Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

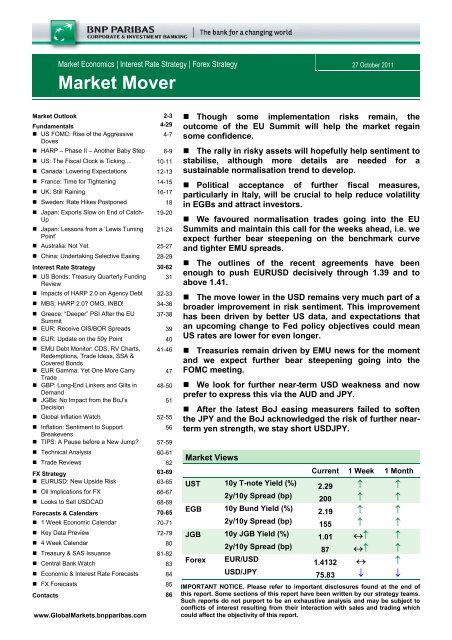

<strong>Market</strong> Economics | Interest Rate Strategy | Forex Strategy 27 October 2011<strong>Market</strong> <strong>Mover</strong><strong>Market</strong> Outlook 2-3Fundamentals 4-29• US FOMC: Rise of the Aggressive 4-7Doves• HARP – Phase II – Another Baby Step 8-9• US: The Fiscal Clock is Ticking… 10-11• Canada: Lowering Expectations 12-13• France: Time for Tightening 14-15• UK: Still Raining 16-17• Sweden: Rate Hikes Postponed 18• Japan: Exports Slow on End of Catch- 19-20Up• Japan: Lessons from a ‘Lewis Turning 21-24Point’• Australia: Not Yet 25-27• China: Undertaking Selective Easing 28-29Interest Rate Strategy 30-62• US Bonds: Treasury Quarterly Funding 31Review• Impacts of HARP 2.0 on Agency Debt 32-33• MBS: HARP 2.0? OMG, INBD! 34-36• Greece: “Deeper” PSI After the EU 37-38Summit• EUR: Receive OIS/BOR Spreads 39• EUR: Update on the 50y Point 40• EMU Debt Monitor: CDS, RV Charts, 41-46Redemptions, Trade Ideas, SSA &Covered Bonds• EUR Gamma: Yet One More Carry47Trade• GBP: Long-End Linkers and Gilts in 48-50Demand• JGBs: No Impact from the BoJ’s51Decision• Global Inflation Watch 52-55• Inflation: Sentiment to Support56Breakevens• TIPS: A Pause before a New Jump? 57-59• Technical Analysis 60-61• Trade Reviews 62FX Strategy 63-69• EURUSD: New Upside Risk 63-65• Oil Implications for FX 66-67• Looks to Sell USDCAD 68-69Forecasts & Calendars 70-85• 1 Week Economic Calendar 70-71• Key Data Preview 72-79• 4 Week Calendar 80• Treasury & SAS Issuance 81-82• Central Bank Watch 83• Economic & Interest Rate Forecasts 84• FX Forecasts 85Contacts 86www.Global<strong>Market</strong>s.bnpparibas.com• Though some implementation risks remain, theoutcome of the EU Summit will help the market regainsome confidence.• The rally in risky assets will hopefully help sentiment tostabilise, although more details are needed for asustainable normalisation trend to develop.• Political acceptance of further fiscal measures,particularly in Italy, will be crucial to help reduce volatilityin EGBs and attract investors.• We favoured normalisation trades going into the EUSummits and maintain this call for the weeks ahead, i.e. weexpect further bear steepening on the benchmark curveand tighter EMU spreads.• The outlines of the recent agreements have beenenough to push EURUSD decisively through 1.39 and toabove 1.41.• The move lower in the USD remains very much part of abroader improvement in risk sentiment. This improvementhas been driven by better US data, and expectations thatan upcoming change to Fed policy objectives could meanUS rates are lower for even longer.• Treasuries remain driven by EMU news for the momentand we expect further bear steepening going into theFOMC meeting.• We look for further near-term USD weakness and nowprefer to express this via the AUD and JPY.• After the latest BoJ easing measurers failed to softenthe JPY and the BoJ acknowledged the risk of further neartermyen strength, we stay short USDJPY.<strong>Market</strong> ViewsUST 10y T-note Yield (%)2y/10y Spread (bp)EGB 10y Bund Yield (%)2y/10y Spread (bp)JGB 10y JGB Yield (%)2y/10y Spread (bp)Forex EUR/USDUSD/JPYCurrent 1 Week 1 Month2.29 ↑ ↑200 ↑ ↑2.19 ↑ ↑155 ↑ ↑1.01 ↔↑ ↑87 ↔↑ ↑1.4132 ↔ ↑75.83 ↓ ↓IMPORTANT NOTICE. Please refer to important disclosures found at the end ofthis report. Some sections of this report have been written by our strategy teams.Such reports do not purport to be an exhaustive analysis and may be subject toconflicts of interest resulting from their interaction with sales and trading whichcould affect the objectivity of this report.

<strong>Market</strong> OutlookPositive outcome of the EUSummit, althoughimplementation details arelackingFinancial markets continue to be primarily driven by swings in eurozonesovereign risk premia. There was a period of consolidation going into the EUsummits, but the risk-on mode is back after EU leaders’ proposals toaddress the crisis. The most positive aspects of the announcement include:the multidimensional nature of the measures agreed; the agreement inprinciple to 'leverage' the EFSF four to five times the amount still available;the agreement on banks’ capital (bank recapitalisation needs amount toEUR 106.4bn according to the EBA: EUR 5.2bn in Germany, 7.8bn inPortugal, 8.8bn in France, 14.8bn in Italy, 26.2bn in Spain and 30bn inGreece for major recapitalisations); the attempts to settle the Greek issue(on the PSI, the nominal discount on Greek debt will be 50% and theobjective is to reduce the debt/GDP ratio to 120% by 2020); and anotherround of fiscal consolidation measures from Italy.There is still work to do. In particular, the mechanics of the EFSF leverageschemes need to be fleshed out; the ECB is not involved in EFSF leverage;the revision of the July 21 PSI for Greece may encourage more defensivebehaviour by investors; and the proposed reduction in the Greek debt/GDPratio may not be adequate.EMU AAA: Further Normalisation AheadIs this just a post-EUSummit relief rally orsomething more decisive?We continue to favournormalisation tradesSource: <strong>BNP</strong> ParibasThe measures announced are partly political and some details about theirimplementation are still lacking. However, although these measures may notyet be seen as the final solution (ECB involvement, stronger fiscal union,Eurobonds…) they are clearly a step in the right direction, which should helprestore some confidence in the market. The political acceptance of furtherfiscal measures, particularly in Italy, will be crucial to reduce volatility inEGBs, which remains a pre-condition for investors’ appetite in peripheralmarkets to return.The market reaction so far can be seen as a relief rally on risky assets, witha setback in benchmark papers and a tightening of intra-EMU spreads.Governments need to quickly deliver the missing details (G20 meeting3-4 November) and to implement further fiscal reforms to sustain the moves.We favoured normalisation trades going into the Summits and we maintainthis call for the weeks ahead – expecting further bear steepening on thebenchmark curve and tighter EMU spreads. A more defensive way to bepositioned on AAA curves after the post-EU Summit’s sharp move onspreads could be 2/10s OATs flatteners versus 5/30s DSL steepeners as2/10y OAT/AAA boxes have reached extreme levels.Beyond the coming weeks and our call for further normalisation, bear inmind that although EMU news has set the tone for several weeks, the otherCyril Beuzit 27 October 2011<strong>Market</strong> <strong>Mover</strong>2www.Global<strong>Market</strong>s.bnpparibas.com

