Accounts at a Glance (2011-12) - Ministry Of Earth Sciences

Accounts at a Glance (2011-12) - Ministry Of Earth Sciences

Accounts at a Glance (2011-12) - Ministry Of Earth Sciences

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

,...:.

P R E F A C EThis is the Fourth issue of our public<strong>at</strong>ion “<strong>Accounts</strong> <strong>at</strong> a<strong>Glance</strong>”. This public<strong>at</strong>ion is prepared annually with the objective ofproviding a macro level summary of the accounts of theMinistries/Departments under our payment control. The inform<strong>at</strong>ionpresented in this document is drawn from the Appropri<strong>at</strong>ion <strong>Accounts</strong>,Finance <strong>Accounts</strong> and other st<strong>at</strong>utory reports and returns for the year<strong>2011</strong>-<strong>12</strong>. Our endeavor has been to provide comprehensive, relevant anduseful accounting inform<strong>at</strong>ion in user friendly form<strong>at</strong>s so th<strong>at</strong> a completepicture of <strong>Ministry</strong>’s finances is available to the readers <strong>at</strong> one place.We are pleased <strong>at</strong> the interest shown and response elicitedfrom various quarters on the contents of this public<strong>at</strong>ion. We trust thisdocument will be useful. Suggestions regarding improvement in theform and content of this public<strong>at</strong>ion are most welcome.09 th November, 20<strong>12</strong> (BINOD KUMAR)NEW DELHICONTROLLER OF ACCOUNTS

CONTENTSChapter Subject Pages1. Accounting Organiz<strong>at</strong>ion ofthe <strong>Ministry</strong> of <strong>Earth</strong> <strong>Sciences</strong>1-72.Role of Controller of <strong>Accounts</strong> (MoES)as per the revised Charter of IFA 8-<strong>12</strong>scheme issued by MoF3. Government <strong>Accounts</strong> 13-234. Highlights of <strong>Accounts</strong> <strong>2011</strong>-<strong>12</strong> 24-305. Expenditure Analysis <strong>2011</strong>-<strong>12</strong> 31-416. Receipts Analysis <strong>2011</strong>-<strong>12</strong> 42-437. Grant-in-Aid & Utiliz<strong>at</strong>ion Certific<strong>at</strong>es 44-498.Important Telephone Numbers ofAccounting Organiz<strong>at</strong>ion50Important Telephone Numbers of9. Senior <strong>Of</strong>ficers of <strong>Ministry</strong> of <strong>Earth</strong><strong>Sciences</strong>51

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Chapter- 1Accounting Organiz<strong>at</strong>ion ofThe <strong>Ministry</strong> of <strong>Earth</strong> <strong>Sciences</strong>The Secretary of <strong>Ministry</strong> of <strong>Earth</strong> <strong>Sciences</strong> besides the executiveand administr<strong>at</strong>ive Head of the <strong>Ministry</strong> is also design<strong>at</strong>ed as the ChiefAccounting Authority for the <strong>Ministry</strong> of <strong>Earth</strong> <strong>Sciences</strong>. The Secretaryperforms this function with the assistance of Additional/Joint Secretary &Financial Adviser and Controller of <strong>Accounts</strong>.2. As per Rule 64 of GFR-2005, the Secretary of a<strong>Ministry</strong>/Department who is the Chief Accounting Authority of the<strong>Ministry</strong>/Department shall: –(i) be responsible and accountable for financial management of his<strong>Ministry</strong> or Department.(ii) ensure th<strong>at</strong> the public funds appropri<strong>at</strong>ed to the <strong>Ministry</strong> orDepartment are used for the purpose for which they were meant.(iii) be responsible for the effective, efficient, economical and transparentuse of the resources of the <strong>Ministry</strong> or Department in achieving thest<strong>at</strong>ed project objectives of th<strong>at</strong> <strong>Ministry</strong> or Department, whilstcomplying with performance standards.(iv) appear before the Committee on Public <strong>Accounts</strong> and any otherParliamentary Committee for examin<strong>at</strong>ion.(v) review and monitor regularly the performance of the programmesand projects assigned to his <strong>Ministry</strong> to determine whether st<strong>at</strong>edobjective are achieved.(vi) be responsible for prepar<strong>at</strong>ion of expenditure and other st<strong>at</strong>ementsrel<strong>at</strong>ing to his <strong>Ministry</strong> or Department as required by regul<strong>at</strong>ions,guidelines or directives issued by <strong>Ministry</strong> of Finance.(vii) shall ensure th<strong>at</strong> his <strong>Ministry</strong> or Department maintains full andproper records of financial transactions and adopts systems andprocedures th<strong>at</strong> will <strong>at</strong> all times afford internal controls.(viii) shall ensure th<strong>at</strong> his <strong>Ministry</strong> of Department follows the Governmentprocurement procedure for execution of works, as well as forprocurement of services and supplies and implements it in a fair,equitable, transparent, competitive and cost-effective manner.(ix) shall take effective and appropri<strong>at</strong>e steps to ensure his <strong>Ministry</strong> orDepartment :-(a) Collects all moneys due to the Government and(b) avoids unauthorized, irregular and wasteful expenditure.1

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>3. As per Para 1.3.2 of Civil <strong>Accounts</strong> Manual, the FinancialAdviser/Controller of <strong>Accounts</strong> (MoES) for and on behalf of the ChiefAccounting Authority shall be responsible for :-(a) arranging all payments through the Pay and <strong>Accounts</strong><strong>Of</strong>fices/Principal <strong>Accounts</strong> <strong>Of</strong>fices except where the Drawingand Disbursing <strong>Of</strong>ficers are authorized to make certain types ofpayments.Note : Any addition proposed to the list of cheque drawingD.D.Os included in the Scheme of Departmentalis<strong>at</strong>ion of<strong>Accounts</strong> of a <strong>Ministry</strong>/Department would require the specificapproval of the Controller General of <strong>Accounts</strong>, <strong>Ministry</strong> ofFinance.(b) compil<strong>at</strong>ion and consolid<strong>at</strong>ion of accounts of the department andtheir submission in the form prescribed, to the Controller Generalof <strong>Accounts</strong>; prepar<strong>at</strong>ion of Annual Appropri<strong>at</strong>ion <strong>Accounts</strong> forthe Demands for Grants of his <strong>Ministry</strong>/Department, getting themduly audited and submitting them to the CGA, duly signed by theChief Accounting Authority.(c) arranging internal inspection of payment and accounts recordsmaintained by the various subordin<strong>at</strong>e form<strong>at</strong>ions and Pay and<strong>Accounts</strong> <strong>Of</strong>fices of the Department and inspection of recordspertaining to transaction of Government Ministries/Departments,maintained in Public Sector Banks.4. The Principal <strong>Accounts</strong> <strong>Of</strong>fice and accounting organiz<strong>at</strong>ion of this<strong>Ministry</strong> started functioning w.e.f. 01-04-2007. The Controller of<strong>Accounts</strong> is the Head of the Departmental Accounting Organiz<strong>at</strong>ion andexercises this control with the assistance of a Deputy Controller of<strong>Accounts</strong>/Asstt. Controller of <strong>Accounts</strong> and 7 Pay & <strong>Accounts</strong> officers.The Payment and accounting functions are performed through five Pay and<strong>Accounts</strong> <strong>Of</strong>fices of which two are loc<strong>at</strong>ed in Delhi, and one each inKolk<strong>at</strong>a, Chennai and Pune. All payments pertaining to theDepartment/<strong>Ministry</strong> are made through Pay & <strong>Accounts</strong> <strong>Of</strong>fices andthrough cheque drawing DDO <strong>at</strong>tached with respective PAOs. Drawingand Disbursing officers present their claims/bills to the design<strong>at</strong>ed PAOsand CDDOs who issue cheques after exercising the necessary scrutiny asper provision of Civil Account Manual, Receipt and Payment Rules andother Govt. orders issued from time to time. As on d<strong>at</strong>e out of 22 DDO’s,4 DDO’s have been given limited cheque drawing power <strong>at</strong> followingst<strong>at</strong>ion i.e. Nagpur, Mumbai, Kochi and Guwah<strong>at</strong>i. The Pay & <strong>Accounts</strong><strong>Of</strong>fices are the field units from where the accounting process initi<strong>at</strong>e. Thevouchers/bills and the bank scrolls form the basis for compil<strong>at</strong>ion ofaccounts.2

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>5. As per Para 1.3.3 of Civil <strong>Accounts</strong> Manual, a Principal <strong>Accounts</strong><strong>Of</strong>fice in New Delhi function under a Principal <strong>Accounts</strong> <strong>Of</strong>ficer who isresponsible for :(a) consolid<strong>at</strong>ion of the accounts of the <strong>Ministry</strong>/Department in themanner prescribed by CGA;(b) prepar<strong>at</strong>ion of Annual Appropri<strong>at</strong>ion <strong>Accounts</strong> of the Demands forGrants controlled by th<strong>at</strong> <strong>Ministry</strong>/Department, submission ofSt<strong>at</strong>ement of Central Transactions and m<strong>at</strong>erial for the FinanceAccount of the Union Government(Civil) to the Controller Generalof <strong>Accounts</strong>;(c) payment of loans and grants to St<strong>at</strong>e Government through ReserveBank of India, and wherever this office has a drawing accountpayment there from to Union Territory Government/Administr<strong>at</strong>ions;(d) prepar<strong>at</strong>ion of manuals keeping in view the objective of managementaccounting system if any, and for rendition of technical advice toPay and <strong>Accounts</strong> <strong>Of</strong>fices, maintaining necessary liaison withCGA’s <strong>Of</strong>fice and to effect overall coordin<strong>at</strong>ion and control inaccounting m<strong>at</strong>ters;(e) maintaining Appropri<strong>at</strong>ion Audit Registers for the <strong>Ministry</strong>/Department as a whole to w<strong>at</strong>ch the progress of expenditure underthe various Grants oper<strong>at</strong>ed on by the <strong>Ministry</strong>/Department;(f) Principal <strong>Accounts</strong> <strong>Of</strong>fice/<strong>Of</strong>ficer also performs all administr<strong>at</strong>iveand coordin<strong>at</strong>ing function of the accounting organiz<strong>at</strong>ion and rendernecessary financial, technical, accounting advise to department aswell as to local Pay & <strong>Accounts</strong> offices and Regional Pay &<strong>Accounts</strong> offices.6. As per Para 1.3.4 of Civil <strong>Accounts</strong> Manual, Pay & <strong>Accounts</strong>offices will make payments pertaining to respective Ministries/Departments and in certain cases payments will be made by thedepartmental Drawing and Disbursing <strong>Of</strong>ficers (DDOs) authorized to drawfunds, by means of cheques drawn on the offices/branches of Reserve Bankof India, St<strong>at</strong>e Bank of India and its subsidiaries or of the Public SectorBank th<strong>at</strong> may be accredited for handling the receipts and payments of the3

