Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

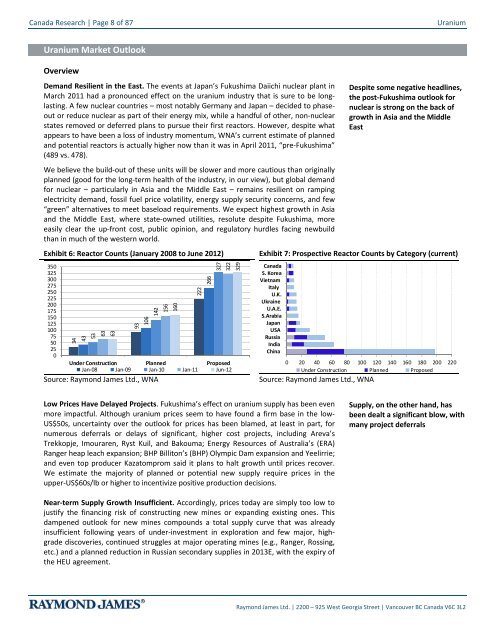

Canada Research | Page 8 of 87UraniumUranium Market OutlookOverviewDemand Resilient in the East. The events at Japan’s Fukushima Daiichi nuclear plant inMarch 2011 had a pronounced effect on the uranium industry that is sure to be longlasting.A few nuclear countries – most notably Germany and Japan – decided to phaseoutor reduce nuclear as part of their energy mix, while a handful of other, non-nuclearstates removed or deferred plans to pursue their first reactors. However, despite whatappears to have been a loss of industry momentum, WNA’s current estimate of plannedand potential reactors is actually higher now than it was in April 2011, “pre-Fukushima”(489 vs. 478).We believe the build-out of these units will be slower and more cautious than originallyplanned (good for the long-term health of the industry, in our view), but global demandfor nuclear – particularly in Asia and the Middle East – remains resilient on rampingelectricity demand, fossil fuel price volatility, energy supply security concerns, and few“green” alternatives to meet baseload requirements. We expect highest growth in Asiaand the Middle East, where state-owned utilities, resolute despite Fukushima, moreeasily clear the up-front cost, public opinion, and regulatory hurdles facing newbuildthan in much of the western world.Exhibit 6: Reactor Counts (January 2008 to June 2012)3503253002752502252001751501251007550250344353636393106142156160222266327322Under Construction Planned ProposedJan-08 Jan-09 Jan-10 Jan-11 Jun-12Source: Raymond James Ltd., WNA329Exhibit 7: Prospective Reactor Counts by Category (current)CanadaS. KoreaVietnamItalyU.K.UkraineU.A.E.S.ArabiaJapanUSARussiaIndiaChina0 20 40 60 80 100 120 140 160 180 200 220Under Construction Planned ProposedSource: Raymond James Ltd., WNADespite some negative headlines,the post-Fukushima outlook fornuclear is strong on the back ofgrowth in Asia and the MiddleEastLow Prices Have Delayed Projects. Fukushima’s effect on uranium supply has been evenmore impactful. Although uranium prices seem to have found a firm base in the low-US$50s, uncertainty over the outlook for prices has been blamed, at least in part, fornumerous deferrals or delays of significant, higher cost projects, including Areva’sTrekkopje, Imouraren, Ryst Kuil, and Bakouma; Energy Resources of Australia’s (ERA)Ranger heap leach expansion; BHP Billiton’s (BHP) Olympic Dam expansion and Yeelirrie;and even top producer Kazatomprom said it plans to halt growth until prices recover.We estimate the majority of planned or potential new supply require prices in theupper-US$60s/lb or higher to incentivize positive production decisions.Supply, on the other hand, hasbeen dealt a significant blow, withmany project deferralsNear-term Supply Growth Insufficient. Accordingly, prices today are simply too low tojustify the financing risk of constructing new mines or expanding existing ones. Thisdampened outlook for new mines compounds a total supply curve that was alreadyinsufficient following years of under-investment in exploration and few major, highgradediscoveries, continued struggles at major operating mines (e.g., Ranger, Rossing,etc.) and a planned reduction in Russian secondary supplies in 2013E, with the expiry ofthe HEU agreement.