MB-II, Chinyalisaur Petition - UJVN Limited Dehradun...

MB-II, Chinyalisaur Petition - UJVN Limited Dehradun...

MB-II, Chinyalisaur Petition - UJVN Limited Dehradun...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

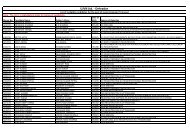

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 25: Depreciation (Rs. Cr.) for FY 2013-14, 2014-15 and 2015-16 (Rs. Crore)............................................................................................................................. 29Table 26: Proposed Interest on Loan from FY 2013-14 to 2015-16 (Rs. Cr.) ....... 30Table 27: Proposed O&M Expenses for FY 2013-14 to 2015-16 (Rs. Cr.) ............ 31Table 28: Interest on Working Capital from FY 2013-14 to 2015-16 (Rs. Cr.) .... 32Table 29: Fixed Charges from FY 2013-14 to 2015-16 (Rs. Cr.)........................... 32Table 30: Design Energy from FY 2013-14 to FY 2015-16 (MU) ......................... 33Table 31: Capacity Charges for FY 2013-14, 2014-15 and 2015-16 (Rs. Cr.) ...... 33Table 32: Energy Charge Rate (Rs./kWh) ............................................................ 33LIST OF ANNEXURESAnnexure 1: GoU order dated November 5, 2001 regarding transfer of allhydropower assets from UPJVNLAnnexure 2: Government of Uttrakhand (GoU) notified provisional transferscheme (notification no. 70/AS (E)/I/2008-04 (3)/22/08 dated 07/03/08)Annexure 3: Annual Audited Accounts for FY 2008-09Annexure 4: Annual Audited Accounts for FY 2009-10Annexure 5: Annual Audited Accounts for FY 2010-11Annexure 6: Allocation of capital expenditure for the FY 2008-09 to 2011-12Annexure 7: UPCL vide letter no. 2185/<strong>UJVN</strong>L/MD/UERC dated May 18, 2012Annexure 8: Colony Consumption for FY 2008-09, 2009-10 and 2010-11Annexure 9: Separation of Insurance Policies<strong>II</strong>I

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY169. 5-Apr-1010.11.12.30-Nov-1010-May-1129-Nov-1113. 4-Apr-12Generation Tariff forFY 2010-11 for tenlarge generatingstations including<strong>MB</strong>-<strong>II</strong>OrderonGeneration Tariff of<strong>UJVN</strong> <strong>Limited</strong> forFY 2010-11 forvarious HydroGenerating Stationsincluding <strong>MB</strong>-<strong>II</strong><strong>Petition</strong> fordetermination ofGeneration Tariff forten large generatingstations including<strong>MB</strong>-<strong>II</strong> for FY 2011-12OrderonGeneration Tariff of<strong>UJVN</strong> <strong>Limited</strong> forFY 2011-12 forvarious HydroGenerating Stationsincluding <strong>MB</strong>-<strong>II</strong><strong>Petition</strong> fordetermination ofGeneration Tariff forten large generatingstations including<strong>MB</strong>-<strong>II</strong> for FY 2012-13OrderonGeneration Tariff of<strong>UJVN</strong> <strong>Limited</strong> forFY 2012-13 forvarious HydroGenerating Stationsincluding <strong>MB</strong>-<strong>II</strong>submitted for approval beforeUERCUERC approved the Tariff on thebasis of the earlier capital cost ofRs. 1741.72 Crore. UERC did notconsider additional capitalisation asthe final capital cost was yet to bedetermined<strong>UJVN</strong> <strong>Limited</strong> submittedIndependent auditor report beforethe Commission along with the<strong>Petition</strong> to approve the actualcapital costUERC ruled that report ofindependent auditor did not servethe purpose. UERC approved theTariff on the basis of the earliercapital cost of Rs. 1741.72 Crore.UERC did not consider additionalcapitalisation as the final capitalcost was yet to be determined.UERC directed to form a High-levelCommittee to determine thereasons of delay and cost overrunto arrive at actual capital cost.<strong>UJVN</strong> <strong>Limited</strong> intimated UERC thatHigh-Level Committee has beenformed and the report is inprogress. <strong>UJVN</strong> <strong>Limited</strong> filed<strong>Petition</strong> for determination ofGeneration Tariff for FY 2012-13UERC approved the Tariff on thebasis of the earlier capital cost ofRs. 1741.72 Crore in absence ofHigh-level Committee Report.UERC did not consider additionalcapitalisation as the final capitalcost was yet to be determined.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 3

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16UERC directed <strong>UJVN</strong> <strong>Limited</strong> tosubmit findings of High-levelCommittee.1.1.5 The Hon’ble Commission in its tariff order 28.11.2008 had reviewed variousclaims of the petitioner. Number of claims submitted by the petitioner werenot considered by the Hon’ble Commission. The Hon’ble Commission in para66 of the said order had directed as follows:-“The petitioner is directed to file appropriate petition for approval of final tariffin accordance with the terms and conditions notified by the Commission fromtime to time based on the actual audited accounts as applicable on the date ofcommercial operation and till then the provisional tariff approved in this ordershall continue to apply.”1.1.6 It is further respectfully submitted that the petitioner had submitted petitionfor determination of final tariff of <strong>MB</strong>-<strong>II</strong> HEP on 7.8.2009 for the financial years2007-08, 2008-09 and 2009-10. In the said petition the reason for delay incommissioning of the project and increase in capital cost were submittedwhich were primarily on account of geological surprises and natural and socialphenomena. Subsequently vide reply petition filed on 30.10.2009 fixed assetsregister in evidence of capital cost incurred was submitted.The Hon’bleCommission disposed of the said petition vide its order dated 30.12.2009wherein in para 25 it was directed as follows:-“The Commission directs the <strong>Petition</strong>er to get an independent audit of thecapital cost of the project done within 6 months of the issue of this Order. Thework of assessing and estimating the capital cost may be awarded to anyindependent audit firm by proper tendering process and the scope of work forthis assignment should include the scope as laid down in Annexure 1.”1.1.7 In accordance to the above stated directives of the Hon’ble Commissionindependent audit of capital cost of <strong>MB</strong>-<strong>II</strong> HEP was conducted by M/s SumitSahbarwal & Associates, Chartered Accountants, and the report wassubmitted with the petition filed on 30.11.2010.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 4