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong><strong>Ministry</strong>/Department. These payments will be accounted for in separ<strong>at</strong>escrolls to be rendered to the Pay and <strong>Accounts</strong> <strong>Of</strong>fices of<strong>Ministry</strong>/Department concerned. Each Pay and <strong>Accounts</strong> <strong>Of</strong>fice orDrawing and Disbursing <strong>Of</strong>ficer authorized to make payments by cheques,will draw only on the particular branch/branches of the Reserve Bank ofIndia/St<strong>at</strong>e Bank of India or its subsidiary or the Public Sector Bank withwhich the Pay and <strong>Accounts</strong> <strong>Of</strong>fice or the Drawing and Disbursing <strong>Of</strong>ficeras the case may be, is placed in account. All receipts of the<strong>Ministry</strong>/Department shall also be finally accounted for in the books of thePay and <strong>Accounts</strong> <strong>Of</strong>fice. The Pay and <strong>Accounts</strong> office is the basic Unit ofDepartmentalized Accounting Organiz<strong>at</strong>ion. Its main function include:-• Pre-check and payment of all bills, including those of loansand grants-in-aid, submitted by Non-Cheque Drawing DDOs.• Accur<strong>at</strong>e and timely payments in conformity with prescribedrules and regul<strong>at</strong>ions.• Timely realiz<strong>at</strong>ion of receipts.• Issue of quarterly letter of credit to Cheque Drawing DDOsand post audit of their vouchers/bills.• Compil<strong>at</strong>ion of monthly accounts of receipts and expendituresmade by them incorpor<strong>at</strong>ing there with the accounts of thecheque Drawing DDOs.• Maintenance of GPF accounts and authoriz<strong>at</strong>ion of retirementbenefits.• Maintenance of all DDR Heads.• Efficient service delivery to the <strong>Ministry</strong>/Department by thebanking system by way of E-payment.• Adherence to the prescribed Accounting Standards, rules andprinciples.• Timely, accur<strong>at</strong>e, comprehensive, relevant and useful financialreporting.7. The specific approval of the CGA, <strong>Ministry</strong> of Finance would haveto be obtained in connection with any proposal for cre<strong>at</strong>ion (orreorganiz<strong>at</strong>ion) of a new Pay & <strong>Accounts</strong> <strong>Of</strong>fice or for adding to the list ofcheque drawing DDOs included in the Scheme of Departmentaliz<strong>at</strong>ion of<strong>Accounts</strong> of a <strong>Ministry</strong>/Department.4

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>8. The overall responsibilities of Principal Accounting Organiz<strong>at</strong>ion inrespect of <strong>Ministry</strong> of <strong>Earth</strong> <strong>Sciences</strong> are:-• Consolid<strong>at</strong>ion of accounts of <strong>Ministry</strong> and its submission tothe CGA.• Annual Appropri<strong>at</strong>ion <strong>Accounts</strong>.• St<strong>at</strong>ement of Central Transactions.• Prepar<strong>at</strong>ion of “Account <strong>at</strong> a <strong>Glance</strong>”.• Union Finance accounts which are submitted to the CGA,<strong>Ministry</strong> of Finance and Principal Director of Audit, Scientificdepartment.• Payments of loans and grants to St<strong>at</strong>e Government/GranteeInstitutions/Autonomous Bodies etc.• Rendering technical advice to all PAOs and <strong>Ministry</strong>; ifnecessary in consult<strong>at</strong>ion with other organiz<strong>at</strong>ion like DOPT,<strong>Ministry</strong> of Finance and CGA etc.• Prepar<strong>at</strong>ion of Receipt Budget.• Prepar<strong>at</strong>ion of Pension Budget.• Procuring and supplying cheque books to PAOs/Chequedrawing DDOs.• Maintaining necessary liaison with Controller General of<strong>Accounts</strong> office and to effect overall co-ordin<strong>at</strong>ion and controlin accounting m<strong>at</strong>ters and accredited Bank. Verify andreconcile all receipts and payments made on behalf of<strong>Ministry</strong> of <strong>Earth</strong> <strong>Sciences</strong> through the accredited Bank, St<strong>at</strong>eBank of India.• Maintaining accounts with Reserve Bank of India rel<strong>at</strong>ing to<strong>Ministry</strong> of <strong>Earth</strong> <strong>Sciences</strong> and reconciling the cash balances.• Ensuring prompt payments.• Speedy settlement of Pension/Provident fund and otherretirement benefits.• Internal Audit of the ministry, Meteorological Departmentoffices, Autonomous bodies of MoES and its granteeinstitutions.• Making available accounting inform<strong>at</strong>ion to concernedauthorities.5

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>• Budget works of MoES and monitoring of C & AG AuditParas/ATN/ATR and User fee etc.• Monitoring of New Pension Scheme and revision of pensioncases of Pre-2006 and Pre-1990 pensioners.• Computeriz<strong>at</strong>ion of <strong>Accounts</strong> and e-payment.• Administr<strong>at</strong>ive and co-ordin<strong>at</strong>ion function of the accountingorganiz<strong>at</strong>ion.9. Internal Audit WingThe Internal Audit Wing carries out audit of accounts of variousunits of the <strong>Ministry</strong> to ensure th<strong>at</strong> rules, regul<strong>at</strong>ions and proceduresprescribed by the government are adhered to by these units in their day today functioning.Internal Auditing is an independent, objective assurance andconsulting activity designed to add value and improve an organiz<strong>at</strong>ion’soper<strong>at</strong>ions. It basically aims <strong>at</strong> helping the organiz<strong>at</strong>ion to accomplish itsobjectives by bringing a system<strong>at</strong>ic, disciplined approach to evalu<strong>at</strong>e andimprove the effectiveness of risk management, control and governanceprocesses. It is also an effective tool for providing objective assurance andadvice th<strong>at</strong> adds value, influence change th<strong>at</strong> enhances governance, assistrisk management and control processes and improve accountability forresults. It also provides valuable inform<strong>at</strong>ion to rectify the proceduralomissions and deficiencies and, thus, acts as an aid to the management.The periodicity of audit of a unit is regul<strong>at</strong>ed by its n<strong>at</strong>ure and volume ofwork and quantum of funds.10. Banking arrangementsSt<strong>at</strong>e Bank of India is the accredited bank for theDepartment/<strong>Ministry</strong>. Cheques issued by the PAO are presented to thenomin<strong>at</strong>ed branch of the accredited bank for payment. The receipts arealso remitted to the St<strong>at</strong>e Bank of India by CDDOs/PAOs. Any change inaccredited bank requires specific approval of Controller General of<strong>Accounts</strong>, Department of expenditure, <strong>Ministry</strong> of Finance.6

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Banking ArrangementsFlow diagram of accounting of CashReceipt & PaymentCGACAS-<strong>12</strong>2 & DMA-2RBICAS-<strong>12</strong>2 &DMA-2 Daily Advice DMA-IPr.AO PutThrough(DMA-I)VDMS &AccountLink Cell/SBI GADPut Through(DMA-I)DDOChequeBillChequePAODMS &Main ScrollVDMS &Verified ScrollVDMS&DailyAdviceChequePayeeChequeDealingBranchScrollFocal PointBranch7

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Chapter- 2The Role of Controller of <strong>Accounts</strong> (MoES) as per the revisedcharter of Integr<strong>at</strong>ed Finance Scheme issuedby the <strong>Ministry</strong> of FinanceThe Controller of <strong>Accounts</strong> (MoES) is the Head of Department ofthe accounting organiz<strong>at</strong>ion in the <strong>Ministry</strong> of <strong>Earth</strong> <strong>Sciences</strong>. Hisfunctions can be put into the following broad c<strong>at</strong>egories:-(i) Receipts, Payments and <strong>Accounts</strong> :a. Accur<strong>at</strong>e and timely payments in conformity with prescribed rulesand regul<strong>at</strong>ions;b. Timely realiz<strong>at</strong>ion of receipts;c. Timely and accur<strong>at</strong>e compil<strong>at</strong>ion and consolid<strong>at</strong>ion of monthly andannual accounts;d. Ensure efficient service delivery to the <strong>Ministry</strong>/Department by thebanking system;e. Adherence to prescribed accounting standards, rules and principles;f. Timely, accur<strong>at</strong>e, comprehensive, relevant and useful financialreporting.g. In respect of the above responsibilities the Controller of <strong>Accounts</strong>shall function under the direction superintendence and control of theController General of <strong>Accounts</strong>.(ii) Financial Management Systems :The Controller of <strong>Accounts</strong> as the head of the accounts wingshall render their professional expertise in the functioning of thefinancial management system, from the system point of view andmaking it more effective. He would also be responsible for theimplement<strong>at</strong>ion of the financial inform<strong>at</strong>ion systems of theController General of <strong>Accounts</strong>.8

