Integrated 4th ANNUAL Wealth Management - Euromoney Institutional ...

Integrated 4th ANNUAL Wealth Management - Euromoney Institutional ...

Integrated 4th ANNUAL Wealth Management - Euromoney Institutional ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

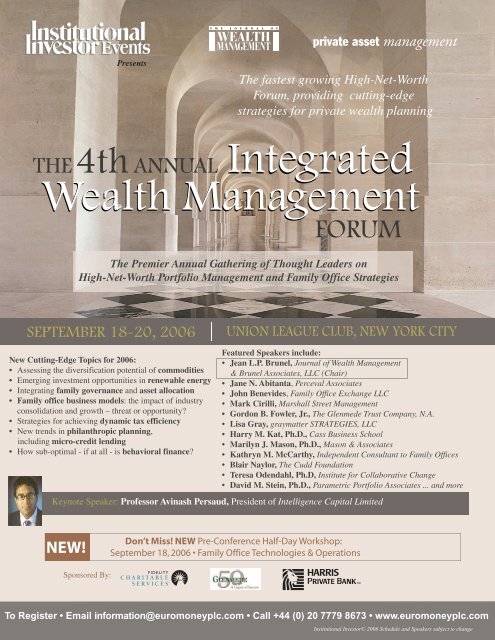

PresentsThe fastest growing High-Net-WorthForum, providing cutting-edgestrategies for private wealth planningTHE <strong>4th</strong> <strong>ANNUAL</strong> <strong>Integrated</strong><strong>Wealth</strong> <strong>Management</strong>FORUMThe Premier Annual Gathering of Thought Leaders onHigh-Net-Worth Portfolio <strong>Management</strong> and Family Office StrategiesSEPTEMBER 18-20, 2006UNION LEAGUE CLUB, NEW YORK CITYNew Cutting-Edge Topics for 2006:• Assessing the diversification potential of commodities• Emerging investment opportunities in renewable energy• Integrating family governance and asset allocation• Family office business models: the impact of industryconsolidation and growth – threat or opportunity?• Strategies for achieving dynamic tax efficiency• New trends in philanthropic planning,including micro-credit lending• How sub-optimal - if at all - is behavioral finance?Featured Speakers include:• Jean L.P. Brunel, Journal of <strong>Wealth</strong> <strong>Management</strong>& Brunel Associates, LLC (Chair)• Jane N. Abitanta, Perceval Associates• John Benevides, Family Office Exchange LLC• Mark Cirilli, Marshall Street <strong>Management</strong>• Gordon B. Fowler, Jr., The Glenmede Trust Company, N.A.• Lisa Gray, graymatter STRATEGIES, LLC• Harry M. Kat, Ph.D., Cass Business School• Marilyn J. Mason, Ph.D., Mason & Associates• Kathryn M. McCarthy, Independent Consultant to Family Offices• Blair Naylor, The Cudd Foundation• Teresa Odendahl, Ph.D, Institute for Collaborative Change• David M. Stein, Ph.D., Parametric Portfolio Associates ... and moreKeynote Speaker: Professor Avinash Persaud, President of Intelligence Capital LimitedNEW!Don’t Miss! NEW Pre-Conference Half-Day Workshop:September 18, 2006 • Family Office Technologies & OperationsTo Register • Email information@euromoneyplc.com • Call +44 (0) 20 7779 8673 • www.euromoneyplc.com<strong>Institutional</strong> Investor© 2006 Schedule and Speakers subject to change

<strong>4th</strong> Annual <strong>Integrated</strong> <strong>Wealth</strong> <strong>Management</strong> ForumSeptember 18-20, 2006, Union League Club, New York CityMessage from the Conference ChairWe are delighted to welcome you to <strong>Institutional</strong> Investor’s <strong>4th</strong> Annual <strong>Integrated</strong> <strong>Wealth</strong> <strong>Management</strong> Forum, whichevolves every year to meet the changing needs of the ever-growing private wealth management industry. Once morewe will be bringing together the thought leaders in high-net-worth portfolio management to share their experience andexpertise on cutting-edge themes such as the diversification potential of commodities, investing in renewableenergy, asset allocation-family governance integration, dynamic tax efficiency, family office business models, newtrends in philanthropic planning, compliance and auditing for family offices, and much more!Jean L.P. BrunelEditor, Journal of <strong>Wealth</strong> <strong>Management</strong>; Managing Principal, Brunel Associates, LLC2006 Advisory Board• Jean L.P. Brunel, Editor, Journal of <strong>Wealth</strong> <strong>Management</strong>; Managing Principal, Brunel Associates, LLC• Gordon B. Fowler, Jr., Chief Investment Officer; Senior Vice President, The Glenmede Trust Company, N.A.