Solutions to Midterm exam Stochastic Calculus, 1999-2000

Solutions to Midterm exam Stochastic Calculus, 1999-2000

Solutions to Midterm exam Stochastic Calculus, 1999-2000

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

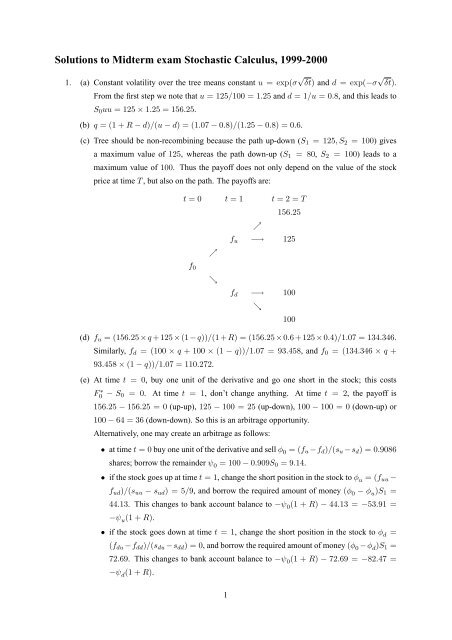

<strong>Solutions</strong> <strong>to</strong> <strong>Midterm</strong> <strong>exam</strong> S<strong>to</strong>chastic <strong>Calculus</strong>, <strong>1999</strong>-<strong>2000</strong>1. (a) Constant volatility over the tree means constant u = exp(σ √ δt) and d = exp(−σ √ δt).From the first step we note that u = 125/100 = 1.25 and d = 1/u = 0.8, and this leads <strong>to</strong>S 0 uu = 125 × 1.25 = 156.25.(b) q = (1 + R − d)/(u − d) = (1.07 − 0.8)/(1.25 − 0.8) = 0.6.(c) Tree should be non-recombining because the path up-down (S 1 = 125, S 2 = 100) givesa maximum value of 125, whereas the path down-up (S 1 = 80, S 2 = 100) leads <strong>to</strong> amaximum value of 100. Thus the payoff does not only depend on the value of the s<strong>to</strong>ckprice at time T , but also on the path. The payoffs are:t = 0 t = 1 t = 2 = T156.25↗f u −→ 125↗f 0↘f d −→ 100↘100(d) f u = (156.25 × q + 125 × (1 − q))/(1 + R) = (156.25 × 0.6 + 125 × 0.4)/1.07 = 134.346.Similarly, f d = (100 × q + 100 × (1 − q))/1.07 = 93.458, and f 0 = (134.346 × q +93.458 × (1 − q))/1.07 = 110.272.(e) At time t = 0, buy one unit of the derivative and go one short in the s<strong>to</strong>ck; this costsF0 ∗ − S 0 = 0. At time t = 1, don’t change anything. At time t = 2, the payoff is156.25 − 156.25 = 0 (up-up), 125 − 100 = 25 (up-down), 100 − 100 = 0 (down-up) or100 − 64 = 36 (down-down). So this is an arbitrage opportunity.Alternatively, one may create an arbitrage as follows:• at time t = 0 buy one unit of the derivative and sell φ 0 = (f u −f d )/(s u −s d ) = 0.9086shares; borrow the remainder ψ 0 = 100 − 0.909S 0 = 9.14.• if the s<strong>to</strong>ck goes up at time t = 1, change the short position in the s<strong>to</strong>ck <strong>to</strong> φ u = (f uu −f ud )/(s uu − s ud ) = 5/9, and borrow the required amount of money (φ 0 − φ u )S 1 =44.13. This changes <strong>to</strong> bank account balance <strong>to</strong> −ψ 0 (1 + R) − 44.13 = −53.91 =−ψ u (1 + R).• if the s<strong>to</strong>ck goes down at time t = 1, change the short position in the s<strong>to</strong>ck <strong>to</strong> φ d =(f du −f dd )/(s du −s dd ) = 0, and borrow the required amount of money (φ 0 −φ d )S 1 =72.69. This changes <strong>to</strong> bank account balance <strong>to</strong> −ψ 0 (1 + R) − 72.69 = −82.47 =−ψ d (1 + R).1

