A Guide to your Council Tax 2012-13 - Bournemouth Borough Council

A Guide to your Council Tax 2012-13 - Bournemouth Borough Council

A Guide to your Council Tax 2012-13 - Bournemouth Borough Council

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

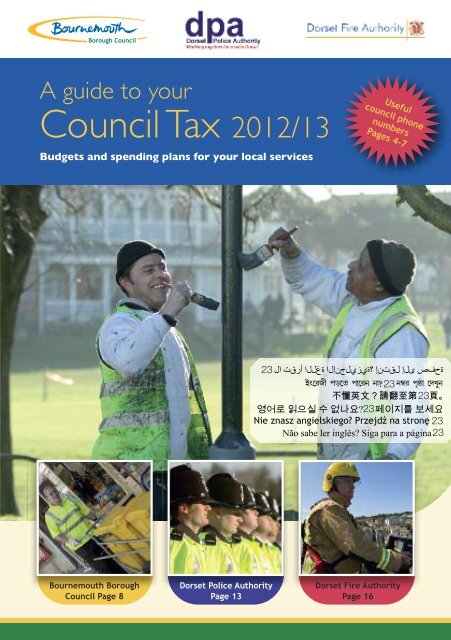

A guide <strong>to</strong> <strong>your</strong><br />

<strong>Council</strong> <strong>Tax</strong> <strong>2012</strong>/<strong>13</strong><br />

Budgets and spending plans for <strong>your</strong> local services<br />

<strong>Bournemouth</strong> <strong>Borough</strong><br />

<strong>Council</strong> Page 8<br />

Dorset Police Authority<br />

Page <strong>13</strong><br />

Useful<br />

council phone<br />

numbers<br />

Pages 4-7<br />

��<br />

��<br />

23 �� ���� ����� �����������<br />

����� ��� ����<br />

Cw®lS£ ��<br />

fs®a f¡®le e¡? 23 X eðl ��<br />

fªù¡ ®cM¤e<br />

�<br />

��<br />

����������� ���� 23<br />

��������������� � �� ��<br />

23 ����������<br />

� � ��<br />

Nie ��<br />

znasz � angielskiego? Przejd� na stron� 23<br />

��������������������� 23�<br />

�<br />

Dorset Fire Authority<br />

Page 16

2<br />

Introduction<br />

Statement from<br />

<strong>Council</strong>lor John<br />

Beesley, Leader<br />

of <strong>Bournemouth</strong><br />

<strong>Borough</strong> <strong>Council</strong><br />

During these difficult economic times it’s<br />

important that the <strong>Council</strong> tries as hard as<br />

possible <strong>to</strong> relieve the burden on local<br />

taxpayers. We are freezing <strong>Council</strong> <strong>Tax</strong><br />

again for a second year, taking advantage<br />

of the Government’s <strong>Council</strong> <strong>Tax</strong> Freeze<br />

Grant. However, this grant is only in place<br />

for the coming financial year and as a<br />

result, our budget will be under ongoing<br />

pressure when that grant ends, as some £2<br />

million will be removed from the <strong>Council</strong>’s<br />

budget next year.<br />

Government grant and <strong>Council</strong> <strong>Tax</strong> provide<br />

<strong>Bournemouth</strong> <strong>Council</strong> with an income of<br />

£140 million a year <strong>to</strong> spend on services<br />

for residents. Despite a cut in government<br />

grant of £5.87 million (8.3%), on <strong>to</strong>p of<br />

last year’s cut of £12.33 million (14.9%),<br />

there will be no cuts in front line services<br />

for the residents of <strong>Bournemouth</strong>.<br />

We continue <strong>to</strong> work hard <strong>to</strong> make sure<br />

that <strong>Bournemouth</strong> <strong>Council</strong> is in a strong<br />

financial position. Due <strong>to</strong> careful financial<br />

planning and despite much lower<br />

government funding, we have been able <strong>to</strong><br />

balance our budgets. Services such as care<br />

for children, the elderly and the<br />

vulnerable are facing increased demand<br />

and are coming under greatly increased<br />

financial pressure. However, we have put<br />

money aside and this will ensure that the<br />

<strong>Council</strong> continues <strong>to</strong> fully fund these<br />

services <strong>to</strong> meet the demands of<br />

<strong>Bournemouth</strong>’s residents.<br />

Our ongoing efficiency programme has<br />

already produced savings of more than<br />

£32 million since 2007. The partnership<br />

with Mouchel is set <strong>to</strong> deliver savings that<br />

will put the <strong>Council</strong> in the best possible<br />

position <strong>to</strong> protect and positively<br />

transform frontline services in the future.<br />

Thanks <strong>to</strong> this ongoing work, we will<br />

continue <strong>to</strong> invest in areas that are<br />

important <strong>to</strong> residents such as tackling<br />

anti-social behaviour, cleaning up our<br />

streets and neighbourhoods, improving<br />

roads and pavements and supporting jobs<br />

in the local economy.<br />

<strong>Council</strong>lor John Beesley<br />

Leader of the <strong>Council</strong><br />

Did you Know?<br />

You can find information about the<br />

<strong>Council</strong>’s plans and performance online by<br />

visiting:<br />

www.bournemouth.gov.uk/ourperformance<br />

“<br />

Due <strong>to</strong> careful financial planning and despite much lower<br />

government funding, we have been able <strong>to</strong> balance our budgets.<br />

Publication details: This is a statu<strong>to</strong>ry document <strong>to</strong> inform residents about <strong>Council</strong> <strong>Tax</strong> and budgets.<br />

Published by: <strong>Bournemouth</strong> <strong>Borough</strong> <strong>Council</strong> Date: March <strong>2012</strong><br />

Distribution: All <strong>Bournemouth</strong> households Cost per copy: 7p approx<br />

“

What you pay<br />

Here is a quick look at what you’ll pay<br />

<strong>to</strong>wards local services in <strong>2012</strong>/<strong>13</strong>,<br />

including Dorset Police and Dorset Fire and<br />

Rescue Service. Each property has been<br />

put in<strong>to</strong> one of eight bands although <strong>your</strong><br />

final bill will be less if you qualify for<br />

<strong>Council</strong> <strong>Tax</strong> Benefit or other reductions.<br />

See page 19 for further details.<br />

Band 2011/12 <strong>2012</strong>/<strong>13</strong><br />

A £999.12 £999.12<br />

B £1,165.64 £1,165.64<br />

C £1,332.16 £1,332.16<br />

D £1,498.68 £1,498.68<br />

E £1,831.72 £1,831.72<br />

F £2,164.76 £2,164.76<br />

G £2,497.80 £2,497.80<br />

H £2,997.36 £2,997.36<br />

Where is <strong>your</strong> money spent?<br />

The charts on the right show:<br />

• the proportion of expenditure for<br />

each council service area<br />

• <strong>Council</strong> <strong>Tax</strong> elements, based on a Band<br />

D property, in comparison <strong>to</strong> last year.<br />

Turn <strong>to</strong> the following pages for more<br />

details:<br />

• Page 8 for <strong>Bournemouth</strong> <strong>Borough</strong><br />

<strong>Council</strong>’s finance<br />

• Page <strong>13</strong> for Dorset Police finance<br />

• Page 16 for Dorset Fire & Rescue<br />

Service finance.<br />

Your <strong>Council</strong><br />

<strong>Tax</strong> at a glance<br />

Gross expenditure on<br />

council services<br />

25%<br />

8%<br />

Schools<br />

Adult services<br />

12% 21%<br />

5%<br />

Leisure Trust (BH Live)<br />

Planning and development<br />

Highways<br />

Environmental health<br />

4%<br />

2%<br />

3% 1% 1%<br />

18%<br />

Refuse collection and disposal<br />

Economy and <strong>to</strong>urism<br />

Other children’s services<br />

Housing and benefits<br />

Other services<br />

Band D <strong>Council</strong> <strong>Tax</strong> comparison<br />

2011/12<br />

£60.39 £180.00 £1258.29<br />

<strong>2012</strong>/<strong>13</strong><br />

£60.39 £180.00 £1258.29<br />

Dorset Fire Authority<br />

Dorset Police Authority<br />

<strong>Bournemouth</strong> <strong>Borough</strong> <strong>Council</strong><br />

