Download ICICI Pru LifeLink Pension SP brochure - ICICI Prudential ...

Download ICICI Pru LifeLink Pension SP brochure - ICICI Prudential ...

Download ICICI Pru LifeLink Pension SP brochure - ICICI Prudential ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

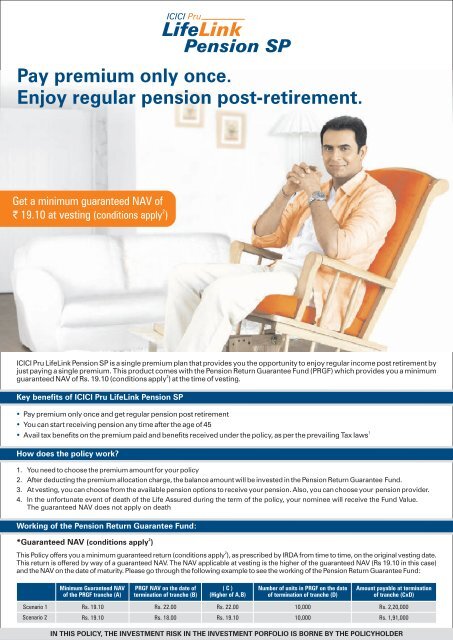

<strong>ICICI</strong> <strong>Pru</strong><strong>LifeLink</strong><strong>Pension</strong> <strong>SP</strong>Pay premium only once.Enjoy regular pension post-retirement.Get a minimum guaranteed NAV of219.10 at vesting (conditions apply )<strong>ICICI</strong> <strong>Pru</strong> <strong>LifeLink</strong> <strong>Pension</strong> <strong>SP</strong> is a single premium plan that provides you the opportunity to enjoy regular income post retirement byjust paying a single premium. This product comes with the <strong>Pension</strong> Return Guarantee Fund (PRGF) which provides you a minimum2guaranteed NAV of Rs. 19.10 (conditions apply ) at the time of vesting.Key benefits of <strong>ICICI</strong> <strong>Pru</strong> <strong>LifeLink</strong> <strong>Pension</strong> <strong>SP</strong>Pay premium only once and get regular pension post retirementYou can start receiving pension any time after the age of 45Avail tax benefits on the premium paid and benefits received under the policy, as per the prevailing Tax lawsHow does the policy work?1. You need to choose the premium amount for your policy2. After deducting the premium allocation charge, the balance amount will be invested in the <strong>Pension</strong> Return Guarantee Fund.3. At vesting, you can choose from the available pension options to receive your pension. Also, you can choose your pension provider.4. In the unfortunate event of death of the Life Assured during the term of the policy, your nominee will receive the Fund Value.The guaranteed NAV does not apply on deathWorking of the <strong>Pension</strong> Return Guarantee Fund:2*Guaranteed NAV (conditions apply )2This Policy offers you a minimum guaranteed return (conditions apply ), as prescribed by IRDA from time to time, on the original vesting date.This return is offered by way of a guaranteed NAV. The NAV applicable at vesting is the higher of the guaranteed NAV (Rs 19.10 in this case)and the NAV on the date of maturity. Please go through the following example to see the working of the <strong>Pension</strong> Return Guarantee Fund:1Minimum Guaranteed NAVof the PRGF tranche (A)PRGF NAV on the date oftermination of tranche (B)( C )(Higher of A,B)Number of units in PRGF on the dateof termination of tranche (D)Amount payable at terminationof tranche (CxD)Scenario 1Scenario 2Rs. 19.10 Rs. 22.00 Rs. 22.00 10,000 Rs. 2,20,000Rs. 19.10Rs. 18.00 Rs. 19.10 10,000 Rs. 1,91,000IN THIS POLICY, THE INVESTMENT RISK IN THE INVESTMENT PORFOLIO IS BORNE BY THE POLICYHOLDER