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.1.8 The observations of Independent Auditor, i.e., M/s Sumit Sabharwal &Associates is reproduced as under:“3. ConclusionBased upon our findings as above, we are of the opinion that the cost overrunand time overrun though existed but it had not affected the capital cost of theproject (excluding IDC). Further all the time overruns were duly approved by thecompetent authorities at various stages of the project. The time overruns weremainly due to the adverse geological conditions, unforeseen events and varioustechnological changes that took place with the efflux of time during theconcurrency of the project. Further, the time overruns due to uncontrollablefactors led to the adverse variance in the IDC as detailed above. “ (Emphasissupplied)1.1.9 The Hon’ble Commission disposed of the petition filed by the petitioner on30.11.2010 vide its tariff order dated 10.5.2011 wherein Para 4.3 of Chapter IVthe Hon’ble Commission observed as follows-“Since, the audit report does not provide complete details as per the scope ofwork approved by the Commission and as per <strong>Petition</strong>ers own submissions,some of the Capital Works related to <strong>MB</strong>-<strong>II</strong> project are still to be completed, theCommission is unable to conduct a thorough prudence check of the Capital costof the Project. The Commission is further of the view that unless properprudence check of the Capital Cost has been carried out, the increase in costdue to cost and time over runs cannot be passed on to the beneficiaries in thetariffs. Accordingly, for thorough prudence check of the Capital Cost of <strong>MB</strong>-<strong>II</strong>project, the Commission will constitute a High Level Expert Committee toexamine in details the reasons for time and cost over-run, impact of time overrun on Capital Cost and for proper identification of various factors leading totime and cost over-runs into controllable and un-controllable factors. TheCommission will take a final view with respect to actual Capital Cost andMeans of Finance for <strong>MB</strong>-<strong>II</strong> Project after submission of report by theCommittee. The Commission also directs the <strong>Petition</strong>er to extend all possiblehelp to the members of the Committee in ascertaining the final project cost ofthe <strong>MB</strong>-<strong>II</strong> project”.1.1.10 The Hon’ble Commission vide its letter No. 549/UERC/6/TF/11 dated 28.07.11directed the petitioner to constitute a high level expert committee to comply<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 5

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16with above referred directives of the Hon’ble Commission. The desired highlevel committee has been constituted by the petitioner vide letter No.2684/<strong>UJVN</strong>L/MD/C-18/U-6 dated 10.08.11 of Managing Director, <strong>UJVN</strong> Ltd.1.1.11 As regards report of High-level Committee, <strong>UJVN</strong> <strong>Limited</strong> in its <strong>Petition</strong> fordetermination of generation tariff for FY 2012-13 stated as under:“The Hon’ble Commission vide its letter No. 549/UERC/6/TF/11 dated 28.07.11directed the petitioner to constitute a high level expert committee to complywith above referred directives of the Hon’ble Commission. The desired high levelcommittee has been constituted by the petitioner vide letter No.2684/<strong>UJVN</strong>L/MD/C-18/U-6 dated 10.08.11 of Managing Director, <strong>UJVN</strong> Ltd.The Committee thus constituted is examining in details the reasons for time andcost over-run, impact of time over run on Capital Cost and for properidentification of various factors leading to time and cost over-runs intocontrollable and un-controllable factors.The work entrusted to the committee is in final stages and its report shall befurnished to the Hon’ble Commission shortly.”1.1.12 The Hon’ble Commission in the Order dated April 4, 2012 for determination ofTariff of <strong>UJVN</strong> <strong>Limited</strong> ((Maneri Bhali-<strong>II</strong> Hydro Generating Station) for FY 2012-13 ruled as under:“…The Commission re-iterates its views that unless proper prudence check of theCapital Cost has been carried out, the increase in cost due to cost and timeover-runs cannot be passed on to the beneficiaries in the tariffs. TheCommission will take a final view with respect to actual completed Capital Costof the Project and Means of Finance for <strong>MB</strong>-<strong>II</strong> Project along with the costsubmitted in the Supplementary <strong>Petition</strong> after receipt of the detailed report ofthe Committee constituted by the <strong>Petition</strong>er. Hence, for the purpose of tariffdetermination for FY 2012-13, the Commission has taken the capital cost asapproved by it in the Order dated May 10, 2011. The Commission directs the<strong>Petition</strong>er to submit the report of the Expert Committee based on viewsexpressed by the Commission in its earlier Tariff Order dated May 10, 2011 toascertain the Capital Cost of <strong>MB</strong>-<strong>II</strong> Project, within 3 months from the date ofthis Order.” (Emphasis supplied)<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 6

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.1.13 It is respectfully submitted that <strong>UJVN</strong> <strong>Limited</strong> has already submitted the High-Level Committee Report before the Commission vide its letter number3487/MD/<strong>UJVN</strong>L/U-6 dated June 25, 2012.1.1.14 As regards the various factors responsible for increase in original capital costof Maneri Bhali-<strong>II</strong>, the report of High-level Committee states as under:“... On examination of the Books of Account, relevant records, correspondencesexchanged and various note issued by Competent Authorities from time to timeand report dated September 13, 2010 of independent Auditor M/s SumitSabharwal and Associates Chartered Accountants, the Committee observed asfollows:1) That delay on completion of the works were mainly due to adversegeological conditions unforeseen events and various technologicalchanges that took place with efflux of time during the concurrency of theproject.2) That no cost overrun resulted due to delay in completion of the works.However, due to time overrun the interest during the construction period(IDC) increase by Rs. 105.76 Crore along with other financial expensesmainly withdrawal of AG & SP subsidy and Guarantee fee.....It is evident from the bar charts that in certain periods, delays attributable todifferent reasons, whether controllable or uncontrollable were occurringconcurrently. However, it is also clear that the delay is on the critical path wereuncontrollable, which are entirely attributable to the reasons as per geologyand other extraneous causes such as extra time required to restart theunderground works after 10 years, collapses, huge quantity of slush due toseepage etc. and not attributable to the Contractors and Irrigation Department1.2 Capital Cost1.2.1 In accordance with the details mentioned in paragraphs in Section 1.1, It isnow respectfully submitted that the total capital cost and additionalcapitalisation considered for the purpose of present Tariff <strong>Petition</strong> i.e. for TrueUp and tariff calculation is estimated as under:<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 7

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.3.3.2 FY 2009-10: The Audited Accounts for the FY 2009-10 is placed at Annexure-4 for ready reference.1.3.3.3 FY 2010-11: The Audited Accounts for the FY 2010-11 is placed at Annexure-5 for ready reference.1.3.4 It is further respectfully submitted that the accounts are maintained centrallyfor the various HEPs. In certain instances one - to - one correlation of theaccounting divisions is possible with individual stations. However, for others,some form of apportionment is necessary for allocating certain expenses thatare incurred by accounting units that serves more than one station.1.3.5 In view of the above, the additional capital expenses incurred by suchaccounting divisions serving more than one station have been allocated as perthe procedure followed in earlier filings and considered by the Hon’bleCommission detailed below:-1.3.5.1 10 % of total additional capital expenses incurred by such accountingdivisions serving more than one station e.g Head Office/ Corporate Officehave been apportioned on <strong>MB</strong>-<strong>II</strong>.1.3.5.2 The detailed working of such allocation of capital expenditure for the FY2008-09 to 2010-11 is placed at Annexure-6 enclosed.1.3.6 It is respectfully submitted that in order to ensure efficiency and safety as wellas ensuring continuous operation of the plants the additional capitalizationwas required to be incurred which may kindly be considered and allowed bythe Hon’ble commission. Kind attention is invited to Regulation 16 (2) of theTariff Regulations 2004 explicitly permit additional works/service, which maybecome necessary for efficient and successful operation of the plant.1.3.7 The <strong>Petition</strong>er respectfully prays that the additional capital expenditureincurred/ accrued Rs. 2.114 Crore, Rs. 0.879 Crore and Rs. 7.854 Crore for theFY 2008-09, FY 2009-10 and FY 2010-11 respectively may kindly be approved.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 10