3

4<br />

Make the most of <strong>your</strong> council services<br />

Whether you are visiting the local park, sending <strong>your</strong> children <strong>to</strong> school or putting the<br />

rubbish out for collection, everyone uses council services. Your council is working 24<br />

hours a day, 365 days a year <strong>to</strong> keep the <strong>to</strong>wn running and <strong>to</strong> support vulnerable<br />

people locally.<br />

With hundreds of local services on offer why not make the most of them? There are a<br />

number of ways you can find out more:<br />

Read all about it<br />

BH Life is the <strong>Council</strong>’s magazine. It is delivered <strong>to</strong> homes four times a year <strong>to</strong> keep you<br />

informed about <strong>your</strong> local services. See page 23 <strong>to</strong> tell us if you’re not regularly receiving<br />

<strong>your</strong> copy.<br />

Do it online<br />

You can find the latest news and information, apply for council services, report an issue<br />

in the borough, pay for services and much more at: www.bournemouth.gov.uk<br />

Be the first <strong>to</strong> know<br />

We put regular updates on Facebook and Twitter so why not take a look at our pages:<br />

• www.facebook.com/bournemouthbc<br />

• www.twitter.com/bournemouthbc<br />

Have <strong>your</strong> say<br />

Help influence local decisions by joining the e-panel. You will receive emails with short<br />

surveys <strong>to</strong> complete online about a varied range of <strong>to</strong>pics and we will tell you about other<br />

local consultations taking place <strong>to</strong>o. Sign up and have <strong>your</strong> say!<br />

Visit: www.bournemouth.gov.uk/epanel for full details.<br />

Contact us<br />

Over the next few pages we’ve listed the telephone numbers of some of <strong>your</strong><br />

key services.<br />

If you’re ever unsure of which council service it is that you need or you can’t find the<br />

number you’re looking for -<br />

• telephone our main number on: 01202 451451<br />

• visit us online at: www.bournemouth.gov.uk<br />

• or email: enquiries@bournemouth.gov.uk

Adult social care<br />

Telephone <strong>Bournemouth</strong> Care Direct on<br />

01202 454979 for all <strong>your</strong> adult social<br />

care including:<br />

• Advice for carers<br />

• Living independently<br />

• Day care<br />

• Home care.<br />

Business services<br />

Business Rates 01202 943286<br />

Business support 01202 454630<br />

Conferencing 01202 456545<br />

Trade waste 01202 451199<br />

Trading standards 01202 451400<br />

<strong>Council</strong> <strong>Tax</strong> and benefits<br />

<strong>Council</strong> <strong>Tax</strong><br />

24 hour payment line 01202 454748<br />

<strong>Council</strong> <strong>Tax</strong> – enquiries 01202 451597<br />

Benefits<br />

<strong>Council</strong> <strong>Tax</strong>/housing 01202 451592<br />

Your council<br />

services<br />

Children’s services<br />

Telephone the Children’s Information<br />

Service on: 01202 456222 for information<br />

about:<br />

• Childcare and family support<br />

• Children’s centres<br />

• School admissions.<br />

Children’s social care 01202 458101<br />

Did you Know?<br />

72% of <strong>Bournemouth</strong> households pay<br />

their <strong>Council</strong> <strong>Tax</strong> by Direct Debit, which<br />

helps the <strong>Council</strong> be more efficient and<br />

cost effective. We now offer a range of<br />

Direct Debit payment dates <strong>to</strong> help you<br />

budget more easily - see page 24<br />

for details.<br />

Make the most of…<br />

...<strong>your</strong> local community centre.<br />

There are a number of centres in<br />

<strong>Bournemouth</strong> offering a wide range of<br />

social activities and groups for people<br />

of all ages and interests. Find the<br />

details of <strong>your</strong> local centre by visiting:<br />

www.bournemouthcommunitycentres.co.uk<br />

5

6<br />

Your council services<br />

Housing and planning<br />

Building control 01202 45<strong>13</strong>23<br />

Housing – council tenants<br />

Housing defects –<br />

0800 0281870<br />

private tenants 01202 454979<br />

Housing grants<br />

Housing waiting list/<br />

01202 454979<br />

homelessness 01202 451467<br />

Land charges 01202 451119<br />

Planning services 01202 45<strong>13</strong>23<br />

Parking and travel<br />

Blue Badges<br />

Concessionary travel<br />

01202 458744<br />

(bus passes) 01202 451584<br />

Parking 01202 454721<br />

Make the most of…<br />

… parks, playgrounds, ball courts and<br />

skate parks. There are acres of open<br />

Parks, space for leisure everyone <strong>to</strong> and enjoy all over<br />

entertainment<br />

<strong>Bournemouth</strong>. Find <strong>your</strong> local park and<br />

details of news and events such as guided<br />

walks at: www.bournemouth.gov.uk/parks<br />

Parks, leisure and<br />

entertainment<br />

* BIC/Pavilion –<br />

visit: www.bic.co.uk 0844 576 3000<br />

* Leisure centres –<br />

visit: www.bhlive.co.uk for details:<br />

• Littledown Centre 01202 417600<br />

• Pelhams Park Leisure<br />

Centre 01202 437801<br />

• S<strong>to</strong>kewood Leisure<br />

Centre 01202 437840<br />

• Sir David English Sports<br />

Centre 01202 437800<br />

Libraries 01202 454848<br />

Parks 01202 451629<br />

Queen’s Park Golf Course 01202 451675<br />

Russell-Cotes Art Gallery<br />

& Museum 01202 451858<br />

Seafront, beach office 01202 451781<br />

Tourist information 0845 051 1700<br />

*services provided by BH Live, working with<br />

<strong>Bournemouth</strong> <strong>Borough</strong> <strong>Council</strong><br />

Did you Know?<br />

There were over a million visits made <strong>to</strong> <strong>Bournemouth</strong>’s 12 libraries last year. Our<br />

libraries are all quite different and have lots of events on offer.<br />

Visit: www.bournemouth.gov.uk/libraries <strong>to</strong> find out more.

