Brazil's Tax and Trade Policies under the Rousseff - Brazil-US ...

Brazil's Tax and Trade Policies under the Rousseff - Brazil-US ...

Brazil's Tax and Trade Policies under the Rousseff - Brazil-US ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

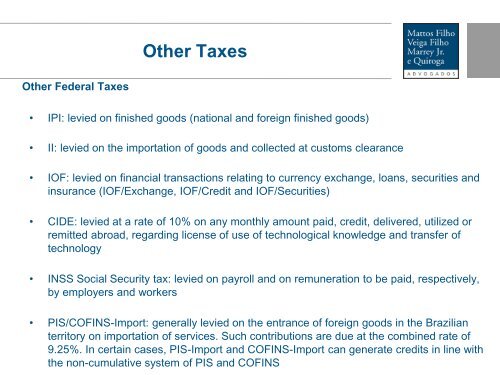

O<strong>the</strong>r <strong>Tax</strong>esO<strong>the</strong>r Federal <strong>Tax</strong>es• IPI: levied on finished goods (national <strong>and</strong> foreign finished goods)• II: levied on <strong>the</strong> importation of goods <strong>and</strong> collected at customs clearance• IOF: levied on financial transactions relating to currency exchange, loans, securities <strong>and</strong>insurance (IOF/Exchange, IOF/Credit <strong>and</strong> IOF/Securities)• CIDE: levied at a rate of 10% on any monthly amount paid, credit, delivered, utilized orremitted abroad, regarding license of use of technological knowledge <strong>and</strong> transfer oftechnology• INSS Social Security tax: levied on payroll <strong>and</strong> on remuneration to be paid, respectively,by employers <strong>and</strong> workers• PIS/COFINS-Import: generally levied on <strong>the</strong> entrance of foreign goods in <strong>the</strong> <strong>Brazil</strong>ianterritory on importation of services. Such contributions are due at <strong>the</strong> combined rate of9.25%. In certain cases, PIS-Import <strong>and</strong> COFINS-Import can generate credits in line with<strong>the</strong> non-cumulative system of PIS <strong>and</strong> COFINS