textiles, clothing, leather & footwear presentation to ppc

textiles, clothing, leather & footwear presentation to ppc

textiles, clothing, leather & footwear presentation to ppc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TEXTILES, CLOTHING, LEATHER &FOOTWEAR PRESENTATIONTO PPCBYAbisha Peter TemboOn31 st OCTOBER 20121

Sec<strong>to</strong>r BackgroundThe TCL&F economic impactDirect employment of 120,000 people representing 11 percent of manufacturingemployment.The estimated direct employment of over 160,000 people through informalestablishments and SME’s not accounted for by National BargainingCouncils.Indirect employment <strong>to</strong> about 320000.The annual turnover value of R35-billion.Contribution <strong>to</strong> GDP of about 2.8 percent.Of about 2000 active companies with 1429 registered with NBC as at 2009.Employer by size and region in TCL&F sec<strong>to</strong>r in South AfricaSource: CTFL database (2009)

RECENT ECONOMIC PERFORMANCERecent economic performanceTextilesClothingLeather and <strong>leather</strong>goodsFootwearProduction -19.6 -8.9 -2.8 -4.1Capacity utilisation -7.2% -2.9 -9.8 +1.1Exports -5.9% -15 -44.7 +13.4Imports +1.7% +18.7 -15.8 +24.1Source: IDC, Manufacturing Survey, 20103

Employment Trends for TCL&F Sec<strong>to</strong>r 2000 <strong>to</strong> 2009Source: Quantec 2010Challenges•Stronger exchange rate•Illegal imports•High cot<strong>to</strong>n price•Sec<strong>to</strong>r education and skills gaps•Increasing utility cost•Stagnated FDI•Though LDI was stagnated it is increasing due <strong>to</strong> theProduction Incentives offered <strong>to</strong> the sec<strong>to</strong>r by the dti

Textile, Clothing, Leather & Footwear Manufacturing ProfileGlobal manufacturing and trade trendsWorld Merchandised Exports of TCL&FW900800$ - Billion70060050040030020010001985 1990 1995 2000 2005 2010ClothingTextileLeatherFootwearTotalSource: Quantec 2010

Textile, Clothing, Leather & Footwear Manufacturing ProfileLocal manufacturing and trade trendsTotal SA CTL&F Trade (2010 R -billion $ billion %CTL&FW ImportsLocal Sales 31.23 4.46 89.2Exports Sales 3.77 0.54 10.8Total Sales 35.00 500 5.00 100Imports 24.54 3.5 70.1Rand -Billi on30252015105SA Production value of CTL&FWSec<strong>to</strong>rs (Total Sales – Imports)10.46 1.49 29.902001 2002 2003 2004 2005 2006 2007 2008 2009 2010 201108: Textiles (311-312) 09: Wearing apparel (313-315)10: Leather & <strong>leather</strong> products (316) 11: Footw ear (317)TotalR-BillionCTL&FW Trade BalanceCTL&FW ExportsRand -Billion502001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011-5-10-15-20-25Rand -Bil lion8765432102001 2002 2003 2004 2005 2006 2007 2008 2009 2010 201108: Textiles (311-312) 09: Wearing apparel (313-315) 10: Leather & <strong>leather</strong> products (316)11: Footw ear (317) TotalR-Billion08: Textiles (311-312) 09: Wearing apparel (313-315)10: Leather & <strong>leather</strong> products (316) 11: Footw ear (317)TotalR-Billion

South Africa still has an integrated industry in the textile, <strong>clothing</strong>, <strong>leather</strong> & <strong>footwear</strong> sec<strong>to</strong>r.There has been continuous loss in manufacturing capacity and employment due <strong>to</strong> downsizing and closures during last decade.Niche can be broadly defined as a comparative and competitive advantage a product or a segment in one region has over another region:The majority of the manufacturers are currently operating in the domestic market with specific or combined niches either in raw material ormarket segment or product or process or fast fashion coordination.The technical and industrial <strong>textiles</strong> manufacturers, however, have still been able <strong>to</strong> retain their presence in domestic as well asinternational markets.The review of products and process technologies involved in 150 manufacturers indicate that manufacturers have acquired operatingniches either due <strong>to</strong> their presence in specific niche markets or by acquiring specific technologies divided along the process streams.

Cus<strong>to</strong>mized Sec<strong>to</strong>r Programme• Textiles & Clothing CSP 2005• Leather & Footwear CSP 2007• Textiles & Clothing Implementation 2009• Leather & Footwear Implementation 2010• Studies carried out in the sec<strong>to</strong>rs– Outcomes:• Uncompetitiveness• Illegal l imports• Skills shortages• Lack of investment• Loss of local l market share

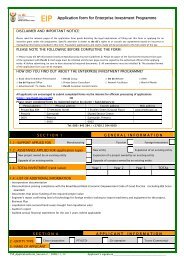

DTI INCENTIVES• Clothing and Textiles Competitiveness Programme(CTCP)– CIP (2009) which facilitate competitiveness ofsec<strong>to</strong>rs through process improvement– PIP (2010) provide grant calculated as apercentage of manufacturing value addition– Guidelines www.ctcp.co.za• Designation– Sec<strong>to</strong>rs re-designated through new PPPFA inDecember 2011– Original designation 2002

IMPACT of CTCP• CIP– R283 m (R36.5m)• PIP– R 637.5 m ( R501 m)– 49888 Jobs saved (19014)– 12205 Jobs created (6668)– 144 SMEs (60)

Impact (cont..)• Retailers moving <strong>to</strong> local Purchases– Foschini approx. 68 %– Edcon approx. 45 %• Footwear exporting <strong>to</strong> SADC region• Cluster programmes developed <strong>to</strong> challenge<strong>footwear</strong> imports• Created shortages of fashion fabrics no longerbeing manufactured locally (Labour, Texfed &AMSA)

DESIGNATION• Textiles, Clothing, Leather & Footwearinitially iti designated d in 2002• Designated in December 2011 under newPPPFA• Practice Note signed by Minister of Financeon 17 July 2012• All sec<strong>to</strong>rs designated at 100 % localcontent.12

REGIONAL PARTICIPATION• SACU– DCCS discontinued d 31 st March 2010 and PIPsuccessfully promoted and accepted as longterm replacement of DCCS– SACU Industrial Policy being pursued• PI and Hides Tanning identified as pilots• SADC– Country of Origin Labeling– Rules of Origin

Thank you !14