Written Answers. - Parliamentary Debates - Houses of the Oireachtas

Written Answers. - Parliamentary Debates - Houses of the Oireachtas Written Answers. - Parliamentary Debates - Houses of the Oireachtas

395 Questions— 22 February 2005. Written Answers 396[Mr. Connaughton.]not restore houses to their original state, will hisDepartment, through the Irish Red Cross, acceptapplications for such eventualities; and if he willmake a statement on the matter. [5660/05]Minister of State at the Department of Finance(Mr. Parlon): Humanitarian aid schemes forhouseholders who have suffered damage to theirhomes as a result of flooding are consideredwhere the extent of the damage has been catastrophicand the normal safety nets that protectagainst risk are either inoperable or inadequateand hardship is suffered on an extensive scale.Such schemes, which have been administered bythe Irish Red Cross, provided for the relief ofhardship and were not compensation for losses ora substitute for insurance. The aid was notdesigned to put victims in the position they werein before the catastrophic event but to alleviateextreme hardship and to assist flood victims inrestoring their lives to some semblance ofnormality.The local authorities are the housing authorityin their respective areas and there are no plans toinvolve the Irish Red Cross in cases where houseshave been damaged beyond repair. Arising fromthe Government decision last September whichapproved the recommendations of the floodpolicy review group, the administration ofhumanitarian assistance in the future by the communitywelfare services of the regional healthexecutive in conjunction with, as appropriate,local community and voluntary groups and nongovernmentalorganisations is being examined.Standards in Public Office Commission.152. Mr. Cuffe asked the Minister for Financeif he has plans to extend the scope and remit ofthe Standards in Public Office Commission.[5724/05]Minister for Finance (Mr. Cowen): There areno plans to extend the scope and remit of theStandards in Public Commission.Departmental Correspondence.153. Mr. Durkan asked the Minister for Financewhen a correct P21 will re-issue to a person(details supplied) in County Kildare; and if hewill make a statement on the matter. [5549/05]Minister for Finance (Mr. Cowen): I amadvised by the Revenue Commissioners that acorrect PAYE balancing statement 2003, formP21, issued to the taxpayer dated 16 February2005.Disabled Drivers.154. Mr. Timmins asked the Minister for Financethe position in relation to the case of a person(details supplied) in County Wicklow; if thiswill be dealt with as speedily as possible; and if hewill make a statement on the matter. [5586/05]Minister for Finance (Mr. Cowen): I have nodirect responsibility for the day-to-day operationof the medical board of appeal for the disableddrivers and disabled passengers (tax concessions)scheme. However, my Department, together withthe Department of Health and Children, is reconstitutingthe medical board of appeal for thescheme. Progress has been made and it is hopedthat the new arrangements will be put in placeshortly. I will arrange for the new secretary to theboard, when in place, to contact the individualconcerned in regard to his appeal.155. Mr. Timmins asked the Minister for Financethe position in relation to the case of a person(details supplied) in County Wicklow; if thiswill be dealt with as speedily as possible; and if hewill make a statement on the matter. [5587/05]Minister for Finance (Mr. Cowen): I have nodirect responsibility for the day-to-day operationof the medical board of appeal for the disableddrivers and disabled passengers (tax concessions)scheme. However, my Department, together withthe Department of Health and Children, is reconstitutingthe medical board of appeal for thescheme. Progress has been made and it is hopedthat the new arrangements will be put in placeshortly. I will arrange for the new secretary to theboard, when in place, to contact the individualconcerned in regard to his appeal.Tax Code.156. Mr. Ferris asked the Minister for Financethe number of first-time buyers who have paidstamp duty at the lowest rate, 3%, in Dublin in2004; and the number who paid stamp duty at thelowest rate, 3%, in Mayo in 2004. [5606/05]157. Mr. Ferris asked the Minister for Financethe number of first-time buyers in 2004 who wereexempt from paying stamp duty; the number whopaid at the 3%, 3.75%, 4.75%, 7.5% and 9%rates; and the amount of revenue raised in eachrate for first-time buyers. [5607/05]Minister for Finance (Mr. Cowen): I proposeto take Questions Nos. 156 and 157 together.As the Deputy will be aware, I changed thestamp duty rates for first-time owner-occupiers ofsecond-hand property in the 2005 budget, whichwas announced on 1 December 2004. The followingtable, which was provided to the Deputy in aprevious parliamentary question response, outlinesthe old rates which were applicable up to 1December 2004, as well as the new rates asapplicable on or after 2 December 2004. It alsoshows relevant information available regardingthe number of transactions and the stamp dutyyield relating to first-time buyers who paid stampduty in 2004 as provided to me by the RevenueCommissioners:

