Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

34 IFRS 10 Consolidated Financial StatementsThe example below indicates how the criteria set out above could be applied in practice.Example 10 – Application of ‘linkage’ criteria [IFRS 10.B72 Application Example 14 – 14D]Basic ScenarioA fund manager (the decision maker) establishes markets and manages a fund that provides investmentopportunities to a number of investors.The fund manager must make decisions in the best interests of all investors and in accordance with the fund’sgoverning agreements but has wide decision-making discretion.The fund manager receives a market-based fee for its services equal to:––1% of assets under management, and––20% of all the fund’s profits if a specified profit level is achieved.The fees are commensurate with the services provided.AnalysisThe fund manager is likely to be an agent.Although it must make decisions in the best interests of all investors, the fund manager has extensive decisionmakingauthority to direct the relevant activities of the fund.The investors do not hold substantive rights that could affect the fund manager’s decision-making authority.The fund manager is paid fixed and performance-related fees that are commensurate with the services provided.In addition, the remuneration aligns the interests of the fund manager with those of the other investors toincrease the value of the fund, without creating exposure to variability of returns from the activities of the fundthat is of such significance that the remuneration, when considered in isolation, indicates that the fund manager isa principal.Scenario 2Same facts as in basic scenario plus:––Fund manager has 2% investment in fund but no obligation to fund losses beyond its 2% investments––Investors can remove the fund manager by a simple majority vote, but only for breach of contract.AnalysisThe fund manager is likely to be an agent.The fund manager’s 2% investment increases its exposure to variability of returns from the activities of the fundwithout creating exposure that is of such significance that it indicates that the fund manager is a principal.The other investors’ rights to remove the fund manager are considered to be protective rights because they areexercisable only for breach of contract.

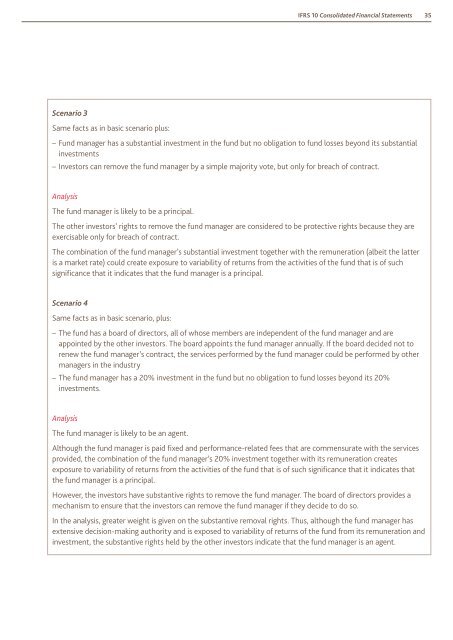

IFRS 10 Consolidated Financial Statements35Scenario 3Same facts as in basic scenario plus:––Fund manager has a substantial investment in the fund but no obligation to fund losses beyond its substantialinvestments––Investors can remove the fund manager by a simple majority vote, but only for breach of contract.AnalysisThe fund manager is likely to be a principal.The other investors’ rights to remove the fund manager are considered to be protective rights because they areexercisable only for breach of contract.The combination of the fund manager’s substantial investment together with the remuneration (albeit the latteris a market rate) could create exposure to variability of returns from the activities of the fund that is of suchsignificance that it indicates that the fund manager is a principal.Scenario 4Same facts as in basic scenario, plus:––The fund has a board of directors, all of whose members are independent of the fund manager and areappointed by the other investors. The board appoints the fund manager annually. If the board decided not torenew the fund manager’s contract, the services performed by the fund manager could be performed by othermanagers in the industry––The fund manager has a 20% investment in the fund but no obligation to fund losses beyond its 20%investments.AnalysisThe fund manager is likely to be an agent.Although the fund manager is paid fixed and performance-related fees that are commensurate with the servicesprovided, the combination of the fund manager’s 20% investment together with its remuneration createsexposure to variability of returns from the activities of the fund that is of such significance that it indicates thatthe fund manager is a principal.However, the investors have substantive rights to remove the fund manager. The board of directors provides amechanism to ensure that the investors can remove the fund manager if they decide to do so.In the analysis, greater weight is given on the substantive removal rights. Thus, although the fund manager hasextensive decision-making authority and is exposed to variability of returns of the fund from its remuneration andinvestment, the substantive rights held by the other investors indicate that the fund manager is an agent.