Street services<br />

Telephone: 01202 451199 for all the<br />

following services:<br />

• Graffiti reporting<br />

• Highways – roads and pavements<br />

• Street cleaning and lighting<br />

• Rubbish and recycling.<br />

Other council services<br />

Adult learning 01202 451950<br />

Anti-social behaviour<br />

Births, deaths, marriages<br />

01202 451433<br />

and civil partnerships 01202 454945<br />

Elections and voting 01202 451123<br />

Environmental health 01202 451296<br />

Licensing<br />

Trading standards<br />

01202 451180<br />

(Consumer Direct) 0845 404 0506<br />

Pest control 01202 451199<br />

Your council<br />

services<br />

Other local services<br />

Dorset Police<br />

Dorset Fire and<br />

101<br />

Rescue Service 0<strong>13</strong>05 252600<br />

Only dial 999 if life is in danger or a crime<br />

is in progress.<br />

Did you Know?<br />

During 2011, lamp posts, signs,<br />

benches and railings were given a lick<br />

of paint as part of our Smart Streets<br />

programme <strong>to</strong> help create cleaner<br />

neighbourhoods. This included<br />

painting 1,748 metres of railings and<br />

1,025 lamp posts!<br />

Make the most of…<br />

… waste and recycling facilities. We<br />

help you reduce, reuse and recycle<br />

<strong>your</strong> waste - from a fortnightly<br />

kerbside recycling service <strong>to</strong><br />

neighbourhood recycling centres and<br />

regular events such as the ‘Give or<br />

Take days’. Find out more at:<br />

www.bournemouth.gov.uk/recycling<br />

7

8<br />

Good value local services<br />

The money you pay in <strong>Council</strong> <strong>Tax</strong> makes up a proportion of the <strong>Council</strong>’s overall budget<br />

with the rest coming from government grants and income from fees and charges.<br />

<strong>Council</strong> <strong>Tax</strong> is collected by <strong>Bournemouth</strong> <strong>Borough</strong> <strong>Council</strong> but the charge covers council,<br />

police and fire services as well as paying <strong>to</strong>wards the Environment Agency.<br />

The following ‘shopping receipt’ illustrates the weekly and annual cost of some of <strong>your</strong><br />

services. This is based on Band D <strong>Council</strong> <strong>Tax</strong> payments:<br />

Social care for children, families and adults<br />

Weekly Cost £<strong>13</strong>.22 Annual Cost £687.<strong>13</strong><br />

Education for all ages<br />

Weekly Cost £1.73 Annual Cost £89.92<br />

Planning advice, applications and enforcement<br />

Weekly Cost £0.<strong>13</strong> Annual Cost £6.65<br />

Environmental health<br />

Weekly Cost £0.21 Annual Cost £10.92<br />

Trading standards and consumer protection<br />

Weekly Cost £0.<strong>13</strong> Annual Cost £6.54<br />

Housing for those in need<br />

Weekly Cost £0.45 Annual Cost £23.62<br />

Economic development and improving the <strong>to</strong>wn’s wealth<br />

Weekly Cost £0.27 Annual Cost £14.00<br />

Registrations<br />

Weekly Cost £0.05 Annual Cost £2.57<br />

Housing and <strong>Council</strong> <strong>Tax</strong> benefits<br />

Weekly Cost £0.<strong>13</strong> Annual Cost £6.80<br />

Roads and pavement maintenance<br />

Weekly Cost £0.30 Annual Cost £15.75<br />

Refuse collection, disposal and recycling<br />

Weekly Cost £2.11 Annual Cost £109.97<br />

Maintaining parks, open spaces and golf courses<br />

Weekly Cost £0.64 Annual Cost £33.43<br />

All <strong>your</strong> other council services<br />

Weekly Cost £4.83 Annual Cost £250.99<br />

Sub Total:<br />

Weekly Cost £24.20 Annual Cost £1,258.29<br />

Dorset Police<br />

Weekly Cost £3.46 Annual Cost £180.00<br />

Dorset Fire and Rescue Service<br />

Weekly Cost £1.16 Annual Cost £60.39<br />

Total:<br />

Weekly Cost £28.82 Annual Cost £1,498.68

Where the money is spent<br />

The following table shows the estimated costs and income of the services <strong>to</strong> be provided<br />

by the <strong>Council</strong> in <strong>2012</strong>/<strong>13</strong>, including a comparison with 2011/12.<br />

Expenditure<br />

The <strong>Council</strong>’s<br />

budget<br />

2011/12 £m <strong>2012</strong>/<strong>13</strong> £m<br />

Income Net Costs Expenditure Income Net Costs<br />

105.1 (103.2) 1.9 Schools 86.5 (84.7) 1.8<br />

38.9 (10.3) 28.6 Other children’s services 38.3 (10.9) 27.4<br />

76.0 (17.9) 58.1 Adult services 77.5 (19.1) 58.4<br />

<strong>13</strong>.3 (3.5) 9.8 Highways 10.7 (1.7) 9.0<br />

114.1 (108.7) 5.4 Housing and benefits 111.9 (107.0) 4.9<br />

6.1 (0.3) 5.8 Environmental health 4.7 (0.9) 3.8<br />

11.1 (2.6) 8.5 Refuse collection and disposal 11.2 (1.2) 10.0<br />

28.4 (16.8) 11.6 Economy and <strong>to</strong>urism 21.8 (10.5) 11.3<br />

15.8 (15.8) 0.0 Leisure Trust (BH Live) 6.5 (0.9) 5.6<br />

3.8 (2.7) 1.1 Planning and development 3.9 (3.0) 0.9<br />

59.2 (43.3) 15.9 Other services 60.1 (46.2) <strong>13</strong>.9<br />

471.8 (325.1) 146.7 Total 433.1 (286.1) 147.0<br />

3.1 0.0 3.1 Contribution <strong>to</strong> Capital 0.0 0.0 0.0<br />

(10.8) 0.0 (10.8) Non-service operating items (15.9) 0.0 (15.9)<br />

<strong>13</strong>9.0 Gross expenditure/income <strong>13</strong>1.1<br />

6.4 (2.7) 3.7 Contributions <strong>to</strong>/(from) funds 8.9 0.0 8.9<br />

142.7 Budget requirement 140.0<br />

Reading the figures<br />

Income, surpluses and reduction in expenditure are shown in brackets. Spending, deficits<br />

and reductions in income are shown without brackets.<br />

9

10<br />

The <strong>Council</strong>’s budget<br />

Where the money comes from<br />

Number of Band D equivalent properties 2011/12<br />

<strong>2012</strong>/<strong>13</strong><br />

64,035<br />

64,538<br />

Amount per<br />

Band D property<br />

£m £m<br />

£<br />

<strong>Borough</strong> net expenditure 142.510 <strong>13</strong>9.826<br />

Environment Agency Levy 0.196 0.199<br />

<strong>Bournemouth</strong> <strong>Council</strong> budget requirement 142.706 140.025<br />

Less<br />

Government Grant (14.373) (1.081)<br />

National non-domestic rate (46.499) (55.763)<br />

Collection Fund (surplus)/deficit (1.259) (1.973)<br />

<strong>Bournemouth</strong> <strong>Council</strong> - <strong>Council</strong> <strong>Tax</strong> requirement 80.575 81.208 1,258.29<br />

Dorset Police Authority Precept 11.526 11.617 180.00<br />

Dorset Fire and Rescue Service Precept 3.867 3.897 60.39<br />

Total <strong>Council</strong> <strong>Tax</strong> requirement 95.968 96.722 1,498.68<br />

Business Rates<br />

Businesses and other occupants of 'non-domestic properties' must pay Business Rates. The<br />

bill is calculated by multiplying the property's 'rateable value' with the Government's<br />

<strong>2012</strong>/<strong>13</strong> National Rate in the pound of 45.8p. Eligible small businesses with a rateable<br />

value of less than £18,000 will qualify for a lower rate in the pound of 45.0p for <strong>2012</strong>/<strong>13</strong>.<br />

This is unless the ratepayer is in receipt of a manda<strong>to</strong>ry rate relief or is liable for<br />

unoccupied property rate in which case the higher rate in the pound of 45.8p will apply.<br />

The resulting figure may then be adjusted <strong>to</strong> reflect transitional arrangement or<br />

relief applicable <strong>to</strong> the particular circumstances of the property. As part of the<br />

Government's five yearly revaluation process, all rateable values have been reassessed<br />

from 1 April 2010.<br />

Find out more at: www.local.communities.gov.uk, www.voa.gov.uk and www.businesslink.gov.uk<br />

Did you Know?<br />

Business Rates, also called non-domestic rates, are collected and paid in<strong>to</strong> a central<br />

pool. These are re-distributed <strong>to</strong> councils based on per head of population.