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.4 Debt Equity Ratio1.4.1 In accordance with the Regulation 18 of Tariff Regulations 2004, normativedebt-equity ratio of 70:30 has been considered for True-up of FY-2009, FY-2010 and FY-2011. This normative debt-equity ratio has been considered onGFA as on March 2008 and additional capitalisation incurred till respectivefinancial year.1.5 Return on Equity1.5.1 In the Tariff Order dated April 4, 2012, the Hon’ble Commission has notconsidered the amount of equity contributed out of withdrawal from PDF andruled as under:“…Since, under the Tariff Regulations of the Commission, licensees are not allowedany return on money contributed by the consumers for creation of assets, theCommission has not been allowing return on such contributions made by theGovernment out of PDF…”1.5.2 Section-3 of Uttarakhand PDF Act, 2003 states as under:“Uttarakhand Power Development Fund Act, 2003...Section 3. (1) The Government may collect duty with effect from such date asthe State Government may, by notification in the official gazette, specify for thepurpose of the Act on the saleable energy generated from existing and notifiedgenerating Hydro Power Plants of the generating company of the State ofUttraranchal which have been in commercial operation for over ten years.(2) The rate of the duty shall be notified by the Government.(3) Every duty leviable under subsection (1) shall be payable by the generatingcompany on whom such duty is imposed.(4) The duty leviable under subsection (1) shall be in addition to any dutyleviable under any other law for the time being in force.Section 4. The proceeds of the duty levied under Section-3 shall first be creditedto the consolidated fund of the State Government and the State Governmentmay, if the State Assembly by appropriation so provides, credit such proceeds tothe Fund from time to time after deducting the expenses of collection, for beingutilised exclusively for the purpose of the Act.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 11

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Section 5. The State Government may, after the appropriation made by theState Assembly, credit by way of grants or loans, such sums of money as theState Govenment may consider necessary to the fund.”1.5.3 The State of Uttarakhand enacted Uttaranchal Power Development Fund Act,2003 with effect from January 1, 2004. Under Section 3(1), the Governmenthas been empowered to impose a duty on saleable energy generated from theexisting and notified generating Hydro Plans of the generating company of theState of Uttarakhand which have been in commercial operation for over 10years.1.5.4 Section-4 of the Act specifies that the taxes levied on account of PowerDevelopment Fund is first to be deposited in the consolidated funds of theState Government and if State Assembly by appropriation so provides, suchproceeds may credited to the said Power Development Fund. Under Section-5,the State Government may further credit sum of money to PowerDevelopment Fund by way of grants or loans as may be authorised by theState Assembly.1.5.5 Hence the Power Development Fund created under the said Act not onlyconsist of duty collected through levy on saleable energy but also consist ofsuch other funds which is not collected through any such levy from the sale ofenergy instead credited to Power Development Fund under Section-5.1.5.6 The Power Development Fund consists of contributions not only through dutylevied on saleable energy but through other sources also. Therefore it may notbe possible to distinguish the investment made from Power DevelopmentFund collected through levy on saleable energy and investment made fromPower Development Fund collected through other sources.1.5.7 As regards source of funding of equity, there is no exception which has beencarved out on the basis of source of such equity in accordance with UERC(Terms & Conditions for determination of Hydro generation Tariff) Regulation,2004.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 12

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.5.8 <strong>UJVN</strong> <strong>Limited</strong> would like to submit that in other states, the State ElectricityRegulatory Commissions provides return on equity on total equity withoutgoing into details of sources of equity in accordance with Tariff Regulationsapplicable in that particular State.1.5.9 <strong>UJVN</strong> <strong>Limited</strong> requests the Hon’ble Commission to consider the return onequity infused by Government of Uttarakhand from Power Development ofFunds.1.5.10 As explained in Section 1.4, Return on Equity has been computed on anormative equity of 30% on capital base and additional capitalisation.1.5.11 It is respectfully submitted that GoU vide letter No 337/I(2)/2011-04-(1)/84/2008 dated 11.2.2011 advised the Hon’ble Commission to allow Return onequity contributed out of withdrawal from Power Development Fund (PDF).1.5.12 In accordance with Opening GFA of Rs. 1958.22 crores as on 15 March 2008,equity amount has been calculated Rs. 587.47 Crores as on 15 March 2008.Further, after taking into account normative equity percentage of 30% onadditional capitalisation as approved by the Hon’ble Commission till 2007-08,the opening equity for FY 2008-09 is calculated as Rs. 587.44 Crores. Based onthe Additional Capitalisation occurred from 2008-09 onwards as explained inthe section 1.3 the equity base is increasing at a rate of 30% of additionalcapitalisation in each year from FY 2008-09 onwards. In accordance with TariffRegulations 2004, 14% Return on Equity has been adopted for <strong>MB</strong>-<strong>II</strong> HEP. Theresultant returns are as follows:Table 6: Return on Equity for True Up (Rs. Crores)Year 2007-08 2008-09 2009-10 2010-11Opening Equity 587.44 587.47 588.10 588.37Addition 0.0285 0.63 0.26 2.36Closing Equity 587.47 588.10 588.37 590.72Average Equity 587.45 587.78 588.23 589.54RoE @ 14% 3.83 82.29 82.35 82.54<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 13

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.5.13 It is respectfully prayed that the Return on Equity proposed in accordancewith above table as Rs. 3.83 Crore, Rs. 82.29 Crore, Rs. 82.35 Crore and Rs.82.54 Crore for the FY 2007-08, FY 2008-09, FY 2009-10 and FY 2010-11respectively may kindly be considered and allowed by the Hon’bleCommission.1.6 Depreciation1.6.1 The Capital Cost for the purpose of calculating depreciation is alreadyexplained in Section 1.2. The same Capital Base of Rs. 1958.13 Cr. has beenconsidered as on the date of CoD for the purpose of depreciation for True Upwhich is further increased by Additional Capitalisation made in respectivefinancial year for which Depreciation is being estimated.1.6.2 In the Tariff Order dated April 4, 2012, Hon’ble Commission instructed the<strong>Petition</strong>er to claim the depreciation on additional capitalisation from the nextTariff filing in accordance with the rates specified under the Regulations fordifferent class of assets instead of claiming it at 2.66%.1.6.3 The following rates have been considered for the purpose of calculatingdepreciation:Table 7: Rates of Depreciation (Tariff Regulations 2004)<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 14

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 8: Depreciation for FY 2007-08 (March 15 to March 31, 2008)Component Amount DepreciationLand 0.00 0.00Building 1096.65 1.31Major civil works 404.84 0.34Plant & Machinery 456.42 0.55Vehicles 0.08 0.00Furniture & Fixtures 0.04 0.00Office Equipment 0.10 0.00Total 1958.13 2.20Table 9: Depreciation for FY 2008-09 (Rs. Crore)FY 2008-09Component Opening Bal. Addition Closing Bal. Dep. Rate DepreciationLand 0.00 0.00 0.00 0.00% 0.00Building 1096.65 -0.01 1096.64 2.57% 28.18Major civil works 404.84 0.00 404.84 1.80% 7.29Plant & Machinery 456.44 1.28 457.72 2.57% 11.75Vehicles 0.10 0.09 0.19 18.00% 0.03Furniture & Fixtures 0.08 0.33 0.41 6.00% 0.01Office Equipment 0.12 0.42 0.54 6.00% 0.02Total 1958.22 2.11 1960.34 47.28Table 10: Depreciation for FY 2009-10 (Rs. Crore)Table 11: Depreciation for FY 2010-11 (Rs. Crore)<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 15

