 3t 52 4q 55 4 60Source: <strong>BNP</strong> ParibasRich/Cheap bp Free-float (%)Chart 6: 10y Gilt/Bunds versus UK/GER CDSSpread120%100%80%60%40%20%0%90%80%70%60%50%40%30%20%110%100%90%80%70%60%50%Good entry point for long gilt/BundFollowing the supportive outcome of the EuropeanSummit, we still like long 10y gilt/Bund plays. Therecent underperformance of gilts into the highduration UKTi-62 syndication events leaves the 10ygilt/Bunds spread attractive in the 40bp area giventhe strongly net negative supply on conventionals inQ4.Source: <strong>BNP</strong> ParibasShahid Ladha 27 October 2011<strong>Market</strong> <strong>Mover</strong>48www.Global<strong>Market</strong>s.bnpparibas.com