ECB to remain active onliquidity measures and thesecondary marketUS markets driven by EMUnews until 2 NovemberFOMC meetingFurther upside on EURUSDJPY’s upward trend todevelop furtherkey driving force going into the turn of the year will remain the fundamentalpicture. Within the eurozone, leading indicators have already deterioratedand hard data will follow their fall. This week, PMIs fell further below 50, withforward-looking sub-indices, such as new orders, still sliding. This favours anECB rate cut: the macro-economic background sets a compelling case for acut straight away, although the fact that November will be Draghi’s firstmeeting may be a complication. We still see the ECB moving in Decemberas the most likely scenario, in tandem with the release of new economicprojections, with a 50bp cut aimed at boosting confidence. In other words,the macro environment will remain bond supportive for a while and the‘japanisation’ theme is likely to resurface once EMU stress has easedsignificantly.Regarding liquidity, the latest measures could have a negative impact onliquidity and bank lending as banks have to commit to raise EUR 106bn inorder to show Core Tier 1 capital of 9% by June 2012. The ECB will have toremain active on the liquidity front. The 12mth tender conducted this weekattracted reasonable, but not that strong, demand. However, both liquidityand its duration were increased. In addition, the latest EU decisions arelikely to improve the credit quality assessment on banks. Thus CDS haveroom to decline. We recommend receiving OIS/BOR spreads.In the US, economic data continue to surprise to the upside and equitiesremain well bid, so the near-term momentum for rates continues to be to theupside in our opinion. We have preferred to express this view via 5s30ssteepeners, given that the market could run with the idea of UER/inflationtargeting or an MBS purchase programme at next week’s FOMC meeting(both of which should support the 5y sector). We may not carry this positionthrough the actual meeting, but if the market prices a meaningful chance ofthis in the days before, then we believe this gives an added kicker to 5s30ssteepeners.In the FX market, the outline of the latest eurozone rescue deal has beensufficient to push EURUSD decisively through 1.39 and to above 1.40. Thefall in the USD remains very much part of a broader improvement in risksentiment. This improvement has been driven by better US data, alongsideexpectations that upcoming changes to the Fed’s policy could mean USrates are lower for even longer, and some easing of fears of a China hardlanding.The fact that the euro is weakening – not strengthening – against commoditycurrencies in particular is testimony to the above argument. We see the USDhas continuing to have downward potential and we marginally prefer toexpress this via the likes of the AUD and JPY than the EUR. The comingweek's RBA meeting will be the key focus for the former; the market is fairlyfully priced for a 25bp rate cut, meaning the AUD’s upside risk is significantif, as we expect, the RBA stands pat. But we do look for a cut in December.The ECB and Fed meetings now loom large as the next key drivers for themajors. A rate cut from the ECB, or strong hint thereof at Mr. Draghi’sinaugural press conference, could take some of the heat out of the euro butprobably not for long. Language from the FOMC meeting that suggests ratescould be kept low for an even longer “extended period” has the potential todrive a more lasting weakening in the USD.The Bank of Japan increased the size of the Asset Purchase Program byJPY 5trn to JPY 55trn, directed at JGB purchases. However, the decisiondisappointed some market participants, which had strongly expected theextension of maturities of JGBs subject to purchases.This latest easing has been accompanied by an acknowledgement that theJPY could strengthen further in the short term. We continue to expectUSDJPY to head lower, all the more so if US treasury yields do fall after theFOMC meeting.Cyril Beuzit 27 October 2011<strong>Market</strong> <strong>Mover</strong> 3 www.Global<strong>Market</strong>s.bnpparibas.com

US FOMC: Rise of the Aggressive Doves• Disappointing H1 economic performance,downward revisions to GDP over the past threeyears, and rising financial market volatility ledthe Fed to downgrade its outlook not just in thenear term, but also over a longer horizon.Chart 1: Retail Mortgage Spread a Worry to Fed• November FOMC meeting is the first timesince June that economic forecasts will bepublished.• Financial markets have been pleasantlysurprised over the past month by incoming dataconsistent with the 2.5% q/q saar reading on Q3GDP growth. However, the performance hasbeen less of a surprise to the FOMC whosemembers generally anticipated a strongergrowth performance in H2 2011 as some of thetemporary factors restraining growth eased.Source: Reuters EcoWin ProChart 2: Financial market volatility can take a tollon hiring• Most FOMC participants indicated they sawadvantages in being more transparent about theconditionality in the Committee’s forwardguidance by providing more information aboutthe economic conditions to which the guidancerefers. The November meeting with its forecastand post-meeting press conference is ideallysuited to roll out such a new policy framework.• While it may have appeared in recent monthsthat the Fed was becoming less aggressive, itnow appears that they were simply steppingback and reformulating their reaction function.A weaker outlook for longerSomething momentous happened at the Fed inAugust. A disappointing H1 economic performance,downward revisions to GDP over the past threeyears, and rising financial market volatility led theFed to downgrade its outlook not just in the nearterm, but also over a longer horizon. In June, theFOMC statement said, “the slower pace of therecovery reflects in part factors that are likely to betemporary”. However, the statement released afterthe August meeting acknowledged that “temporaryfactors…appear to account for only some of therecent weakness in economic activity”.Much of the Fedspeak in recent months has cited thefiscal adjustment taking place at the state and locallevel and likely to take place in coming years at thefederal level, and refocused attention on the specialrole the ongoing housing correction plays inrestraining the recovery.Source: Reuters EcoWin ProChart 3: Aggressive policy has helped avert worseeconomic outcomesSource: Reuters EcoWin ProThus began a recalibration of the Fed’s reactionfunction. A lower growth outlook means lessprogress on their mandates. Policies in place may,therefore, not be strong enough to produce desiredresults as they were based on a forecast for animmediate return to self-sustaining above-trendgrowth. In addition, emerging downside risks to theoutlook suggested a more aggressive stance.Julia Coronado 27 October 2011<strong>Market</strong> <strong>Mover</strong>4www.Global<strong>Market</strong>s.bnpparibas.com

The November FOMC meeting is the first time sinceJune that economic forecasts will be published. Asshown in Chart 1, we expect a significant markdownto 2011 growth projections that factor in a rebound toa 2.0% to 2.5% annualised rate of growth in H2.However in addition, we expect them to mark downtheir growth expectations through 2013 inacknowledgement of what Vice Chair Janet Yellenrecently referred to as “persistent restraints on theeconomic recovery”.While the growth estimates are lower, they will stillbe for activity above the FOMC’s own estimate of thelonger-term trend of 2.5% to 2.8%. After all, theforecasts are conditional on appropriate monetarypolicy, and if growth isn’t above trend, theunemployment rate won’t be declining and the Fedwill be failing on one of its mandates. The Fed neverforecasts its own failure.Chart 4: Unemployment and Underemployment area National “Crisis”Source: Reuters EcoWin ProChart 5: The Fed’s Policies Have SupportedAs with GDP growth, the Fed has been too optimisticon progress on the unemployment rate, and weexpect these forecasts to be marked up throughoutthe forecast horizon. These will serve as a keycalibrating point for their new communicationstrategy as will be discussed in more detail below.The FOMC has done a better job forecasting bothheadline and core inflation, and we look for onlyminor adjustments to its forecasts. Particularly in lightof the downgrade to their growth and unemploymentrate forecasts, the FOMC is likely to continue toanticipate that inflation will settle “at levels at orbelow those consistent with the Committee's dualmandate as the effects of past energy and othercommodity price increases dissipate further.”Downside risks remainFinancial markets have been pleasantly surprisedover the past month by incoming data consistent withthe 2.5% q/q saar reading on Q3 GDP growth.However, the performance has been less of asurprise to the FOMC whose members generallyanticipated a stronger growth performance in H22011 as some of the temporary factors restraininggrowth eased. Supply chain disruptions following theJapan earthquake held back Q2 and boosted Q3; theaverage of the two quarters is 1.9%, a pace notstrong enough to consistently generate job growth orstrong enough to reduce unemployment over time.A number of recent speeches from FOMC membershave reinforced the message from the Septemberstatement that “there are significant downside risksto the economic outlook, including strains in globalfinancial markets”. Vice Chair Janet Yellen in arecent speech cited “the potential for such adversefinancial developments to derail the recovery”.Source: Reuters EcoWin ProIn particular, she noted that “U.S. financialinstitutions facing earnings and fundingpressures…could cut back on lending, tighten creditterms, or attempt to delever by rapidly selling offassets”. This is, of course, a problem not unique to,or even centred in, the US as European banks arefacing the same situation. This has been andcontinues to be a credit cycle, and an intensificationof deleveraging threatens to derail the fragilerecoveries in the US and Europe.The financial market turbulence has also led todepressed levels of consumer and businessconfidence. While the transmission of weakconfidence to activity was not apparent in theSeptember data, it is only one month, and thepersistence of low levels of confidence has beenfrequently cited by Fed speakers as anotherdownside risk to the outlook.A new reaction functionThe Fed has not stood idly by as the outlook hasdeteriorated. They eased at each of the last twomeetings first by pushing rate hike expectations backwith a conditional promise to maintain “exceptionallylow levels for the federal funds rate at least throughmid-2013” and, in September, by extending theJulia Coronado 27 October 2011<strong>Market</strong> <strong>Mover</strong>5www.Global<strong>Market</strong>s.bnpparibas.com