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.6.4 It is respectfully prayed that the depreciation proposed in accordance withabove tables as Rs. 2.20 Crore, Rs. 47.28 Crore, Rs. 47.35 Crore and Rs. 47.48Crore for the FY 2007-08, FY 2008-09, FY 2009-10 and FY 2010-11 respectivelymay kindly be considered and allowed by the Hon’ble Commission.1.7 Advance Against Depreciation1.7.1 Tariff Regulation 2004 allows generating companies to recover AdvanceAgainst Depreciation also. Regulation 24 of Tariff Regulations 2004 isreproduced below:“In addition to allowable depreciation, generating company shall be entitled toan advance against depreciation, computed in the manner given hereunder.AAD = Loan repayment amount as per regulation 22 subject to a ceiling of1/10th of loan amount as per regulation 18 minus depreciation as per schedule.Provided that Advance Against Depreciation shall be permitted only if thecumulative repayment up to a particular year exceeds the cumulativedepreciation up to that year;Provided further that Advance Against Depreciation in a year shall be restrictedto the extent of difference between cumulative repayment and cumulativedepreciation up to that year.”1.7.2 In accordance with above provisions, the Advance Against Depreciation iscalculated as under”<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 16

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 12: Advance Against Depreciation for True Up (Rs. Cr.)2008-09 2009-10 2010-11Cumulative Repayment 69.00 205.16 344.46Cumulative Depreciation 49.48 96.83 144.31Eligible for AAD Yes Yes YesAnnual Repayment (A) 69.00 136.16 139.29Annual Depreciation (B) 47.28 47.35 47.48Difference(C=A-B) 21.72 88.81 91.811/10 of Loan 120.00 124.41 111.74Advance Against Dep. 21.72 88.81 91.811.7.3 It is respectfully prayed that the Advance Against Depreciation proposed inaccordance with above table as Rs. 21.72 Crore, Rs. 88.81 Crore and Rs. 91.81Crore for the FY 2008-09, FY 2009-10 and FY 2010-11 respectively may kindlybe considered and allowed by the Hon’ble Commission.1.8 Interest on loan capital1.8.1 Regulation 18(1) of Tariff Regulations 2004 is reproduced as under:“In case of all generating stations, debt–equity ratio as on the date ofcommercial operation shall be 70:30 for determination of tariff. Where equityemployed is more than 30%, the amount of equity for determination of tariffshall be limited to 30% and the balance amount shall be considered as thenormative loan.”1.8.2 Hence, at the end of FY 2007-08, a normative loan of Rs. 1370.691 Cr. hasbeen considered which is 70% of project Capital Cost and AdditionalCapitalisation in FY 2007-08.1.8.3 It is further respectfully submitted that in terms of the directives of theHon’ble Commission, interest on normative debt has been considered on thevalue equivalent to 70% of actual additional capitalisation only.1.8.4 The interest rate for the purpose of Interest calculation has been consideredactual weighted average interest rate on debt from all sources for respectivefinancial year for which True Up is being undertaken. The details of loans for<strong>MB</strong>-<strong>II</strong> hydro power project are mentioned in respective financial year.Summary of principal amount due and actual interest and finance chargespaid during respective financial years is given as under:<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 17

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 13: Weighted Average Rate of Interest for <strong>MB</strong>-<strong>II</strong> HEPFYPrincipalDue (Rs.Cr.)InterestandFinanceChargesWeightedAvg. Rateof Interest2008-09 1,148.10 152.91 13.32%2009-10 1,114.69 136.69 12.26%2010-11 993.69 129.26 13.01%2007-08 1,200.00 6.42 0.54%1.8.5 Accordingly, the interest on normative debt has been calculated as under:-:Table 14: Interest on Loan Capital for Truing Up (Rs. Crore)2007-08* 2008-09 2009-10 2010-11Opening Balance 1370.691 1370.76 1372.24 1372.85Addition 0.067 1.48 0.62 5.50Closing Balance 1370.76 1372.24 1372.85 1378.35Rate of Interest 0.54% 13.32% 12.26% 13.01%Interest on Loan 7.33 182.66 168.30 178.94* Figure for 2007-08 is only for 17 days.1.8.6 It is respectfully prayed that the Interest on Loan proposed in accordance withabove table as Rs. 7.33 Crore, Rs. 182.66 Crore, Rs. 168.30 Crore and Rs.178.94 Crore for the FY 2007-08, FY 2008-09, FY 2009-10 and FY 2010-11respectively may kindly be considered and allowed by the Hon’bleCommission.1.9 O&M Expenses1.9.1 It is respectfully submitted that O & M expenses for the FY 2007-08, FY 2008-09, FY 2009-10 and FY 2010-11 have been considered as per the auditedaccounts.1.9.2 The components of total O&M expenses have been bifurcated into direct andindirect expenses. Direct expenses have been allotted to respective hydropower project for which corresponding expenses being incurred. Indirectexpenses i.e. corporate office, other common expenses have been divided inthe ratio of 80:10:10 to 9 LHPs, <strong>MB</strong>-<strong>II</strong> HEP and Small Hydro Projectsrespectively.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 18

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.9.3 In accordance with Hon’ble Commission’s directions in the earlier Tariff Orderissued in May 2011, impact of arrear of VIth pay commission has beenconsidered on cash basis. The O&M expenses for F.Y 2008-09, FY 2009-10 and2010-11 have been computed as under:-Table 15: O&M Expenses Excluding Concessional Power SupplyComponents/FY 2007-08 2008-09 2009-10 2010-11A&G Expenses 0.075 1.77 1.50 2.69R&M Expenses 0.072 15.55 18.65 22.74Employee Expenses -0.026 9.40 9.92 11.07Total Expenses 0.121 26.73 30.07 36.50Less: Vith PayCommission Arrear 0.00 1.97 0.00 0.00on Accrual BasisAdd: Vith PayCommission Arrear 0.00 0.00 0.54 0.43on Cash BasisNet Expenses 0.12 24.76 30.61 36.931.9.4 Cost of Colonies/Dam/Barrages1.9.4.1 It is submitted that the cost of power supplies to employees of the<strong>Petition</strong>er residing in plant colonies is borne by the <strong>Petition</strong>er. The samehas been recognised and approved by the Hon’ble Commission in itsprevious tariff orders. Hon’ble Commission, in its Tariff Order dated April 4,2012, directed the <strong>Petition</strong>er to segregate the consumption of employeesof other departments, offices, etc. and also install the meters in all the unmeteredconnections including connections given to its employees. The<strong>Petition</strong>er is also directed not to include the consumption of consumersother than its departmental employees, while claiming cost of colonyconsumption in future.1.9.4.2 In this Regard, it is respectfully submitted that the process of separation ofemployees with other consumers is already in progress.1.9.4.3 The Tariff at which concessional power is supplied to the employees of<strong>UJVN</strong>L in each financial year has been considered same as proposed in thePresent Tariff <strong>Petition</strong> for Truing Up for corresponding financial years.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 19