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>(iii) Internal Audit/Performance Audit :The revised charter of the roles and responsibilities of theController of <strong>Accounts</strong> envisage th<strong>at</strong> the Internal Audit Wingworking under the control and supervision of the Controller of<strong>Accounts</strong> would move beyond the existing system ofcompliance/regul<strong>at</strong>ory audit and would focus on;(i) the appraisal, monitoring and evalu<strong>at</strong>ion of individualschemes,(ii)assessment of adequacy and effectiveness of internal controlin general, soundness of financial systems and reliability offinancial and accounting reports in particular;(iii) Identific<strong>at</strong>ion and monitoring of risk factors (including thosecontained in the Outcome Budget);(iv) Critical assessment of economy, efficiency and effectivenessof service delivery mechanism to ensure value for money;(v) Providing an effective monitoring system to facilit<strong>at</strong>e midcourse corrections.The above revised functions shall be carried out as per theguidelines issued by the CGA from time to time.(iv) FRBM rel<strong>at</strong>ed Tasks :The Controller of <strong>Accounts</strong> shall be responsible for assistingin the prepar<strong>at</strong>ion of the disclosure st<strong>at</strong>ements required under theFRBM Act in respect of their <strong>Ministry</strong>/Department for incorpor<strong>at</strong>ion inthe consolid<strong>at</strong>ed st<strong>at</strong>ement compiled by the <strong>Ministry</strong> of Finance for theGovernment as a whole. He would also provide Financial Adviser withthe requisite inform<strong>at</strong>ion and m<strong>at</strong>erial for his input for FinanceMinister’s quarterly review of fiscal situ<strong>at</strong>ion to be presented to theParliament.(v) Expenditure and Cash Management :9

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>The Controller of <strong>Accounts</strong> will support Financial Adviser in thedischarge of their responsibilities for expenditure and cashmanagement. The expenditure management function should also beclosely linked to the Outcome Budget. He would provide support toimprove cash management through monitoring of monthly cash flowseffectively in the context of cash expenditure/commitments, tighten thesystem of receipt and payment monitoring and assist in securinggre<strong>at</strong>er convergence of revenue inflow and expenditure outflows.(vi) Non-Tax Receipt :The Controller of <strong>Accounts</strong> shall be responsible for assisting theFinancial Adviser in rel<strong>at</strong>ion to estim<strong>at</strong>ion and flow of non-tax revenuereceipts. In the discharge of these responsibilities, the Controller of<strong>Accounts</strong> shall hold consult<strong>at</strong>ions with the administr<strong>at</strong>ive divisions toreview various non-tax revenue receipts of the Ministries/Departments,review user charges for quantific<strong>at</strong>ion of the subsidy elements andperiodical reviews, as may be required, of rent, license fees, royalties,profit share and dividends.(vii) Monitoring of Assets and Liabilities :The Controller of <strong>Accounts</strong> would be responsible for assisting theFinancial Adviser to cause appropri<strong>at</strong>e action for <strong>Ministry</strong> to have acomprehensive record of its assets and liabilities. He should takeappropri<strong>at</strong>e action in this regard for initial building up of such records,their ongoing upd<strong>at</strong>ion and also for the recording of maintenance andoptimum utiliz<strong>at</strong>ion of the assets. He shall also be responsible formonitoring Government guarantees.(viii) <strong>Accounts</strong> and Audit :Finance Adviser would be kept informed about the overallquality of maintenance of departmental accounts by Controller of<strong>Accounts</strong>. He would be responsible for providing necessaryinform<strong>at</strong>ion to the FAs for his regular review of the progress of internalaudit and action taken thereon, so as to make it an important tool forfinancial management.(ix) Budget Formul<strong>at</strong>ion :10

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>The Controller of <strong>Accounts</strong> will support the Financial Advisertowards improving budgeting and facilit<strong>at</strong>ing moving from ‘itemized’to ‘budgetary’ control of expenditure. He would also support theFinancial Adviser in assisting the administr<strong>at</strong>iveMinistries/Departments in moving towards zero based budgeting andassist in better inter se programme prioritiz<strong>at</strong>ion/alloc<strong>at</strong>ion within thebudgetary ceilings, based on the analysis of expenditure and profile ofeach programme/ sub-programme and inform<strong>at</strong>ion on costcenters/drivers, assessment of output outcome and performance, andst<strong>at</strong>us of the projects/programmes.(x) Outcome Budget :The Controller of <strong>Accounts</strong> would provide necessary support toFinancial Adviser active involvement in the prepar<strong>at</strong>ion of OutcomeBudgets by the administr<strong>at</strong>ive Ministries in accordance with the timeschedule/guidelines laid down from time to time by <strong>Ministry</strong> ofFinance. He would also assist in clear definition of measurable andmonitorable outcome and set up appropri<strong>at</strong>e appraisal, monitoring andevalu<strong>at</strong>ion system (in the context of their Internal Audit/performanceaudit responsibilities of appraisal, monitoring and evalu<strong>at</strong>ion ofindividual schemes).(xi) Performance Budget :The Controller of <strong>Accounts</strong> would provide necessary support tothe Financial Adviser in the prepar<strong>at</strong>ion of Performance Budget fortheir respective administr<strong>at</strong>ive Ministries. He must assist in linking thepresent, future and past in an integr<strong>at</strong>ed manner through BudgetFormul<strong>at</strong>ion, Outcome Budget and Performance Budget.(xii)Reporting Systems- Annual Finance Report and AnnualOutcome and Systems Report :The Controller of <strong>Accounts</strong> shall be responsible for providingnecessary m<strong>at</strong>erial in respect of Annual Finance Report, AnnualOutcome and Systems Report of the Financial Adviser to the Secretary(Expenditure), through the Secretary/the Chief Accounting Authorityof the administr<strong>at</strong>ive <strong>Ministry</strong>(structured in such form<strong>at</strong> as may berequired following instructions th<strong>at</strong> <strong>Ministry</strong> of Finance would issue).11

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>(xiii)Interaction between <strong>Ministry</strong> of Finance and the FinancialAdviser :The Controller of <strong>Accounts</strong> shall provide required m<strong>at</strong>erial andassistance for the quarterly meeting of Financial Adviser withSecretary (Expenditure) and the Finance Minister.(xiv) Annual/Five Year Plans :All units in the Ministries currently looking after the function ofundertaking evalu<strong>at</strong>ion, prepar<strong>at</strong>ion of Annual/Five Year Plan are,henceforth, to function under the overall supervision and control of theFA. The Controller of <strong>Accounts</strong> shall provide appropri<strong>at</strong>e support tothe FAs in the discharge of these responsibilities (in the context oftheir various responsibilities specified above).<strong>12</strong>

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Chapter- 3Government <strong>Accounts</strong>Prepar<strong>at</strong>ion and Present<strong>at</strong>ion of <strong>Accounts</strong>:<strong>Accounts</strong> of the Union government shall be prepared every yearshowing the receipts and disbursement for the year, surplus or deficitgener<strong>at</strong>ed during the year and changes in Government liabilities and assets.The accounts so prepared shall be certified by the Comptroller and AuditorGeneral of India. The report of the Comptroller and Auditor General ofIndia rel<strong>at</strong>ing to these accounts shall be submitted to the President of India,who shall cause them to be laid before each House of Parliament.Form of <strong>Accounts</strong>:By virtue of the provisions of Article 150 of the Constitution, the<strong>Accounts</strong> of the Union Government shall be kept in such form as thePresident may, on the advice of the Comptroller and Auditor-General ofIndia, prescribe.The Controller General of <strong>Accounts</strong> in the <strong>Ministry</strong> of finance(Department of Expenditure) is responsible for prescribing the form ofaccounts of the Union and St<strong>at</strong>es, and to frame, or revise, rules andmanuals rel<strong>at</strong>ing thereto on behalf of the President of India in terms ofArticle 150 of the Constitution of India, on the advice of the comptrollerand Auditor-General of India.Principles of Accounting:The main principles according to which the accounts of theGovernment of India shall be maintained are contained in governmentAccounting Rules, 1990; Accounting Rules for Treasuries; Account CodeVol.-III and Civil <strong>Accounts</strong> Manual etc.Cash-based Accounting :Government accounts shall be prepared on cash basis. With theexception of such book adjustments as may be authorized by GovernmentAccounting Rules, 1990 or by any general or special order issued by theCentral Government on the advice of the Comptroller and Auditor –General of India, the transactions in Government accounts shall representthe actual cash receipts and disbursements during a financial year asdistinguished from amount due to or by Government during the sameperiod.13

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Period of <strong>Accounts</strong> :The annual accounts of the Central Government shall recordtransactions which take place during a financial year running from the 1stApril to the 31 st March thereof.Currency in which <strong>Accounts</strong> are kept :The accounts of Government shall be maintained in Indian rupees. Allforeign currency transactions and foreign aid shall be brought into accountafter conversion into Indian rupees.Main Divisions and structure of <strong>Accounts</strong>:The accounts of Government shall be kept in three parts, namelyConsolid<strong>at</strong>ed Fund (Part–I), Contingency Fund (Part–II) and PublicAccount (Part–III).Part–I: Consolid<strong>at</strong>ed Fund is divided into two Divisions, namely,‘Revenue’ and ‘Capital” divisions. The Revenue Division comprises of thesections ‘Receipt Heads (Revenue Account)’ dealing with the proceeds oftax<strong>at</strong>ion and other receipts classified as revenue and the section‘Expenditure Heads (Revenue <strong>Accounts</strong>)’ dealing with the expendituremet therefrom. The Capital Division comprises of three sections viz.‘Receipt Heads (Capital <strong>Accounts</strong>)’, ‘Expenditure Heads (Capital<strong>Accounts</strong>)’ and Public Debt, Loans and Advances, etc. These sections arein turn divided into sectors such as ‘General services’, ‘social andcommunity Services’, Economic Services’, etc., under which specificfunctions or services are grouped corresponding to the sectors of Planclassific<strong>at</strong>ion and which are represented by Major Heads (comprising Sub-Major Heads, wherever necessary). All revenues collected, loan raised andtheir repayment go into this fund. All the expenditure of the government isalso met from this fund. Money can be spent through this fund only if it isappropri<strong>at</strong>ed by Parliament.In Part II – Contingency Fund, are recorded transactions connectedwith the Contingency Fund set up by the Government of India underArticle 267 of the Constitution or Section 48 of the Government of UnionTerritory Act 1963. There shall be a single Major Head to record thetransactions there -under, which will be followed by Minor, Sub and/ordetailed Heads. The unforeseen expenditure which can not wait approvalof Parliament is met from this fund. The government can incurexpenditure from this fund with the approval of <strong>Ministry</strong> of Finance andseek the approval of Parliament l<strong>at</strong>er.14