Environment Agency Levy (Wessex Region)<br />

The Environment Agency (Wessex Region) has powers in respect of flood defence along<br />

2,8<strong>13</strong> km of main rivers and tidal and sea defences. It maintains the river system and<br />

flood defences <strong>to</strong>gether with the operation of a flood warning system. Funding comes<br />

from the Department for Environment, Food and Rural Affairs (DEFRA) and a local levy.<br />

The local levy was £3,167,409 in 2011/12 and is £3,167,000 in <strong>2012</strong>/<strong>13</strong>. <strong>Bournemouth</strong><br />

<strong>Borough</strong> <strong>Council</strong>’s share of the levy in <strong>2012</strong>/<strong>13</strong> is £199,016.<br />

Why the costs have changed<br />

The following table highlights the reasons for the change in the <strong>Council</strong>'s budget:<br />

2011/12 Budget 142.706<br />

Add increased costs of service provision:<br />

Inflation on existing services (excluding schools) 1.567<br />

Removal of short term items from base 0.070<br />

New burdens 1.374<br />

Budget pressures 1.780<br />

This has been offset by:<br />

The <strong>Council</strong>’s<br />

budget<br />

Contribution from earmarked reserves (2.252)<br />

Budget reductions and efficiency savings made (5.220)<br />

<strong>2012</strong>/<strong>13</strong> Budget 140.025<br />

11

12<br />

The <strong>Council</strong>’s budget<br />

Proposed capital spend<br />

The <strong>Council</strong> is planning <strong>to</strong> invest over £9 million on ‘capital projects’ during <strong>2012</strong>/<strong>13</strong>.<br />

Capital spending provides improved corporate or community assets such as equipment,<br />

land and buildings.<br />

Service £m<br />

Corporate Services 0.739<br />

Childrens' Services 4.277<br />

Housing Landlord and Parks 1.427<br />

Planning and Transport 0.400<br />

Technical Services 2.149<br />

Leisure Trust (BH Live) 0.034<br />

Total 9.026<br />

Number of staff<br />

Employees 2011/12 <strong>2012</strong>/<strong>13</strong><br />

(Full-time equivalent)<br />

Schools 2,083.0 1,325.4<br />

Other 2,384.9 2,151.6<br />

Total 4,467.9 3,477.0<br />

A reduction has resulted because of restructures, staff transfers <strong>to</strong> the Mouchel Partnership and<br />

as a result of a number of schools changing <strong>to</strong> academy status.<br />

Find out more<br />

You can find out more about <strong>Bournemouth</strong> <strong>Borough</strong> <strong>Council</strong>’s finance at:<br />

www.bournemouth.gov.uk/accounts, including:<br />

• Budget Books – a look at the budget and spending plans for the coming year<br />

• Statement of Accounts – a look at where money was spent in the last financial year<br />

• Payments <strong>to</strong> suppliers – monthly lists of expenditure over £500.

Dorset Police Authority<br />

Statement by<br />

Michael Taylor CBE<br />

DL, Chairman of<br />

the Dorset Police<br />

Authority<br />

Each year the Police Authority works with<br />

the Chief Constable <strong>to</strong> determine how<br />

much money will be spent on policing in<br />

Dorset for the coming year. Our work<br />

takes in<strong>to</strong> account views expressed by<br />

members of the public through local<br />

consultations and surveys, the national<br />

and local objectives for policing, and the<br />

implications for the <strong>Council</strong> <strong>Tax</strong> payer.<br />

Police funding comes from a combination<br />

of national and local taxation. This takes<br />

the form of grants from central<br />

government with the balance met locally<br />

through the policing element of <strong>Council</strong><br />

<strong>Tax</strong> set by the Police Authority.<br />

As a consequence of continuing efforts <strong>to</strong><br />

tackle the national deficit, the Police<br />

Authority has had a significant reduction in<br />

its central government grant and over the<br />

four years <strong>to</strong> 2014/15 this will result in the<br />

need <strong>to</strong> reduce costs by £18 million from<br />

an annual budget of £120 million. The<br />

Authority has already reduced expenditure<br />

by more than £6 million <strong>to</strong>wards this<br />

target, with further cuts of £5 million<br />

planned for <strong>2012</strong>/<strong>13</strong>.<br />

Last year, the Police Authority froze the<br />

policing precept which secured additional<br />

national funding for at least three years.<br />

This year the Government has offered an<br />

additional grant <strong>to</strong> police authorities that<br />

freeze their <strong>Council</strong> <strong>Tax</strong> for a second year,<br />

but have offered the grant for one year<br />

only. In making its decision, the Authority<br />

has sought <strong>to</strong> balance the desire <strong>to</strong> keep<br />

the <strong>Council</strong> <strong>Tax</strong> low while simultaneously<br />

ensuring Dorset Police is adequately<br />

resourced <strong>to</strong> meet the needs of the public,<br />

in the context of reduced national<br />

funding.<br />

After very careful consideration, the<br />

Authority has decided <strong>to</strong> continue <strong>to</strong><br />

freeze the policing precept which will<br />

remain at £180 per year for a Band D<br />

property for a third year in a row which<br />

we anticipate <strong>Council</strong> <strong>Tax</strong> payers will<br />

welcome.<br />

We will place a continuing focus on value<br />

for money and maximising efficiency and<br />

productivity <strong>to</strong> protect operational<br />

services wherever possible and this focus<br />

is central <strong>to</strong> our Strategic and Annual<br />

Policing Plan, our Medium Term Financial<br />

Plan and our <strong>2012</strong>/<strong>13</strong> budget. This is on<br />

<strong>to</strong>p of the significant efficiency savings<br />

that have already been made in recent<br />

years.<br />

In the context of the sharp fall in national<br />

funding for policing, the budget we have<br />

agreed for <strong>2012</strong>/<strong>13</strong> will require us <strong>to</strong><br />

continue <strong>to</strong> make hard choices and <strong>to</strong>ugh<br />

decisions about the future size and shape<br />

of Dorset Police in terms of its staffing,<br />

equipment and buildings. However, the<br />

budget will maintain operational<br />

necessities, as well as supporting the<br />

continuing deployment of Safer<br />

Neighbourhood Teams across the County<br />

which will remain focused on community<br />

priorities.<br />

Notwithstanding the immensely<br />

challenging national financial context, the<br />

Authority’s key focus is for Dorset Police <strong>to</strong><br />

continue <strong>to</strong> provide high quality policing<br />

services and ensure that Dorset remains a<br />

safe place in which <strong>to</strong> live, learn, work<br />

and visit.<br />

<strong>13</strong>

14<br />

Dorset Police Authority<br />

A Police and Crime Commissioner for Dorset, <strong>to</strong> be elected in November <strong>2012</strong>, will take<br />

over responsibility for setting the annual force budget and the policing precept.<br />

Information about Police and Crime Commissioners is available on the Home Office<br />

website: www.homeoffice.gov.uk/police/police-crime-commissioners<br />

Where the money is spent<br />

Where the money is spent 2011/12 £’000 <strong>2012</strong>/<strong>13</strong> £’000<br />