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 16: Cost of Power Supply to Plant ColoniesComponents/FY 2007-08 2008-09 2009-10 2010-11Colony Supply(MU) 0.00 3.90 4.37 2.01Tariff 0.00 3.41 3.57 3.38Amount(Rs. Cr.) 0.00 1.33 1.56 0.681.9.5 The total O&M expenses after including all components as discussed aboveare tabulated as under:Table 17: Total O&M Expenses for <strong>MB</strong>-<strong>II</strong> Power Project (Rs. Crore)Components/FY 2007-08 2008-09 2009-10 2010-11Net Expenses 0.00 24.76 30.61 36.93Concession - ColonySupply 0.00 1.33 1.56 0.68Total O&M Expenses 0.12 26.09 32.17 37.611.9.6 It is respectfully prayed that the Operation and Maintenance Expensesproposed in accordance with above table as Rs. 0.12 Crore, Rs. 26.09 Crore,Rs. 32.17 Crore and Rs. 37.61 for the FY 2007-08, FY 2008-09, FY 2009-10 andFY 2010-11 respectively may kindly be considered and allowed by the Hon’bleCommission.1.10 Interest on Working Capital1.10.1 In accordance with the norms established under Tariff Regulations 2004, thecomponents of working capital are as follows:O&M expense at one month of projected expenses;Maintenance spares @ 1% of project cost escalated @ 6% per annum fromthe date of commercial operation (in case of <strong>UJVN</strong>L‟s stations transferredfrom UPJVNL, historical cost shall be the cost as on the date of unbundling ofUPSEB to be escalated @ 6% p.a. thereafter); andReceivables at two months of revenue from sale of electricity.1.10.2 Hon’ble Commission, in the previous Tariff Orders dated October 21, 2009,May 10, 2011 and April 4, 2012, pursuant to the request of the <strong>Petition</strong>er,while estimating the interest on working capital, had considered the prevailing<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 20

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16PLR, so as to effectively capture the existing market conditions. Accordingly, inthe present Tariff <strong>Petition</strong> also, the <strong>Petition</strong>er has considered prevailing SBIPLR as on April 1 st of respective financial year. The details of working capitaland interest thereon are given hereunder:Table 18: Interest on Working Capital for Truing Up (Rs. Crore)Components/FY 2007-08 2008-09 2009-10 2010-11One Month O&MExpenses0.01 2.17 2.68 3.131% Spares 20.76 22.02 23.36 24.832 Months Receivables 2.65 61.47 71.83 75.08Total W.C. 23.42 85.67 97.87 103.05Rate of Interest 10.25% 10.25% 12.25% 11.75%Interest on W.C. 2.40 8.78 11.99 12.111.10.3 It is respectfully prayed that the Interest on Working Capital proposed inaccordance with above table as Rs. 2.40 Crore, Rs. 8.78 Crore, Rs. 11.99 Croreand Rs. 12.11 Crore for the FY 2007-08, FY 2008-09, FY 2009-10 and FY 2010-11 respectively may kindly be considered and allowed by the Hon’bleCommission.1.11 Non Tariff Income1.11.1 The non-tariff income earned by the <strong>Petition</strong>er has been deducted from theAnnual Fixed Charges to arrive at net Annual Fixed Charges.1.12 Total Fixed Charges1.12.1 The gross and net Annual Fixed Charges for <strong>MB</strong>-<strong>II</strong> power plant for each of thetariff years is provided in the table below:<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 21

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 19: Annual Fixed Charges (Rs. Crore)Components/FY 2007-08 2008-09 2009-10 2010-11Interest on Loan 7.33 182.66 168.30 178.94O&M 0.12 26.09 32.17 37.61RoE 3.83 82.29 82.35 82.54DepreciationIncluding AAD 2.20 69.00 136.16 139.29Interest on W.C. 2.40 8.78 11.99 12.11Total AFC 15.88 368.82 430.98 450.49Less:Non TariffIncome 15.35 7.03 2.08Net AFC 15.88 353.47 423.95 448.401.12.2 It is respectfully submitted that Annual Fixed Charges Rs. 15.88 Cr., Rs. 353.47Cr., Rs. 423.95 Cr. and Rs. 448.40 Cr. for FY 2007-08, FY 2008-09, FY 2009-10and FY 2010-11 respectively, may kindly be approved and allowed for energysales to UPCL.1.13 Normative Capacity Index1.13.1 Based on the norms as per clause no. 12(1) of Tariff Regulations 2004, for runof the river stations with pondage, the normative capacity index for thestation during the first year of commercial operation is 80% and after first yearof operation of generating station is 85%. The same have been adopted by thepetitioner.1.14 Design Energy and Saleable Energy1.14.1 It is respectfully submitted that the original design energy of the Project was1566.10 MU. This Design Energy was calculated considering total installedcapacity of Power Station and attainment of full barrage level of 1108 m.Presently, due to restriction of reservoir level of 1104 m at Joshiyara Barrageinstead of designed maximum level of 1108 m, the peaking capacity hasreduced. However after completion of required essential civil works at barrageand modification of Tail Race Channel, it is expected that Power Station wouldbe able to attain its Design Energy.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 22

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.14.2 Due to restriction of barrage level and improper evacuation of water throughTRC, presently the capacity of the plant has been restricted to 280 MW. Also,due to technical reasons and availability of reduced quantity of water, which isbeyond the control of the <strong>Petition</strong>er, the net generation is less than theexpected generation. Hence, <strong>Petition</strong>er requests Hon’ble Commission that tillsuch time the proposed civil works are completed, Design Energy of ManeriBhali Stage <strong>II</strong> HEP for the Control Period be considered based on actualgeneration in the relevant year for which True Up is being taken. After,completion of Civil works at barrage and modification of TRC of Power Station,<strong>UJVN</strong> Ltd. shall approach the Hon’ble Commission for revision in DesignEnergy of Maneri Bhali Stage <strong>II</strong> HEP.1.14.3 In view of the above, <strong>Petition</strong>er requests to the Hon’ble Commission toconsider the saleable primary energy as the actual billed energy madeavailable to UPCL on ex-bus for the FY 2008-09, FY 2009-10, FY 2010-11 and FY2011-12. Actual or saleable energy is tabulated as under:Table 20: Saleable/Actual/Billed Energy Proposed for True Up (MUs)1.15 Average Tariff for Truing Up2008-09 2009-10 2010-11Billed Energy (MU) 1035.71 1187.47 1324.691.15.1 The average tariff has been determined on the basis of net primaryenergy/billed energy. In accordance with the Tariff Regulations 2004, anyenergy generated above primary energy would be considered secondaryenergy.1.15.2 In accordance with Annual Fixed Charges explained in section Error! Referencesource not found. and net primary energy explained above, the average tariff(Rs./kWh) for Truing Up is proposed as under:<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 23

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 21: Proposed Average Tariff (Rs./kWh)Components/FY 2007-08 2008-09 2009-10 2010-11Net Primary Energy/Billed Energy (MU)31.40 1035.71 1187.47 1324.69Expenditure (Rs. Cr.) 15.88 353.47 423.95 448.40Average Tariff(Rs./kWh)5.06 3.41 3.57 3.381.15.3 It is respectfully submitted that average tariff of Rs. 5.06 per kWh for FY 2007-08, Rs. 3.41 per kWh for FY 2008-09, Rs. 3.57 per kWh for FY 2009-10 and Rs.3.38 per kWh for FY 2010-11, may kindly be approved and allowed. The netimpact of average tariff as compared to average tariff charged on actual basisduring True Up years should be allowed to be recovered from thebeneficiaries immediately in the FY 2012-13.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 24

