Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

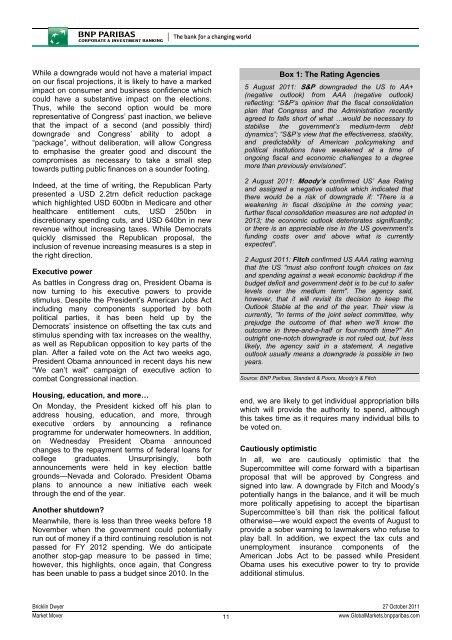

While a downgrade would not have a material impacton our fiscal projections, it is likely to have a markedimpact on consumer and business confidence whichcould have a substantive impact on the elections.Thus, while the second option would be morerepresentative of Congress’ past inaction, we believethat the impact of a second (and possibly third)downgrade and Congress’ ability to adopt a“package”, without deliberation, will allow Congressto emphasise the greater good and discount thecompromises as necessary to take a small steptowards putting public finances on a sounder footing.Indeed, at the time of writing, the Republican Partypresented a USD 2.2trn deficit reduction packagewhich highlighted USD 600bn in Medicare and otherhealthcare entitlement cuts, USD 250bn indiscretionary spending cuts, and USD 640bn in newrevenue without increasing taxes. While Democratsquickly dismissed the Republican proposal, theinclusion of revenue increasing measures is a step inthe right direction.Executive powerAs battles in Congress drag on, President Obama isnow turning to his executive powers to providestimulus. Despite the President’s American Jobs Actincluding many components supported by bothpolitical parties, it has been held up by theDemocrats’ insistence on offsetting the tax cuts andstimulus spending with tax increases on the wealthy,as well as Republican opposition to key parts of theplan. After a failed vote on the Act two weeks ago,President Obama announced in recent days his new“We can’t wait” campaign of executive action tocombat Congressional inaction.Housing, education, and more…On Monday, the President kicked off his plan toaddress housing, education, and more, throughexecutive orders by announcing a refinanceprogramme for underwater homeowners. In addition,on Wednesday President Obama announcedchanges to the repayment terms of federal loans forcollege graduates. Unsurprisingly, bothannouncements were held in key election battlegrounds—Nevada and Colorado. President Obamaplans to announce a new initiative each weekthrough the end of the year.Another shutdown?Meanwhile, there is less than three weeks before 18November when the government could potentiallyrun out of money if a third continuing resolution is notpassed for FY 2012 spending. We do anticipateanother stop-gap measure to be passed in time;however, this highlights, once again, that Congresshas been unable to pass a budget since 2010. In theBox 1: The Rating Agencies5 August 2011: S&P downgraded the US to AA+(negative outlook) from AAA (negative outlook)reflecting: “S&P’s opinion that the fiscal consolidationplan that Congress and the Administration recentlyagreed to falls short of what …would be necessary tostabilise the government’s medium-term debtdynamics”; “S&P’s view that the effectiveness, stability,and predictability of American policymaking andpolitical institutions have weakened at a time ofongoing fiscal and economic challenges to a degreemore than previously envisioned”.2 August 2011: Moody’s confirmed US’ Aaa Ratingand assigned a negative outlook which indicated thatthere would be a risk of downgrade if: “There is aweakening in fiscal discipline in the coming year;further fiscal consolidation measures are not adopted in2013; the economic outlook deteriorates significantly;or there is an appreciable rise in the US government’sfunding costs over and above what is currentlyexpected”.2 August 2011: Fitch confirmed US AAA rating warningthat the US "must also confront tough choices on taxand spending against a weak economic backdrop if thebudget deficit and government debt is to be cut to saferlevels over the medium term". The agency said,however, that it will revisit its decision to keep theOutlook Stable at the end of the year. Their view iscurrently, "In terms of the joint select committee, whyprejudge the outcome of that when we'll know theoutcome in three-and-a-half or four-month time?" Anoutright one-notch downgrade is not ruled out, but lesslikely, the agency said in a statement. A negativeoutlook usually means a downgrade is possible in twoyears.Source: <strong>BNP</strong> Paribas, Standard & Poors, Moody’s & Fitchend, we are likely to get individual appropriation billswhich will provide the authority to spend, althoughthis takes time as it requires many individual bills tobe voted on.Cautiously optimisticIn all, we are cautiously optimistic that theSupercommittee will come forward with a bipartisanproposal that will be approved by Congress andsigned into law. A downgrade by Fitch and Moody’spotentially hangs in the balance, and it will be muchmore politically appetising to accept the bipartisanSupercommittee’s bill than risk the political falloutotherwise—we would expect the events of August toprovide a sober warning to lawmakers who refuse toplay ball. In addition, we expect the tax cuts andunemployment insurance components of theAmerican Jobs Act to be passed while PresidentObama uses his executive power to try to provideadditional stimulus.Bricklin Dwyer 27 October 2011<strong>Market</strong> <strong>Mover</strong>11www.Global<strong>Market</strong>s.bnpparibas.com