• The payoff in the up-up state is f uu −φ u s uu −ψ u (1+R) 2 = 11.76; in the up-down state,it is f ud −φ u s ud −ψ u (1+R) 2 = 11.76; in the down-up state, it is f du −φ d s du −ψ d (1+R) 2 = 11.76, and in the down-down state it is again f dd −φ d s dd −ψ d (1+R) 2 = 11.76.Thus this strategy leads <strong>to</strong> a certain payoff of 11.76, which is exactly the difference betweenf 0 and F ∗ 0 , with accumulated interest: (f 0 − F ∗ 0 )(1 + R)2 = 11.76.2. (a) log P t = f(t, P t ), with derivatives ∂f/∂t = 0, ∂f/∂P t = 1/P t , and ∂ 2 f/∂P 2 t = −1/P 2 t .Hence(b) Integrating the SDE yieldsd log P t = 1 dP t − 1P t 2Pt2 σ 2 t dt= r t dt + σ(T − t)dB t − 1 2 σ2 (T − t) 2 dtlog P t = log P 0 += ( r t − 1 2 σ2 (T − t) 2) dt + σ(T − t)dB t .∫ t0(rs − 1 2 σ2 (T − s) 2) ∫ tds + σ(T − s)dB s , (1)which indeed expresses log P t in terms of P 0 and (r s , B s , s ≤ t). The expression can berewritten using∫ t0and, using integration by parts,∫ t0− 1 2 σ2 (T − s) 2 ds = [ 16 σ2 (T − s) 3] t0 = 1 6 σ2 [ (T − t) 3 − T 3] ,σ(T − s)dB s = σ(T − t)B t − σThus, (1) leads <strong>to</strong>log P t = log P 0 +∫ t0∫ t(c) P T = 1 implies log P T = 0, and hence, via (1),0 = log P 0 +0B s d(T − s) = σ(T − t)B t + σr s ds + 1 6 σ2 [ (T − t) 3 − T 3] + σ(T − t)B t + σ∫ T00∫ t(rs − 1 2 σ2 (T − s) 2) ∫ Tds + σ(T − s)dB s ,and solving this for log P 0 and substituting this back in<strong>to</strong> (1) gives00∫ t0B s ds.B s ds. (2)and hencelog P t = −+= −∫ T0∫ t0∫ Tt(rs − 1 2 σ2 (T − s) 2) ∫ Tds − σ(T − s)dB s(rs − 1 2 σ2 (T − s) 2) ∫ tds + σ(T − s)dB s(rs − 1 2 σ2 (T − s) 2) ∫ Tds − σ(T − s)dB s ,( ∫ T (P t = exp − rs − 1 2 σ2 (T − s) 2) ∫ T)ds − σ(T − s)dB s , (3)tt00t2

which is of the required form. Analogously <strong>to</strong> (2), this can be further rewritten as( ∫ T∫ T)P t = exp − r s ds + 1 6 σ2 (T − t) 3 + σ(T − t)B t − σ B s ds .tt(d) Itô’s Lemma applied <strong>to</strong> R t = f(t, log P t ) = − log P t /(T −t) gives ∂f/∂t = − log P t /(T −t) 2 = R t /(T − t), ∂f/∂ log P t = −1/(T − t) and ∂ 2 f/∂ log P 2 t = 0, sodR t ===1T − t R tdt − 1T − t d log P t1 [(Rt − r t + 1T − t2 σ2 (T − t) 2) ]dt − σ(T − t)dB t( )Rt − r tT − t + 1 2 σ2 (T − t) dt − σdB t .The volatility of R t becomes −σ. The negative sign reflects that positive increments in B t ,which will lead <strong>to</strong> an increase in the bond price P t , will obviously decrease the yield <strong>to</strong>maturity. Unlike the volatility σ t of P t , the volatility of R t is constant, i.e., not a functionof (T − t). The fact that P t should converge <strong>to</strong> P T= 1 as t → T , requires the bondprice volatility <strong>to</strong> approach zero as t → T . In the present model the bond price volatity isproportional <strong>to</strong> (T −t), which implies that the yield-<strong>to</strong>-maturity will exactly have a constantvolatility.(e) One possibility would be <strong>to</strong> use the original SDE for P t , which leads <strong>to</strong> the approximationP n t i= P n t i−1+ r ti−1 P n t i−1[t i − t i−1 ] + σ(T − t i−1 )P n t i−1[B ti − B ti−1 ].Here the starting value should be chosen such that P n Texponent of= 1! Alternatively, one could use thelog P n t i= log P n t i−1+ ( r ti−1 − 1 2 σ2 (T − t i−1 ) 2) [t i − t i−1 ] + σ(T − t i−1 )[B ti − B ti−1 ],again using the boundary condition log P T = 0.(f) Note that d log β t = r t dt, which implies dβ −1tmotion term”. This implies that= −r t βt−1 dt, which has no “BrowniandP t β −1t= β −1t dP t + P t dβt −1 ,see e.g. Baxter and Rennie, p.62, exercise 3.6. HencedZ t = β −1tdP t − r t P t β −1 dt= β −1t (dP t − r t P t dt)= β −1t σ(T − t)P t dB t= σ(T − t)Z t dB t .This is an Itô process with a zero drift term, and hence a martingale.t3