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Chapter 2. Tariff Determination for FY 2013-14, FY 2014-15 and FY 2015-162.1 Additional Capitalisation2.1.1 It is respectfully submitted that Hon’ble Commission has accepted only theactual capital cost incurred / accrued in its earlier tariff orders. Hence noestimation for additional capitalisation has been claimed for the period fromFY 2013-14 to FY 205-16.2.2 Return on Equity2.2.1 For proposed tariff from FY 2013-14 to FY 2015-16, Section 27(2) of TariffRegulations 2011 have been considered for calculating RoE. Section 27(2) isreproduced as under:“Return on equity shall be computed on at the rate of 15.5% for GeneratingStations, Transmission Licensee and SLDC and at the rate of 16% for DistributionLicensee on a post-tax basis.”2.2.2 Also, in accordance with Regulation 35 of Tariff Regulations 2011-“Income Tax, if any, on the income stream of the regulated business ofGenerating Companies, Transmission Licensees, Distribution Licensees andSLDC shall be reimbursed to the Generating Companies, TransmissionLicensees, Distribution Licensees and SLDC as per actual income tax paid, basedon the documentary evidence submitted at the time of truing up of each yearof the Control Period, subject to the prudence check.”2.2.3 It is respectfully submitted that <strong>UJVN</strong>L pays income tax at corporate level andnot project level. Bifurcation of tax which is paid at company level intoprojects level may be a complicated process and cause dissatisfaction amongbeneficiaries.2.2.4 In this regard Regulation 15 of CERC (Terms and Conditions of TariffRegulations) Regulations 2009 may be considered. The relevant extracts ofCERC Tariff Regulation 2009 are reproduced as under:<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 25

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Regulation 15(2) – Return on equity shall be computed on pre-tax basis at thebase rate of 15.5% to be grossed up as per clause (3) of this regulation:Regulation 15(3) - “The rate of return on equity shall be computed by grossingup the base rate with the normal tax rate for the year 2008-09 applicable to theconcerned generating company or the transmission licensee, as the case maybe:”“Provided that return on equity with respect to the actual tax rate applicable tothe generating company or the transmission licensee, as the case may be, inline with the provisions of the relevant Finance Acts of the respective yearduring the tariff period shall be trued up separately for each year of the tariffperiod along with the tariff petition filed for the next tariff period.”Regulation 15(4) – “Rate of return on equity shall be rounded off to threedecimal points and be computed as per the formula given below:Rate of pre-tax return on equity = Base rate / (1-t)Where t is the applicable tax rate in accordance with clause (3) of thisregulation.Illustration.-(i) In case of the generating company or the transmission licensee payingMinimum Alternate Tax (MAT) @ 11.33% including surcharge and cess:Rate of return on equity = 15.50/ (1-0.1133) = 17.481%(ii) In case of generating company or the transmission licensee paying normalcorporate tax @ 33.99% including surcharge and cess:Rate of return on equity = 15.50/ (1-0.3399) = 23.481%"2.2.5 Hence, it is requested to the Hon’ble Commission that for the purpose ofproposed tariff, total tax liability may be computed and provisionally approvedupfront, in the Tariff Order to be given against this Tariff <strong>Petition</strong>, based onpresent income tax rates. In case of variation of present tax rates with actual<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 26

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16tax rates, the same may be taken care at the time of Truing Up for relevantyear.2.2.6 In accordance with explanation given as above RoE has been calculated asunder:Table 22: Calculation of RoE for FY 2013-14 to 2015-16 (Rs. Crores)2.2.7 It is respectfully prayed that the Return on Equity proposed in accordancewith above table as Rs. 136.55 Crore, Rs. 136.55 Crore and Rs. 136.55 Crorefor the FY 2013-14, FY 2014-15 and FY 2015-16 respectively may kindly beconsidered and allowed by the Hon’ble Commission.2.3 Depreciation2.3.1 Relevant provisions pertaining to depreciation under Regulation 29 of TariffRegulation 2011 are reproduced as under29(1) – “The value base for the purpose of depreciation shall be the capital costof the asset admitted by the Commission.”29(2) “The salvage value of the asset shall be considered as 10% anddepreciation shall be allowed up to maximum of 90% of the capital cost of theasset.”29(5) “Depreciation shall be calculated annually based on Straight Line Methodand at rates specified in Appendix - <strong>II</strong> to these Regulations.Provided that, the remaining depreciable value as on 31st March of the yearclosing after a period of 12 years from date of commercial operation shall bespread over the balance useful life of the assets.”29(6) In case of the existing projects, the balance depreciable value as on1.4.2013 shall be worked out by deducting the cumulative depreciation asadmitted by the Commission upto 31.3.2013 from the gross depreciable valueof the assets. The difference between the cumulative depreciation recoveredand the depreciation so arrived at by applying the depreciation rates asspecified in these Regulations corresponding to 12 years shall be spread over<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 27

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16the remaining period upto 12 years. The remaining depreciable value as on 31stMarch of the year closing after a period of 12 years from date of commercialoperation shall be spread over the balance life.”2.3.2 In accordance with above provisions and rates provided in Tariff Regulations2011, depreciation has been calculated based on rates tabulated as under:Table 23: Rates of Depreciation as per Tariff Regulations 20112.3.3 In accordance with directives of Hon’ble Commission, <strong>Petition</strong>er hasconsidered only actual Additional Capitalisation to arrive at GFA as on 1 st April2012.2.3.4 Tariff Regulations 2011 are applicable from Ist April 2013. Hence, till FY 2012-13, <strong>Petition</strong>er has calculated depreciation based on Tariff Regulations 2004.Table 24: Depreciation in FY 2012-13 (Rs. Crore)2.3.5 In order to calculate Depreciation from FY 2013-14 to FY 2015-16, <strong>Petition</strong>erclaims depreciation on actual Additional Capitalisation only. In accordancewith rates provided in Tariff Regulations 2011, the depreciation is proposed asunder:<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 28

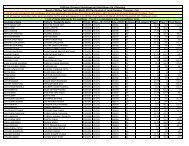

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 25: Depreciation (Rs. Cr.) for FY 2013-14, 2014-15 and 2015-16 (Rs. Crore)Depreciation Till FY2012-13DepreciationTill 12 Yearsas per TariffRegulationsDepreciationfor FY 14, FY15 and FY 16ComponentOpeningBalanceRatesDepreciationtill FY 2015-16Land (Ownership) 1.28 - 0.0% 0.00% - -Land under Lease 1.28 - 40.1% 3.34% 0.04 0.13Building 1,096.68 112.74 40.1% 3.34% 36.63 222.62Major civil works 412.21 29.35 40.1% 3.34% 13.77 70.66Plant & Machinery 458.29 47.06 63.4% 5.28% 24.20 119.65Vehicles 0.63 0.28 100.0% 9.50% 0.06 0.46Furniture & Fixtures 0.60 0.11 76.0% 6.33% 0.04 0.22Office Equipment 0.85 0.15 76.0% 6.33% 0.05 0.32Total 1,971.83 189.69 4.36 74.79 414.062.3.6 In accordance with Tariff Regulations 2011, depreciation may be recovered till12 years from the date of Commissioning of the Project at a rate mentioned inthe Regulations and shown in Section 2.3.2. Hence % of depreciation onAdditional Capitalisation from FY 2013-14 onwards needs to be reconciledwith the % of depreciation for the 12 years as per Tariff Regulations 2011.2.3.7 It is respectfully prayed that the depreciation proposed in accordance withabove paragraphs Rs. 74.79 Cr., Rs. 74.79 Cr. and Rs. 74.79 Cr. for the FY 2013-14, FY 2014-15 and FY 2015-16 respectively, may kindly be considered andallowed by the Hon’ble Commission.2.4 Interest on Loan Capital2.4.1 It is submitted that in terms of the directives of the Hon’ble Commission,interest on normative debt has been considered on the value equivalent to70% of fixed asset base and additional capitalisation.2.4.2 Rate of Interest is assumed to be same as calculated for FY 2011-12 which isweighted average rate of interest on actual loan for <strong>MB</strong>-<strong>II</strong> hydro powerproject.2.4.3 Accordingly, the interest on normative debt has been calculated as under:-:<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 29