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>In Part III- Public Account, transaction rel<strong>at</strong>ing to debt (other thanthose included in Part-I), reserve funds, deposits, advances, suspense,remittances and cash balances shall be recorded. All other moneysreceived by or on behalf of government are credited to Public Account.Classific<strong>at</strong>ion of transactions in Government <strong>Accounts</strong>:As a general rule, classific<strong>at</strong>ion of transactions in Government<strong>Accounts</strong>, shall have closer reference to functions, programmers andactivities of the Government and the object of revenue or expenditure,r<strong>at</strong>her than the department in which the revenue or expenditure occurs.Major Heads (comprising Sub-Major Heads wherever necessary) aredivided into Minor Heads. Minor Heads may have a number ofsubordin<strong>at</strong>e heads, generally known as Sub-Heads. The sub-Heads arefurther divided into Detailed Heads followed by Object Heads.The Major Head of Account falling within the sectors ofexpenditure heads, generally correspond to functions of Government, whilethe Minor Heads identify the programmes undertaken to achieve theobjectives of the functions represented by the Major Heads. The Sub-Headrepresents schemes , the Detailed Heads denotes sub-schemes and ObjectHead represents primary unit of appropri<strong>at</strong>ion showing the economicn<strong>at</strong>ure of expenditure such as salaries and wages, office expenses, travelexpenses, professional services, grants-in-aid etc. The above six tiers arerepresented by a unique 15 digit numeric code.Authority to open new Head of Account:The List of Major and Minor Head of <strong>Accounts</strong> of Union and St<strong>at</strong>eis maintained by the <strong>Ministry</strong> of Finance (Department of Expenditure-Controller General of <strong>Accounts</strong>) which is authorized to open a new Headof Account on the advice of the Comptroller and Auditor General of Indiaunder the powers of Article 150 of the Constitution. It contains GeneralDirections for opening Heads of <strong>Accounts</strong> (and also some Sub/DetailedHeads under some of them authorized to be so opened).Ministries/Departments may open Sub-Heads and Detailed Heads asrequired by them in consult<strong>at</strong>ion with the Budget Division of the <strong>Ministry</strong>of Finance. Their Principal <strong>Accounts</strong> <strong>Of</strong>fice may open Sub/DetailedHeads required under the Minor Heads falling within the Public Account ofIndia subject to the above stipul<strong>at</strong>ions.15

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>The object Heads have been prescribed under Government of India’sorders below Rule 8 of Deleg<strong>at</strong>ions of Financial Powers Rules. The powerto amend or modify these Object Heads and to open new Object Heads restwith Department of Expenditure of <strong>Ministry</strong> of Finance on the advice ofthe Comptroller and Auditor General of India.Conformity of Budget Heads with rules of classific<strong>at</strong>ion:Budget Heads exhibited in estim<strong>at</strong>es of receipts and expenditureframed by the Government or in any appropri<strong>at</strong>ion order shall conform tothe prescribed rules of classific<strong>at</strong>ion.Responsibility of Departmental <strong>Of</strong>ficer:Every <strong>Of</strong>ficer responsible for the collection of Government dues orexpenditure of Government money shall see th<strong>at</strong> proper accounts of thereceipts and expenditure, as the case may be, are maintained in such formas may have been prescribed for the financial transactions of Governmentwith which he is concerned and tender accur<strong>at</strong>ely and promptly all suchaccounts and returns rel<strong>at</strong>ing to them as may be required by Government,Controlling <strong>Of</strong>ficer or <strong>Accounts</strong> <strong>Of</strong>ficer, as the case may be.Classific<strong>at</strong>ions should be recorded in all the bills and challans byDrawing <strong>Of</strong>ficer:Suitable classific<strong>at</strong>ion shall be recorded by Drawing <strong>Of</strong>ficers on allbills drawn by them. Similarly, classific<strong>at</strong>ion on challans creditingGovernment money into the Bank shall be indic<strong>at</strong>ed or recorded byDepartmental <strong>Of</strong>ficers responsible for the collection of Government duesetc. In cases of doubt regarding the Heads under which a transactionshould be accounted, however, the m<strong>at</strong>ter shall be referred to the Principal<strong>Accounts</strong> <strong>Of</strong>ficer of he <strong>Ministry</strong>/Department concerned for clarific<strong>at</strong>ion ofthe <strong>Ministry</strong> of Finance and the Controller General of <strong>Accounts</strong>, wherevernecessary.Charged or Voted expenditure :The expenditure covered under Article 1<strong>12</strong>(3) of the Constitution ofIndia is charged on the Consolid<strong>at</strong>ed Fund of India and is not subject tovote by the legisl<strong>at</strong>ure. All other expenditure met out of the Consolid<strong>at</strong>edFund of India is tre<strong>at</strong>ed as Voted expenditure. Charged or VotedExpenditure shall be shown separ<strong>at</strong>ely in the accounts as well as in theBudget documents. Salary of President, Judges, C & AG etc. areexempted from vote in the Parliament and these are termed as “Charged”expenditure. Sovereign debt and releases to st<strong>at</strong>e government are also“Charged” on the Consolid<strong>at</strong>ed Fund of India.16

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Plan or Non-Plan Expenditure:Plan expenditure representing expenditure on Plan outlays approvedfor each scheme or organiz<strong>at</strong>ion by the Planning Commission andindic<strong>at</strong>ing the extent to which such outlays are met out of budgetaryprovisions shall be shown distinctly from each other (Non-Plan)expenditure in the accounts as well as in the Budget documents.Capital or Revenue Expenditure:Significant expenditure incurred with the object of acquiringtangible assets or a permanent n<strong>at</strong>ure (for use in the organiz<strong>at</strong>ion and notfor sale in the ordinary course of business) or enhancing the utility ofexisting assets, shall broadly be defined as Capital expenditure.Subsequent charges on maintenance, repair, upkeep and working expenses,which are required to maintain the assets in a running order as also all otherexpenses incurred for the day-to-day running of the organiz<strong>at</strong>ion, includingestablishments and administr<strong>at</strong>ive expenses shall be classified as Revenueexpenditure. Capital and Revenue expenditure shall be shown separ<strong>at</strong>elyin the <strong>Accounts</strong>.ANNUAL ACCOUNTSAppropri<strong>at</strong>ion <strong>Accounts</strong> :Appropri<strong>at</strong>ion <strong>Accounts</strong> of Central Ministries (other than <strong>Ministry</strong>of Railways) and of Central Civil Departments (excluding Department ofPosts and Defense Services) shall be prepared by the Principal <strong>Accounts</strong><strong>Of</strong>ficer of the respective Ministries and Departments (Under the guidanceand supervision of the Controller General of <strong>Accounts</strong>) and signed by theirrespective Chief Accounting Authorities i.e., the Secretaries in theconcerned Ministries or Departments. Union Government Appropri<strong>at</strong>ion<strong>Accounts</strong> (Civil) required to be submitted to Parliament, shall be preparedannually by the Controller General of <strong>Accounts</strong> by consolid<strong>at</strong>ing theaforesaid Appropri<strong>at</strong>ion <strong>Accounts</strong>.Finance <strong>Accounts</strong>:Annual accounts of the Government of India (Including transactionsof Department of Posts and Ministries of Defense and Railways andtransactions under Public Account of India of Union TerritoryGovernments), showing under the respective Heads the annual receipts anddisbursements for the purpose of the Union, called Finance <strong>Accounts</strong>, shallbe prepared by the Controller General of <strong>Accounts</strong>.17

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Present<strong>at</strong>ion of Annual <strong>Accounts</strong>:The Appropri<strong>at</strong>ion and Finance accounts mentioned above, shall beprepared by the respective authorities on the d<strong>at</strong>ed mutually agreed uponwith the Comptroller and Auditor-General of India, in the forms prescribedby the President on the advice of the Comptroller and Auditor General ofIndia and sent to the l<strong>at</strong>ter for recording his certific<strong>at</strong>e. The certifiedannual accounts and the Reports rel<strong>at</strong>ing to the accounts shall be submittedby the Comptroller and Auditor General of India to the President inaccordance with the provisions of Section 11 of the Comptroller andAuditor-General’s (Duties, Powers and Conditions of Services) Act, 1971and Clause (1) of Article 151 of the Constitution of India.COMPUTERIZATION OF ACCOUNTSThe process of computeriz<strong>at</strong>ion of accounts in this office started withthe accounting functioning starts in the <strong>Ministry</strong> i.e. 01-04-2007. Thesoftware titled COMPACT has been used in the Pay & <strong>Accounts</strong> officesfor computeriz<strong>at</strong>ion of a monthly consolid<strong>at</strong>ed account. In this <strong>Ministry</strong> allthe 5 PAO’s, voucher level computeriz<strong>at</strong>ion is done using the softwareCOMPACT. All the stages like pre-check, cheque writing, cheque review,scrolls, Transfer Entries and consolid<strong>at</strong>ion is being done by using thispackage. From the month of November-2008 onwards the monthlyaccount has been submitted to the O/o CGA after PAO wise adjustment ofPut Through St<strong>at</strong>ement with online acceptance by the Pr. Account’s office.Window based applic<strong>at</strong>ions like Microsoft Word and Excel are also usedfor prepar<strong>at</strong>ion of Head-wise Appropri<strong>at</strong>ion accounts, M<strong>at</strong>erial of UnionGovernment Finance Account (Civil) and monthly expenditure and receiptst<strong>at</strong>ements for submission to <strong>Ministry</strong> and for other MIS purposes.COMPACT (PAO 2000) :Multi-user software for use <strong>at</strong> the Pay & <strong>Accounts</strong> <strong>Of</strong>fice level hasbeen inducted to replace the existing IMPROVE software. This softwarehas been developed with a view to computerize the work in all Pay &<strong>Accounts</strong> offices.18