Police Authority 710 857<br />

Employees 110,167 106,002<br />

Premises 4,905 4,580<br />

Transport 3,759 4,053<br />

Supplies and services 6,926 7,210<br />

Specialist police support services 9,890 10,889<br />

Capital financing costs 674 675<br />

Gross expenditure <strong>13</strong>7,031 <strong>13</strong>4,266<br />

Income generated by Dorset Police (3,803) (3,602)<br />

Specific government grants (12,415) (12,524)<br />

Transfer from reserves (352) (529)<br />

Budget requirement 120,461 117,611<br />

Police Grant 45,866 42,408<br />

Government Revenue Support Grant 4,965 406<br />

Redistributed non-domestic rates 16,063 20,927<br />

Non-<strong>Council</strong> <strong>Tax</strong> funding 66,894 63,741<br />

Balance <strong>to</strong> be met by <strong>Council</strong> <strong>Tax</strong> payers 53,567 53,870<br />

Total funding 120,461 117,611

Dorset Police Authority<br />

How the proportion of costs paid for<br />

by <strong>Council</strong> <strong>Tax</strong> has changed<br />

£’000<br />

Met by <strong>Council</strong> <strong>Tax</strong> payers in 2011/<strong>2012</strong> 53,567<br />

Savings, reductions and re-investment (net) (5,887)<br />

Pay and price inflation 2,784<br />

Increase in specific grant income (226)<br />

Revenue effect of new buildings and other prior year capital schemes 239<br />

Contributions <strong>to</strong> regional collaboration <strong>to</strong> increase operational effectiveness 240<br />

Reduction in non <strong>Council</strong> <strong>Tax</strong> funding 3,153<br />

To be met by <strong>Council</strong> <strong>Tax</strong> payers in <strong>2012</strong>/20<strong>13</strong> 53,870<br />

Staffing figures<br />

2011/12<br />

<strong>2012</strong>/<strong>13</strong><br />

Police Officers 1,344 1,294<br />

Police Community Support Officers 162 156<br />

Police Staff 914 853<br />

Special Constables / Volunteers 476 412<br />

<strong>Council</strong> <strong>Tax</strong> Bands To contact the Chief<br />

Executive of the Police<br />

Authority:<br />

Property Type 2011/12 £ <strong>2012</strong>/<strong>13</strong> £<br />

Band A 120.00 120.00<br />

Band B 140.00 140.00<br />

Band C 160.00 160.00<br />

Band D 180.00 180.00<br />

Band E 220.00 220.00<br />

Band F 260.00 260.00<br />

Band G 300.00 300.00<br />

Band H 360.00 360.00<br />

Tel: 01202 223966<br />

E-mail: council.tax@dorset.pnn.police.uk<br />

or write <strong>to</strong>: Dorset Police Authority,<br />

Force HQ, Dorchester DT2 8DZ<br />

www.dpa.police.uk<br />

For general enquiries, responding <strong>to</strong><br />

witness information appeals or <strong>to</strong> report a<br />

non-urgent crime, contact Dorset Police<br />

on:<br />

101<br />

or visit: www.dorset.police.uk<br />

For the deaf, hard of hearing or speech<br />

impaired use Typetalk 18000<br />

Only dial 999 if life is in danger<br />

or a crime is in progress.<br />

15

16<br />

Dorset Fire Authority<br />

Dorset Fire<br />

Authority statement<br />

from Chairman<br />

<strong>Council</strong>lor<br />

Rebecca Knox<br />

Dorset Fire Authority has approved a net<br />

budget of £30.149 million for <strong>2012</strong>/<strong>13</strong>,<br />

with the average Band D <strong>Council</strong> <strong>Tax</strong><br />

remaining at £60.39 for the third year<br />

running. The Authority decided <strong>to</strong> accept a<br />

one off <strong>Council</strong> <strong>Tax</strong> Freeze Grant from the<br />

Government, equivalent <strong>to</strong> a 3% increase<br />

in <strong>Council</strong> <strong>Tax</strong>, rather than increase<br />

<strong>Council</strong> <strong>Tax</strong> at this stage. This means that<br />

our level of <strong>Council</strong> <strong>Tax</strong> is the lowest of all<br />

our neighbours and remains one of the<br />

lowest of all Combined Fire Authorities<br />

(that is fire authorities outside of<br />

metropolitan areas or those that remain<br />

part of a County <strong>Council</strong>) in England.<br />

The Government has made it clear that<br />

this <strong>Council</strong> <strong>Tax</strong> Freeze Grant is a one off<br />

payment and will not continue after<br />

<strong>2012</strong>/<strong>13</strong>. As a minimum therefore, from<br />

next year, the Authority will have <strong>to</strong> find<br />

savings of £535,000. Any ending of the<br />

grant given <strong>to</strong> freeze <strong>Council</strong> <strong>Tax</strong> in<br />

2011/12 will increase the level of savings<br />

required <strong>to</strong> around £1 million and will<br />

mean that some difficult decisions will<br />

have <strong>to</strong> be made in future years in order<br />

<strong>to</strong> balance the budget. As a result of the<br />

pressures on budgets that all public sec<strong>to</strong>r<br />

bodies have had <strong>to</strong> face, we had already<br />

found annual savings of over £1 million by<br />

significantly reducing costs in back office<br />

(support) functions and in reductions in<br />

our workforce and senior management. We<br />

are now also working with a range of<br />

partners, including neighbouring fire and<br />

rescue services, <strong>to</strong> share services and<br />

reduce costs further. The options open <strong>to</strong><br />

us <strong>to</strong> achieve a further £1 million of<br />

savings without having a direct impact on<br />

frontline service delivery are limited. We<br />

are also aware that there are new and<br />

emerging pressures on us, such as<br />

firefighter training and safety, which will<br />

add further pressure on our budget.<br />

We respond <strong>to</strong> over 8,000 incidents per<br />

year, including road traffic collisions, coresponder<br />

callouts, specialist rescues and<br />

of course fire-related incidents. We have<br />

made significant investment in prevention<br />

activity and now deliver more than 10,000<br />

home safety visits each year. Currently, of<br />

the 40 frontline fire engines we have, 32<br />

(or 33 at night) are crewed by on-call<br />

firefighters, i.e. they are only paid when<br />

they respond <strong>to</strong> an incident. There is one<br />

fire station in Weymouth, which is crewed<br />

with a mixture of wholetime and on-call<br />

firefighters, and in the Poole and<br />

<strong>Bournemouth</strong> area, we have three<br />

wholetime stations and three crewed with<br />

a mixture of wholetime and on-call<br />

firefighters. This means that we have very<br />

few options <strong>to</strong> change the way that these<br />

stations are crewed, and thereby reduce<br />

our costs, without it having a significant<br />

impact on public safety, including slower<br />

response times and the potential loss of<br />

specialist rescue services.<br />

Over the coming months, Elected Members<br />

will be working with officers <strong>to</strong> look at the<br />

options that are available <strong>to</strong> us <strong>to</strong> make<br />

changes <strong>to</strong> service delivery. We anticipate<br />

that the options chosen will be subject <strong>to</strong><br />

public consultation between September<br />

and December <strong>2012</strong>, allowing us <strong>to</strong> begin<br />

implementing any changes from March<br />

20<strong>13</strong> onwards.<br />

Despite the financial issues that we face,<br />

we remain fully committed <strong>to</strong> providing<br />

the residents of Dorset with an exemplary<br />

service, helping <strong>to</strong> make Dorset a safer<br />

place <strong>to</strong> work and live.

