Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

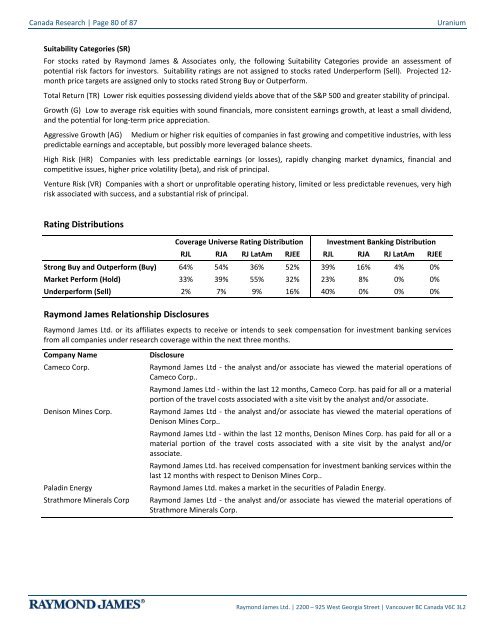

Canada Research | Page 80 of 87UraniumSuitability Categories (SR)For stocks rated by Raymond James & Associates only, the following Suitability Categories provide an assessment ofpotential risk factors for investors. Suitability ratings are not assigned to stocks rated Underperform (Sell). Projected 12-month price targets are assigned only to stocks rated Strong Buy or Outperform.Total Return (TR) Lower risk equities possessing dividend yields above that of the S&P 500 and greater stability of principal.Growth (G) Low to average risk equities with sound financials, more consistent earnings growth, at least a small dividend,and the potential for long-term price appreciation.Aggressive Growth (AG) Medium or higher risk equities of companies in fast growing and competitive industries, with lesspredictable earnings and acceptable, but possibly more leveraged balance sheets.High Risk (HR) Companies with less predictable earnings (or losses), rapidly changing market dynamics, financial andcompetitive issues, higher price volatility (beta), and risk of principal.Venture Risk (VR) Companies with a short or unprofitable operating history, limited or less predictable revenues, very highrisk associated with success, and a substantial risk of principal.Rating DistributionsCoverage Universe Rating DistributionInvestment Banking DistributionRJL RJA RJ LatAm RJEE RJL RJA RJ LatAm RJEEStrong Buy and Outperform (Buy) 64% 54% 36% 52% 39% 16% 4% 0%Market Perform (Hold) 33% 39% 55% 32% 23% 8% 0% 0%Underperform (Sell) 2% 7% 9% 16% 40% 0% 0% 0%Raymond James Relationship DisclosuresRaymond James Ltd. or its affiliates expects to receive or intends to seek compensation for investment banking servicesfrom all companies under research coverage within the next three months.Company NameCameco Corp.Denison Mines Corp.Paladin EnergyStrathmore Minerals CorpDisclosureRaymond James Ltd - the analyst and/or associate has viewed the material operations ofCameco Corp..Raymond James Ltd - within the last 12 months, Cameco Corp. has paid for all or a materialportion of the travel costs associated with a site visit by the analyst and/or associate.Raymond James Ltd - the analyst and/or associate has viewed the material operations ofDenison Mines Corp..Raymond James Ltd - within the last 12 months, Denison Mines Corp. has paid for all or amaterial portion of the travel costs associated with a site visit by the analyst and/orassociate.Raymond James Ltd. has received compensation for investment banking services within thelast 12 months with respect to Denison Mines Corp..Raymond James Ltd. makes a market in the securities of Paladin Energy.Raymond James Ltd - the analyst and/or associate has viewed the material operations ofStrathmore Minerals Corp.