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>This software has the following fe<strong>at</strong>ures:-1. Pre-check (Integr<strong>at</strong>ed payment and accounting functions andAutom<strong>at</strong>ic Cheque printing)2. Electronic Bank Reconcili<strong>at</strong>ion3. General Provident fund4. Compil<strong>at</strong>ion of <strong>Accounts</strong>5. Settlement of Pension Cases6. Expenditure Vs Budget ControlPr.AO to e-lekha Package :This is single user software titled as “Pr.AO to e-lekha package” foruse in the Pr. <strong>Accounts</strong> <strong>Of</strong>fices. Principal Account’s office uploads theBudget Estim<strong>at</strong>es of Detailed Demand for Grants, Supplementary Grantsand Re-appropri<strong>at</strong>ion Orders to e-lekha website with the help of thissoftware.DEFINED CONTRIBUTION PENSION SCHEMEA new Pension Scheme called “Defined Contribution PensionScheme” introduced by the Government of India w. e. f. 01-01-2004 hasbeen implemented in the <strong>Ministry</strong>. All the PAOs and CDDOs are to remitthe subscribers contribution to the trustee bank of NSDL and upload thesubscriber contribution filed to the NSDL website regularly.RECENT INITIATIVES ON E- PAYMENTThe e-payment system in all Pay & <strong>Accounts</strong> <strong>Of</strong>fices of <strong>Ministry</strong>of <strong>Earth</strong> <strong>Sciences</strong> has been successfully implemented w.e.f. 01.04.20<strong>12</strong>under phase-II.e- Payment SystemSince, the IT Act, 2000 recognizes the digitally signed documents orelectronic records digitally authentic<strong>at</strong>ed by means of an electronicmethod or procedure in accordance with the provisions of section 3 of theAct, the Controller General of <strong>Accounts</strong> has developed a facility inCOMPACT for electronic payment (e-payment) through digitally signedelectronic advices. This will replace the existing system of paymentthrough cheque while leveraging the COMPACT applic<strong>at</strong>ion running inall Pay & <strong>Accounts</strong> <strong>Of</strong>fices in all Ministries/ Departments of CentralGovernment.19

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>The e-payment system developed is a fully secured web based system ofelectronic payment services which introduces transparency in governmentpayment system. Payment of dues from the government under this systemis made by credit of money directly in to the bank account of payeethrough a digitally signed e-advices gener<strong>at</strong>ed from COMPACT throughthe ‘Government e-payment G<strong>at</strong>eway (GePG)’ on a securedcommunic<strong>at</strong>ion channel. Necessary functional and security certific<strong>at</strong>ionhas been obtained from STQC Director<strong>at</strong>e for its role out. The system isbeing implemented in all Central Government Civil Ministries/Departments in a phased manner.I. Government e-payment G<strong>at</strong>eway (GePG)Government e-payment G<strong>at</strong>eway (GePG) is a portal which enables thesuccessful delivery of payment services from Pay & <strong>Accounts</strong> <strong>Of</strong>fices foronline payment transactions. The portal is developed by the <strong>Of</strong>fice ofCGA and has got STQC certific<strong>at</strong>ion from Department of Inform<strong>at</strong>ion &Technology. The GePG serves as middleware between COMPACTapplic<strong>at</strong>ion <strong>at</strong> PAOs and the Core Banking Solutions (CBS) of thebanks/RBI and facilit<strong>at</strong>es autom<strong>at</strong>ing the manual registr<strong>at</strong>ion process, e-payment advice, and e-scrolls communic<strong>at</strong>ions.Highlights of e-payment and GePG System‣ High Security Standards and System Logs of Transactions.‣ The PAO’s applic<strong>at</strong>ions has the following securityrequirements in place for effective e-payments.• <strong>12</strong>8 Bit PKI encryption.• Integrity of Inform<strong>at</strong>ion: Hash Algorithm (SHAI):security standard are designed to ensure confidently ofd<strong>at</strong>a, authenticity of d<strong>at</strong>a and integrity of d<strong>at</strong>a beingconveyed on the internet by PAOs to the bank.• Non-repudi<strong>at</strong>ion- Key gener<strong>at</strong>ion/ Digital Sign<strong>at</strong>urebased on <strong>12</strong>8 Bit PKI Infrastructure (as recommendedby RBI)‣ Digitally signed e-payment Authoriz<strong>at</strong>ion along with Itemizedtracking of each e-payment authoriz<strong>at</strong>ion and autom<strong>at</strong>edreconcili<strong>at</strong>ion.20

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Process Flow of e-payment SystemRegistr<strong>at</strong>ion of digital sign<strong>at</strong>ures: The Pay & <strong>Accounts</strong> <strong>Of</strong>ficer obtainsdigital sign<strong>at</strong>ure from the NIC Certifying Authority. The digital sign<strong>at</strong>uresobtained from the NIC Certifying Authority are stored in a USB Tokencalled i-Key. The PAO registers the digital sign<strong>at</strong>ures with GePG portalthrough the Principal <strong>Accounts</strong> <strong>Of</strong>fice of the concerned <strong>Ministry</strong>/Department. The concerned banks download the PAOs digital sign<strong>at</strong>uresfrom the GePG portal. Digital sign<strong>at</strong>ures of the authorized sign<strong>at</strong>ory of theconcerned banks are also uploaded on GePG portal for authentic<strong>at</strong>ion of e-payment scrolls provided to PAOs by the banks.BILLENTRYCOMPACT<strong>12</strong>TOKENGENERATION3 STAGEAUDITe-SCROLLPAYMENTGATEWAY(GePG)DIGITALLYSIGNEDe-PAYMENTADVICEe-PAY ADVICEBANKe-SCROLLCOMPILATION(COMPACT)Submission of Bill: The Drawing and Disbursing <strong>Of</strong>ficers (DDOs) submit billsfor e-payment along with mand<strong>at</strong>e form and details of payee viz. IFSC Code ofBank Branch, A/C Number, Name, Address, etc., to the Pay & <strong>Accounts</strong><strong>Of</strong>ficer (PAO). A token number is gener<strong>at</strong>ed from COMPACT andcommunic<strong>at</strong>ed to DDO.Bill Processing: The bills are processed in the Pay & <strong>Accounts</strong> office inCOMPACT System.21

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Digital Sign<strong>at</strong>ures: Once the bill is passed by the PAO ,it is digitally signedusing the secure I-Key and e-payment authoriz<strong>at</strong>ion is gener<strong>at</strong>ed by the system.Uploading authoriz<strong>at</strong>ion on GePG: The e-payment authoriz<strong>at</strong>ion file (eadvice)is uploaded on the GePG in a secure environment. Concerned banksdownloads the e-advices from GePG and after necessary verific<strong>at</strong>ion of digitalsign<strong>at</strong>ure etc, the bank would credit the beneficiaries’ account usingCBS/NEFT/RTGS as applicable.e-Scrolls: A digitally signed electronic scroll is gener<strong>at</strong>ed and uploaded by thebank on GePG for all successful e-payments. e-Scrolls are downloaded by thePAOs and incorpor<strong>at</strong>ed in the COMPACT system for reconcili<strong>at</strong>ion and otherMIS purposes.Advantages of e-payment• Saving in time and effort due to online fund transfer usingdigitally signed unique e-authoriz<strong>at</strong>ion ID.• Secure mode of payment.• Transparency in payment procedure.• Elimin<strong>at</strong>ion of physical cheques and their manual processing.• Elimin<strong>at</strong>ion of constraints of manual deposit of cheque by thepayee into his bank account.• Enhancement of overall payment processing efficiency.• Online auto-reconcili<strong>at</strong>ion of payments.• Efficient compil<strong>at</strong>ion of accounts.• Complete audit trail of transactions <strong>at</strong> all level.SYSTEMS GROUPA systems Group has been formed in the Principal <strong>Accounts</strong> officeprimarily to oversee the implement<strong>at</strong>ion of COMPACT and to issueguidelines for its smooth functioning.This group is currently involved in:1. Development of software to monitor Outstanding utiliz<strong>at</strong>ionCertific<strong>at</strong>es.2. IT rel<strong>at</strong>ed inventory management.3. Training of staff for the development of office rel<strong>at</strong>ed skills andfor COMPACT.4. All other IT rel<strong>at</strong>ed m<strong>at</strong>ters in the CA’s organiz<strong>at</strong>ion.22

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>ACCOUNTING ORGANIZATION SETUP INMINISTRY OF EARTH SCIENCESSECRETARY(MoES)Chief Accounting AuthorityController General of <strong>Accounts</strong>(<strong>Ministry</strong> of Finance)ADDITIONAL SECRETARY &FINANCIAL ADVISERCONTROLLER OF ACCOUNTSDY. CONTROLLER OF ACCOUNTSPr.AO(Admn) Pr.AO(Control) Internal Audit Wing Budget SectionPAO(Sectt.)New DelhiPAO(IMD)New DelhiPAO(IMD)PunePAO(IMD)ChennaiPAO(IMD)Kolk<strong>at</strong>a23

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Finance Account:Chapter- 4Highlights of <strong>Accounts</strong><strong>Ministry</strong> of <strong>Earth</strong> <strong>Sciences</strong> <strong>2011</strong>-<strong>12</strong>Finance <strong>Accounts</strong> reflect the account of <strong>Ministry</strong> of <strong>Earth</strong> <strong>Sciences</strong>as a whole. It presents the accounts of receipts and expenditure from theConsolid<strong>at</strong>ed Fund of India and Public <strong>Accounts</strong> along with the financialresults, account of public debt, other liabilities, and assets as recorded inthe accounts.The expenditure account of the <strong>Ministry</strong> of <strong>Earth</strong> <strong>Sciences</strong> depictsthe picture of total receipts and total disbursement under Revenue &Capital during the year <strong>2011</strong>-<strong>12</strong>.Receipts:The receipts and disbursements of Public Account heads mainlyappear under Major Head “8009 St<strong>at</strong>e Provident Fund”, “8011 Insuranceand Pension Funds”, “8443 Civil Deposits”, “8658 Suspense Account”,“8670 Cheques & Bills” and “8675 Deposits with RBI”.During <strong>2011</strong>-<strong>12</strong>, total Receipts and Disbursements under Revenue,Capital and Public Account Heads were as below:(`. in Crore)Receipts DisbursementRevenue Section 38.67 1<strong>12</strong>2.89Capital Section 0.67 63.59Public Account <strong>12</strong>84.78 137.64(Fig. as per SCT )24