duration of their securities portfolio through operationtwist.Operation twist was recognised in the minutes fromSeptember FOMC meeting as being “necessarilylimited by the amount of shorter-term securities in theSOMA portfolio” and “a number of participants sawlarge-scale asset purchases as potentially a morepotent tool that should be retained as an option in theevent that further policy action to support a strongereconomy was warranted”.A number of Fed speakers including Chicago FedPresident Evans, Boston Fed President Rosengren,New York Fed President Dudley, Governor Tarullo,Vice Chair Yellen, and Chairman Bernanke himselfhave all confirmed that QE3 is very much still anoption they are willing to turn to. This puts to rest thenotion that the Fed is being held back by a potentialpolitical backlash domestically and abroad. Many ofthese speakers have specifically emphasised theindependent nature of the Fed.In the meantime, the September minutes alsoindicated that “most participants indicated that theyfavoured taking steps to increase further thetransparency of monetary policy”. Indeed “mostparticipants also indicated they saw advantages inbeing more transparent about the conditionality in theCommittee’s forward guidance by providing moreinformation about the economic conditions to whichthe guidance refers”.Last week, Chicago Fed President Evans proposed apolicy rule in which the Fed “commit[ed] to keepshort-term rates at zero until either theunemployment rate goes below 7 percent or theoutlook for inflation over the medium term goesabove 3 percent”, Without endorsing the specificrule, Vice Chair Yellen referred to President Evans’proposal as “potentially promising” as it would“facilitat[e] public understanding of how various shiftsin the economic outlook would be likely to affect theanticipated timing of future policy”.Chairman Bernanke recently gave a speechdescribing the global paradigm of monetary policy as“flexible inflation targeting” or “constraineddiscretion.” This is a policy characterised by explicitguidance on long-term inflation goals combined withnear-term flexibility to deviate from these targets and“respond to economic shocks as needed to moderatedeviations of output from its potential”. However, healso noted that, in contrast to many central banks,the Fed has a dual mandate for “maximumemployment and price stability, on an equal footing”.Thus, it would appear that the Chairman issympathetic to providing more explicit guidance onthe longer-term goals for both inflation andunemployment. Indeed, the September FOMCminutes highlighted that the Committee would like tocouch its current policy in the context of mediumtermgoals for employment and inflation while, at thesame time, confirming its commitment to longer termgoals. The minutes noted that this was a complicatedtask and that the post-meeting statement as “not wellsuited to communicate fully the Committee’s thinkingabout its objectives and its policy framework”. TheNovember meeting with its forecast and postmeetingpress conference is, therefore, ideally suitedto roll out such a new policy framework.There are a number of ways the FOMC couldprovide more concrete medium-term markers for itspolicy. It could maintain the time commitment put inplace in August but be clear about the conditionsthey expect to prevail at that time. <strong>Market</strong>participants could then adjust their expectationsaccording to their own forecasts and changes ineconomic conditions. Alternatively, they could go theroute suggested by President Evans in which theyeschew the time frame altogether and make thecurrent policy stance explicitly contingent oneconomic conditions. Even their prior forecasts forthe unemployment rate suggest that a policytightening would not be likely before “at least throughmid-2013” and very likely after that under newforecasts. Therefore, the new communication policywill also be a policy easing as it will push rate hikeexpectations back even further.The new framework will also provide guidance aboutwhat the triggers for further easing will be. Consistentwith prior communication, we think that the triggerwould be failure to make progress on their mandates.That is, if inflation decelerates and unemploymentfails to decline, the Fed would be ready to expand itsbalance sheet. In particular, recent Fedspeak hasindicated a shift toward a renewed focus onmortgage purchases along with Treasury purchases.Such a policy has the advantage of targeting themost distressed sector of the economy, and it alsohelps accommodate some of the blow to mortgagemarkets of recent mortgage refinancing proposalsthat will inflict losses on mortgage investors. Weexpect QE3 as early as December just as themortgage refinancing program is kicking into gear.If at first you don’t succeed…While it may have appeared in recent months thatthe Fed was becoming less aggressive, it nowappears that they were simply stepping back andreformulating their reaction function. As PresidentEvans acknowledged “more than once the FOMC’sprojections have proved too optimistic, and the U.S.economy has been unable to achieve escapevelocity for returning to stronger, self-sustaininggrowth. But instead of doing nothing, the FOMC tookJulia Coronado 27 October 2011<strong>Market</strong> <strong>Mover</strong>6www.Global<strong>Market</strong>s.bnpparibas.com

further actions to support stronger growth in thecontext of continued price stability”.Indeed if the transmission of monetary policy to theeconomy is weaker than in the past, and/or fiscalpolicies are not taking the desired direction, theimplication is that monetary policy has to be more,not less aggressive. Such an argument was maderecently by Governor Tarullo who said “ we have totake the world as we find it and adjust our actionsaccordingly. Sometimes this will mean tightermonetary policy to offset the inflationary effects ofother policies. Sometimes, as at present, it will meanmore accommodative policies, even when we knowthat monetary policy alone cannot solve all theeconomy’s problems.”While President Evans and Governor Tarullo mightbest be characterised as aggressive doves, ViceChair Yellen effectively endorsed the type of policyproposed by President Evans, and like GovernorTarullo, Chairman Bernanke characterised thecurrent state of the labour market as a “crisis”. Thus,it would appear the Fed will continue to beaggressive and flexibly respond to economicdevelopments.Table 1: FOMC Economic Projections 1Central Tendencies 2011 2012 2013 2014 Longer RunReal GDP GrowthNov 2011 1.5 to 1.8 2.8 to 3.3 3.3 to 4.0 3.5 to 4.2 2.5 to 2.8Jun 2011 2.7 to 2.9 3.3 to 3.7 3.5 to 4.2 - 2.5 to 2.8Apr 2011 3.1 to 3.3 3.5 to 4.2 3.5 to 4.3 - 2.5 to 2.8Jan 2011 3.4 to 3.9 3.5 to 4.4 3.7 to 4.6 - 2.5 to 2.8Unemployment RateNov 2011 9.0 to 9.1 8.4 to 8.6 7.2 to 7.7 6.5 to 7.0 5.2 to 5.6Jun 2011 8.6 to 8.9 7.8 to 8.2 7.0 to 7.5 - 5.2 to 5.6Apr 2011 8.4 to 8.7 7.6 to 7.9 6.8 to 7.2 - 5.2 to 5.6Jan 2011 8.8 to 9.0 7.6 to 8.1 6.8 to 7.2 - 5.0 to 6.0PCE InflationNov 2011 2.4 to 2.6 1.5 to 2.0 1.5 to 2.0 1.5 to 2.0 1.7 to 2.0Jun 2011 2.3 to 2.5 1.5 to 2.0 1.5 to 2.0 - 1.7 to 2.0Apr 2011 2.1 to 2.8 1.2 to 2.0 1.4 to 2.0 - 1.7 to 2.0Jan 2011 1.3 to 1.7 1.0 to 1.9 1.2 to 2.0 - 1.6 to 2.0Core PCE InflationNov 2011 1.5 to 1.7 1.2 to 2.0 1.4 to 2.0 1.5 to 2.0Jun 2011 1.5 to 1.8 1.4 to 2.0 1.4 to 2.0 -Apr 2011 1.3 to 1.6 1.3 to 1.8 1.4 to 2.0 - -Jan 2011 1.0 to 1.3 1.0 to 1.5 1.2 to 2.0 - -Source: Federal Reserve1. Projections of real GDP growth, PCE inflation, and core PCE inflation are Q4/Q4 growth rates. Projections for the unemployment rateare the average for Q4 in the respective year. Each participant's projections are conditional on his or her assessment of appropriatemonetary policy. The central tendencies exclude the three highest and three lowest projections for each variable in each year.Julia Coronado 27 October 2011<strong>Market</strong> <strong>Mover</strong>7www.Global<strong>Market</strong>s.bnpparibas.com

HARP - Phase II – Another Baby Step• While fewer than 1 million borrowers wereable to refinance through the initial HARP, theFed estimates that 4 million borrowers appear tomeet the basic eligibility for HARP refinancingunder changes announced 24 October 2011.Chart 1: Share of Borrowers with NegativeEquity by Mortgage Rate Segment• FHFA is providing incentives for borrowersto refinance into shorter-term loans by“eliminating certain risk-based fees forborrowers who refinance into shorter-termmortgages”.• We estimate the maximum number ofeligible households to be around 4.5mn, theactual increase is likely to be far lower, around800,000 to 1mn.• HARP reforms could be more beneficial inthose cities and states where the proportion ofdeeply underwater borrowers is much largerthan the national average.• Overall, we consider the FHFA initiative tobe a positive, albeit small, step in the directionof reducing the structural problems in the UShousing sector. But other policy initiatives arealso clearly neededOn 24 October 2011, the Federal Housing FinanceAgency (FHFA), along with Fannie Mae and FreddieMac, announced changes to the Home AffordableRefinance Program (HARP) that are designed tomake it easier for underwater homeowners torefinance their mortgages at current, lower interestrates. The original HARP programme, which waslaunched in 2009, targeted borrowers with LTVsbetween 105% and 125% and has enabled justunder 900,000 borrowers to refinance their loans.Addressing existing impedimentsWhile fewer than 1 million borrowers were able torefinance through the initial HARP, the Fed estimatesthat 4 million borrowers appear to meet the basiceligibility for HARP refinancing. At a recent FederalReserve housing market forum, Governor Duke listedfour possible impediments to greater penetration byHARP: (i) upfront fees that are added to therefinancing costs of loans that are judged to havehigher risk characteristics, such as high loan-to-valueratios; (ii) put-back risk that the loan originator willhave to repurchase the loan from the GSEs becausethe underwriting violated GSE guidelines; (iii) holdersof junior liens refusing to allow their loans to remainsubordinate to a proposed new refinance loan; andSource: CoreLogic, <strong>Market</strong> Rate = 5.1% as of Q2(iv) mortgage insurers not agreeing to re-underwritetheir policies.The reforms to HARP will increase the reach of theprogram by directly addressing the first twoimpediments: risk-based fees should be reduced oreliminated, and mortgage originators will be relievedof put-back risk. Eligibility will also be extended tohouseholds with LTVs above 125%. To qualify forrefinancing, borrowers must have their loans sold toeither Fannie Mae or Freddie Mac on or before 31May 2009, be current on their mortgages (no latepayments in the past six months and nor more thanone late payment in the past twelve), and haveadequate income.Encouraging borrowers to shorten the termFHFA is providing incentives for borrowersto refinance into shorter-term loans by “eliminatingcertain risk-based fees for borrowers who refinanceinto shorter-term mortgages”. Mortgage rates tend tobe less for shorter-term mortgages. In fact, thespread between 30 Year and 15 Year Freddie Macfixed rate has widened significantly this year and isabout 2 standard deviations above the historicalmean (Chart 2). However, reducing the term of theloan to get a lower mortgage rate will result in asignificantly higher monthly payment. For manyunderwater borrowers, that might not be a viableoption, regardless of attractive incentives.Macroeconomic effects are not materialPrecisely estimating the rise in refinancing that thereformed HARP will unleash is difficult. However, wecan identify realistic upper and lower bounds forrefinancing. We estimate the maximum number ofeligible households to be around 4.5mn. We arrive atYelena Shulyatyeva 27 October 20111<strong>Market</strong> <strong>Mover</strong>8www.Global<strong>Market</strong>s.bnpparibas.com