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Uranium Canada Research | Page 81 of 87Company NameUr-Energy Inc.Uranium One Inc.DisclosureRaymond James Ltd - the analyst and/or associate has viewed the material operations ofUr-Energy Inc..Raymond James Ltd - within the last 12 months, Ur-Energy Inc. has paid for all or a materialportion of the travel costs associated with a site visit by the analyst and/or associate.Raymond James Ltd. has provided non-investment banking securities-related serviceswithin the last 12 months with respect to Ur-Energy Inc..Raymond James Ltd. has received compensation for investment banking services within thelast 12 months with respect to Ur-Energy Inc..Raymond James Ltd. has received compensation for services other than investmentbanking within the last 12 months with respect to Ur-Energy Inc..Raymond James Ltd. makes a market in the securities of Ur-Energy Inc..Raymond James Ltd - the analyst and/or associate has viewed the material operations ofUranium One Inc..Raymond James Ltd - within the last 12 months, Uranium One Inc. has paid for all or amaterial portion of the travel costs associated with a site visit by the analyst and/orassociate.Raymond James Ltd. has provided non-investment banking securities-related serviceswithin the last 12 months with respect to Uranium One Inc..Raymond James Ltd. has received compensation for services other than investmentbanking within the last 12 months with respect to Uranium One Inc..Stock Charts, Target Prices, and Valuation MethodologiesValuation Methodology: The Raymond James methodology for assigning ratings and target prices includes a number ofqualitative and quantitative factors including an assessment of industry size, structure, business trends and overallattractiveness; management effectiveness; competition; visibility; financial condition, and expected total return, amongother factors. These factors are subject to change depending on overall economic conditions or industry- or companyspecificoccurrences.Target Prices: The information below indicates target price and rating changes for the subject companies included in thisresearch.Security Price (C$)$47.00$45.00$43.00$41.00$39.00$37.00$35.00$33.00$31.00$29.00$27.00$25.00$23.00$21.00$19.00$17.00$15.00Jul-27-09Aug-21-09Sep-18-09MP3 C$37.50Oct-16-09MP3 C$38.50MP3 C$34.00Nov-13-09Dec-11-09Jan-08-10Feb-05-10Cameco Corp. (CCO) 3 yr. Stock PerformanceMP3 C$32.30MP3 C$27.00Mar-05-10Apr-02-10Apr-30-10May-28-10Jun-25-10Jul-23-10Aug-20-10MP3 C$30.00Sep-17-10MP3 C$33.00Oct-15-10MP3 C$37.20Price Rating Change Target Price ChangeCoverage Suspended Target Price and Rating Change Split AdjustmentNov-12-10Dec-10-10Jan-06-11Feb-03-11MP3 C$35.10Mar-01-11Mar-26-11Date: July 23 2012MO2 C$35.10MO2 C$33.50Apr-22-11May-19-11Jun-16-11MO2 C$32.20 MO2 C$30.50Jul-14-11Aug-09-11Sep-03-11MO2 C$29.50Oct-01-11Oct-28-11Nov-22-11UR URAnalyst Recommendations & 12 Month Price ObjectiveSB1: Strong Buy MO2: OutperformMP3: Market Perform MU4: UnderperformNR : Not Rated R: RestrictedDec-20-11Jan-17-12Feb-14-12Mar-14-12Apr-12-12May-10-12Jun-06-12Jul-05-12UpdateDateClosingPriceTargetPriceRatingDec-08-11 19.01 UR URNov-08-11 20.64 29.50 2Nov-02-11 21.36 30.50 2Aug-05-11 23.76 32.20 2May-06-11 27.68 33.50 2Apr-15-11 26.92 35.10 2Mar-16-11 32.07 35.10 3Dec-07-10 38.28 37.20 3Nov-25-10 38.18 33.00 3Oct-25-10 31.58 30.00 3Apr-09-10 27.63 27.00 3Mar-03-10 28.10 32.30 3Dec-09-09 31.32 34.00 3Dec-04-09 32.65 38.50 3Nov-23-09 31.42 37.50 3Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2