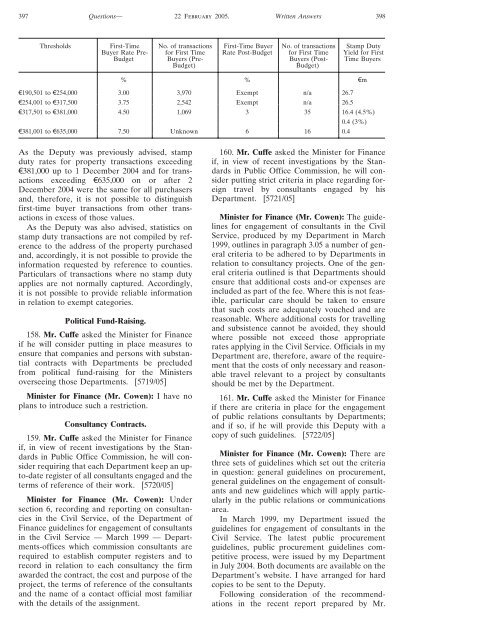

397 Questions— 22 February 2005. Written Answers 398Thresholds First-Time No. of transactions First-Time Buyer No. of transactions Stamp DutyBuyer Rate Pre- for First Time Rate Post-Budget for First Time Yield for FirstBudget Buyers (Pre- Buyers (Post- Time BuyersBudget)Budget)% % \m\190,501 to \254,000 3.00 3,970 Exempt n/a 26.7\254,001 to \317,500 3.75 2,542 Exempt n/a 26.5\317,501 to \381,000 4.50 1,069 3 35 16.4 (4.5%)\381,001 to \635,000 7.50 Unknown 6 16 0.40.4 (3%)As the Deputy was previously advised, stampduty rates for property transactions exceeding\381,000 up to 1 December 2004 and for transactionsexceeding \635,000 on or after 2December 2004 were the same for all purchasersand, therefore, it is not possible to distinguishfirst-time buyer transactions from other transactionsin excess of those values.As the Deputy was also advised, statistics onstamp duty transactions are not compiled by referenceto the address of the property purchasedand, accordingly, it is not possible to provide theinformation requested by reference to counties.Particulars of transactions where no stamp dutyapplies are not normally captured. Accordingly,it is not possible to provide reliable informationin relation to exempt categories.Political Fund-Raising.158. Mr. Cuffe asked the Minister for Financeif he will consider putting in place measures toensure that companies and persons with substantialcontracts with Departments be precludedfrom political fund-raising for the Ministersoverseeing those Departments. [5719/05]Minister for Finance (Mr. Cowen): I have noplans to introduce such a restriction.Consultancy Contracts.159. Mr. Cuffe asked the Minister for Financeif, in view of recent investigations by the Standardsin Public Office Commission, he will considerrequiring that each Department keep an upto-dateregister of all consultants engaged and theterms of reference of their work. [5720/05]Minister for Finance (Mr. Cowen): Undersection 6, recording and reporting on consultanciesin the Civil Service, of the Department ofFinance guidelines for engagement of consultantsin the Civil Service — March 1999 — Departments-officeswhich commission consultants arerequired to establish computer registers and torecord in relation to each consultancy the firmawarded the contract, the cost and purpose of theproject, the terms of reference of the consultantsand the name of a contact official most familiarwith the details of the assignment.160. Mr. Cuffe asked the Minister for Financeif, in view of recent investigations by the Standardsin Public Office Commission, he will considerputting strict criteria in place regarding foreigntravel by consultants engaged by hisDepartment. [5721/05]Minister for Finance (Mr. Cowen): The guidelinesfor engagement of consultants in the CivilService, produced by my Department in March1999, outlines in paragraph 3.05 a number of generalcriteria to be adhered to by Departments inrelation to consultancy projects. One of the generalcriteria outlined is that Departments shouldensure that additional costs and-or expenses areincluded as part of the fee. Where this is not feasible,particular care should be taken to ensurethat such costs are adequately vouched and arereasonable. Where additional costs for travellingand subsistence cannot be avoided, they shouldwhere possible not exceed those appropriaterates applying in the Civil Service. Officials in myDepartment are, therefore, aware of the requirementthat the costs of only necessary and reasonabletravel relevant to a project by consultantsshould be met by the Department.161. Mr. Cuffe asked the Minister for Financeif there are criteria in place for the engagementof public relations consultants by Departments;and if so, if he will provide this Deputy with acopy of such guidelines. [5722/05]Minister for Finance (Mr. Cowen): There arethree sets of guidelines which set out the criteriain question: general guidelines on procurement,general guidelines on the engagement of consultantsand new guidelines which will apply particularlyin the public relations or communicationsarea.In March 1999, my Department issued theguidelines for engagement of consultants in theCivil Service. The latest public procurementguidelines, public procurement guidelines competitiveprocess, were issued by my Departmentin July 2004. Both documents are available on theDepartment’s website. I have arranged for hardcopies to be sent to the Deputy.Following consideration of the recommendationsin the recent report prepared by Mr.