• Harry M. Kat, Ph.D., Professor of Risk <strong>Management</strong>; Director, Alternative Investment Research Center, Cass Business School• Marilyn J. Mason, Ph.D., President, Mason & Associates• Kathryn McCarthy, Independent Consultant to Families & Family OfficesWho Should Attend:Single and Multi-Family Offices, High-Net-Worth Investors, Trusts, Private Banks, Portfolio Managers, Asset Managers, FinancialPlanners, Consulting and Advisory Firms, Independent Consultants, Tax and Estate Planning Attorneys, Accountants,Family Office Technology and Service ProvidersPre-Conference Half Day Workshop: September 18, 2006, 1:30-5:00 p.m.Family Office Technologies & OperationsLearn what technology solutions are available for tackling the latest challenges of data aggregation, portfolio management andaccounting, performance reporting, accounting and bill pay, cash management and banking, client communications, CRM andclient reporting, and document management. Should you buy off the shelf applications, develop your own systems, or outsourceto outside vendors? How can you ensure that your family office has a sufficient operational structure to support its growth? Inthis practical, interactive workshop, which will include real-life case studies, learn about the different platforms used by privatebanks, advisory firms, multi-family offices and single family offices.I: IntroductionII: Identifying your technology and operational needsIII: The pros and cons of buying, building, and outsourcingIV: Strategies and solutions for:• Data aggregation• Cash management and banking• Portfolio management and reporting • Client communications, CRM and reporting• Investment analytics• Document management:• General accounting and accounts payableV: Q&A and Troubleshooting SessionWorkshop led by: Jon Carroll, MBA, CPA, Principal, Family Office Metrics, LLCJon Carroll is a co-founder and principal of Family Office Metrics, a consultancy that delivers strategic business advice, operationssuccessful practices, benchmarking, and technology implementation to ultra-high-net-worth families and their advisors. Working withsingle family offices, multi-family offices, and private fiduciaries, Family Office Metrics implements successful business practices inthe areas of investment operations, trust administration, financial controls, regulatory compliance, and technology.To Register • Email information@euromoneyplc.com • Call +44 (0) 20 7779 8673 • www.euromoneyplc.com

Main Conference Day One: September 19, 20068:15 Registration & Breakfast8:45 Welcome Address & Opening Remarks from the ChairJean L.P. Brunel, Editor, Journal of <strong>Wealth</strong> <strong>Management</strong>;Managing Principal, Brunel Associates, LLC9:00 How Sub-Optimal – If At All – Is Behavioral Finance?Following the success enjoyed by goal-based allocationover the last several years, this session will investigate whatthe focus away from traditional finance and toward behavioralfinance may be costing, if anything, in terms oftraditional investment efficiency. The session will beginwith a review of the modern portfolio theory framework,offering a hypothesis as to how the demonstrated inabilityof individuals to stick to a single optimal portfolio might beinterpreted. It will then go on to review the behavioralsolution of a hypothetical case study and compare theoutcomes with a traditional optimization.Jean L.P. Brunel, Editor, Journal of <strong>Wealth</strong> <strong>Management</strong>;Managing Principal, Brunel Associates, LLCMr. Brunel is the managing principal of Brunel Associates, afirm offering wealth management consulting services to ultraaffluent individuals. He spent the bulk of his career in theinvestment management group of J.P. Morgan, where heworked in the U.S. and abroad from 1976 until his retirementin the spring of 1999, when he started consulting for wealthyindividuals and the institutions that serve them. Jean is theEditor of the Journal of <strong>Wealth</strong> <strong>Management</strong>, published by<strong>Institutional</strong> Investor Journals, has participated in varioustaskforces for the CFA Institute, is a Trustee of the ResearchFoundation of The CFA Institute and a Director of CULP, Inca NYSE listed Textile Company. Further, he authored “<strong>Integrated</strong><strong>Wealth</strong> <strong>Management</strong>: The New Direction for PortfolioManagers.”9:45 Strategies for Achieving Dynamic Tax EfficiencyDavid M. Stein, Ph.D., Managing Director & ChiefInvestment Officer, Parametric Portfolio AssociatesDavid Stein leads the