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Expenditure:Revenue Expenditure:The total revenue expenditure under Grant No.29 during <strong>2011</strong>-<strong>12</strong>was `. 1073.63 crore against the Budget Provision `. <strong>12</strong>85.06 crore. Thisincludes the expenditure of `. 675.63 crore rel<strong>at</strong>ing to OceanographicResearch, `. 75.48 crore of Other Scientific Research, `. 19.38 crore ofSecretari<strong>at</strong>-Economic Services, `. 303.14 crore under Meteorology.Capital Expenditure:Expenditure under Capital grant was `. 100.97 crore against thebudget provision of `. 284.20 crore under Grant No.29. The overallsavings in Grant No.29 was `. 394.66 crore.(Fig. as per Appropri<strong>at</strong>ion Account Stage-III)25

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong><strong>Accounts</strong> HighlightsFinancial Year <strong>2011</strong>-<strong>12</strong>Grant No.29Sl. No. ITEM BUDGETESTIMATE1. Revenue ReceiptsTax RevenueNon Tax Revenue…38.27FINALGRANT……( `. in Crore)ACTUALSRECEIPTS /EXPENDITURE11.2327.44Capital ReceiptsLoans & Advances1.75…0.67Total Receipts40.02…39.342. ExpenditureNon PlanOn revenue A/c VotedChargedOn Capital A /c Voted348.020.101.10348.020.101.10355.820.000.063. PlanOn revenue A/c VotedChargedOn Capital A/c Voted936.900.00283.10936.940.00281.06717.810.00100.914. Total Revenue exp.votedChargedTotal Capital Exp.Voted<strong>12</strong>84.920.10284.20<strong>12</strong>84.960.10284.201073.630.00100.975. Total Expenditure1569.221569.261174.60VotedCharged1569.<strong>12</strong>0.101569.160.101174.600.00(Fig. as per Appropri<strong>at</strong>ion Account Stage-III & SCT)26

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>FUND FLOWFinancial Year <strong>2011</strong>-<strong>12</strong>(`. in Crore)RECEIPTS(Cr.)Consolid<strong>at</strong>ed Fund of IndiaDISBURSEMENTS(Dr.)Consolid<strong>at</strong>ed Fund of IndiaRevenue receiptsTax Revenue 11.23Non-Tax Revenue 27.44VotedRevenue ExpenditureGeneral Services 42.26Social Services 0.<strong>12</strong>Economic services 1059.44Grant-in-Aid(Contribution) 0.03Charged Expenditure 21.03Capital ReceiptsLoan Recoveries 0.67 CapitalGeneral service ---Social Services ---Economic Services 63.44Loans And Advances 0.16Total (C.F.I.) 39.34 Total (C.F.I.) 1186.48Public <strong>Accounts</strong>Public <strong>Accounts</strong>Small Savings Provident Fund 75.59Reserve Fund --Deposits and Advances 20.56Suspense and Misc. 1188.62Small Savings Provident Fund 59.99Reserve Fund --Deposits and Advances 21.11Suspense and Misc. 56.53Total (Public <strong>Accounts</strong>) <strong>12</strong>84.77 Total (Public <strong>Accounts</strong>) 137.63Total Receipts 1324.11 Total Disbursements 1324.11Figures are based on SCT figures and include transaction pertaining to Grant No.29 of <strong>Ministry</strong> of <strong>Earth</strong><strong>Sciences</strong> and other composite grants.27

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>GRAPH NO.2FUND FLOW DURING <strong>2011</strong>-<strong>12</strong>(`. in Crore)RECEIPTS39.340<strong>12</strong>84.77Consolid<strong>at</strong>ed Fund of IndiaPublic AccountDISBURSEMENT137.641186.48Consolid<strong>at</strong>ed Fund of IndiaPublic Account28

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Total Budget Outlay and Total Expenditure <strong>2011</strong>-<strong>12</strong>Grant No.29(`. in Crore)Section Final Grant ExpenditureRevenue SectionPlanNon-PlanNon Plan (Charged)936.94348.020.10717.81355.82--Capital SectionTotal <strong>12</strong>85.06 1073.63PlanNon-Plan283.101.10100.910.06TotalGrant Total284.20 100.971569.26 1174.60Vari<strong>at</strong>ion betweenFinal Grant &Expenditure394.66(Fig. as per Appropri<strong>at</strong>ion Account Stage-III)29

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>ACCOUNTING OPERATIONS – AN OVERVIEW(`. in Crore)Grant No.29<strong>Ministry</strong> of <strong>Earth</strong> <strong>Sciences</strong><strong>2011</strong>-<strong>12</strong>REVENUESECTIONCAPITALSECTION<strong>12</strong>85.02 BUDGET284.20ESTIMATEFINAL GRANT<strong>12</strong>85.06 284.20ACTUAL1073.63 EXPENDITURE 100.97NET SAVING211.43 183.23(Fig. as per Appropri<strong>at</strong>ion Account Stage-III)30

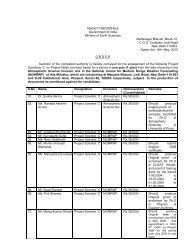

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Chapter- 5Expenditure Analysis <strong>2011</strong>-<strong>12</strong>During the year <strong>2011</strong>-<strong>12</strong> under Grant No.29 the Gross expenditurewas `. 1174.60 crore against the revised budgetary provisions of`. 1569.26 crore. There was an overall saving of `. 394.66 crore. Detailsof savings have been discussed in this Chapter. The expenditure trendsshow an increasing trend in the past few years. The sectoral analysisreveals th<strong>at</strong> the major expenditure is on the scientific sector. The majortrends, components of expenditure etc. are explained in the form ofAppropri<strong>at</strong>ion Tables and diagrams here below:-( `. in Crore)Grant No. Revenue Capital Total29 VotedCharged1073.630.00100.970.001174.600.00(Fig. as per Appropri<strong>at</strong>ion Account Stage-III)Total Plan & Non-Plan ExpenditureFinancial year <strong>2011</strong>-<strong>12</strong>(`. in Crore)Grant No.29 Plan Expenditure Non-Plan Expenditure29 818.72 355.88(Fig. as per Appropri<strong>at</strong>ion Account Stage-III)31

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Major Head-Wise Expenditure during <strong>2011</strong>-<strong>12</strong>Grant No.29(As per Appropri<strong>at</strong>ion Account)HeadMajor Head “3451”O. 24,00,00R. -3,73,82Total GrantOrAppropri<strong>at</strong>ionActualExpenditure(`. in Thousands)Excess +Saving -20,26,18 19,38,00 -88,18Major Head “3403”O. 8,38,88,00S. 3,00R. -19,73,50 8,19,17,50 6,75,62,63 -1,43,54,87Major Head “3425”O. 74,88,00S. 1,00R. 8,95,00 83,84,00 75,47,60 -8,36,40Major Head “3455”Charged10,00..-10,00VotedO. 3,46,66,00R. -1,07,50Major Head “3601”3,45,58,503,03,14,85-42,43,65Capital SectionMajor Head “5403”O. 16,50,00R. - 2,74,0050,00 .. -50,0013,76,00 5,87,<strong>12</strong> -7,88,88Major Head “5425”O. 3,40,002,60,00 2,10,00 -50,00R. -80,00Major Head “5455”O. 2,64,30,00R. 1,50,00 2,65,80,00 92,99,82 -1,72,80,1832

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>OBJECT HEADWISE EXPENDITURE OF <strong>2011</strong>-<strong>12</strong>(`. in crores)A/c Object Head Budget Revised ExpenditureCodeEstim<strong>at</strong>es Estim<strong>at</strong>es01 Salary 255.43 252.63 249.4802 Wages 1.72 2.97 2.6403 Overtime Allowance 2.79 2.29 2.1106 Medical Tre<strong>at</strong>ment 4.63 4.33 2.8511 Domestic Travel10.77 7.15 6.32Expenses<strong>12</strong> Foreign Travel7.63 4.24 2.89Expenses13 <strong>Of</strong>fice Expenses 39.48 29.40 29.1314 Rents, R<strong>at</strong>es and Taxes 2.11 2.11 0.8016 Public<strong>at</strong>ions 0.80 0.36 0.2917 BCTT 0.02 0.01 0.0020 Other Administr<strong>at</strong>ive 3.79 2.39 1.62Expenses21 Supplies & M<strong>at</strong>erials 31.00 13.57 8.2724 P.O.L. 0.01 0.00 0.0026 Advertising and1.85 0.49 0.33Publicity27 Minor Works 16.27 8.82 5.0728 Professional Services 29.18 18.90 17.9830 Other Contractual43.16 61.70 60.87Services31 Grant-in-aid 800.16 668.02 654.4932 Contributions 10.05 10.82 9.9733 Subsidies 0.10 0.10 0.0334 Scholarships / Stipend 0.10 0.10 0.0635 Grants for cre<strong>at</strong>ion of 15.00 15.30 15.00capital Assets50 Other charges0.10 0.10 0.00(Charged)50 Other charges (Voted) 6.27 2.68 2.2151 Motor vehicles 1.40 1.00 0.0052 Machinery and195.50 54.68 57.19Equipment53 Major Works 89.90 62.95 45.0070 Deduct Recoveries -2.22 -4.11 -4.33TOTAL 1567.00 <strong>12</strong>23.00 1170.27(Fig. as per DDG & Elekha <strong>2011</strong>‐<strong>12</strong>)33