- Page 6 and 7: 6 IFRS 10 Consolidated Financial St

- Page 8 and 9: 8 IFRS 10 Consolidated Financial St

- Page 10 and 11: 10 IFRS 10 Consolidated Financial S

- Page 12 and 13: 12 IFRS 10 Consolidated Financial S

- Page 14 and 15: 14 IFRS 10 Consolidated Financial S

- Page 16 and 17: 16 IFRS 10 Consolidated Financial S

- Page 18 and 19: 18 IFRS 10 Consolidated Financial S

- Page 20 and 21: 20 IFRS 10 Consolidated Financial S

- Page 22 and 23: 22 IFRS 10 Consolidated Financial S

- Page 24 and 25: 24 IFRS 10 Consolidated Financial S

- Page 26 and 27: 26 IFRS 10 Consolidated Financial S

- Page 28 and 29: 28 IFRS 10 Consolidated Financial S

- Page 30 and 31: 30 IFRS 10 Consolidated Financial S

- Page 32 and 33: 32 IFRS 10 Consolidated Financial S

- Page 36 and 37: 36 IFRS 10 Consolidated Financial S

- Page 38 and 39: 38 IFRS 10 Consolidated Financial S

- Page 40 and 41: 40 IFRS 10 Consolidated Financial S

- Page 42 and 43: 42 IFRS 10 Consolidated Financial S

- Page 44 and 45: 44 IFRS 10 Consolidated Financial S

- Page 46 and 47: 46 IFRS 10 Consolidated Financial S

- Page 48 and 49: 48 IFRS 10 Consolidated Financial S

- Page 50 and 51: 50 IFRS 10 Consolidated Financial S

- Page 52 and 53: 52 IFRS 10 Consolidated Financial S

- Page 54 and 55: 54 IFRS 10 Consolidated Financial S

- Page 56 and 57: 56 IFRS 10 Consolidated Financial S

- Page 58 and 59: 58 IFRS 10 Consolidated Financial S

- Page 60 and 61: 60 IFRS 10 Consolidated Financial S

- Page 62: ContactFor further information abou

<strong>IFRS</strong> <strong>10</strong> <strong>Consolidated</strong> <strong>Financial</strong> Statements35Scenario 3Same facts as in basic scenario plus:––Fund manager has a substantial investment in the fund but no obligation <strong>to</strong> fund losses beyond its substantialinvestments––Inves<strong>to</strong>rs can remove the fund manager by a simple majority vote, but only for breach of contract.AnalysisThe fund manager is likely <strong>to</strong> be a principal.The other inves<strong>to</strong>rs’ rights <strong>to</strong> remove the fund manager are considered <strong>to</strong> be protective rights because they areexercisable only for breach of contract.The combination of the fund manager’s substantial investment <strong>to</strong>gether with the remuneration (albeit the latteris a market rate) could create exposure <strong>to</strong> variability of returns from the activities of the fund that is of suchsignificance that it indicates that the fund manager is a principal.Scenario 4Same facts as in basic scenario, plus:––The fund has a board of direc<strong>to</strong>rs, all of whose members are independent of the fund manager and areappointed by the other inves<strong>to</strong>rs. The board appoints the fund manager annually. If the board decided not <strong>to</strong>renew the fund manager’s contract, the services performed by the fund manager could be performed by othermanagers in the industry––The fund manager has a 20% investment in the fund but no obligation <strong>to</strong> fund losses beyond its 20%investments.AnalysisThe fund manager is likely <strong>to</strong> be an agent.Although the fund manager is paid fixed and performance-related fees that are commensurate with the servicesprovided, the combination of the fund manager’s 20% investment <strong>to</strong>gether with its remuneration createsexposure <strong>to</strong> variability of returns from the activities of the fund that is of such significance that it indicates thatthe fund manager is a principal.However, the inves<strong>to</strong>rs have substantive rights <strong>to</strong> remove the fund manager. The board of direc<strong>to</strong>rs provides amechanism <strong>to</strong> ensure that the inves<strong>to</strong>rs can remove the fund manager if they decide <strong>to</strong> do so.In the analysis, greater weight is given on the substantive removal rights. Thus, although the fund manager hasextensive decision-making authority and is exposed <strong>to</strong> variability of returns of the fund from its remuneration andinvestment, the substantive rights held by the other inves<strong>to</strong>rs indicate that the fund manager is an agent.