Dementia Rating Scale - 2 DRS-2 - ACER

Dementia Rating Scale - 2 DRS-2 - ACER Dementia Rating Scale - 2 DRS-2 - ACER

- Page 2 and 3: Client: Sample A. Client Test Date:

- Page 4: The Right QuestionsTo illustrate th

- Page 8: Client: Sample A. Client Test Date:

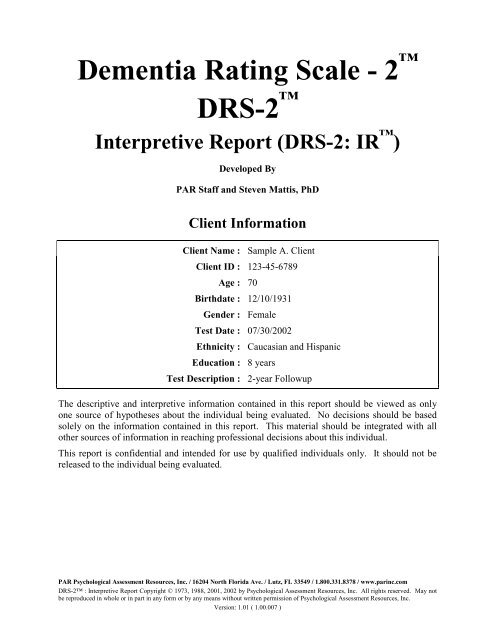

Client: Sample A. Client Test Date: 07/30/2002Client ID: 123-45-6789 Page 2 of 8<strong>Scale</strong> / Subscale<strong>DRS</strong>-2 Summary TableRaw ScoreAge-CorrectedMOANS<strong>Scale</strong>d Score(AMSS)Age- andEducation-CorrectedMOANS<strong>Scale</strong>d Score(AEMSS)%ile RangeAttention 30 4 2Initiation/Perseveration 32 6 6 - 10Construction 5 7 11 - 18Conceptualization 29 5 3 - 5Memory 21 6 6 - 10<strong>DRS</strong>-2 Total Score 117 3 3Note. MOANS <strong>Scale</strong>d Scores and Percentile Ranges are based on persons 69 to 71 years of age.For additional information, refer to Appendixes A and B in the <strong>DRS</strong>-2 Professional Manual.<strong>DRS</strong>-2 Longitudinal Assessment Summary Table<strong>Scale</strong> / SubscaleRaw ScoreAge-Corrected MOANS<strong>Scale</strong>d Score07/30/2002 07/30/2000 07/30/2002 07/30/2000Attention 30 36 4 11Initiation/Perseveration 32 36 6 10Construction 5 6 7 10Conceptualization 29 34 5 8Memory 21 24 6 10<strong>DRS</strong>-2 Total Score 117 136 3 9Note. MOANS <strong>Scale</strong>d Scores and Percentile Ranges for 07/30/2002 are based on persons 69 to 71 years of age. Other MOANS <strong>Scale</strong>d Scoresare based on the ranges corresponding to the age of the client at the time of testing.For additional information, refer to Appendix A in the <strong>DRS</strong>-2 Professional Manual.

Client: Sample A. Client Test Date: 07/30/2002Client ID: 123-45-6789 Page 3 of 8Profile of <strong>DRS</strong>-2 Subtest and Total Age-Corrected MOANS <strong>Scale</strong>d Scores(AMSS)<strong>Scale</strong>dScore<strong>Scale</strong>dScore1818171716161515141413131212111110109988776655443322TOTAL ATT I/P CONST CONCEPT MEMAMSS 3 4 6 7 5 6%ile 1 2 6 - 10 11 - 18 3 - 5 6 - 10Raw Score 117 30 32 5 29 2107/30/2002 07/30/2000