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Head ofAccountNAME OF THE SCHEMESCHEME WISE EXPENDITURE( `. in Crore)B.E.(<strong>2011</strong>-<strong>12</strong>)FINAL-GRANT(<strong>2011</strong>-<strong>12</strong>)Expenditure% w.r.t.B.E.% w.r.t.FINALGRANT34030000401RESEARCH & DEVELOPMENT R& D IN EARTH & ATMOSPHERICSCIENCES --(Voted)36.00 36.0035.9399.81 99.8134030000402SEISMICITY AND EARTHQUAKEPRECURSORS --(Voted) 50.00 31.1922.5745.14 72.363403001010134030010102340300101033403001010434030010201OCEANOGRAPHIC RESEARCHVESSEL --(Voted) 21.70 34.01 33.26 153.27 97.79FISHERY ANDOCEANOGRAPHIC RESEARCHVESSEL(FORV)/ MARINE LIVINGRESOURCES(MLR) --(Voted)OTHER RESEARCH VESSEL /COASTAL RESEARCH VESSELS& OTHER RESEARCH VESSELS--(Voted)CONTINENTAL SHELF /DELINEATION OF THE OUTERLIMITS OF CONTINENTALSHELF --(Voted)EXPEDITION TOANTARCTICA/POLAR SCHIENCE--(Voted)27.18 36.107.00 7.003433.666.00<strong>12</strong>3.84 93.2485.71 85.711.00 1.00 0.48 48.00 48.00260.00 273.0<strong>12</strong>41.8993.03 88.6034030010204ANTARCTIC STUDY CENTRE --(Voted) 15.00 9.007.9052.66 87.7734030010301MARINE RESEARCH ANDDEVELOPMENT --(Voted) 8.50 8.502.9034.11 34.1134030010302 NIOT --(Voted) 45.00 24.30 22.00 48.89 90.5334030010303 SEAFRONT FACILITY --(Voted) 1.00 1.00 0.00 0.00 03403001040134030010402SURVEY AND EXPLORATION --(Voted) 2.00 2.00 0.24 <strong>12</strong>.00 <strong>12</strong>MINING RESEARCH ANDDEVELOPMENT --(Voted) 10.00 10.00 0.00 0.00 034030010404 METALLURGY --(Voted) 4.00 2.70 0.84 21.00 31.1134030010405ENVIRONMENTAL IMPACTASSESSMENT STUDIES /ENVIRONMENTAL IMPACTAREA STUDY --(Voted)2.00 2.00 0.00 0.00 0.0034030020004COASTAL OCEAN MONITORINGAND PREDICTION SYSTEM(COMAPS) --(Voted)8.00 7.86 6.62 82.75 84.2234030020005 DRUGS FROM SEA --(Voted) 11.00 11.00 5.20 47.27 47.27340300200063403002000734030020008OCEAN OBSERVATION ANDINFORMATION SYSTEM --(Voted)30.00 22.00 14.80 49.33 67.27MARINE RESOURCESPROGRAMME --(Voted) 10.00 10.00 0.85 8.50 8.50INTEGRATED COASTAL ANDMARINE MANAGEMENT(ICMAM) --(Voted)9.50 9.64 7.29 76.74 75.6234030020009COMPREHENSIVEBATHYMETRIC SURVEY OF EEZ/ COMPREHENSIVE 5.00 4.00 0.00 0.00 0.00TOPOGRAPHIC SURVEYS --(Voted)34030020010 GAS HYDRATES --(Voted) 18.00 17.00 11.00 61.11 64.71

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Head ofAccountNAME OF THE SCHEMEB.E.(<strong>2011</strong>-<strong>12</strong>)FINAL-GRANT(<strong>2011</strong>-<strong>12</strong>) Expenditure% w.r.t.B.E.% w.r.t.FINALGRANT340300200<strong>12</strong>NEW RESEARCH VESSELS /ACQUISITION OF RESEARCHVESSELS "SAGAR NIDHI" --(Voted)18.00 26.00 26.00 144.44 100.003403002001334030020014340300200153403002001634030020017340300200193403002002034030020021DATA BUOY PROGRAMME --(Voted) 18.00 34.01 34.00 188.89 99.97TSUNAMI AND STORM SURGEWARNING SYSTEM --(Voted) <strong>12</strong>.00 28.00 28.00 233.33 100.00EXPEDITION TO ARCTIC --(Voted) 15.00 10.00 8.79 58.60 87.90INDIAN NATIONAL CENTRE FOROCEAN INFORMATIONSERVICES (INCOIS) --(Voted)25.00 25.65 25.65 102.60 100.00DEVELOPMENT OF MANNEDSUBMERSIBLE --(Voted) 5.00 4.35 0.00 0.00 0.00DESALINATION PROJECT /DESALINATION PLANT --(Voted) 10.00 10.00 10.00 100.00 100.00NATIONAL OCEANARIUM --(Voted) 2.00 1.95 0.00 0.00 0.00DEMONSTRATION OF SHOREPROTECTION MEASURESTHROUGH PILOT PROJECT /DEMONSTRATION OF 5.00 2.00 0.00 0.00 0.00SHORELINE PROTECTIONMEASURES --(Voted)34030020022INTEGRATED OCEAN DRILLINGPROGRAMME (IODP)/INTEGRATED OCEAN DRILLINGPROGRAMME & GEOTECHNOICSTUDIES(IODP) --(Voted)6.00 6.00 4.95 82.50 82.50340300200233403002002434030020025ICE CLASS RESEARCH VESSEL--(Voted) 69.00 40.00 40.00 57.97 100.00MULTI-HAZARDS EARLYWARNING SUPPORT SYSTEM --(Voted)5.00 5.00 0.00 0.00 0.00CENTRE FOR CLIMATECHANGE --(Voted) 50.00 50.00 38.00 76.00 76.0034030080001 EXHIBITIONS & FAIRS-(Voted) 5.30 5.30 1.66 31.32 31.3234030080002ASSISTANCE FOR SEMINARSYMPOSIA --(Voted) 4.70 4.70 4.69 99.79 99.7934030080004 E-GOVERNANCE --(Voted) 7.00 6.91 0.44 6.29 6.373425602000234256060001SCIENTIFIC INSTITUTIONS/PROFESSIONAL BODIES/AUTONOMOUS R & DINSTITUTIONS --(Voted)NATIONAL CENTRE FORMEDIUM RANGE WEATHERFORECASTING (NCMRWF) --(Voted)58.40 67.06 66.18 113.32 98.6916.48 16.78 9.30 56.43 55.423451000901734550000101DEPARTMENT OF OCEANDEVELOPMENT/MINISTRY OFEARTH SCIENCE --(Voted)24.00 20.26 19.43 80.96 95.90DIRECTOR GENERAL-METEREOLOGY --(Charged) 0.10 0.10 0.00 0.00 0.0035

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Head ofAccountNAME OF THE SCHEMEB.E.(<strong>2011</strong>-<strong>12</strong>)FINAL-GRANT(<strong>2011</strong>-<strong>12</strong>) Expenditure% w.r.t.B.E.% w.r.t.FINALGRANT3455000010134550000301DIRECTOR GENERAL-METEREOLOGY --(Voted) 26.15 25.80 25.13 96.10 97.40TRAINING ORGANIZATIONS -(Voted) 3.96 3.81 3.10 78.28 81.3634550000401RESEARCH ANDDEVELOPMENT SERVICES --(Voted)22.41 21.61 20.94 93.44 96.90345500101013455001020134550010202345500200013455002000234550020003SATELLITE SERVICES / SPACEMETEROLOGY --(Voted) 24.80 24.07 19.07 76.90 79.23OBSERVATORY SERVICES --(Voted) 147.92 150.92 143.39 96.94 95.01AVIATION METEOROLOGY --(Voted) 2.00 2.00 0.17 8.50 8.50METEROLOGICAL SERVICES --(Voted) 68.20 65.84 63.65 93.33 96.67AGROMET ADVISORYSERVICES --(Voted) 9.00 9.00 6.23 69.22 69.22AIRBORNE PLATFORMS ANDFDPS --(Voted) 5.00 5.00 0.03 0.60 0.60345500798013455007980234550080002CONTRIBUTION TO WORLDMETEOROLOGICALORGANISATION --(Voted)CONTRIBUTION TOINTERNATIONALSEISMOLOGICAL CENTRE --(Voted)EARTHQUAKE RISKEVALUATION CENTRE /SEISMIC HAZARD AND RISKEVALUATION --(Voted)1.74 2.04 1.88 108.05 92.160.26 0.35 0.22 84.62 62.868.00 8.20 3.49 43.63 42.5634550080003MODERNIZATION OF IMD --(Voted) 23.00 22.93 15.46 67.22 67.4234550080004COMMONWEALTH GAMES &DEDICATED WEATHER 2.00 1.80 0.37 18.50 20.56CHANNEL --(Voted)36010384001 DRUGS FROM SEA --(Voted) 0.50 0.50 0.00 0.00 0.0054030010102MARINE LIVING RESOURCESAND FISHERY OFOCEANAGRAPHIC RESEARCHVES SEL (FORV) --(Voted)10.00 8.50 2.03 20.30 23.885403008000154030080002HEAD QUARTER BUILDING --(Voted) 5.00 3.76 3.76 75.20 100.00INTEGRATED COASTAL ANDMARINE AREA --(Voted) 1.50 1.50 0.08 5.33 5.3354250080006MEDIUM RANGE WEATHERFORECASTING CENTRE --(Voted)3.40 2.60 2.10 61.76 80.7754550010101EQUIPMENT / SPACEMETEOROLOGY --(Voted) 14.00 13.45 1.42 10.14 10.5654550010201EQUIPMENT / OPERATION &MAINTENANCE --(Voted) 56.10 55.95 27.11 48.32 48.4554550010202 BUILDINGS --(Voted) 55.50 54.30 1.39 2.50 2.5654550020001 EQUIPMENT --(Voted) 8.70 8.70 0.07 0.80 0.8054550020004AIRBORNE PLATFORMS & FDPS-(Voted) 16.00 14.20 1.08 6.75 7.6136

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Head ofAccountNAME OF THE SCHEMEB.E.(<strong>2011</strong>-<strong>12</strong>)FINAL-GRANT(<strong>2011</strong>-<strong>12</strong>) Expenditure% w.r.t.B.E.% w.r.t.FINALGRANT54550080001EARTHQUAKE RISKEVALUATION CENTRE --(Voted) 15.00 15.65 5.66 37.73 36.1754550080003MODENIZATION OF IMD --(Voted) 89.00 94.05 48.03 53.97 51.0754550080004 COMMONWEALTH GAMES &DEDICATED WEATHERCHANNEL --(Voted)10.00 9.50 8.22 82.20 86.53TOTAL 1567.00 1549.41 1174.60 74.96 74.84(Fig. as per e‐lekha/Appropri<strong>at</strong>ion Account Stage III)37