this figure by starting with CoreLogic’s Q2 2011estimate for the number of borrowers in negativeequity who are also paying above-market mortgagerates - 8mn (Chart 1). We then discount this numberby the share of agency mortgages in totaloutstanding mortgages (62%) and the MortgageBankers’ Association’ (MBA) estimate for theproportion of outstanding mortgages that are current- 91%; comprised of a 6% delinquency rate and a 3%foreclosure rate.Assuming an average loan size of USD 250,000 anda 1.5pp reduction in mortgage rates (from 6% to4.5%), each borrower would save around USD 230per month; thus, a 4.5mn increase in refinancingwould raise personal disposable income by USD13bn, or 0.1%.However, the actual increase is likely to be far lower.Not all eligible borrowers will apply for refinancing,while the proportion of households with negativeequity that are also current on their mortgages islikely to be below 91%. The FHFA, in what we regardto be the lower bound, estimates that between800,000 and 1mn borrowers will take advantage ofthe HARP reforms. Combining this lower figure withthe same assumptions about mortgage sizes andrates yields an estimate of USD 2.75bn in overallsavings, or just 0.02% of disposable income. Thus,while the households that are able to refinance couldsee disposable income increases of up to 5%, in theaggregate the direct impact of the programme onhousehold incomes will not be material from amacroeconomic point of view, regardless of whetherthe eventual uptake is on the low or high side.Regional impact of removing 125% LTV ceilingSo far, our analysis has made use of only nationalmortgage statistics. However, the severity of thehousing crisis varies significantly across the US.Consequently, HARP reforms could be morebeneficial in those cities and states where theproportion of deeply underwater borrowers is muchlarger than the national average. For example,borrowers with large negative equity positions aremore likely to strategically default; that is, they aremore likely to voluntarily default despite having themeans to meet their payment obligations. In Q22011, Nevada had the highest percentage of homeswith negative equity at 60% (unsurprisingly, Nevadaalso has also experienced the largest house pricefalls since 2006), followed by Arizona (49%), Florida(45%), Michigan (36%), and California (30%)according to CoreLogic. The situation is particularlygloomy for those with severe negative equity. Themost recent report also indicated that out of morethan half a million mortgage loans in Nevada almost45% are severely underwater. For Arizona, thisshare is just slightly below 30% out of 1.3mnChart 2: 15-Year Rates More AttractiveSource: Reuters Ecowin Pro, BloombergChart 3: Negative Equity of 25% or MoreSource: CoreLogicproperties; Florida has a similar percentage of its4.4mn mortgages, which are in negative equity bymore than 25%. Out of 6.8mn loans in California 17%are severely underwater, while this share forMichigan is 17% of 1.4mn mortgages loans (Chart 3).Adding estimates for just these five states yields anestimate of 3.25mn homeowners, who can potentiallybenefit from the enhanced HARP. Therefore, the newprogramme has the most potential and could help toput the floor under plunging housing prices in theseparticular regions.Overall, we consider the FHFA initiative to be apositive, albeit small, step in the direction of reducingthe structural problems in the US housing sector. Butother policy initiatives are also clearly needed. Forexample, we think that it is important to place agreater emphasis on the rapid conversion offoreclosed homes into rental properties. Such anapproach would involve encouraging privateinvestment by converting some of the real estateowned (REO) by the GSEs into rental structures. Ifwell-designed, the Obama plan could shift asignificant number vacant properties from theownership to the rental market alleviating bothdownward pressure on home prices and upwardpressure on rents.Yelena Shulyatyeva 27 October 20111<strong>Market</strong> <strong>Mover</strong>9www.Global<strong>Market</strong>s.bnpparibas.com

US: The Fiscal Clock is Ticking…• The Supercommittee in charge of proposinga USD 1.2trn fiscal deficit reduction plan by 23November is “running short on time”, accordingto one of the Supercommittee’s co-chairs.• Wednesday, Democrats on the Committeesubmitted a USD 3bn deficit reduction plan thatwas quickly shot down by Republicans due to itsheavy reliance on tax increases.• If the Supercommittee does not come upwith a plan in time, then it could risk anotherratings downgrade.• We are cautiously optimistic that theSupercommittee will come forward with abipartisan proposal that will be approved byCongress and signed into law.420-2-4-6-8-10-12Chart 1: Federal Deficit: <strong>BNP</strong> Paribas vs CBO(% of GDP)1992 1997 2002 2007 2012 2017Source: Haver Analytics, CBO, <strong>BNP</strong> ParibasForecast -->CBO<strong>BNP</strong> ParibasChart 2: Federal Government Debt (% of GDP)• As battles in Congress drag on, PresidentObama is now turning to his executive powers toprovide stimulus.1059585Forecast -->Time is not on their sideThe Supercommittee in charge of proposing a USD1.2trn fiscal deficit reduction plan by 23 November is“running short on time”, according to one of theSupercommittee’s co-chairs. In fact, a plan, whichwill need to be run by the CBO for official “scoring”,or unbiased measuring, will need to be submitted tothe CBO a few days prior to the 23 Novemberdeadline in order to allow adequate time for thescoring. However, the parties still appear to be a longway from an agreement.Democrats move firstOn Wednesday, Democrats on the Committeesubmitted a USD 3bn deficit reduction plan thatlargely mirrored President Obama’s “Grand Bargain”which was debated this summer. Republicans werequick to refute this proposal as it included asignificant tax increase component. Disagreementsover tax increases continue to hinder negotiations,and we foresee that it will take some compromisefrom Republicans in order to get a deal done. TheDemocrats do not believe that they can give in onthis; otherwise, Republicans are likely to get fullcredit for the deficit reduction. Nevertheless, theRepublicans have some room to eliminate some taxloopholes, which would not actually raise the taxrate, allowing both parties to claim victory.75655545352008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020Source: Haver Analytics, <strong>BNP</strong> ParibasRisking another downgradeAs we have written before, coming up with USD1.2trn in deficit reduction is not the difficult part. Thedifficulty is striking an agreement that allows bothparties to claim credit for any deal as we enter anelection year. If the Supercommittee does not comeup with a plan before the deadline, then it could riskanother ratings downgrade. We see two likelyscenarios: i/ the Supercommittee puts together apackage which is approved by Congress by 23December, Republican’ compromise and everyoneclaims victory; or, ii/ the Supercommittee cannotcome to a compromise over taxes and the plan fails.If the second outcome is the case, Congress still hasanother year before the forced sequestration wouldtake effect. Thus, Congress would have time to enactUSD 1.2trn worth of deficit reduction after theelections and before the sequestration takes effect,although this added time could come at the cost of aFitch or Moody’s downgrade (see Box 1).Bricklin Dwyer 27 October 2011<strong>Market</strong> <strong>Mover</strong>10www.Global<strong>Market</strong>s.bnpparibas.com