Where the money is spent<br />

Dorset Fire Authority<br />

2011/12<br />

£’000<br />

<strong>2012</strong>/<strong>13</strong><br />

£’000<br />

Fire Authority 231 2<strong>13</strong><br />

Employees 20,889 21,512<br />

Ill health pensions 926 957<br />

Premises 1,455 1,540<br />

Transport 1,040 1,089<br />

Equipment and supplies 1,840 1,893<br />

Fees and services 2,477 2,533<br />

Capital financing costs 1,784 1,818<br />

Gross revenue expenditure 30,642 31,555<br />

Income (2,060) (2,786)<br />

Reserves 721 1,380<br />

Net budget requirement 29,303 30,149<br />

Where the money comes from<br />

2011/12<br />

£’000<br />

<strong>2012</strong>/<strong>13</strong><br />

£’000<br />

Government Formula Grant and Business Rates 10,884 11,539<br />

Collection Fund surplus 116 123<br />

Precept (<strong>Council</strong> <strong>Tax</strong> payers) 17,855 17,949<br />

<strong>Council</strong> <strong>Tax</strong> Freeze Grant 448 538<br />

Total funding 29,303 30,149<br />

Why our budget has changed<br />

Budget requirement in<br />

2011/<strong>2012</strong><br />

£’000<br />

29,303<br />

One off items in 2011/12<br />

budget<br />

(928)<br />

Pay and price inflation 414<br />

Contribution <strong>to</strong> reserves 1,343<br />

Other adjustments 18<br />

Savings and reductions (95)<br />

Reduction in investment income 30<br />

Increase in capital financing costs 34<br />

Increase in ill health pensions costs 30<br />

Budget requirement in<br />

<strong>2012</strong>/20<strong>13</strong><br />

30,149<br />

17

18<br />

Dorset Fire Authority<br />

<strong>Council</strong> <strong>Tax</strong> Bands Staff numbers<br />

Band A 40.26<br />

Band B 46.97<br />

Band C 53.68<br />

Band D 60.39<br />

Band E 73.81<br />

Band F 87.23<br />

Band G 100.65<br />

Band H 120.78<br />

Spending on major capital projects<br />

The <strong>to</strong>tal number of staff employed by<br />

Dorset Fire and Rescue Service as at 31<br />

December 2011 was 819 (764 full time<br />

equivalents), compared <strong>to</strong> equivalent<br />

figures as at 31 December 2010 of 829 (772<br />

full time equivalents).<br />

Our performance<br />

Our performance during 2011/12 is<br />

available on our website from 30 June at<br />

www.dorsetfire.gov.uk or contact us on<br />

0<strong>13</strong>05 252615 for a copy.<br />

For more information:<br />

Contact Ian Cotter on 0<strong>13</strong>05 252697 or<br />

email: finance@dorsetfire.gov.uk<br />

The Authority's capital programme for <strong>2012</strong>/<strong>13</strong> <strong>to</strong>tals £1.15 million and will be entirely<br />

funded from the Fire Capital Grant. Expenditure includes £147,000 on improvements <strong>to</strong><br />

fire stations and other buildings, £444,000 for the vehicle replacement programme and<br />

£264,000 for new or replacement equipment and information systems. We are also<br />

awaiting an announcement from the Department of Communities and Local Government<br />

(DCLG) on our bid for funding in connection with the Networking Fire Control Services<br />

Partnership project. This is a joint project with Devon & Somerset, Hampshire and<br />

Wiltshire Fire Services <strong>to</strong> procure a common Fire Control system.<br />

If you are an older person or<br />

someone who is vulnerable why not<br />

have a free home safety check?<br />

Call us on 0<strong>13</strong>05 252600 <strong>to</strong> find<br />

out more.<br />

Dorset Fire & Rescue Service<br />

For general enquiries, contact us on:<br />

0<strong>13</strong>05 252600

Your <strong>Council</strong> <strong>Tax</strong> bill explained<br />

Your <strong>Council</strong> <strong>Tax</strong> bill shows the <strong>to</strong>tal charge<br />

for <strong>your</strong> property, including the charges made<br />

by Dorset Police Authority, Dorset Fire<br />

Authority and <strong>Bournemouth</strong> <strong>Borough</strong> <strong>Council</strong>.<br />

<strong>Council</strong> <strong>Tax</strong> valuation bands<br />

Most homes (whether rented or owned, lived<br />

in or not) will be subject <strong>to</strong> <strong>Council</strong> <strong>Tax</strong>.<br />

There is one bill per dwelling. Each property<br />

has been placed in<strong>to</strong> one of eight bands by<br />

the Listing Officer of the Valuation Office<br />

Agency according <strong>to</strong> its open market capital<br />

value at 1 April 1991.<br />

The valuation band for <strong>your</strong> property is<br />

shown on <strong>your</strong> <strong>Council</strong> <strong>Tax</strong> bill. You may look<br />

at any property’s valuation band by visiting<br />

www.voa.gov.uk<br />

Valuation Band Range of Values<br />

H More than £320,000<br />

G £160,001-£320,000<br />

F £120,001 –£160,000<br />

E £88,001 –£120,000<br />

D £68,001- £88,000<br />

C £52,001 – £68,000<br />

B £40,001 – £52,000<br />

A Up <strong>to</strong> and including<br />

£40,000<br />

Appeals <strong>to</strong> the Valuation<br />

Office Agency<br />

The grounds for appeal against <strong>your</strong><br />

property’s valuation band are:<br />

• You become the <strong>Council</strong> <strong>Tax</strong> payer in<br />

respect of a property for the first time –<br />

<strong>your</strong> appeal must be made within six<br />

months of taking possession.<br />

• You believe there has been a material<br />

reduction in the dwelling’s value – for<br />

example part of it has been demolished.<br />

• The Listing Officer has altered the band –<br />

this may occur following a sale if the<br />

previous owner had added an extension.<br />

• You start or s<strong>to</strong>p using <strong>your</strong> property <strong>to</strong><br />

carry out a business or the balance<br />

between domestic and business use<br />

changes.<br />

Any appeal against the banding should be<br />

made in writing <strong>to</strong>: Listing Officer,<br />

<strong>Council</strong> <strong>Tax</strong> West, Valuation Office Agency,<br />

Overline House, Blechynden Terrace,<br />

Southamp<strong>to</strong>n, SO15 1GW.<br />

Telephone enquiries: 03000 501501<br />

Email: ctwest@voa.gsi.gov.uk<br />

Website: www.voa.gov.uk<br />

Making an appeal does not allow you <strong>to</strong><br />

withhold payment or part payment of <strong>Council</strong><br />

<strong>Tax</strong>. If <strong>your</strong> appeal is successful you will be<br />

entitled <strong>to</strong> a refund of overpayment.<br />

Discounts<br />

A full <strong>Council</strong> <strong>Tax</strong> bill assumes that there are<br />

two or more adults living in a property. If you<br />

are the only adult living in <strong>your</strong> property you<br />

will be entitled <strong>to</strong> a 25% discount.<br />

The people listed below may be disregarded<br />

when counting the number of adult residents.<br />

The categories are shortened versions of the<br />

actual regulations and are given for guidance<br />

only:<br />

• prisoners<br />

• certain full-time students and student<br />

nurses<br />

• certain students’ non-British partner or<br />

dependant<br />

• apprentices<br />

• youth training trainees<br />

• foreign diplomats<br />

• school leavers<br />

• residents aged 18 or 19 for whom Child<br />

Benefit is payable<br />

19

20<br />

Your <strong>Council</strong> <strong>Tax</strong> bill explained<br />

• patients living permanently in hospital<br />

• patients living permanently in a care home<br />

• certain care workers or carers<br />

• members of religious communities<br />

• hostel residents<br />

• members of visiting forces<br />

• severely mentally impaired.<br />

If all of the adults living in <strong>your</strong> property are<br />

disregarded, a discount of 50% will apply. If<br />

all but one of the adults living in <strong>your</strong><br />

property is disregarded, a discount of 25%<br />

will apply.<br />

Second homes<br />

Second homes are defined as furnished<br />

properties which are not anyone’s sole or<br />

main residence. There are two categories of<br />

second homes:<br />

Class A – where occupation is restricted by a<br />

planning condition preventing occupancy for<br />

a continuous period of at least 28 days in the<br />

relevant year.<br />

Class B – where occupation is not restricted<br />

by a planning condition.<br />

The <strong>Council</strong> has decided <strong>to</strong> award a discount<br />