Investment, Research and Technologyactivities of Parametric Portfolio Associates, a Seattle-basedInvestment <strong>Management</strong> firm. Prior to joining Parametric,Mr. Stein held senior Research, Development and Portfolio<strong>Management</strong> positions at GTE Investment <strong>Management</strong>Corp., The Vanguard Group, and IBM Retirement Funds.Previously, as a Research Scientist at IBM Research Laboratories,he designed computer hardware and softwaresystems. He has served on the After-Tax Subcommittee of theAIMR-PPS standards committee, and on the advisory boardof the Journal of <strong>Wealth</strong> <strong>Management</strong>. He has published in(among others) “Mathematics of Operations Research”,“The Journal of <strong>Wealth</strong> <strong>Management</strong>” and the “Journal ofPortfolio <strong>Management</strong>.”10:30 Morning Networking Break11:00 Investing in Commodities: What Every High-Net-WorthInvestor Should Know• Determining the real risk premium offered bycommodities• Are commodity returns excessively volatile?• Commodity returns' dependence on the business cycle,monetary environment and the shape of the futures curve• Examining the importance of the index composition• Assessing the diversification potential of commodityinvestmentsHarry M. Kat, Ph.D., Professor of Risk <strong>Management</strong>;Director, Alternative Investment Research Center,Cass Business SchoolHarry M. Kat is Professor of Risk <strong>Management</strong> andDirector of the Alternative Investment Research Centre atthe Sir John Cass Business School at City University inLondon. Before returning to academia, Professor Kat wasHead of Equity Derivatives Europe at Bank of America inLondon, Head of Derivatives Structuring and Marketing atFirst Chicago in Tokyo and Head of Derivatives Research atMeesPierson in Amsterdam. He holds MBA and Ph.Ddegrees in economics and econometrics from the TinbergenGraduate School of Business at the University of Amsterdamand is a member of the editorial board of The Journalof Derivatives, The Journal of Alternative Investments andThe Journal of <strong>Wealth</strong> <strong>Management</strong>. Professor Kat is a wellknown and popular speaker at conferences worldwide11:45 Catching the Wave: Investments in Renewable EnergyHow should high-net-worth investors be integrating energyinvestments into their portfolios? Is the energy marketoverheated? With the current environmental agenda and thepush for less dependence on oil and fossil fuels, renewableenergy has become a hot trend. Assess the opportunities inthe emerging field of investing in renewable energies.John Bruce Wells, Managing Director,Citizens InternationalJohn Bruce Wells has 20 years of experience in the designand management of innovative public-private alliances andthe analysis of corporate strategies to manage social andenvironmental concerns. Prior to joining Citizens International,he led the corporate consulting practice of ChemonicsInternational Inc, and was also the founder and president ofThe Bruce Company, a two-time Inc. 500 firm that advisedthe U.S. Environmental Protection Agency (EPA), U.S.Department of Energy, World Bank and United NationsDevelopment Programme on global environmental issues.His firm led efforts to launch EPA’s voluntary programs onclimate change, and he was awarded a Citation of Excellenceby the U.N. Environment Programme "in recognitionVisit www.euromoneyplc.com for speaker & agenda updatesTo Register • Email information@euromoneyplc.com • Call +44 (0) 20 7779 8673 • www.euromoneyplc.com