- Page 1 and 2: 337 Questions— 22 February 2005.

- Page 3 and 4: 341 Questions— 22 February 2005.

- Page 5 and 6: 345 Questions— 22 February 2005.

- Page 7 and 8: 349 Questions— 22 February 2005.

- Page 9 and 10: 353 Questions— 22 February 2005.

- Page 11 and 12: 357 Questions— 22 February 2005.

- Page 13 and 14: 361 Questions— 22 February 2005.

- Page 15 and 16: 365 Questions— 22 February 2005.

- Page 17 and 18: 369 Questions— 22 February 2005.

- Page 19 and 20: 373 Questions— 22 February 2005.

- Page 21 and 22: 377 Questions— 22 February 2005.

- Page 23 and 24: 381 Questions— 22 February 2005.

- Page 25 and 26: 385 Questions— 22 February 2005.

- Page 27 and 28: 389 Questions— 22 February 2005.

- Page 29: 393 Questions— 22 February 2005.

- Page 33 and 34: 401 Questions— 22 February 2005.

- Page 35 and 36: 405 Questions— 22 February 2005.

- Page 37 and 38: 409 Questions— 22 February 2005.

- Page 39 and 40: 413 Questions— 22 February 2005.

- Page 41 and 42: 417 Questions— 22 February 2005.

- Page 43 and 44: 421 Questions— 22 February 2005.

- Page 45 and 46: 425 Questions— 22 February 2005.

- Page 47 and 48: 429 Questions— 22 February 2005.

- Page 49 and 50: 433 Questions— 22 February 2005.

- Page 51 and 52: 437 Questions— 22 February 2005.

- Page 53 and 54: 441 Questions— 22 February 2005.

- Page 55 and 56: 445 Questions— 22 February 2005.

- Page 57 and 58: 449 Questions— 22 February 2005.

- Page 59 and 60: 453 Questions— 22 February 2005.

- Page 61 and 62: 457 Questions— 22 February 2005.

- Page 63 and 64: 461 Questions— 22 February 2005.

- Page 65 and 66: 465 Questions— 22 February 2005.

- Page 67 and 68: 469 Questions— 22 February 2005.

- Page 69 and 70: 473 Questions— 22 February 2005.

- Page 71 and 72: 477 Questions— 22 February 2005.

- Page 73 and 74: 481 Questions— 22 February 2005.

- Page 75 and 76: 485 Questions— 22 February 2005.

- Page 77 and 78: 489 Questions— 22 February 2005.

- Page 79 and 80: 493 Questions— 22 February 2005.