of 10% on Class A and Class B empty<br />

properties.<br />

Certain types of empty property (listed<br />

below) are excluded from Class A and Class B<br />

and a 50% discount will apply.<br />

These include:<br />

• pitch occupied by a caravan<br />

• mooring occupied by a boat<br />

• second home where the liable person is<br />

living elsewhere in accommodation<br />

provided by reason of his employment<br />

• second home provided <strong>to</strong> the liable<br />

person by reason of his employment<br />

• second homes owned by service personnel<br />

who live in accommodation provided by<br />

the Ministry of Defence.<br />

The <strong>Council</strong> has also decided that a 50%<br />

discount will apply <strong>to</strong> beach chalets at<br />

Mudeford Sandspit and Hengistbury Head.<br />

Please contact the <strong>Council</strong> if you think you<br />

may be entitled <strong>to</strong> a discount which isn’t<br />

currently shown on <strong>your</strong> bill. If <strong>your</strong> bill<br />

shows that a discount has been awarded you<br />

must tell the <strong>Council</strong> within 21 days of any<br />

change of circumstances that may affect <strong>your</strong><br />

entitlement. If you don’t you risk a penalty<br />

as well as a back-dated bill.<br />

Long-term empty homes<br />

Long-term empty homes are defined as<br />

properties that are unoccupied and<br />

substantially unfurnished. In most cases an<br />

exemption will have been applied before a<br />

dwelling is charged as a long-term empty<br />

home. The <strong>Council</strong> charges full <strong>Council</strong> <strong>Tax</strong><br />

on long-term empty properties.<br />

Reductions for people with<br />

disabilities<br />

If someone who lives in <strong>your</strong> property needs<br />

an extra room (which could include a<br />

bathroom or kitchen) because of a<br />

permanent disability, or requires space for<br />

the use of a wheelchair indoors, you may be<br />

entitled <strong>to</strong> a reduced <strong>Council</strong> <strong>Tax</strong> bill.<br />

A reduced bill will be calculated as if <strong>your</strong><br />

property had been placed in a band<br />

immediately below the one shown in the<br />

valuation list. People living in a Band A<br />

property may also be entitled <strong>to</strong> a reduced<br />

<strong>Council</strong> <strong>Tax</strong> bill, which will be calculated as a<br />

reduction of one ninth of the Band D<br />

<strong>Council</strong> <strong>Tax</strong>.<br />

If a reduction for disability has been<br />

awarded, it will be shown on <strong>your</strong> bill. If you<br />

haven’t been awarded a reduction but think<br />

you may be entitled <strong>to</strong> one, please contact<br />

the <strong>Council</strong>.<br />

If <strong>your</strong> property has any special features<br />

added for a disabled resident which reduce<br />

the value of the property, not taken in<strong>to</strong><br />

account in the valuation band, you should<br />

contact the Listing Officer (see notes<br />

regarding Appeals <strong>to</strong> the Valuation Office<br />

Agency on page 19).

<strong>Council</strong> <strong>Tax</strong> Benefit<br />

If you are liable <strong>to</strong> pay <strong>Council</strong> <strong>Tax</strong> you may<br />

apply for <strong>Council</strong> <strong>Tax</strong> Benefit <strong>to</strong> reduce <strong>your</strong><br />

bill. The amount of Benefit awarded will<br />

depend on <strong>your</strong> household and financial<br />

circumstances. If you do not qualify for<br />

<strong>Council</strong> <strong>Tax</strong> Benefit, you may still qualify for<br />

a second adult rebate if other adults living in<br />

<strong>your</strong> property are on low incomes.<br />

<strong>Council</strong> <strong>Tax</strong> Benefit is not awarded <strong>to</strong> you<br />

au<strong>to</strong>matically – you must claim it.<br />

Contact the Benefits section immediately <strong>to</strong><br />

apply if you think you may qualify.<br />

You must not withhold payment or part<br />

payment of <strong>Council</strong> <strong>Tax</strong> while awaiting the<br />

outcome of <strong>your</strong> application.<br />

Any <strong>Council</strong> <strong>Tax</strong> Benefit awarded is shown on<br />

<strong>your</strong> bill. You must tell the <strong>Council</strong><br />

immediately of any change in <strong>your</strong><br />

circumstances that may affect <strong>your</strong><br />

entitlement.<br />

Exempt properties<br />

Some properties are exempt from <strong>Council</strong><br />

<strong>Tax</strong>. The classes of exempt property are:<br />

A unoccupied/unfurnished properties<br />

requiring major repair works <strong>to</strong> render<br />

them habitable or undergoing structural<br />

alteration. (Exempt for up <strong>to</strong> 12 months or<br />

six months following substantial<br />

completion of the works, if sooner)<br />

B unoccupied properties owned by charities<br />

(exempt for up <strong>to</strong> six months)<br />

C properties left unoccupied and<br />

unfurnished (exempt for up <strong>to</strong> six months)<br />

D properties left unoccupied by prisoners<br />

E properties left unoccupied by patients<br />

staying long term in hospitals and care<br />

homes<br />

F properties where probate or letters of<br />

administration are waiting <strong>to</strong> be granted<br />

(and for up <strong>to</strong> six months after)<br />

G properties where occupation is prohibited<br />

by law<br />

H unoccupied clergy properties<br />

I properties left unoccupied by people<br />

moving permanently <strong>to</strong> receive personal<br />

care from another<br />

J properties left unoccupied by people<br />

moving permanently <strong>to</strong> provide personal<br />

care <strong>to</strong> another<br />

K properties left unoccupied by students<br />

L repossessed properties<br />

M halls of residence<br />

N properties occupied solely by students or<br />

school leavers<br />

O armed forces accommodation, i.e.<br />

barracks<br />

P properties occupied by members of visiting<br />

forces<br />

Q properties left unoccupied by bankrupts<br />

R unoccupied caravan pitches and houseboat<br />

moorings<br />

S properties occupied only by person(s)<br />

under 18<br />

T unoccupied annexes which form part of a<br />

single property and may not be let<br />

separately without a breach of planning<br />

consent<br />

U properties occupied only by person(s) who<br />

are severely mentally impaired who would<br />

otherwise be liable<br />

V properties where at least one person who<br />

would otherwise be liable is a diplomat<br />

W annexes and similar accommodation<br />

occupied by a dependent relative.<br />

These are shortened versions of the actual<br />

regulations and are given for guidance only.<br />

The actual definitions are contained in the<br />

<strong>Council</strong> <strong>Tax</strong> (Exempt Dwellings) Order 1992,<br />

as amended.<br />

21

22<br />

Your <strong>Council</strong> <strong>Tax</strong> bill explained<br />

Appeals <strong>to</strong> the <strong>Council</strong><br />

You may appeal <strong>to</strong> the <strong>Council</strong> if you consider<br />

that:<br />

• you are not liable <strong>to</strong> pay the <strong>Council</strong> <strong>Tax</strong><br />