<strong>4th</strong> Annual <strong>Integrated</strong> <strong>Wealth</strong> <strong>Management</strong> ForumSeptember 18-20, 2006, Union League Club, New York Cityof an outstanding contribution to the protection of the earth'sozone layer".Mark Cirilli, CIO, Marshall Street <strong>Management</strong>Bio not available at press time.Diana Propper de Callejon,General Partner, Expansion Capital PartnersDiana Propper de Callejon has been working in CleanTechnology and venture capital for more than 15 years.Diana is currently a General Partner at Expansion CapitalPartners, a venture capital firm whose Clean TechnologyFund II, LP is backed by families of wealth, Foundations,and financial institutions. Prior to Expansion Capital, Dianawas a co-founder and Managing Director of EA Capital,where she worked with Fortune 500 companies, financialinstitutions, high net-worth clients, and private equity firmsto identify new business and investment opportunities relatedto resource efficiency and productivity. Clients included theTexas Pacific Group, Bechtel, International Finance Corporation,Ted Turner, Duke Energy, the MacArthur Foundation,and the Rockefeller Brothers Fund.12:30 Luncheon2:00 Afternoon Keynote Address:When Currency Empires FallProfessor Avinash Persaud argues that the U.S. dollar willcease to be the World's reserve currency in the first half ofthis century and discusses the process for financial markets,economies and the exercise of power from the perspective ofhistory.Professor Avinash Persaud,President, Intelligence Capital Limited, former GreshamProfessor and winner of the Institute of InternationalFinance's Jacques de Larosiere Award in Global FinanceProfessor Persaud was previously global head of research atState Street, global head of currency and commodity researchat J. P. Morgan and director, fixed-income research at UBS.2:45 Generational Perspectives and Family Dynamics:The Building Blocks of Family Governance andAsset AllocationThrough advanced qualitative and quantitative techniquesand real-life case studies, gain a greater understanding of theinfluence of generational perspectives and family dynamicson high-net-worth investors’ wealth management decisions,and the subsequent implications for asset allocation.Lisa Gray, President, graymatter STRATEGIES, LLCLisa Gray works with investors and their financial andinvestment advisors and consultants to facilitate higher-levelrelationships. She has 18 years' experience in the wealthmanagement industry and is the founder and managingpartner of graymatter STRATEGIES LLC. In 2004, shedeveloped the firm’s proprietary <strong>Wealth</strong> OptimizationConsulting concept which stresses the influence of familydynamics and governance on wealth management decisionmaking. The concept is outlined in her book, The New FamilyOffice: Innovative Strategies for Consulting to the Affluent.Ms. Gray has served on the CFA Institute’s editorial boardfor financial writers and has been a member of the Investment<strong>Management</strong> Consultants Association, the CFAInstitute, and the Memphis Society of Financial Analysts.3:30 Afternoon Networking Break4:00 Case Study: Transitioning from a Single Family Officeto a Multi-Family OfficeUsing real-life examples and experiences, this case study willdemonstrate best practices for achieving a smooth transitionfrom a single family office to a multi-family office. Whatcriteria does the family need to consider for making thistransition and selecting its service provider? What challengesdoes the MFO need to overcome in terms of branding,service offering and delivery and relationship management?Hear insights from the family advisor’s perspective, the MFOperspective, and family members themselves.Jane N. Abitanta, Founder & Principal,Perceval AssociatesJane is an experienced business strategist and marketingconsultant. From her earliest days as an investment strategistwith Citicorp Investment <strong>Management</strong> through executivemarketing positions at Bessemer Trust and Swiss BankCorporation, to the formation of Perceval Associates in 1996,Jane has built an enviable track record with an impressivelist of clients, based on skilled relationship management.Jane has served as a charter faculty member of the Institutefor Private Investors, a member of the Investment Committeeof Women's World Banking, and director of the Associationfor Investment <strong>Management</strong> Sales Executives (AIMSE). Sheis a director of Green Cay Asset <strong>Management</strong>, a Bahamasbasedalternative investment firm and a former director ofShaking the Tree, a not-for-profit