While a downgrade would not have a material impacton our fiscal projections, it is likely to have a markedimpact on consumer and business confidence whichcould have a substantive impact on the elections.Thus, while the second option would be morerepresentative of Congress’ past inaction, we believethat the impact of a second (and possibly third)downgrade and Congress’ ability to adopt a“package”, without deliberation, will allow Congressto emphasise the greater good and discount thecompromises as necessary to take a small steptowards putting public finances on a sounder footing.Indeed, at the time of writing, the Republican Partypresented a USD 2.2trn deficit reduction packagewhich highlighted USD 600bn in Medicare and otherhealthcare entitlement cuts, USD 250bn indiscretionary spending cuts, and USD 640bn in newrevenue without increasing taxes. While Democratsquickly dismissed the Republican proposal, theinclusion of revenue increasing measures is a step inthe right direction.Executive powerAs battles in Congress drag on, President Obama isnow turning to his executive powers to providestimulus. Despite the President’s American Jobs Actincluding many components supported by bothpolitical parties, it has been held up by theDemocrats’ insistence on offsetting the tax cuts andstimulus spending with tax increases on the wealthy,as well as Republican opposition to key parts of theplan. After a failed vote on the Act two weeks ago,President Obama announced in recent days his new“We can’t wait” campaign of executive action tocombat Congressional inaction.Housing, education, and more…On Monday, the President kicked off his plan toaddress housing, education, and more, throughexecutive orders by announcing a refinanceprogramme for underwater homeowners. In addition,on Wednesday President Obama announcedchanges to the repayment terms of federal loans forcollege graduates. Unsurprisingly, bothannouncements were held in key election battlegrounds—Nevada and Colorado. President Obamaplans to announce a new initiative each weekthrough the end of the year.Another shutdown?Meanwhile, there is less than three weeks before 18November when the government could potentiallyrun out of money if a third continuing resolution is notpassed for FY 2012 spending. We do anticipateanother stop-gap measure to be passed in time;however, this highlights, once again, that Congresshas been unable to pass a budget since 2010. In theBox 1: The Rating Agencies5 August 2011: S&P downgraded the US to AA+(negative outlook) from AAA (negative outlook)reflecting: “S&P’s opinion that the fiscal consolidationplan that Congress and the Administration recentlyagreed to falls short of what …would be necessary tostabilise the government’s medium-term debtdynamics”; “S&P’s view that the effectiveness, stability,and predictability of American policymaking andpolitical institutions have weakened at a time ofongoing fiscal and economic challenges to a degreemore than previously envisioned”.2 August 2011: Moody’s confirmed US’ Aaa Ratingand assigned a negative outlook which indicated thatthere would be a risk of downgrade if: “There is aweakening in fiscal discipline in the coming year;further fiscal consolidation measures are not adopted in2013; the economic outlook deteriorates significantly;or there is an appreciable rise in the US government’sfunding costs over and above what is currentlyexpected”.2 August 2011: Fitch confirmed US AAA rating warningthat the US "must also confront tough choices on taxand spending against a weak economic backdrop if thebudget deficit and government debt is to be cut to saferlevels over the medium term". The agency said,however, that it will revisit its decision to keep theOutlook Stable at the end of the year. Their view iscurrently, "In terms of the joint select committee, whyprejudge the outcome of that when we'll know theoutcome in three-and-a-half or four-month time?" Anoutright one-notch downgrade is not ruled out, but lesslikely, the agency said in a statement. A negativeoutlook usually means a downgrade is possible in twoyears.Source: <strong>BNP</strong> Paribas, Standard & Poors, Moody’s & Fitchend, we are likely to get individual appropriation billswhich will provide the authority to spend, althoughthis takes time as it requires many individual bills tobe voted on.Cautiously optimisticIn all, we are cautiously optimistic that theSupercommittee will come forward with a bipartisanproposal that will be approved by Congress andsigned into law. A downgrade by Fitch and Moody’spotentially hangs in the balance, and it will be muchmore politically appetising to accept the bipartisanSupercommittee’s bill than risk the political falloutotherwise—we would expect the events of August toprovide a sober warning to lawmakers who refuse toplay ball. In addition, we expect the tax cuts andunemployment insurance components of theAmerican Jobs Act to be passed while PresidentObama uses his executive power to try to provideadditional stimulus.Bricklin Dwyer 27 October 2011<strong>Market</strong> <strong>Mover</strong>11www.Global<strong>Market</strong>s.bnpparibas.com

Canada: Lowering Expectations• The BoC shifted its expectations for policytightening out significantly as it revised down itsgrowth forecasts. The BoC also left the dooropen to cut rates in the first quarter of 2012 if theUS were to fall into recession as we expect.• The BoC’s downward revision to theCanadian growth outlook also prompted cuts tothe inflation outlook. The BoC now judges therisks to their forecasts to be roughly balanced.• The BoC zeroed in on financial market risks,which we think are likely to be formallyincorporated into their mandate in the comingdays.• We see two likely scenarios for policy: i/growth evolves in line with the BoC’sexpectations, and thus, the Bank remains onhold until at least mid-2013; or ii/ growthdisappoints, and the BoC cuts rates early nextyear and remains on hold until at least mid-2013.We think the latter is more likely.A significant shiftThe Bank of Canada (BoC) kept its overnight rateunchanged in its 25 October policy statement whilelowering expectations for domestic economic growthciting several downside risks to the global economythat have been realised since the last meeting. TheBank of Canada shifted its expectations for policytightening out significantly as it revised down itsglobal and domestic growth expectations.The BoC also left the door open to cut its policy ratein the first quarter of 2012 if the US were to fall intorecession, as we expect. The quarterly MonetaryPolicy Report (MPR) highlighted the significantrevisions to the growth outlook with Q4 growthrevised from 2.9% q/q ar to 0.8% q/q ar—in line withour expectations for the quarter. The revision cameon the back of weaker expectations for both personalconsumption and net exports. This is consistent withthe Conference Board’s consumer confidence indexfor October, which fell to its lowest level since March2009 (see Chart 2).Downside risksThe BoC anticipates a brief recession in the euroarea. Although they expect the euro crisis to becontained, the danger of failing to contain the crisis is“the most serious risk facing the global and Canadian3210-1-2-3-4Chart 1: A Slow Closing of the Output Gap (%)Q1 1995 Q1 1998 Q1 2001 Q1 2004 Q1 2007 Q1 2010Source: Reuters EcoWin Pro1101051009590858075706560Chart 2: Consumer confidence is weakJun 06 Jun 07 Jun 08 Jun 09 Jun 10 Jun 11Source: Conference Boardeconomies”. Meanwhile, they forecast weak growthin the US through the first half of 2012 before theAmerican economy gradually gains strengththereafter. However, in the MPR, the BoC noted that“a US recession would have material consequencesfor growth and inflation in Canada”. In addition, highlevels of household debt “could lead to a sharperthan-expecteddeceleration in household spending.Relatedly, if there were a sudden weakening in theCanadian housing sector, it could have sizeablespillover effects on other areas of the economy”.Upside risksThe upside risks relate to possible unexpectedinflationary pressures on the back of either morepersistent growth in emerging market economies,stronger-than-expected momentum in householdborrowing, and/or more decisive global policy actionwhich “could lift confidence more rapidly thancurrently projected”.Bricklin Dwyer 27 October 2011<strong>Market</strong> <strong>Mover</strong>12www.Global<strong>Market</strong>s.bnpparibas.com

Low for longAs a result of the aforementioned risks and generalweakness in the domestic economy, expectations forCanadian growth were revised down 0.7pp for both2011 and 2012 to 2.1% and 1.9%, respectively.Meanwhile, the BoC’s growth forecast for 2013 wasrevised up to 2.9% from 2.1% previously. Thisimplies a very slow closing of the output gap with theeconomy not expected to return to full capacity untilthe end of 2013 (see Chart 1).The downward revision to the growth outlook alsoprompted downward revisions to the inflation outlook.Core inflation is projected to be “slightly softer thanpreviously expected, declining through 2012 beforereturning to 2 percent by the end of 2013”. Headlineinflation “is expected to trough around 1 percent bythe middle of 2012 before rising with core inflation tothe two percent target by the end of 2013”. Weinterpret the lowering of growth and inflationexpectations to mean that the overnight rate willlikely remain at low levels for some time.Leaving the door open for cutsAfter lowering their expectations, the BoC nowjudges risks to their forecast to be roughly balanced.However, the overall tone of the Policy Statementwas dovish. In particular, the BoC removed the line“some of the considerable monetary policy stimuluswill be eventually withdrawn”.With regard to the policy outlook, there are two likelyscenarios: i/ the global and Canadian economiesgrow in line with the BOC’s current expectations—and thus the Bank would be expected to remain onhold until at least mid-2013; or ii/ the global andCanadian economies grow more slowly than currentBoC expectations (including a US recession)—inwhich case, we would see policy easing in the nearterm, and rates would remain on hold until at leastmid-2013. Of the two, we think the latter is morelikely.We expect that a rate cut would come in early 2012on the back of the implementation of QE3 in the USand have, therefore, moved back our call for the BoCto cut rates from December 2011 to early 2012 onthe back of a delay in our expectations for theimplementation of QE3 and an upward revision to oursecond half of 2011 US growth outlook. In addition,we have pushed back our expectations for theremoval of policy accommodation until mid-2013.Changing the mandateImportantly, the BoC focused a large portion of thestatement on financial market risks. We think there isa good chance that this will become an explicitcomponent of the upcoming changes to their officialmandate. In addition, we could see a move towardtargeting core inflation versus the current mandate oftargeting headline inflation. Both of these outcomeswould give the BoC more wiggle room at times wheninflationary pressures are deemed to be temporary.Bricklin Dwyer 27 October 2011<strong>Market</strong> <strong>Mover</strong>13www.Global<strong>Market</strong>s.bnpparibas.com

