Annual Report - EDP

Annual Report - EDP

Annual Report - EDP

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

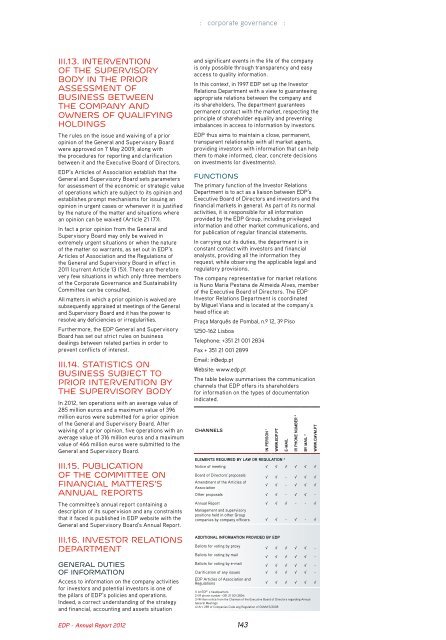

: corporate governance :III.13. Interventionof the supervisorybody in the priorassessment ofbusiness betweenthe company andowners of qualifyingholdingsThe rules on the issue and waiving of a prioropinion of the General and Supervisory Boardwere approved on 7 May 2009, along withthe procedures for reporting and clarificationbetween it and the Executive Board of Directors.<strong>EDP</strong>’s Articles of Association establish that theGeneral and Supervisory Board sets parametersfor assessment of the economic or strategic valueof operations which are subject to its opinion andestablishes prompt mechanisms for issuing anopinion in urgent cases or whenever it is justifiedby the nature of the matter and situations wherean opinion can be waived (Article 21 (7)).In fact a prior opinion from the General andSupervisory Board may only be waived inextremely urgent situations or when the natureof the matter so warrants, as set out in <strong>EDP</strong>’sArticles of Association and the Regulations ofthe General and Supervisory Board in effect in2011 (current Article 13 (5)). There are thereforevery few situations in which only three membersof the Corporate Governance and SustainabilityCommittee can be consulted.All matters in which a prior opinion is waived aresubsequently appraised at meetings of the Generaland Supervisory Board and it has the power toresolve any deficiencies or irregularities.Furthermore, the <strong>EDP</strong> General and SupervisoryBoard has set out strict rules on businessdealings between related parties in order toprevent conflicts of interest.III.14. Statistics onbusiness subject toprior intervention bythe supervisory bodyIn 2012, ten operations with an average value of285 million euros and a maximum value of 396million euros were submitted for a prior opinionof the General and Supervisory Board. Afterwaiving of a prior opinion, five operations with anaverage value of 316 million euros and a maximumvalue of 466 million euros were submitted to theGeneral and Supervisory Board.III.15. Publicationof the Committee onFinancial Matters’sannual reportsThe committee’s annual report containing adescription of its supervision and any constraintsthat it faced is published in <strong>EDP</strong> website with theGeneral and Supervisory Board’s <strong>Annual</strong> <strong>Report</strong>.III.16. Investor RelationsDepartmentGENERAL DUTIESOF INFORMATIONAccess to information on the company activitiesfor investors and potential investors is one ofthe pillars of <strong>EDP</strong>’s policies and operations.Indeed, a correct understanding of the strategyand financial, accounting and assets situation<strong>EDP</strong> - <strong>Annual</strong> <strong>Report</strong> 2012and significant events in the life of the companyis only possible through transparency and easyaccess to quality information.In this context, in 1997 <strong>EDP</strong> set up the InvestorRelations Department with a view to guaranteeingappropriate relations between the company andits shareholders. The department guaranteespermanent contact with the market, respecting theprinciple of shareholder equality and preventingimbalances in access to information by investors.<strong>EDP</strong> thus aims to maintain a close, permanent,transparent relationship with all market agents,providing investors with information that can helpthem to make informed, clear, concrete decisionson investments (or divestments).FUNCTIONSThe primary function of the Investor RelationsDepartment is to act as a liaison between <strong>EDP</strong>’sExecutive Board of Directors and investors and thefinancial markets in general. As part of its normalactivities, it is responsible for all informationprovided by the <strong>EDP</strong> Group, including privilegedinformation and other market communications, andfor publication of regular financial statements.In carrying out its duties, the department is inconstant contact with investors and financialanalysts, providing all the information theyrequest, while observing the applicable legal andregulatory provisions.The company representative for market relationsis Nuno Maria Pestana de Almeida Alves, memberof the Executive Board of Directors. The <strong>EDP</strong>Investor Relations Department is coordinatedby Miguel Viana and is located at the company’shead office at:Praça Marquês de Pombal, n.º 12, 3º Piso1250-162 LisboaTelephone: +351 21 001 2834Fax + 351 21 001 2899Email: ir@edp.ptWebsite: www.edp.ptThe table below summarises the communicationchannels that <strong>EDP</strong> offers its shareholdersfor information on the types of documentationindicated.CHANNELSElements required by law or regulation 4Notice of meeting √ √ √ √ √ √Board of Directors' proposals√ √ - √ √ √Amendment of the Articles ofAssociation√ √ - √ √ √Other proposals √ √ - √ √ -<strong>Annual</strong> <strong>Report</strong> √ √ √ - - √Management and supervisorypositions held in other Groupcompanies by company officers √ √ - √ - √Additional information provided by <strong>EDP</strong>Ballots for voting by proxy√ √ √ √ √ -Ballots for voting by mail√ √ √ √ √ -Ballots for voting by e-mail√ √ √ √ √ -Clarification of any issues √ √ √ √ √ -<strong>EDP</strong> Articles of Association andRegulations √ √ √ √ √ √1) At <strong>EDP</strong>’ s headquarters2) IR phone number +351 21 001 2834;3) Written notice from the Chaiman of the Executive Board of Directors regarding <strong>Annual</strong>General Meetings4) Art. 289 of Companies Code ang Regulation of CMVM 5/2008143In Person 1www.edp.ptE-mailIR Phone Number 2By Mail 3www.cmvm.pt