organization that usesinteractive theater to illustrate family dynamics.Kathryn M. McCarthy, Independent Consultantto Families & Family OfficesKathryn McCarthy has over 25 years experience managingthe financial affairs of wealthy families and individuals. Sheis currently a Consultant to families and family offices. Sheis also a Director of the Rockefeller Trust Company .She wasformerly a Managing Director of Rockefeller & Co. Inc. andwas formerly President of Marujupu,LLC, the family office ofthe Sulzberger Family (The New York Times Company) and amember of the Board of Directors, the Investment Committeeand the Manager of the Sulzberger Foundation. Kathrynalso worked as the Senior Financial Counselor at RockVisit www.euromoneyplc.com for speaker & agenda updatesTo Register • Email information@euromoneyplc.com • Call +44 (0) 20 7779 8673 • www.euromoneyplc.com

efeller & Co., Inc, where she advised members of the Rockefellerand other families on asset allocation, investmentmanager selection, personal financial planning and strategicwealth management. Kathryn is a frequent lecturer on topicsrelating to family education, philanthropy, and the managementand governance of family offices.4:45 High-Net-Worth Investors’ Perspectiveson Selecting and Benchmarking AdvisorsI: SelectionIn an increasingly competitive environment, wealth managementservice providers are under more pressure than ever tooffer high performing products, state-of-the-art communicationsand sound, well-delivered advice. With so many crucialvariables in the balance, how should they focus their efforts?Hear investor insights and the latest research data on howinvestors prioritize investment performance, loyalty, clientadvisorcommunications and quality of advice.II: Performance Measurement/BenchmarkingWhat models are being used for tracking and benchmarkingthe performance of wealth advisors? How effective are they?Catherine S. McBreen, Managing Director,Spectrem GroupCathy McBreen is Managing Director of Spectrem Group, aleader in research on the affluent and retirement marketsand the firm behind the Spectrem Affluent Investor Index(TM) and the Spectrem Millionaire Index (TM). AsManaging Director, Ms. McBreen oversees the developmentof Spectrem’s exclusive market reports, and its consultingservices. Recent report titles include "Affluent MarketInsights 2005," and "Ultra High Net Worth 2005." Ms.McBreen has over 20 years experience in the financialservices industry and is an expert on the retirement,high-net-worth and investment markets. Prior to joiningSpectrem, she was a senior attorney and Vice President andProduct Manager for Harris Trust and Savings Bank whereshe oversaw the organization's retirement businesses.5:30 Chair’s Closing Remarks5:40 Cocktail Networking ReceptionMain Conference Day Two:September 20, 20068:30 Breakfast8:45 Chair’s Recap of Day OneJean L.P. Brunel, Editor, Journal of <strong>Wealth</strong> <strong>Management</strong>;Managing Principal, Brunel Associates, LLC9:00 Determining the Impact of Industry Consolidation andGrowth on Traditional Family Office Business Models:Threat or Opportunity?• Discussing the pros and cons of the open architecture modelversus the ‘one-stop-shop’ model• Examining the impact of the ‘institutionalization’ of familyoffices on the changing dynamics of the wealth managementindustry• Single family office models vs. multi-family office models:- At what point is the single family office no longer aviable entity?