- Page 30 and 31: Canada Research | Page 30 of 87Uran

- Page 32 and 33: Canada Research | Page 32 of 87Uran

- Page 34 and 35: Canada Research | Page 34 of 87Uran

- Page 36 and 37: Canada Research | Page 36 of 87Uran

- Page 38 and 39: Canada Research | Page 38 of 87Uran

- Page 40 and 41: Canada Research | Page 40 of 87Uran

- Page 42 and 43: Canada Research | Page 42 of 87Uran

- Page 44 and 45: Canada Research | Page 44 of 87Uran

- Page 46 and 47: Canada Research | Page 46 of 87Uran

- Page 48 and 49: Canada Research | Page 48 of 87Uran

- Page 50 and 51: Canada Research | Page 50 of 87Uran

- Page 52 and 53: Canada Research | Page 52 of 87Uran

- Page 54 and 55: Canada Research | Page 54 of 87Uran

- Page 56 and 57: Canada Research | Page 56 of 87Uran

- Page 58 and 59: Canada Research | Page 58 of 87Uran

- Page 60 and 61: Canada Research | Page 60 of 87Uran

- Page 62 and 63: Canada Research | Page 62 of 87Uran

- Page 64 and 65: Canada Research | Page 64 of 87Uran

- Page 66 and 67: Canada Research | Page 66 of 87Uran

- Page 68 and 69: Canada Research | Page 68 of 87Uran

- Page 70 and 71: Canada Research | Page 70 of 87Uran

- Page 72 and 73: Canada Research | Page 72 of 87Uran

- Page 74 and 75: Canada Research | Page 74 of 87Uran

- Page 76 and 77: Canada Research | Page 76 of 87Uran

- Page 78 and 79: Canada Research | Page 78 of 87Uran

- Page 82 and 83: Canada Research | Page 82 of 87Uran

- Page 84 and 85: Canada Research | Page 84 of 87Uran

- Page 86 and 87: Canada Research | Page 86 of 87Uran

Canada Research | Page 80 of 87<strong>Uranium</strong>Suitability Categories (SR)For stocks rated by Raymond James & Associates only, the following Suitability Categories provide an assessment ofpotential risk factors for investors. Suitability ratings are not assigned to stocks rated Underperform (Sell). Projected 12-month price targets are assigned only to stocks rated Strong Buy or Outperform.Total Return (TR) Lower risk equities possessing dividend yields above that of the S&P 500 <strong>and</strong> greater stability of principal.Growth (G) Low to average risk equities with sound financials, more consistent earnings growth, at least a small dividend,<strong>and</strong> the potential for long-term price appreciation.Aggressive Growth (AG) Medium or higher risk equities of companies in fast growing <strong>and</strong> competitive industries, with lesspredictable earnings <strong>and</strong> acceptable, but possibly more leveraged balance sheets.High Risk (HR) Companies with less predictable earnings (or losses), rapidly changing market dynamics, financial <strong>and</strong>competitive issues, higher price volatility (beta), <strong>and</strong> risk of principal.Venture Risk (VR) Companies with a short or unprofitable operating history, limited or less predictable revenues, very highrisk associated with success, <strong>and</strong> a substantial risk of principal.Rating DistributionsCoverage Universe Rating DistributionInvestment Banking DistributionRJL RJA RJ LatAm RJEE RJL RJA RJ LatAm RJEEStrong Buy <strong>and</strong> Outperform (Buy) 64% 54% 36% 52% 39% 16% 4% 0%Market Perform (Hold) 33% 39% 55% 32% 23% 8% 0% 0%Underperform (Sell) 2% 7% 9% 16% 40% 0% 0% 0%Raymond James Relationship DisclosuresRaymond James Ltd. or its affiliates expects to receive or intends to seek compensation for investment banking servicesfrom all companies under research coverage within the next three months.Company NameCameco Corp.Denison Mines Corp.Paladin EnergyStrathmore Minerals CorpDisclosureRaymond James Ltd - the analyst <strong>and</strong>/or associate has viewed the material operations ofCameco Corp..Raymond James Ltd - within the last 12 months, Cameco Corp. has paid for all or a materialportion of the travel costs associated with a site visit by the analyst <strong>and</strong>/or associate.Raymond James Ltd - the analyst <strong>and</strong>/or associate has viewed the material operations ofDenison Mines Corp..Raymond James Ltd - within the last 12 months, Denison Mines Corp. has paid for all or amaterial portion of the travel costs associated with a site visit by the analyst <strong>and</strong>/orassociate.Raymond James Ltd. has received compensation for investment banking services within thelast 12 months with respect to Denison Mines Corp..Raymond James Ltd. makes a market in the securities of Paladin Energy.Raymond James Ltd - the analyst <strong>and</strong>/or associate has viewed the material operations ofStrathmore Minerals Corp.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2