The Right QuestionsTo illustrate the point, it is useful to recap first ona few basics. Side B D&O insurance protectionis purchased as balance sheet protection in theevent that the company must pay for the defence,and expense of litigation and settlement onbehalf of its directors and officers. It is generallythe duty of the corporation to indemnify inaccordance with its bylaws. Depending on howcountries, where reimbursement protection forlocal indemnity payments, regulate unlicensedor unauthorised insurance, jurisdictional nuancescan affect the efficacy of insurance payments forcovered loss. Such nuances can lead to a morefundamental problem for Side A cover since itmay be questionable whether specific countrieswould even permit indemnification. More andmore, the certainty of indemnification appearsto be a simplistic assumption that may actuallymiss the mark of what Side A protection canactually afford. In fact, many Side A buyers makethe determination whether to purchase theseMore and more, the certaintyof indemnification appears tobe a simplistic assumption thatmay actually miss the mark ofwhat Side A protection canactually afford.policies only by asking the question about whetherlocal laws and regulations permit indemnity. Sucha linear approach may not achieve the goal ofprotecting the personal assets of the corporation’sdirectors and officers at all. Side A coverage, ofcourse, is intended to provide insurance to protectthe personal assets of the individuals where noindemnification is available by the corporation —whether because of something as indisputable asbankruptcy or something less legitimate. Notablecountries where the law is silent on indemnificationrights yet D&O insurance can be (and is routinely)purchased by corporations on their behalf includeArgentina, Colombia, South Korea, Switzerland, UAEand the Netherlands.Conversely, and to further expand the point,many D&O underwriters believe that a French orSpanish corporation cannot use corporate assets toindemnify its directors for defence costs. However,what may not be clearly understood is that thereis no law in either country expressly prohibitinga corporation from doing so. Many sophisticatedbuyers of D&O insurance continue to purchase aEuropean Union Freedom of Services (FOS) policywith Side AB protection with the expectation thatSide A will be the only section of the policy torespond to events triggering a D&O liability.In our view, there are two additional questionscritical to the analysis: (i) whether indemnity isexpressly prohibited or restricted (and what thelimitations are to any such prohibition or restriction);and (ii) what is a director to do should thecorporation choose not to indemnify him or her fordefence costs? These may provide better guidanceas to what insurance solutions are needed.2. Using Corporate Assets To PayLitigation CostsInterestingly, Brazil, India, China and Russia –countries where many European multinationalsare building their footprints and where growth isexpected to outperform the West in the decadesahead — currently do not address the concept ofthe use of corporate assets to indemnify directorsand officers at all. In fact, these countries’ laws(and those of many others) are silent on the issue.This suggests they have acknowledged the marketacceptance of a local corporation purchasing D&Oinsurance (for instance, Brazil requires that stockcompanies disclose the limits of D&O insurancepurchased, and since 2001, Chinese law hasexpressly permitted corporations to purchaseD&O insurance under certain conditions). So,whilst the law in these countries says nothingon whether indemnification is permitted, the lawexpressly permits the purchase of insurance, andconsequently the safest route for corporationsto take to ensure their directors and officers areprotected is to buy D&O cover.Some countries’ laws give the appearance ofexpressly permitting indemnification but in factonly provide such restricted rights for companiesto indemnify that it is of little practical use to04

Client: Sample A. Client Test Date: 07/30/2002Client ID: 123-45-6789 Page 7 of 8ConstructionItemTaskRaw ScorePointsP. Construction Design 1 Reproduction of vertical lines 1 / 1Q. Construction Design 2 Reproduction of diamond in box 0 / 1R. Construction Design 3 Reproduction of square and diamond 1 / 1S. Construction Design 4 Reproduction of diamond 1 / 1T. Construction Design 5 Reproduction of square 1 / 1U. Construction Design 6 Production of recognizable1 / 1name/signatureCONST Raw Score 5 / 6CONST <strong>Scale</strong>d Score 7ConceptualizationItemTaskRaw ScorePointsV. Identities and Oddities Identifying similar and dissimilar visual 12 / 16designsW. Similarities Identifying how objects are alike; abstract 4 / 8concept formationX. Priming Inductive Reasoning Generating similar objects 3 / 3Y. Differences Identifying dissimilar verbal objects 3 / 3Z. Similarities - Multiple Choice Identifying how objects are alike in a6 / 8multiple-choice formatAB. Verbal Recall - Sentence Initiation Generate sentence using “man” and “car” 1 / 1CONCEPT Raw Score 29 / 39CONCEPT <strong>Scale</strong>d Score 5MemoryItem Task Raw ScorePointsAC. OrientationOrientation to time, day, date, and7 / 9situationAF. Verbal Recall - Reading Recall of sentence presented orally 3 / 4AG. Verbal Recall - Sentence Initiation Recall of sentence that was generated by 3 / 3the clientAI. Verbal RecognitionVerbal forced-choice recognition4 / 5memoryAK. Visual Memory Visual forced-choice recognition memory 4 / 4Memory Raw Score 21 / 25Memory <strong>Scale</strong>d Score 6

Client: Sample A. Client Test Date: 07/30/2002Client ID: 123-45-6789 Page 8 of 8End of Report