- How to retain the best elements of the single family office whileleveraging the benefits of the multi-family office structure- How to avoid being monopolized• Factors to take into account when planning a merger oracquisitionJohn Benevides, President, Family Office Exchange LLCJohn joined Family Office Exchange as president in July 2005. Hewas formerly managing director for the Financial ServicesPractice of the Corporate Executive Board (CEB) in Washington,D.C., where he oversaw the research efforts across the personalfinancial services spectrum of retail banking, wealth management,insurance and institutional services. He has authored, coauthored,and/or participated in the production of more than 30major research studies focused on the affluent, high net worth andultra-affluent markets. John has personally served senior wealthmanagement executives (on site) in over 42 countries, mostrecently running a VIP Forum in Geneva in May for 25 privatebanking chief executives across Europe and South Africa. He wasalso responsible for managing the Financial Services office forCEB in the UK.9:45 Newly Emerging <strong>Wealth</strong> Transfer and Succession Strategies,Including The Next Phase in Transitional Planning -‘Spending Down’• Building consensus between the older generation and trust fundbabies:- Reconciling differences in priorities, values, lifestyle andattitudes towards wealth• Discussing the role of family governance in achieving effectivewealth transfer and preservation• Sharing experiences in managing the problems ofdiminished wealth• Coping with the effects of ‘spending down’, whether intentionalor unintentional• Examining the issues faced by families who ‘outgrow’ their singlefamily office:- Disbanding the family office- Dividing the assets: how does this impact the investment portfolio?- Forming new alliances for managing the wealth10:30 Morning Networking Break11:00 How is the Generation of New <strong>Wealth</strong> Changing the Faceof Philanthropic Planning?Traditional philanthropic models are evolving beyond allVisit www.euromoneyplc.com for speaker & agenda updatesTo Register • Email information@euromoneyplc.com • Call +44 (0) 20 7779 8673 • www.euromoneyplc.com

<strong>4th</strong> Annual <strong>Integrated</strong> <strong>Wealth</strong> <strong>Management</strong> ForumSeptember 18-20, 2006, Union League Club, New York Cityrecognition, as new generations adopt new attitudes tocharitable giving. Hear insights from pioneers in this fieldand wealthy family members on some of the latest innovativeapproaches in philanthropy, including micro credit lending.Moderator: Marilyn J. Mason, Ph.D., President, Mason& AssociatesMarilyn J. Mason, Ph.D., is the President of Mason &Associates. She consults frequently with family foundations,high net worth families, family-owned businesses, familyoffices and private foundations. She is the Executive Directorof the Thornburg Charitable Foundation in Santa Fe, andan internationally recognized speaker on family dynamics,governance and leadership. Dr. Mason served as a Dean forThe Learning Academy Foundation and is Counsel to FamilyPhilanthropy Advisors and a member of the New MexicoWomen’s Forum and The International Women’s Forum.Blair Naylor, Trustee, The Cudd FoundationBlair Naylor is the Managing Member of Palace Capital<strong>Management</strong> LLC, an SEC- registered investment advisorthat specializes in alternative investments for private investorsand family offices, and also a trustee of the Cudd Foundation,a private family foundation. Prior to forming PalaceCapital in September 2002, Ms. Naylor was President ofDraycott Capital Inc., a Santa Fe-based family office. From1987-1998 she was a financial advisor with Merrill Lynchand Smith Barney, focusing on the selection and oversight oftraditional investment managers on behalf of individualinvestors. Ms. Naylor is active within the philanthropiccommunity in Santa Fe and currently serves on the board ofNew Mexico Association of Grantmakers.Teresa Odendahl, Ph.D., Executive Director,Institute for Collaborative ChangeTeresa Odendahl has over 30 years experience in the foundationand nonprofit community as a board member, CEO,critic, employee, trainer and researcher. She is ExecutiveDirector and Co-Founder of the Institute for CollaborativeChange (ICChange) in Santa Fe, New Mexico. In 2004-5 shewas Waldemar A. Neilsen Chair in Philanthropy at theGeorgetown University Public Policy Institute in Washington,D.C. and continues as a Fellow. For the previousdecade, she served as Executive Director of the NationalNetwork of Grantmakers where she led a campaign toincrease foundation payout. Odendahl is author of manypublications on