France: Time for Tightening• The French government will have to reducethe 2012 GDP growth forecast from 1.75% to1.0% at most. This should be accompanied by afiscal tightening package of close to EUR 8bn.• The budget deficit should not overshoot thetarget of 4.6% of GDP in 2012 which has been inall the previous stability plans.• The bulk of the new measures should, onceagain, raise taxes and social contributionincome.50%40%30%20%Chart 1: Distribution of2012 GDP Growth Forecasts for France10%Aug0%Oct0.0 0.5 1.0 1.5 2.0The 2012 budget was built using an economicgrowth estimate of 1.75% for 2012, the same level asin 2011. When these hypotheses were adopted, inAugust, they were in line with market consensusestimates, which were 1.9% for 2011 and 1.7% for2012 according to Consensus Economics. Howeverthe economic situation has dramatically worsenedsince then. The consensus estimate for 2011 growtheased to 1.6% y/y, but for 2012 was revised downsharply, losing four-tenths in September and anotherfour-tenths in October. Consensus Economicscollected more data over time (15 forecasters inAugust, 18 in September and 21 in October) and therange of the forecasts widened, whereas it normallydeclines over time (Chart 1). This shows a strongincrease in uncertainty about the growth outlook. Thesituation is very different for inflation, where theconsensus remained stable and the range narrowedmarginally.Revising growth downThe growth rate for this year has not been revisedmuch since August/September when the governmentestimated the 2011 deficit target would be met. Harddata published since then do not threaten Q3 growthmuch, but business and household surveys clearlyshow there is a growing risk that GDP will contract inthe last quarter of 2011. This would have limitedimpact on the 2011 average growth rate and an evensmaller effect on the budget, given the delay incollecting taxes.The main risk for the current year affects receiptsfrom corporate tax. Consequently we will have to payspecial attention to the September and Decemberfiscal outcomes, when quarterly payments ofcorporate tax are due. The reduction of the deficit,compared to the year before, is developing asexpected in the later part of the year (Chart 2, inSource: Consensus Economics0-20-40-60-80-100-120-140-160Source: MoFChart 2: Central Budget Balance20092011EUR bn, cumulative 20102008Jan. Mar. May July Sept. Nov.particular in August, September and December).Chart 2 shows that the cumulative deficit over thefirst eight months of the year narrowed byEUR 19.4bn to EUR 102.8bn. Social security andlocal government deficits should be smaller thaninitially expected, so that the government has someleeway to face the declining growth. It also has sometime left to cancel some expenditure, currently frozenuntil the end of the fiscal year, in order to deal withthis risk.The October consensus forecast for 2012 GDPgrowth is 0.9%, so a revision by the government toits own growth forecast seems likely. The consensus2012 growth forecast for Germany has fallen from1.9% in August to 1.0% in October. The Germangovernment thus reduced its growth forecast to1.0%. In practice, it will difficult for the Frenchgovernment to come up with a forecast much abovethe German growth level. The government shouldrather cut the growth rate aggressively now, in orderto be sure that no further forecast cut, and no morefiscal tightening, are required until the elections areover.Dominique Barbet 27 October 2011<strong>Market</strong> <strong>Mover</strong>14www.Global<strong>Market</strong>s.bnpparibas.com

In September, we estimated 2012 French growtharound 1.0% (see "French 2012 Deficit: In Control",in <strong>Market</strong> <strong>Mover</strong>, 29 September 2011). We also saidthen the government would not only have to reduceits growth forecast, but would also have to implementnew austerity measures to keep the deficit, as ashare of GDP, at the same level. We estimated thenthat around EUR 8bn of new measures would berequired. At present the risks to our growth forecastare on the downside.The measures to stabilise the deficitConsensus Economics also shows that, despite thelower growth, the deficit forecast remained extremelyflat (Chart 3). Economists clearly share our view thatthe government will toughen its fiscal policy to copewith slower growth, as the president and governmentmembers have already said loud and clear. Thisbudgetary policy may also explain why lower growth,which goes hand in hand with a higherunemployment rate forecast and lower wageincrease expectations, does not result in modificationof the inflation forecast. Most analysts probablyexpect fiscal measures to push prices a little higher.However, we can't say whether this refers to thefiscal measures already announced late August andin the draft budget late September, or whetheranalysts expect more adverse fiscal news in thefuture.The government has already announced the easiestand most obvious measures, so the new austeritypackage will be more difficult to put together. Thefact that 2012 is the main election year naturallycomplicates the decision-making process. Thepolitical factor is the main reason we are notexpecting a hike in VAT, although this wouldgenerate the highest income gain (theoreticallyEUR 6bn for 1pp hike in the standard rate andEUR 3bn for the same increase in the reduced rate).A VAT hike, six months before the elections, wouldbe very risky politically. The election factor also limitsthe potential for further indirect tax hikes onconsumption.Opinion polls also indicate that people are lesswilling to accept spending cuts than tax hikes;probably because most people also want tax rises tohit the wealthy, i.e. not them. Potential savings onspending are limited, and these should be usedpreferably around year-end as a last minute lifeline incase of unexpected bad news at that time.We believe the bulk of fiscal tightening will, onceagain, come from a reduction in breaks on taxes andsocial charges (known as "niches fiscales etsociales"). An interesting insight of what could beannounced is provided by the MoF report, prepared1.91.71.51.31.10.90.7Chart 3: Major Consensus Forecastsfor France in 2012 (mean)15 forecasters 18 forecasters 21 forecastersAugust September OctoberSource: Consensus EconomicsCPI (% y/y)GDP (% y/y)Budget Def(% of GDP, RHS)in June 2011, which analysed 385 different schemes,amounting to a total of EUR 96bn. The report gaveeach of them an efficiency (or inefficiency) rating(see "France: The Deficit Target is the Priority", in<strong>Market</strong> <strong>Mover</strong>, 1 September 2011). As much asEUR 10.7bn of the tax breaks were deemedeconomically inefficient and another EUR 27.1bnwere not efficient enough.A large part (EUR 9.8bn) of the least effectivemeasures affect income tax: a modification decidednow would only affect 2013 fiscal income, not the2012 fiscal year. Some of the least efficientmeasures were already reduced or cancelled earlierthis year. Consequently the main source of incomefor 2012 lies with social contributions. The reportmentions EUR 3.1bn of inefficient cuts in socialcontribution and another EUR 9.4bn have a poorefficiency rating. This is where the bulk of theausterity measures can be found.Asset salesThe government may also be willing to increaseasset sales, although the financial context does notlook favourable for restarting the privatisationprogramme. However, the government may try to sellreal estate, buildings and land, since these priceshave not declined much. More immaterial assetsmay also be sold; the current budget includes theproceeds of the sale of radio bands for mobilephones.Since August, the tax increases already announcedamount to EUR 10.5bn or 0.5% of GDP. Another0.3pp to 0.4pp should be presented by the year-end.Given the measures announced in 2010, for thefiscal year 2012, the total tightening from incomeshould reach 1.0pp of GDP. Expenditure restraintswould also reduce the structural deficit by about0.6pp of GDP. With low growth mechanically adding0.5% to the deficit, the 2012 initial target of 4.6% ofGDP should be respected.5.45.25.04.84.64.44.2Dominique Barbet 27 October 2011<strong>Market</strong> <strong>Mover</strong>15www.Global<strong>Market</strong>s.bnpparibas.com