• <strong>your</strong> property should be exempt<br />

• the amount shown on <strong>your</strong> bill has been<br />

calculated incorrectly – for example, <strong>your</strong><br />

entitlement <strong>to</strong> a discount is not shown.<br />

Any appeal should initially be made in writing<br />

<strong>to</strong> the <strong>Council</strong>. Should you remain dissatisfied<br />

you will have a further right of appeal <strong>to</strong> the<br />

Valuation Tribunal within two months of<br />

being notified of our decision (or two months<br />

from <strong>your</strong> initial appeal if no decision is<br />

made within that time).<br />

Making an appeal does not allow you <strong>to</strong><br />

withhold payment or part payment of the<br />

<strong>Council</strong> <strong>Tax</strong>. If <strong>your</strong> appeal is successful you<br />

will be entitled <strong>to</strong> a refund of any<br />

overpayment.<br />

Housing Benefit<br />

Housing Benefit is <strong>to</strong> help those on a low<br />

income <strong>to</strong> pay their rent <strong>to</strong> their landlord.<br />

The amount of benefit awarded will depend<br />

on <strong>your</strong> household and financial<br />

circumstances.<br />

Housing Benefit is not awarded <strong>to</strong> you<br />

au<strong>to</strong>matically – you must claim it. Contact<br />

the Benefits section immediately <strong>to</strong> apply if<br />

you think you may qualify.<br />

If you currently receive Housing Benefit you<br />

must tell the <strong>Council</strong> immediately of any<br />

change in circumstances which may affect<br />

<strong>your</strong> entitlement.<br />

Security against fraud and error<br />

Benefit money is public money and it’s our<br />

responsibility <strong>to</strong> look after it. We want <strong>to</strong><br />

make sure that all those who are entitled <strong>to</strong><br />

benefit receive it and we want <strong>to</strong> ensure it is<br />

not paid out as a result of fraud or error.<br />

Help us <strong>to</strong> look after <strong>your</strong> money. If you know<br />

someone who is abusing the system tell us so<br />

we can do something about it. Call our<br />

confidential fraud line on 01202 451536.<br />

Data Protection<br />

Your personal information will be<br />

held and used in accordance with<br />

the requirements of the Data<br />

Prot Protection Act 1998.<br />

We will use the information you have<br />

provided in connection with the<br />

administration of <strong>Council</strong> <strong>Tax</strong>. We may<br />

lawfully disclose information <strong>to</strong> other public<br />

sec<strong>to</strong>r agencies <strong>to</strong>:<br />

• prevent or detect benefits fraud and any<br />

other crime<br />

• <strong>to</strong> support national fraud initiatives – we<br />

are required by law <strong>to</strong> participate in<br />

National Fraud Initiative (NFI) data<br />

matching exercises. <strong>Council</strong> <strong>Tax</strong><br />

information may be provided <strong>to</strong> the Audit<br />

Commission for NFI purposes and will be<br />

used for cross-system and cross authority<br />

comparison for the prevention and<br />

detection of fraud<br />

• <strong>to</strong> protect public funds.<br />

We also use basic <strong>Council</strong> <strong>Tax</strong> information<br />

about you, e.g. name and address, in other<br />

areas of service provision if this:<br />

• helps you <strong>to</strong> access our services more<br />

easily<br />

• promotes the more efficient and costeffective<br />

delivery of services<br />

• helps us <strong>to</strong> recover monies that you<br />

owe us.<br />

We will not use <strong>your</strong> personal information in<br />

a way that may cause you unwarranted<br />

detriment. You are able <strong>to</strong> see a copy of the<br />

information held about you. For further<br />

information about this please ask for a copy<br />

of the <strong>Council</strong>’s data protection leaflet or<br />

visit the <strong>Council</strong>’s website at:<br />

www.bournemouth.gov.uk/dataprotection

$<br />

Alternative Format Request<br />

A summary of this leaflet<br />

can also be provided in<br />

large print and in audio<br />

format. Please tick the box<br />

and fill in <strong>your</strong> details<br />

below if you require one:<br />

� Large print<br />

� Audio format<br />

Detach page and send in an envelope <strong>to</strong>:<br />

Corporate Communications<br />

<strong>Bournemouth</strong> <strong>Borough</strong> <strong>Council</strong>,<br />

FREEPOST BH536,<br />

Town Hall, <strong>Bournemouth</strong>, BH2 6BR<br />

� Arabic<br />

� Bengali<br />

� Can<strong>to</strong>nese<br />

� Korean<br />

� Polish<br />

� Portuguese<br />

Keep up-<strong>to</strong>-date with<br />

<strong>your</strong> local magazine<br />

BH Life magazine is delivered<br />

<strong>to</strong> homes in <strong>Bournemouth</strong><br />

four times a year. It contains news about <strong>your</strong><br />

services, the <strong>to</strong>wn and information about<br />

local events.<br />

If you do not receive a copy <strong>to</strong> <strong>your</strong> home we<br />

want <strong>to</strong> know. Please tick the box and fill in<br />

<strong>your</strong> details below or email us at:<br />

bhlife@bournemouth.gov.uk<br />

Why not view the magazine online? Visit:<br />

www.bournemouth.gov.uk/bhlife<br />

�<br />

Name<br />

Address<br />

I do not regularly receive<br />

BH Life magazine<br />

Postcode<br />

This information is about <strong>Council</strong> <strong>Tax</strong> and spending on local services. If you would like a<br />

summary in <strong>your</strong> language please tick the box, fill in <strong>your</strong> details and return this page <strong>to</strong> the<br />

freepost address provided.<br />

23

Easy ways <strong>to</strong> pay <strong>your</strong> bills<br />

There are a number of ways you can easily pay <strong>your</strong><br />

<strong>Council</strong> <strong>Tax</strong> and Business Rate bill.<br />

Over 50,000 people already choose the quickest,<br />

easiest and cheapest way <strong>to</strong> pay. You can now pay on<br />

the 1st, 8th*, 15th or 22nd* of each month and by up<br />

<strong>to</strong> 12 instalments*.<br />

(*only available if you pay by Direct Debit)<br />

Phone now on 01202 451597 and we can set this up for you straight<br />

away or visit our website where you can find the form <strong>to</strong> print, fill in<br />

%Other<br />

and return <strong>to</strong> us. Alternatively, use the form on the back of <strong>your</strong> bill.<br />

ways that you can pay include:<br />

• Online at: www.bournemouth.gov.uk<br />

• Your internet or telebanking service<br />

• Phone our au<strong>to</strong>mated payment system on 01202 454748, which is available 24/7<br />

• In person at a bank or the Post Office<br />

• By post <strong>to</strong> <strong>Bournemouth</strong> <strong>Borough</strong> <strong>Council</strong>, Town Hall, <strong>Bournemouth</strong>, BH2 6EB<br />

Choose the best option for you and please remember:<br />

• Always quote <strong>your</strong> reference number from the front of <strong>your</strong> bill<br />

• Post Offices and some banks may charge a handling fee<br />

• You may have <strong>to</strong> pay a fee if you pay by credit card.<br />

Do you need help with <strong>your</strong><br />

<strong>Council</strong> <strong>Tax</strong> and rent?<br />

Don’t forget, if <strong>your</strong> income is low or you<br />

receive certain benefits you might be able<br />

<strong>to</strong> get help with <strong>your</strong> <strong>Council</strong> <strong>Tax</strong>, rent or<br />

both. If you think you might qualify for<br />

help, please make an application for<br />

benefit as soon as you can.<br />

Benefit application forms are<br />

available from:<br />

• Web: www.bournemouth.gov.uk/benefits<br />

• Email: benefits@bournemouth.gov.uk<br />

• Telephone: 01202 451592<br />

• Minicom: 01202 454728<br />

Turn <strong>to</strong> page 21 for more details.<br />

Other benefits: You can get application forms and more information about<br />

other benefits from: www.direct.gov.uk<br />

Designed and produced by IMS Ltd www.imslimited.net