397 Questions— 22 February 2005. <strong>Written</strong> <strong>Answers</strong> 398Thresholds First-Time No. <strong>of</strong> transactions First-Time Buyer No. <strong>of</strong> transactions Stamp DutyBuyer Rate Pre- for First Time Rate Post-Budget for First Time Yield for FirstBudget Buyers (Pre- Buyers (Post- Time BuyersBudget)Budget)% % \m\190,501 to \254,000 3.00 3,970 Exempt n/a 26.7\254,001 to \317,500 3.75 2,542 Exempt n/a 26.5\317,501 to \381,000 4.50 1,069 3 35 16.4 (4.5%)\381,001 to \635,000 7.50 Unknown 6 16 0.40.4 (3%)As <strong>the</strong> Deputy was previously advised, stampduty rates for property transactions exceeding\381,000 up to 1 December 2004 and for transactionsexceeding \635,000 on or after 2December 2004 were <strong>the</strong> same for all purchasersand, <strong>the</strong>refore, it is not possible to distinguishfirst-time buyer transactions from o<strong>the</strong>r transactionsin excess <strong>of</strong> those values.As <strong>the</strong> Deputy was also advised, statistics onstamp duty transactions are not compiled by referenceto <strong>the</strong> address <strong>of</strong> <strong>the</strong> property purchasedand, accordingly, it is not possible to provide <strong>the</strong>information requested by reference to counties.Particulars <strong>of</strong> transactions where no stamp dutyapplies are not normally captured. Accordingly,it is not possible to provide reliable informationin relation to exempt categories.Political Fund-Raising.158. Mr. Cuffe asked <strong>the</strong> Minister for Financeif he will consider putting in place measures toensure that companies and persons with substantialcontracts with Departments be precludedfrom political fund-raising for <strong>the</strong> Ministersoverseeing those Departments. [5719/05]Minister for Finance (Mr. Cowen): I have noplans to introduce such a restriction.Consultancy Contracts.159. Mr. Cuffe asked <strong>the</strong> Minister for Financeif, in view <strong>of</strong> recent investigations by <strong>the</strong> Standardsin Public Office Commission, he will considerrequiring that each Department keep an upto-dateregister <strong>of</strong> all consultants engaged and <strong>the</strong>terms <strong>of</strong> reference <strong>of</strong> <strong>the</strong>ir work. [5720/05]Minister for Finance (Mr. Cowen): Undersection 6, recording and reporting on consultanciesin <strong>the</strong> Civil Service, <strong>of</strong> <strong>the</strong> Department <strong>of</strong>Finance guidelines for engagement <strong>of</strong> consultantsin <strong>the</strong> Civil Service — March 1999 — Departments-<strong>of</strong>ficeswhich commission consultants arerequired to establish computer registers and torecord in relation to each consultancy <strong>the</strong> firmawarded <strong>the</strong> contract, <strong>the</strong> cost and purpose <strong>of</strong> <strong>the</strong>project, <strong>the</strong> terms <strong>of</strong> reference <strong>of</strong> <strong>the</strong> consultantsand <strong>the</strong> name <strong>of</strong> a contact <strong>of</strong>ficial most familiarwith <strong>the</strong> details <strong>of</strong> <strong>the</strong> assignment.160. Mr. Cuffe asked <strong>the</strong> Minister for Financeif, in view <strong>of</strong> recent investigations by <strong>the</strong> Standardsin Public Office Commission, he will considerputting strict criteria in place regarding foreigntravel by consultants engaged by hisDepartment. [5721/05]Minister for Finance (Mr. Cowen): The guidelinesfor engagement <strong>of</strong> consultants in <strong>the</strong> CivilService, produced by my Department in March1999, outlines in paragraph 3.05 a number <strong>of</strong> generalcriteria to be adhered to by Departments inrelation to consultancy projects. One <strong>of</strong> <strong>the</strong> generalcriteria outlined is that Departments shouldensure that additional costs and-or expenses areincluded as part <strong>of</strong> <strong>the</strong> fee. Where this is not feasible,particular care should be taken to ensurethat such costs are adequately vouched and arereasonable. Where additional costs for travellingand subsistence cannot be avoided, <strong>the</strong>y shouldwhere possible not exceed those appropriaterates applying in <strong>the</strong> Civil Service. Officials in myDepartment are, <strong>the</strong>refore, aware <strong>of</strong> <strong>the</strong> requirementthat <strong>the</strong> costs <strong>of</strong> only necessary and reasonabletravel relevant to a project by consultantsshould be met by <strong>the</strong> Department.161. Mr. Cuffe asked <strong>the</strong> Minister for Financeif <strong>the</strong>re are criteria in place for <strong>the</strong> engagement<strong>of</strong> public relations consultants by Departments;and if so, if he will provide this Deputy with acopy <strong>of</strong> such guidelines. [5722/05]Minister for Finance (Mr. Cowen): There arethree sets <strong>of</strong> guidelines which set out <strong>the</strong> criteriain question: general guidelines on procurement,general guidelines on <strong>the</strong> engagement <strong>of</strong> consultantsand new guidelines which will apply particularlyin <strong>the</strong> public relations or communicationsarea.In March 1999, my Department issued <strong>the</strong>guidelines for engagement <strong>of</strong> consultants in <strong>the</strong>Civil Service. The latest public procurementguidelines, public procurement guidelines competitiveprocess, were issued by my Departmentin July 2004. Both documents are available on <strong>the</strong>Department’s website. I have arranged for hardcopies to be sent to <strong>the</strong> Deputy.Following consideration <strong>of</strong> <strong>the</strong> recommendationsin <strong>the</strong> recent report prepared by Mr.