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 26: Proposed Interest on Loan from FY 2013-14 to 2015-16 (Rs. Cr.)2.4.4 It is respectfully submitted that the Hon’ble Commission may kindly considerand allow the aforesaid interest on Normative Loan amounting to Rs. 181.82Cr., Rs. 181.82 Cr. and Rs. 181.82 Cr. for the FY 2013-14, FY 2014-15 and FY2015-16 respectively.2.5 O&M Expenses2.5.1 In accordance with Regulation 52(1) of Tariff Regulations 2011, Operation andMaintenance (O&M) expenses shall comprise of the following:-salaries, wages, pension contribution and other employee costs (EmployeeExpense);administrative and general expenses including insurance charges if any (A&GExpense);repairs and maintenance expenses (R&M Expense);2.5.1.1 In accordance with Regulation 52(2) of Tariff Regulations 2011, for ForGenerating Stations in operation for less than 5 years in base year: (2011-12)-“In case of the hydro electric generating stations, which have not been inexistence for a period of five years in the base year of FY 2011-12, the operationand maintenance expenses for the base year of FY 2011-12 shall be fixed at1.5% of the capital cost as admitted by the Commission for the first year ofoperation and shall be escalated from the subsequent year ..........”2.5.1.2 Hon’ble Commission had allowed the total O&M expense for the financialyear 2012-13 for <strong>MB</strong>-<strong>II</strong> HEP in its order dated 04.04.12. In this Tariff Order,the Commission had first calculated the base O&M cost as 1.5% of theCapital Cost as on CoD, and then suitably escalated it with escalation rate<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 30

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16applicable for the years (6.51% for FY 2008-09 and FY 2009-10, 6.29% for FY2010-11 and 7.04% for FY 2011-12 and FY 2012-13) computed inaccordance with the provisions of UERC (Terms and Conditions forDetermining Escalation Factor) Regulations, 2008.2.5.1.3 In view of the modified Capital Cost proposed as on CoD of the project inthe present Tariff <strong>Petition</strong> i.e. Rs. 1958.13 Crore, <strong>Petition</strong>er respectfullysubmits that O&M expenses for tariff determination from FY 2013-14 to FY2015-16 may be based on estimated O&M expenses in base year FY 2011-12. To estimate the O&M expenses for FY 2011-12, 1.5% of capital cost ofthe project as on CoD of the project is further escalated with the sameescalation as approved by the Commission in the Tariff Order dated April 4,2012 and mentioned in the above paragraph 2.5.1.2. The O&M expensesare projected as under:Table 27: Proposed O&M Expenses for FY 2013-14 to 2015-16 (Rs. Cr.)2007-08 2011-12 2013-14 2014-15 2015-16Total O&M Expenses 29.37 37.91 43.44 46.49 49.772.5.2 Hence, the O & M expenses amounting to Rs. 43.44 Cores, Rs. 46.49 Cores andRs. 49.77 Cores for the FY 2013-14, 2014-15 and 2015-16, respectively, maykindly be considered and allowed.2.6 Interest on Working Capital2.6.1 In accordance with Regulation 34 of Tariff Regulations 2011:“Rate of interest on working capital shall be on normative basis and shall beequal to the State Bank Advance Rate (SBAR) of State Bank of India as on thedate on which the application for determination of tariff is made.”Interest on Working Capital Shall Cover:Operation and maintenance expenses for one month;Maintenance spares @ 15% of operation and maintenance expenses; andReceivables for sale of electricity equivalent to two months of the annualfixed charges calculated on normative capacity index.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 31

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 28: Interest on Working Capital from FY 2013-14 to 2015-16 (Rs. Cr.)2.6.2 Hence, Interest on Working Capital amounting to Rs. 13.08 Cores, Rs. 13.31Cores and Rs. 13.55 Cores for the FY 2013-14, 2014-15 and 2015-16respectively may kindly be considered and allowed.2.7 Total Fixed Charges2.7.1 The gross and net Annual Fixed Charges for <strong>MB</strong>-<strong>II</strong> power plant for each of thetariff years is provided in the table below:Table 29: Fixed Charges from FY 2013-14 to 2015-16 (Rs. Cr.)Components/FY 2013-14 2014-15 2015-16Interest on Loan 181.82 181.82 181.82O&M 43.44 46.49 49.77RoE 136.55 136.55 136.55Depreciation 74.79 74.79 74.79Interest on W.C. 13.08 13.31 13.55Total AFC 449.67 452.95 456.462.7.2 In accordance with above table it is requested to Hon’ble Commission tokindly consider and allowed the Annual Fixed Charges amounting to Rs. 449.67Cores, Rs. 452.95 Cores and Rs. 456.46 Cores for the FY 2013-14, 2014-15 and2015-16 respectively.2.8 Design Energy2.8.1 In accordance with explanation made in Section 1.14.2 regardingredetermination of design energy, <strong>Petition</strong>er proposes that saleable energyfor FY 2013-14, FY 2014-15 and FY 2015-16 may kindly be allowed and<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 32

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16approved on the basis of average billed energy during FY 2008-09 to FY 2011-12.Table 30: Design Energy from FY 2013-14 to FY 2015-16 (MU)2013-14 2014-15 2015-16Billed Energy (MU) 1221.57 1221.57 1221.572.9 Capacity Charges and Energy Charge Rate:2.9.1 In accordance with the Tariff Regulations 2011, the capacity Charges arecalculated as under:Table 31: Capacity Charges for FY 2013-14, 2014-15 and 2015-16 (Rs. Cr.)2013-14 2014-15 2015-16Capacity Charges 224.84 226.48 228.232.9.2 In accordance with the Tariff Regulations 2011, Energy Charge Rate iscalculated as under:Table 32: Energy Charge Rate (Rs./kWh)2013-14 2014-15 2015-16Net Primary Energy 1221.57 1221.57 1221.57Energy Charge Rate 1.84 1.85 1.872.9.3 It is requested to the Hon’ble Commission that capacity charges amounting toRs. 224.84 Cr., Rs. 226.48 Cr. and Rs. 228.23 Cr. for FY 2013-14, 2014-15 and2015-16 respectively may kindly be considered and allowed.2.9.4 It is requested to the Hon’ble Commission that Energy Charge Rate of Rs. 1.84per kWh, Rs. 1.85 per kWh and Rs. 1.87 per kWh for FY 2013-14, 2014-15 and2015-16 respectively may kindly be considered and allowed.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 33

