ANNUAL REPORT INTRUM JUSTITIA A N N U A L R EP O R T 2 0 ...

ANNUAL REPORT INTRUM JUSTITIA A N N U A L R EP O R T 2 0 ...

ANNUAL REPORT INTRUM JUSTITIA A N N U A L R EP O R T 2 0 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Net earnings amounted to SEK 452 M (441)<br />

and earnings per share before dilution to<br />

SEK 5.67 (5.53).<br />

Cash flow from operations was SEK 1,630 M,<br />

an increase of 14 percent from the previous year.<br />

Operating earnings (EBIT) amounted to SEK 731 M<br />

(668). Revenues and operating earnings included<br />

purchased debt revaluations as well as costs relating<br />

to acquisitions and regional restructuring of SEK -25<br />

M (-106). Excluding these items, the operating earnings<br />

(EBIT) were SEK 756 M (774), which is equivalent<br />

to an operating margin of 20 percent (19).<br />

The Board of Directors<br />

proposes a dividend of SEK<br />

4.10 per share (3.75).<br />

Intrum Justitia strengthened its position<br />

in several sectors during the<br />

year, including telecom and finance,<br />

through new agreements with<br />

Swedbank, Nordea, Sunrise etc.<br />

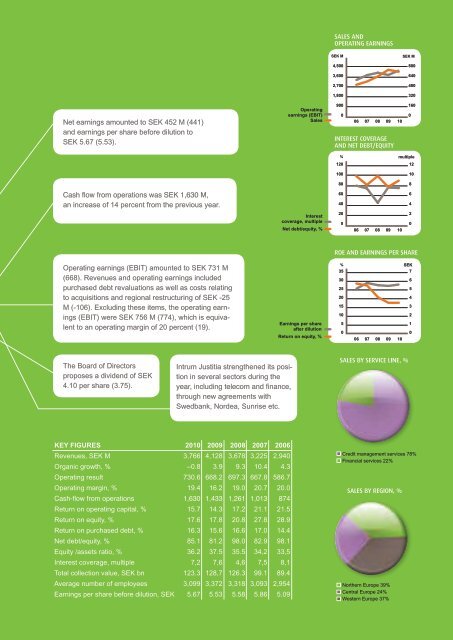

KEY FIGURES 2010 2009 2008 2007 2006<br />

Revenues, SEK M 3,766 4,128 3,678 3,225 2,940<br />

Organic growth, % –0.8 3.9 9.3 10.4 4.3<br />

Operating result 730.6 668.2 697.3 667.8 586.7<br />

Operating margin, % 19.4 16.2 19.0 20.7 20.0<br />

Cash-flow from operations 1,630 1,433 1,261 1,013 874<br />

Return on operating capital, % 15.7 14.3 17.2 21.1 21.5<br />

Return on equity, % 17.6 17.8 20.8 27.8 28.9<br />

Return on purchased debt, % 16.3 15.6 16.6 17.0 14.4<br />

Net debt/equity, % 85.1 81.2 98.0 82.9 98.1<br />

Equity /assets ratio, % 36.2 37.5 35.5 34,2 33,5<br />

Interest coverage, multiple 7,2 7,6 4,6 7,5 8,1<br />

Total collection value, SEK bn 123.3 128,7 126.3 99.1 89.4<br />

Average number of employees 3,099 3,372 3,318 3,093 2,954<br />

Earnings per share before dilution, SEK 5.67 5.53 5.58 5.86 5.09<br />

Operating<br />

earnings (EBIT)<br />

Sales<br />

Interest<br />

coverage, multiple<br />

Net debt/equity, %<br />

Earnings per share<br />

after dilution<br />

Return on equity, %<br />

SALES AND<br />

OPERATING EARNINGS<br />

SEK M<br />

4,500<br />

3,600<br />

2,700<br />

1,800<br />

900<br />

0<br />

namn på kapitel här<br />

06 07 08 09 10<br />

INTEREST COVERAGE<br />

AND NET DEBT/EQUITY<br />

%<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

ROE AND EARNINGS PER SHARE<br />

%<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

06 07 08 09 10<br />

SALES BY SERVICE LINE, %<br />

Credit management services 78%<br />

Financial services 22%<br />

SALES BY REGION, %<br />

Northern Europe 39%<br />

Central Europe 24%<br />

Western Europe 37%<br />

SEK M<br />

800<br />

640<br />

480<br />

320<br />

160<br />

SEK<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

06 07 08 09 10<br />

0<br />

multiple<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

3