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>The details of Expenditure incurred by other Ministries/Departmentson behalf of ministry of <strong>Earth</strong> <strong>Sciences</strong> during <strong>2011</strong>-<strong>12</strong>(`. in Thousand )<strong>Ministry</strong> / Major Head / Minor headAmountDepartment<strong>Ministry</strong> ofInform<strong>at</strong>ion &Broadcasting--do----do--<strong>Ministry</strong> ofCommunic<strong>at</strong>ion& IT<strong>Ministry</strong> ofScience &Technology<strong>Ministry</strong> ofUrbanDevelopment--do----do----do----do--3451-Secretari<strong>at</strong> Economic Services00.090-Secretari<strong>at</strong>17-<strong>Ministry</strong> of <strong>Earth</strong> Science3455-Meteorology00.102-Observ<strong>at</strong>ories & We<strong>at</strong>her St<strong>at</strong>ions01- Observ<strong>at</strong>ory Services3455-Meteorology00.800-Other Expenditure03- Moderniz<strong>at</strong>ion of IMD3455-Meteorology00.800-Other Expenditure03- Moderniz<strong>at</strong>ion of IMD3455 –Meteorology00.800 –Other Expenditure02 –<strong>Earth</strong>quake Risk Evalu<strong>at</strong>ion Centre/SeismicHazard & Risk Evalu<strong>at</strong>ion3455-Meteorology00.102-Observ<strong>at</strong>ories & We<strong>at</strong>her St<strong>at</strong>ions01- Observ<strong>at</strong>ory Services3455-Meteorology00.800-Other Expenditure03- Moderniz<strong>at</strong>ion of IMD3455 –Meteorology00.800 –Other Expenditure02 –<strong>Earth</strong>quake Risk Evalu<strong>at</strong>ion Centre/SeismicHazard & Risk Evalu<strong>at</strong>ion5403-Capital Outlay on Oceanographic Research00.101-Oceanographic Survey02- Marine Living Resources(MLR) & FisheryOceanographic Research Vessel (FORV)5455-Capital Outlay on Meteorology00.102-Observ<strong>at</strong>ories & We<strong>at</strong>her St<strong>at</strong>ions01-Oper<strong>at</strong>ion & Maintenance38620631100096675448318066382<strong>12</strong>544203392085635455 –Capital Outlay on Meteorology746--do-- 00.200 –Other Meteorological Services01 –Agromet Advisory Services5455-Capital Outlay on Meteorology27--do-- 00.800-Other Expenditure01-Seismic Hazard and Risk Evalu<strong>at</strong>ion5455-Capital Outlay on Meteorology145648--do-- 00.800-Other Expenditure03-Maintenance of IMDTOTAL 503163Source: Annual Expenditure St<strong>at</strong>ement of Agent Ministries <strong>2011</strong>-<strong>12</strong>.

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>The details of Expenditure incurred by <strong>Ministry</strong> of <strong>Earth</strong> <strong>Sciences</strong> onbehalf of other Ministries/Department during <strong>2011</strong>-<strong>12</strong>(`. in Thousand )<strong>Ministry</strong> / Grant Major Head / Minor headAmountDepartment<strong>Ministry</strong> ofExternalAffairs<strong>Ministry</strong> ofAgriculturePlanningCommissionNo.31 3605-Technical & Economic Co-Oper<strong>at</strong>ionwith other Countries00.101-Co-oper<strong>at</strong>ion with other Countries23 – Multil<strong>at</strong>eral Economic Rel<strong>at</strong>ionProgramme.01 2401-Crop Husbandry00.111-Agriculture Economics & St<strong>at</strong>istics21- FASC74 3475- Other General Economic Services00.800- Other Expenditure93- Plan Formul<strong>at</strong>ion, Appraisal & Review327281811154Trend of Sectoral Analysis of Expenditure(`. in Crore)Particulars 2010-11 <strong>2011</strong>-<strong>12</strong>Plan Non- Total Plan Non- TotalPlanPlanRevenue AccountGeneral -- 52.84 52.84 -- 63.29 63.29ServiceSocial -- 0.84 0.84 -- 0.<strong>12</strong> 0.<strong>12</strong>ServiceEconomic 629.83 324.79 954.62 709.52 349.92 1059.44ServiceTotal 629.83 378.47 1008.30 709.52 413.33 1<strong>12</strong>2.85Capital AccountGeneral --- --- --- --- --- ---ServiceSocial --- --- --- --- --- ---ServiceEconomic 92.74 0.19 92.93 63.38 0.06 63.44ServiceLoans & --- 0.27 0.27 --- 0.16 0.16AdvancesTotal 92.74 0.46 93.20 63.38 0.22 63.60Note: - Based on SCT figures.39

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Monthly Flow of Expenditure <strong>2011</strong>-<strong>12</strong>: Grant No.29.( `. In Crore)Month PlanExpenditureNon-PlanExpenditureTotalExpenditureApril 03.94 38.86 42.80May 06.17 38.59 44.76June 19.93 21.35 41.28July 78.60 29.43 108.03August 115.39 36.44 151.83September 149.58 24.02 173.60October 41.56 31.61 73.17November 99.81 23.32 <strong>12</strong>3.13December 18.07 25.62 43.69January 75.40 29.36 104.76February 58.87 24.09 82.96March 151.41 28.85 180.26Total 818.73 351.54 1170.27Note: - Figures as per Monthly <strong>Accounts</strong> (e-lekha) of respective months (net expenditure).For Graphical represent<strong>at</strong>ions see Graph No.340

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>GRAPH No.3MONTHLY FLOW OF EXPENDITURE DURING <strong>2011</strong>-<strong>12</strong>(`. in Crore)160140149.58151.411<strong>2011</strong>5.3910099.818078.6075.406058.8740200APRIL38.86 38.593.946.17MAYJUNE19.93 21.35PLAN29.4336.4424.0241.5631.6<strong>12</strong>3.3225.6218.0729.36JULYAUGUSTSEPTEMBEROCTOBERNOVEMBERDECEMBERJANUARYFEBRUARYNON PLAN24.09MARCH28.8541

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Chapter-6Receipts Analysis <strong>2011</strong>-<strong>12</strong>Tax Revenue consists of Corpor<strong>at</strong>ion tax, Income tax and other taxes on Incomeand Expenditure. Non-tax Revenue consists of Interest Receipts and otherreceipts. The major contribution towards revenue receipts were from non-taxrevenue receipts. Under capital section the receipts were primarily from therefund of interest and installments of Loans and Advances to the governmentservants and others. The details of these receipts and the trends are presented intabular and graphical form<strong>at</strong> below:-(`. in Crore)Revenue AccountReceiptsReceipt Head(Revenue Account)A. Tax Revenue0021-Taxes on Income other than corpor<strong>at</strong>ion tax 11.110044- Service Tax 0.<strong>12</strong>Total Tax Revenue 11.23B. Non-Tax Revenue0049-Interest Receipts 0.590070-Other Administr<strong>at</strong>ive Services --0071-Contriution and Recoveries towards Pension0.01& other Retirement scheme0075- Misc. General Services --0210-Medical & Public Health 0.880216-Housing 1.100235-Social Security & Welfare --1425-Other Scientific Research 1.051475-Other General Economic Service 23.81Total Non-Tax Revenue 27.44Total – Receipts ( Tax + Non Tax Revenue) 38.67Capital <strong>Accounts</strong>7610-Loans to Govt. Servants 0.67Total Receipts ( Revenue + Capital) 39.34Source: SCT figures <strong>2011</strong>-<strong>12</strong>42

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Receipts during the Year 2009-10, 2010-11 & <strong>2011</strong>-<strong>12</strong>:(`. in Crore)YearRevenue Capital Receipts TotalReceipts2009-10 44.19 1.04 45.232010-11 42.62 0.95 43.57<strong>2011</strong>-<strong>12</strong> 38.67 0.67 39.34For Graphical Represent<strong>at</strong>ion see Graph No.445403530252015105044.1942.621.04 0.9538.670.672009-10 2010-11 <strong>2011</strong>-<strong>12</strong>RevenueReceiptsCapitalReceiptsGraph No.443

<strong>2011</strong>-<strong>12</strong> <strong>Accounts</strong> <strong>at</strong> a <strong>Glance</strong>Chapter-7Grant-in-Aid & Utiliz<strong>at</strong>ion Certific<strong>at</strong>esGRANT-IN-AID RELEASES FOR THE YEAR <strong>2011</strong>-<strong>12</strong>S.No. INSTITUTES NAME GrantsReleased(`. in Crore)%age1. NIOT, CHENNAI <strong>12</strong>4.11 18.962. NCAOR, GOA 298.51 45.613. INCOIS, HYDERABAD 51.41 7.854. IITM, PUNE 107.19 16.385. NIO, GOA 7.52 1.156. KOCHI UNIVERSITY SCIENCE & 0.99 0.15TECHNOLOGY7. ANNAIMALAI UNIVERSITY, 1.31 0.20CHIDAMBARAM8. IIT, KHARAGPUR 2.91 0.449. GOA UNIVERSITY 0.62 0.0910 INTER UNIVERSITY6.80 1.04ACCELERATOR, NEW DELHI11. NGRI, HYDERABAD 15.96 2.44<strong>12</strong>. I.I.T., DELHI 2.80 0.4313. INDIAN INSTITUTE OF SCIENCE, 3.38 0.52BANGLORE14. CSIR, NEW DELHI 1.51 0.2315. PRL, AHAMDABAD 0.97 0.1516. I.I.T, ROORKEE 0.69 0.1117. I.I.T., KANPUR 1.97 0.30SUB TOTAL:- 628.65 96.05Other Institutes holding smaller grants i.e. 25.84 3.95GRAND TOTAL:- 654.49 100.0044