philanthropy and nonprofits. She is formerChair of AIDS Foundation San Diego, the Institute forWomen’s Policy Research, and the National Committee forResponsive Philanthropy, and Vice Chair of the board of theCenter for Economic Justice, headquartered in Albuquerque.12:00 Practical Tools for Integrating Philanthropic Planninginto Your <strong>Wealth</strong> <strong>Management</strong> StrategyJacqueline Valouch, Vice President; Planned GivingConsultant, Fidelity Charitable Services12:30 Luncheon2:00 Women and <strong>Wealth</strong>: How Do Female Investors Differ?This session will address the ongoing debate on whether andhow female high-net-worth investors differ to men. How canwealthy women harness their wealth more effectively, and howshould wealth advisors tailor their services to meet the specificneeds of their female clients?2:30 Holistic Asset Allocation for Private Individuals• Devising an asset allocation strategy that simultaneouslyprovides the optimal location of assets and an investmentstrategy that meets life goals• Comparing the benefits of a single asset allocation vs.multiple asset allocation for multiple goals and asset locations• Adapting the model to behavioral finance considerationsGordon B. Fowler, Jr., Chief Investment Officer; SeniorVice President, The Glenmede Trust Company, N.A.Gordon B. Fowler Jr., is Senior Vice President and ChiefInvestment Officer of The Glenmede Trust Company, N.A.Mr. Fowler oversees all the Company’s investment activities.As Chief Investment Officer, he is responsible for Glenmede’sinvestment process, policies, fund managers, trading andinvestment research group. Prior to joining Glenmede, Mr.Fowler was a managing director and chief investment officerat J.P. Morgan’s Global Private Bank. With a background inboth U.S. and global investment management, he has extensiveexperience with quantitative investment analysis, assetallocation models, structured products and tax aware investing3:15 Risk Measurement for Hedge Funds and OtherAlternative InvestmentsAnalyzing the changing landscape of alternatives: how are theybeing integrated into high-net-worth portfolios and what riskbudgeting and risk management methodologies are emerging?4:00 Afternoon Break4:15 Best Practices in Regulatory Compliance and Auditingfor Family Offices and High-Net-Worth InvestorsUnderstand the latest regulatory developments with regard toprivate wealth management and sound strategies for ensuringcompliance, as well as expert insights on auditing andfinancial reporting.5:00 Chair’s Closing Remarks5:15 End of Forum followed by Cocktail ReceptionVisit www.euromoneyplc.com for speaker & agenda updatesTo Register • Email information@euromoneyplc.com • Call +44 (0) 20 7779 8673 • www.euromoneyplc.com

A Must-Attend!Private Asset <strong>Management</strong> presents…The 5th Annual High-Net-Worth Industry AwardsSeptember 19, 2006 * 6:30 pm * Jumeirah Essex House, New York CityFind out who has made an impact in the private client arena this year! Nominees will be honored and winners will be awarded at a gala,black-tie dinner on September 19, 2006. For information on securing a table and for sponsorship details please contact, Tracey Redmondat (212) 224-3239 or tredmond@iievents.com.Media Partners:<strong>Institutional</strong> Investor Events is registered with the National Association ofState Boards of Accountancy (NASBA) as a sponsor of continuing professionaleducation on the National Registry of CPE Sponsors. State boards ofaccountancy have final authority on the acceptance of individual coursesfor CPE credit. Complaints regarding registered sponsors may beaddressed to the National Registry of CPE Sponsors, 150 Fourth AvenueNorth, Suite 700, Nashville, TN, 37219-2417. Web site: www.nasba.org.Administrative Details:Venue:Union League Club38 East 37th Street, New York, New York 10016(212) 685-3800Cancellation Policy:All cancellations must be submitted in writing before September 4,2006. Credit vouchers will be issued for the full amount (valid for12 months) and can be used for other conferences hosted