UK: Still Raining• The UK’s past income and savings behaviourhas been revised by the ONS. Real disposableincome is now estimated to have risen in 2010, ifonly just. And the UK savings rate has beenrevised up significantly.• Combined with weak but positive realincome growth in 2012, scope for households toease back on their rate of saving should providesome room for consumption growth in thesecond half of 2012.Chart 1: Household Disposable Income Growth(% y/y)20151050Impact of inflationOtherTaxes and benefitsNet property incomeCompensation of employees• Still, there are lots of bridges to cross beforethen and the near-term outlook is bleak. Weexpect GDP to contract in Q4 2011.-5-102006 2007 2008 2009 2010More revisions to economic historyThis week saw the Office for National Statistics(ONS) release further information on the UK’sfinancial and economic accounts, followingsignificant methodological changes put in place inthe context of the ONS ‘Bluebook 2011’ revisionexercise. We have already seen some impact fromthese changes in downward revisions to the Q2 2011growth estimate, to 0.1%, and also the revision to theoverall level of GDP which saw the fall in output overthe 2008/9 recession revised to 7.1% rather than theprevious estimate of 6.4%.But in contrast to the fairly negative news from theearlier release of the revised series, this week’s datacontained some more positive reinterpretations ofhistory.The revised data provide new estimates forhousehold’s real disposable income growth in recentyears. While these continue to show that growth inreal disposable income has been depressed, thesituation is not so severe as previously estimated. Sothe previous estimate suggested that real disposableincome had fallen by 0.8% in 2010, which wouldhave been the first annual fall in more than 30 years.Now, however, in a reminder never to place toomuch credence on any particular set of statistics, thatdecline has been revised. Upward revisions to theestimate of net property income and a downwardrevision to the estimate of the deflator over theperiod now shows the annual change in realdisposable income as having grown 0.1% in 2010.The 2009 real disposable income figures have alsobeen revised up to show growth of 1.6%, up from1.1% in the previous estimate. In the latest quarter,Q2 2011, the data show a surprising 1.2% q/q rise inSource: Office for National Statistics1086420Chart 2: Savings Rate (%)Latest DataPrevious Estimates-22005 2006 2007 2008 2009 2010 2011Source: Office for National Statisticsreal disposable income. But that does not reflect amarked pick-up in wages and salaries, which rose0.5%. Rather, it appears a 2.8% rise in socialbenefits is partly responsible.In the bigger picture the data does not really changethe story that household disposable income growth isbeing held back by high inflation. In the year to Q22011, total household real income growth has fallenby 1.2%. Within that, while nominal income hasgrown by 3.2%, high inflation has eroded the realvalue of that increase.A higher savings rate may give more upside toconsumption next yearThe earlier release of the Q2 2011 GDP datashowed a downward revision to the level ofconsumption over the last few years. And whencombined with the new income release, the result isDavid Tinsley 27 October 2011<strong>Market</strong> <strong>Mover</strong>16www.Global<strong>Market</strong>s.bnpparibas.com

a fairly significant change in the estimate of thehousehold savings ratio in recent years. The averagerevision to the savings ratio since 2008 is 1.6pp, withthe savings rate in Q2 2011 at 7.4%.Next year the outlook is for slow nominal incomegrowth, with a continuation of sluggish wage growthand the growth in other sources of income likely tofall back. But with inflation easing, the picture may bebetter for real disposable income than in 2010. Andsince the current savings rate probably reflects ahigher than usual precautionary ‘rainy day’ level ofsavings given economic uncertainty, there is somescope for households to augment their spending bylowering their rate of saving if current economicuncertainty eases.In consequence, there may be some scope for somepositive rates of consumption growth next year,particularly in the second half.For now though the news flow remains weakHowever, there are several bridges to cross betweennow and then, many of them not of the UK’s making.And the near-term outlook remains pretty bleak. Thisweek’s CBI Industrial Trends survey saw a slump innew orders and business optimism, suggestingmanufacturing is contracting. And in the comingweek the first release of UK third quarter GDP islikely to be an estimated 0.4% on the quarter. It couldhave been worse, but the evidence from the surveyssuggests activity was sliding towards the end of thequarter and we agree with MPC member MartinWeale that output is likely to contract in Q4.David Tinsley 27 October 2011<strong>Market</strong> <strong>Mover</strong>17www.Global<strong>Market</strong>s.bnpparibas.com

Sweden: Rate Hikes Postponed• The Riksbank left the policy rate at 2.0% atits October meeting.Table 1: Riksbank’s Latest Forecasts (% y/y)2011 2012 2013 2014• The Bank cut its growth and inflationforecasts further, which paved the way for adownward revision to the repo rate profile.• Given the increased uncertainty about theeconomic outlook, we expect the Bank to keepits policy rate on hold for the rest of this year,and deliver a 25bp cut in Q1 2012.CPICPIFGDPRepo Rate (%,annual avg.)3.0(3.0)1.5(1.5)4.2(4.5)1.8(1.8)1.9(2.1)1.3(1.5)1.5(1.7)2.2(2.4)2.4(2.6)1.8(2.0)2.4(2.4)2.7(2.9)2.62.02.53.3The Riksbank kept its policy rate at 2.0% at itsOctober meeting, in line with our and the market’sexpectations.Source: The Riksbank. September 2011 forecasts in bracketsChart 1: Policy Rate (%)The rationale of the decision was that uncertaintyabout the economic outlook has increased mainlydue to the eurozone debt crisis, growth is expectedto be slightly weaker in the coming period andinflation pressures are low.The policy statement was broadly balanced. TheBank noted that so far the main impact ofdevelopments abroad on Sweden was via a declinein household and business confidence. Whenuncertainty declines and confidence returns, theeconomy is expected to grow at a more normal rate.On inflation, although underlying inflationary pressureis currently low, the Bank expects it to increase asresource utilisation rises.Riksbank’s forecast revisionsIn terms of economic forecasts, because recentevidence suggests economic growth is slowing, theBank revised down its GDP forecast from 4.5% to4.2% in 2011 and 1.7% to 1.5% in 2012. This, in turn,led to a downward revision in the inflation forecast.The Bank now expects 2012 headline inflation at1.9%, down from 2.1% previously (the 2013 inflationforecast was also revised down, from 2.6% to 2.4%).The CPIF inflation forecast for 2012, meanwhile, wasrevised down from 1.5% to 1.3% (2013 inflation wasalso revised lower, from 2.0% to 1.8%). There wereno changes to the Bank’s 2011 inflation forecasts.In all, these downward revisions have paved the wayfor a lower repo rate profile. The new profile suggeststhe Riksbank is to postpone continued increases inthe repo rate. The Bank’s forecast for the quarterlyaverage of the repo rate suggests it will average2.00% in Q4 this year and 2.34% in Q4 2012. This isdown from the Bank’s September forecast of 2.05%for Q4 2011 and 2.57% for Q4 2012. TheseSource: Reuters EcoWin Proprojections suggest the Bank intends to deliver thenext rate hike in Q2 next year.The decision to keep the repo rate unchanged wasnot unanimous. Deputy governors Ekholm andSvensson preferred to lower the repo rate by 25bp to1.75% and wanted to see a lower repo rate path thatstays at 1.5% from Q1 2012 through Q1 2013, andthen rises to just above 3% by end-2014.Policy outlookWe believe risks to the Riksbank’s policy profile areto the downside. The next move of the Bank will becut, rather than a hike, in our view. Over the comingperiod, the Riksbank’s focus is likely to shift to afurther loss of momentum in the economy, whichshould pave the way for further downward revisionsto the policy rate profile. Furthermore, the Bank willbe unwilling to deviate too much from otheradvanced country central banks in terms of policyrates, as a significant appreciation of the krona willput downside risks to inflation. Overall, we expect thepolicy rate to remain unchanged at 2.00% this year,before being cut to 1.75% in Q1 2012.Gizem Kara 27 October 2011<strong>Market</strong> <strong>Mover</strong>18www.Global<strong>Market</strong>s.bnpparibas.com

Japan: Exports Slow on End of Catch-Up• Japan’s trade account was in deficit for asixth straight month but the scale of the shortfallplunged sharply, as nominal exports surged inSeptember while nominal imports contracted.• Real exports, which have been on the mendsince May, rose 1.3% m/m but the pace ofincrease has dropped recently, reflecting the endof the post-disaster catch-up phase for mostproducts.• US-bound shipments fell 1.5%, while EUboundexports rose 2.3%. But exports to bothhave been losing steam since July, as demandhas weakened with fiscal/financial turmoilweighing on sentiment. • Exports to China rose 2.9% but the level isstill below normal, due largely to the slowdownof the Chinese economy. On this score, generalmachinery exports remain more than 24% belowtheir pre-disaster level, indicative of theweakness of investment demand.• Although real imports fell 2.8%, the firstsetback in six months, the tone remains firmthanks to yen appreciation, resurgent demandfrom normalised factory activity and briskdemand for fuel for thermal power generation.Trade account deficit continues for sixth straightmonthAccording to the MOF’s trade statistics forSeptember, Japan’s seasonally-adjusted tradeaccount remained in deficit for a sixth straight month,but the scale of the shortfall plunged sharply to justJPY 21.8bn from JPY 265.2bn in August, as nominalexports surged 2.0% m/m but nominal importscontracted 2.2%.Exports lose much steamAdjusted for exchange rate and price fluctuations,our calculations show real exports rose 1.3% m/m,for a second straight, albeit slower, gain (2.7% inAugust). Trend-wise, real exports have been on themend since May, thanks to production recoveringalongside the restoration of supply chains. For thequarter ending in September, real exports rose arobust 9.5% q/q after contracting 6.0% q/q in Q2(real imports rose 0.1% q/q in Q2 and 2.8% q/q inQ3). Even so, with the exception of transportequipment, where output is still being ramped up,production growth and exports have significantlymoderated recently, as activity has largely returned7,5007,0006,5006,0005,5005,0004,5004,000Chart 1: Real Exports (sa, JPY bn)totalTransport equipment (RHS)05 06 07 08 09 10 11Source: MOF, BOJ, <strong>BNP</strong> Paribas1,6001,5001,4001,3001,2001,1001,000900800700600Chart 2: Real Exports to China (sa, JPY bn)05 06 07 08 09 10 11Source: MOF, BOJ, <strong>BNP</strong> Paribas2,0001,8001,6001,4001,2001,000to normal (to the pre-disaster levels of February).Consequently, the main determinant of export growthfrom now on will be foreign demand, not domesticsupply capability. With developed and emergingeconomies showing signs of losing momentum,Japan’s exports look likely to shift into a lower gearor even stall.Except for transport equipment, exports aregenerally weakLooking at the breakdown of real exports by productcategory, the sector contributing most to real exportgrowth in September was again transport equipmentat roughly 30% of total exports: shipments rose 4.3%m/m (12.1% in August). Exports of this key productplunged in March-April as the disaster threwautomotive supply chains into chaos, but reboundedsharply from May as damaged plants were broughtback online and electricity rationing ended. As ofSeptember, the index level for this product was14.3% higher than in pre-quake February.800600Ryutaro Kono/ Azusa Kato 27 October 2011<strong>Market</strong> <strong>Mover</strong>19www.Global<strong>Market</strong>s.bnpparibas.com