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Chapter 3. Status of Directives in Tariff Order Dated 4 April 20123.1 Action Taken by <strong>UJVN</strong>L on the Directives3.1.1 It is respectfully submitted that the <strong>Petition</strong>er has taken following action onthe directives issued by Hon’ble Commission in the Tariff Order dated April 4,2012:3.1.1.1 In accordance with the directions of the Hon’ble Commission to the<strong>Petition</strong>er (vide tariff order dated December 30, 2009, October 21, 2009,May 19, 2009, March 18, 2008 and for FY 2004-05 to 2006-07) an amountof Rs. 92.86 crore and Rs. 105.95 is payable by UPCL to the <strong>Petition</strong>ertowards energy charges and on account of arrears of tariff revisionrespectively. Inspite of repeated follow up with UPCL, the amount has yetnot been remitted to the <strong>Petition</strong>er by UPCL. The relevant extract of TariffOrders are reproduced as under(Extract from Tariff Order March 18, 2009 )“..............the payment of approvedcharges in excess of the existing charges shall be made by UPCL to <strong>UJVN</strong>L inequal monthly installments from first day of the month following the date ofissue of this Order till 31.03.2009.”(Extract from Tariff Order December 30, 2009 for <strong>MB</strong>-<strong>II</strong>) - “Arrears of bills dueto increased tariff for the period upto the month of November 2009 shall bepayable in balance 4 months in equal installments. Incentives and secondaryenergy charges shall, however, be payable only at the year end on annual basisas stipulated in the Regulations.”3.1.1.1.1 Hence, regarding settlement of additional amount of Rs. 9.48 crorerecovered from UPCL, the <strong>Petition</strong>er has requested to the UPCL videletter no. 2185/<strong>UJVN</strong>L/MD/UERC dated May 18, 2012 to adjust theadditional amount in the pending amount payable by UPCL. The letter no.is attached as Annexure – 7.3.1.1.2 As mentioned in the relevant section of the <strong>Petition</strong>, the segregation ofconsumption of employees of other departments, offices etc. and meterinstallation is in process. The necessary information of colony consumptionfor True Up years is attached as Annexure 8.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 34

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY163.1.1.3 Regarding handover of power distribution network in plant colony to UPCL,the <strong>Petition</strong>er has requested to the UPCL to complete necessary formalitiesrelated to the transfer the distribution network. It is requested to theHon’ble Commission to kindly give necessary directions to UPCL also toexpedite the process of transfer of such distribution network.3.1.1.4 The <strong>Petition</strong>er has already submitted benchmarking report for its fivestations. Benchmarking report for other stations is in progress and wouldbe submitted to the Hon’ble Commission shortly.3.1.1.5 The depreciation has been claimed assetwise in the present <strong>Petition</strong> to theextent the segregation of assets was available with the <strong>Petition</strong>er.3.1.1.6 Regarding DPR and transfer scheme for 9 large hydro projects, it is reportedthat even after rigorous follow-up with UPJVNL, the <strong>Petition</strong>er could not getrequired information. Hon’ble Commission may like to consider the factthat getting such information from other departments is beyond thecontrol of the <strong>Petition</strong>er. Also, in order to speed up the process offinalisation of transfer scheme, the <strong>Petition</strong>er has appointed a consultant.3.1.1.7 Regarding examining the O&M expenses allocation practices being followedin similar utilities in other states as well as central sector utilities, pleaserefer Section 1.7.3 of the <strong>Petition</strong>.3.1.1.8 Annual budget 2012-13 has already been provided to the Hon’bleCommission vide letter no. 1691 MD/<strong>UJVN</strong>L/U-6 dated April 25, 2012.3.1.1.9 Regarding the report of the Expert Committee to ascertain the Capital Costof <strong>MB</strong>-<strong>II</strong> Project, The directive has been complied vide letter no.3487/MD/<strong>UJVN</strong>L/U-6 dated June 25, 2012, submitted to the Hon’bleCommission.3.1.1.10 <strong>Petition</strong>er has separated the insurance policies taken for the hydro projectsand allocated them to 10 large hydro projects and SHPs. Please referAnnexure 9.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 35

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY163.1.1.11 <strong>Petition</strong>er has taken necessary action to comply all directives issued byHon’ble Commission. Some other reports/information is in process andwould be submitted shortly to the Hon’ble Commission.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 36

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Chapter 4.Relief Sought4.1 Relief Sought4.1.1 In view of the facts mentioned above, the <strong>Petition</strong>er respectfully prays for therelief as stated below:4.1.2 The <strong>Petition</strong>er respectfully requests that the orders of the Hon’bleCommission may adequately consider the positions expounded in the presentpetition for approval of Annual Fixed Charges for FY 2013-14, FY 2014-15 andFY 2015-16 and true up for the F.Y. 2008-09, 2009-10 and fY 2010-11. This<strong>Petition</strong> incorporates substantially improved information as compared to theearlier tariff petition. However the <strong>Petition</strong>er is making continuous efforts torefine the information system further which has started generating results.The same may be suitably considered for the orders of the Hon’bleCommission.4.1.3 The financial projections have been developed based on the <strong>Petition</strong>er’sassessment, trend available and estimates available. There could bedifferences between the projections and the actual performance of the<strong>Petition</strong>er. The Hon’ble Commission may condone the same. The <strong>Petition</strong>eralso requests the Hon’ble Commission to allow to make revisions to the<strong>Petition</strong> and submit additional relevant information that may emerge orbecome available subsequent to this filing.4.1.4 In view of the foregoing, the <strong>Petition</strong>er respectfully prays that the Hon'bleCommission may:4.1.4.1 Accept and approve the accompanying projected financial information ofthe <strong>Petition</strong>er for determination of generation tariff for the FY 2013-14, FY2014-15 and FY 2015-16 and true up for the F.Y. 2008-09, 2009-10 and fY2010-11 prepared in accordance with Tariff Regulations established by theHon’ble Commission and directives of the Hon’ble Commission contained inthe earlier tariff orders.<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 37

True-up of FY08, FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY164.1.4.2 Grant suitable opportunity to the <strong>Petition</strong>er within a reasonable time frameto file additional material information that may be subsequently available;4.1.4.3 Grant the waivers prayed with respect to such filing requirements as the<strong>Petition</strong>er is unable to comply with at this stage of filing;4.1.4.4 Treat the filing as complete in view of substantial compliance and also thespecific humble requests for waivers with justification placed on record;4.1.4.5 Condone any inadvertent omissions/ errors/ shortcomings and permit the<strong>Petition</strong>er to add/ change/ modify/ alter this filing and make furthersubmissions as may be required at a future date;4.1.4.6 Consider and approve the <strong>Petition</strong>er’s application including all requestedregulatory treatments in the filing;4.1.4.7 Consider the submissions of <strong>Petition</strong>er that could be at variance with theorders and regulations of the Hon’ble Commission, but are neverthelessfully justified from a practical viewpoint;4.1.4.8 Pass such orders as the Hon’ble Commission may deem fit and properkeeping in mind the facts and circumstances of the case.4.2 Particulars of Fee Remitted4.2.1 The details of the fee remitted are as follows:Bank Draft NoIn favour of- Uttarakhand Electricity Regulatory CommissionDrawn at - PNB - Yamuna ColonyDated -<strong>MB</strong>-<strong>II</strong> HEP November 2012 Page 38