<strong>ICICI</strong> <strong>Pru</strong> <strong>LifeLink</strong> <strong>Pension</strong> <strong>SP</strong> at a glanceMinimum / Maximum Age At EntryMinimum / Maximum Vesting AgePolicy Term35 / 70 years 45 / 80 years10 yearsIllustrationPremium Amount: Rs. 2,00,000 Term: 10 years Age: 45 years Annuity Option: Life Annuity Annuity Frequency: Annual* 2Minimum guaranteed Fund Value at vesting (conditions apply ) Rs. 3,64,748#Expected Annual Annuity Rs. 27,466*This amount is calculated based on the fund attaining a minimum NAV of Rs. 19.10 on October 11, 2020 from Rs. 10.00 and is net of allapplicable charges. The NAV applicable at vesting is the higher of the guaranteed NAV (Rs. 19.10) and the then prevailing NAV.#The annuity amounts have been calculated based on indicative annuity rates and are subject to change from time to time.Loyalty AdditionLoyalty Addition will be allocated at end of the 10th policy year. Loyalty Addition will depend on the single premium amount. For more details,please refer the sales <strong>brochure</strong>.Loyalty Addition will be calculated on the average of the Fund Values on the last day of eight policy quarters preceding the said allocation.Charges under the PolicyPremium Allocation ChargeThis charge will be deducted from the premium amount at the time of premium payment and units will be allocated thereafter.Single premium amount< Rs. 5,00,000> Rs. 5,00,000Premium Allocation Charge (as a % of Single Premium)4% 5%2%4%Policy Administration Charge#There would be a fixed policy administration charge of Rs. 60 per month and it will be charged only during the first three policy years.Fund Management Charge (FMC)A fund management charge of 1.25% p.a. will be applicable. There will be an additional charge for the cost of investmentguarantee of 0.25% per annum. This will be charged by adjustment to the NAV.Surrender ChargesThe policy can be surrendered only after completion of five policy years. There will be no surrender charges in this policy.The guaranteed NAV does not apply on surrender. In the case of surrender, you can avail only up to a maximum of one-third of thesurrender value in lump sum and the remaining amount must be used to purchase an annuity.Miscellaneous Charges#If there are any policy alterations during the policy term, they will be subject to a miscellaneous charge of Rs. 250 per alteration.#These charges will be made by redemption of units.Terms and Conditions (T&C)1. Tax benefits: Tax benefits under the policy are subject to conditions under section 80CCC and 10(10A) of the Income Tax Act, 1961.Service tax and education cess will be charged extra as per applicable rates and company policy from time to time. The tax laws aresubject to amendments from time to time. Amount received on surrender or as pension is taxable as income.2. In case of surrender and Death Benefit payouts, guaranteed NAV will not be applicable. There will be a cost of investment guarantee of0.25% p.a. of Fund Value which will be charged by adjustment to the fund NAV.Call our advisor at:Registered Office: <strong>ICICI</strong> <strong>Pru</strong>dential Life Insurance Company Limited, <strong>ICICI</strong> <strong>Pru</strong>Life Towers, 1089, Appasaheb Marathe Marg, Prabhadevi, Mumbai 400 025.www.iciciprulife.comIN THIS POLICY, THE INVESTMENT RISK IN THE INVESTMENT PORFOLIO IS BORNE BY THE POLICYHOLDER. Insurance is the subject matter of the solicitation. For moredetails on the risk factors, term and conditions please read sales <strong>brochure</strong> carefully before concluding the sale. Unlike traditional products, Unit linked insurance products aresubject to market risk, which affect the Net Asset Values and the customer shall be responsible for his/her decision. The names of the Company, Product names or fund options donot indicate their quality or future guidance on returns. Investments are subject to market risk. This product leaflet is indicative of the terms, conditions, warranties andexceptions in the insurance policy. In the event of conflict, if any between the terms & conditions contained in this leaflet and those contained in the policy documents, the terms &conditions contained in the Policy Document shall prevail. © 2010, <strong>ICICI</strong> <strong>Pru</strong>dential Life Insurance Co. Ltd. Reg. No. 105. <strong>ICICI</strong> <strong>Pru</strong> <strong>LifeLink</strong> <strong>Pension</strong> <strong>SP</strong> - Form No. U81; UIN:105L113V01; Advt. No.: L/II/598/2010-11.