Another key product, electrical machinery alsocontributed to overall export growth, with shipmentsreviving 1.3% after contracting 1.1% in August. Butthe level remains 3.9% below pre-disaster Februaryand is likely to stay weak as the global IT/digitalsector adjusts to slowing private demand in Chinaand stalling consumer spending in the US andEurope.On the downside, general machinery exports fell0.6% (–2.9% in August), marking a third straightdecline. Having suffered relatively little damagecompared to other sectors, general machineryexports stopped falling in April and by June the levelwas already 1.3% higher than in February. But thedeepening slowdown in the global manufacturingcycle has caused shipments of this key exportproduct to turn down. Exports of chemical productsalso remain weak, falling 0.2% (–0.1% in August).US-bound exports: First decline in five monthsA geographical breakdown of the September tradereport (seasonally adjusted, real basis, ourestimates) has US-bound exports turning sour for thefirst time in five months with a 1.5% m/m decline(4.1% in August). Even so, exports for Q3 overall areup a huge 20.3% q/q (compared with -5.4% q/q in Q1and -11.4% q/q in Q2), with quarterly gains beingposted by most products, except chemical productsand nonferrous metals. In addition to pronouncedquarterly recoveries by electrical machinery (12.6%q/q in Q3 from -9.8% q/q in Q2) and generalmachinery (8.3% from -3.9% in Q2), shipments oftransport equipment surged a phenomenal 56.6%(-14.1% in Q1, -25.1% in Q2), reflecting inventoryreplenishment. With monthly trade figures from Julyshowing exports to the US have lost momentum, itseems that the catch-up phase following the 11March disaster is over for most products, excepttransport equipment. With financial turmoil furtherundermining sentiment in American households andbusinesses, this year’s Christmas sales could drop,leading to a less bright outlook for Japanese exports.EU-bound exports: first decline in five monthsEU-bound shipments rose 2.3% m/m in September(0.0% in August) and grew 13.4% q/q in Q3 overall(-3.9% q/q in Q2). Products contributing to thequarterly gain include transport equipment (43.5%from -24.2% in Q2), electrical machinery (8.5% from0.0% in Q2), and general machinery (9.1%from -2.5% in Q2). But like shipments to the US, EUboundexports have lost momentum with the end ofthe post-disaster catch-up process. Making mattersworse, the eurozone’s deepening sovereign debtwoes have shaken the financial markets andsubstantially eroded growth expectations. It wouldnot be unexpected for exports to start trending lower.Asia-bound exports: Shipments to China stillbeing adjustedExports to Asia rose 2.5% m/m in September afterfalling 0.5% in August, and shipments in Q3 overallare up 5.8% q/q after plunging 8.4% q/q in Q2.Exports to China, Japan’s largest trading partner,rose 2.9% m/m in September after dropping 1.6% inAugust, and exports in Q3 overall recovered 8.6%q/q after plummeting 14.5% q/q in Q2. But comparedto pre-disaster January-February (we take a twomonthaverage because the February level isboosted by the Chinese New Year effect), exports toAsia and exports to China are still down 4.7% and10.3%, respectively. Trend-wise, exports to Chinahave been basically flat since July, a sluggishnessthat reflects the slowdown in the Chinese economythat began before Japan’s March disaster.Regarding products in Q3, China-bound shipmentsof transport equipment soared 63.4% q/q (-37.0% q/qin Q2) and electrical machinery shipments rose 8.8%q/q (-14.3% in Q2). While transport equipmentshipments have roughly returned to the normalJanuary-February average, electrical machineryshipments are still down by more than 10%. Generalmachinery exports to China posted a second straightquarterly decline (-10.4% q/q in Q2, -7.5% q/q in Q3):24.4% below normal, a grim indication of theweakness of Chinese domestic demand. Japanesedata for machine tool orders shows demand fromChina has yet to stabilise and is still trending lowerafter cresting at the start of the year.Real imports remain firm, as strong yen takesrootFinally turning to imports, real imports fell 2.8% m/m(2.5% in August), for the first setback in six months.Even so, real imports rose 2.8% q/q in Q3 (0.1% q/qin Q2), for a third straight quarterly advance. Thelevel as of September is 2.8% higher than predisasterFebruary. Such strong imports reflect threethings: the effect of yen appreciation (includingreverse imports by some companies), resurgentdemand for materials now that production hasrecovered and brisk demand for mineral fuel forthermal power generation, reflecting reduceddependence on nuclear power. In terms of products,mineral fuel imports rose 4.2% q/q (-3.4% q/q in Q2),transport equipment shipments surged 9.0% (-3.4%in Q2), electrical machinery shipments increased3.4% (-4.0% in Q2) and general machinery importspicked up the pace with 6.7% gains (2.0% in Q2).Ryutaro Kono/ Azusa Kato 27 October 2011<strong>Market</strong> <strong>Mover</strong>20www.Global<strong>Market</strong>s.bnpparibas.com

Japan: Lessons from a ‘Lewis Turning Point’• Japan’s era of rapid economic expansioncoincided with massive internal migration. Butwhen the supply of surplus rural labour forurban industries was fully absorbed, the era ofrapid growth ended. This is the ‘Lewis turningpoint,’ where wages rise as the labour supplyfrom the countryside tapers off: a modeldescribing the industrial revolution in Europethat applies surprisingly well to Japan.• Looking back, Japan’s trend growth ratestarted falling in the early 1970s after internalmigration began tapering off a decade earlier.But the authorities at the time misunderstoodthis and adopted stimulative policies to shore upgrowth, resulting in rampant real estatespeculation and soaring inflation of 25% y/y.• Conditions in China today resemble Japanwhen its era of robust growth ended. With wageshaving risen for several years in China’s coastalregions, surplus labour from the countrysidecould be tapering off (the Lewis turning point). Ifso, Chinese trend growth could be shiftinglower, and the authorities ought to adjust to anew cruising speed in order to avoid a hardlanding.• While it is just a risk scenario, prematurelyshifting to stimulative policies could put Chinaon the same path as Japan in the 1970s.65605550Chart 1: Manufacturing PMI –China, Brazil and <strong>India</strong>45China40Brazil<strong>India</strong>3508 09 10 11Source: Markit Group Limited, EcoWin, <strong>BNP</strong> paribas1612840-4-8Chart 2: Japan’s Real GDP (% y/y)195719739.4197419904.2 199120081.2-1257 60 63 66 69 72 75 78 81 84 87 90 93 96 99 02 05 08 11Source: Cabinet Office, <strong>BNP</strong> Paribas *Note: Trend calculated using HP filter.The global economy is slowing these days in largepart because the emerging market economies(EMEs) like China, Brazil and <strong>India</strong>, which havespearheaded growth since the Lehman shock, arelosing momentum. Developed economies like the USand eurozone have until recently somehow continueda modest expansion on the back of exports to theEMEs, while their own internal demand has stayedsluggish because of unresolved balance-sheets. Butwith the EMEs losing steam since the spring,recovery in the US and Europe has also stalled. Thishas aggravated structural problems in the US andEurope, including the sovereign debt woes insouthern Europe. That the US and Europe shouldsuccumb to economic soft patches, or even outrightrecession, whenever the global economy turns souris very much like the Japanese business cycle overthe past 20 years. Increasingly the EMEs are callingthe tune for the developed economies.EMEs look for early end to tighteningIn China and the other EMEs, economic growth isdecelerating alongside accelerating inflation. In otherwords, the economies are slowing not because ofweak aggregate demand but because aggregatedemand has expanded so briskly in the past threeyears that it has outstripped generating capacity.This has resulted in supply constraints that aredampening economic growth and pushing priceshigher. As such, to ensure sustainable growth,continued tightening policies are now needed to coolthe red-hot aggregate demand so inflationarypressures can be adequately neutralised.Unfortunately, concerns about slowing growth haveprompted many EMEs to start looking for an earlyend to tightening policies. In fact, Brazil has alreadyreversed course and slashed its policy rate in lateAugust and again in October.Ryutaro Kono 27 October 2011<strong>Market</strong> <strong>Mover</strong>21www.Global<strong>Market</strong>s.bnpparibas.com