by<strong>Institutional</strong> Investor Events. Refunds will be subject to a $300administrative cancellation fee. No refunds or vouchers will beissued for cancellations received after September 4, 2006. Substitute delegates are always welcome and will be admitted for noextra charge. In the event of a conference cancellation, <strong>Institutional</strong>Investor Events assumes no liability for airfare, hotel or other travelcharges incurred by registrants. The conference program andspeakers are subject to change without notice.Please note that this charge will appear on your credit cardstatement as “<strong>Euromoney</strong>.”Registration Fee:The registration fee includes participation in the conference,lunches and documentation material, which will be distributed atthe beginning of the event. All registrations are consideredbinding on receipt of the registration form. For details on groupdiscount rates, please contact us.Cannot Attend?Please pass this brochure on to a colleague or you can purchasethe conference documentation for $595.Sponsorship & Exhibit Opportunities:For sponsorship and exhibiting opportunities please contact AliHarapko at aharapko@iievents.com or call 1.212.224.3609.Visit www.euromoneyplc.com for speaker & agenda updatesTo Register • Email information@euromoneyplc.com • Call +44 (0) 20 7779 8673 • www.euromoneyplc.com

THE <strong>4th</strong> <strong>ANNUAL</strong> <strong>Integrated</strong><strong>Wealth</strong> <strong>Management</strong>FORUMThe Premier Annual Gathering of Thought Leaders onHigh-Net-Worth Portfolio <strong>Management</strong> and Family Office StrategiesSEPTEMBER 18-20, 2006UNION LEAGUE CLUB, NEW YORK CITY5 Easy Ways to Register• Tel: +44 (0) 20 7779 8673 • Fax: +44 (0) 20 7246 5200• Email: information@ieuromoneyplc.com • Web: www.euromoneyplc.com• Mail: Alberto Anido, <strong>Institutional</strong> Investor EventsNestor House, Playhouse Yard, London, EC4V 5EXPlease Note Your Booking Number: EVN11EBRORegistration Fees Before After8/04/06 8/04/2006Conference & Workshop $2,595.00 $2,695.00* Multi Family Office Discount $2,095.00 $2,195.00* Single Family Office & High- $795.00 $895.00Net-Worth Individual DiscountConference Only $2,195.00 $2,295.00* Multi Family Office Discount $1,695.00 $1,795.00* Single Family Office & High- $595.00 $695.00Net-Worth Individual Discount* Subject to <strong>Institutional</strong> Investor approval. Call 1.800.437.9997 today.PERSONAL DETAILS (Please photocopy this form for additional delegates)First Name/Last Name _____________________________________________________Company ______________________________________________________________Address _______________________________________________________________Zip __________________ Country __________________________________________Tel __________________Fax ______________________________________________Email _________________________________________________________________The information you provide will be safeguarded by the <strong>Euromoney</strong> <strong>Institutional</strong> Investor PLC group, who may share it with thesponsors of this event. As an international group, we may transfer your data internationally and our subsidiaries may use it to keepyou informed of relevant products and services. If you object to being contacted by telephone [ ], fax [ ] or email [ ], please checkthe relevant box. We occasionally make your details available to other reputable organizations who may wish to contact you.Please check this box [ ], if you would prefer your details to remain confidential.PAYMENT DETAILSPlease find check enclosed (make payable to <strong>Institutional</strong> Investor Events)Please charge my credit card for $____________:____ MasterCard ____ Visa ____ American Express ____ Diners ClubCard Number __ __ __ __ / __ __ __ __ / __ __ __ __ / __ __ __ __Card Verification Check __ __ __ __ (last 3/4 digits printed on signature strip of card)Expiry Date __ __ / __ __ Issue No. (Debit cards only) _________Invoice me<strong>Institutional</strong> Investor Events225 Park Ave SouthNew York, New York, 10003