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Uranium Canada Research | Page 9 of 87Outlook Bullish. We therefore remain decidedly bullish on the supply-demandfundamentals in the uranium space, projecting a three-year long deficit beginning in2014E. Our supply-demand model reflects what we believe is the most likely scenariofor the industry over the next 18 years. Below, we highlight several themes that are fluidin nature and difficult to forecast, but could have a meaningful effect (for better or forworse) on this outlook.A looming three-year supplydeficit underpins our bullishoutlook on uranium pricesSupply-Demand ThemesKazakh Supply Growth. Since the early 2000s, Kazakhstan has been the shining star ofthe uranium mining industry. From 2004A to 2011A, while primary supply in the rest ofthe world dropped by 7 Mlbs/year (to 88 Mlbs in 2011A), Kazakhstan’s rose by 42Mlbs/year (to 50 Mlbs) – a 29% CAGR. A critical question for future uranium prices iswhether the country is able and willing to continue this growth. Comments from Kazakhofficials in October 2011 and February 2012 suggest, at most, 52 Mlbs/year in 2012(implying only 2 Mlbs/year more than 2011A) in order to support uranium prices.Kazatomprom CEO Vladimir Shkolnik, in seemingly contradictory fashion, still targets 65Mlbs/year in 2015, implying 30% growth in three years. Regardless of how thesecomments are interpreted, producer discipline, challenging sulphuric acid logistics, andthe lower grades, increasing depth and carbonate levels of new southern regiondeposits, each suggest the days of easy, meteoric production growth may be behindKazakhstan. We bias towards the conservative, and model continued ramp-up in thecountry, including 54 Mlbs in 2012E and 57 Mlbs in 2013E, plateauing at 64 Mlbs/yearby 2015E.German Inventory Selling. In March 2011, Germany immediately shut down eight (8.4GW) of its 17 operating nuclear reactors and made plans to shut the remaining nine(12.6 GW) by 2022. These units represented about 5% of global output and uraniumconsumption prior to Fukushima. We estimate the utilities hold ~9 Mlbs – 18 Mlbs ininventory (assuming WNA’s burn rate in April 2011 and one to two years supply onhand). What will happen to this material? We see immediate market disposition of largeamounts (and the consequent downward pressure on prices) as unlikely in the nearterm.Utilities will still need ~4 Mlbs – 5 Mlbs/year to keep the remaining nine unitsrunning and may even hold out some hope that policy flips back; recall, Germany’snuclear policy has now switched between ‘life extensions’ and ‘near/medium-termshutdowns’ five times since 1986; the prospect of higher electricity prices has alsospurred some industrial users (e.g., pharmaceutical giant Bayer) to consider relocatingproduction. Our model reflects the government’s current phase-out plan and we see ameasured approach to inventory divestment as shutdowns loom in the latter half of thedecade.Further Production Slips. We believe mine supply disruption will continue to be animportant theme. The effect on prices cannot be understated, with events such asflooding at Cigar Lake in 2006 resulting, in part, to a doubling of the price that year(from US$36/lb to US$72/lb). More recently, three of the world’s largest mines havemissed guidance – Olympic Dam (shaft damage from accident), Ranger (flooding) andRössing (flooding, disappointing grades) – and numerous smaller ones havedisappointed on ramp-up rates and start-up timelines. As a result, global 2011Aproduction was -1% y/y. Kazakhstan has been able to muffle the impact, but we nowview further Kazakh growth as uncertain, as outlined above. With 53% of 2012E primarysupply coming from only 10 mines, we see supply as highly centralized and vulnerable.Kazakh growth has been meteoric,but similar increases in the futureare doubtfulWe expect German utilities to siton the majority of their inventoryfor the next few yearsSlips in highly centralized minesupply could again play a key rolein the direction of uranium pricesRaymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2

- Page 1 and 2: Mining & Natural ResourcesDavid Sad

- Page 3 and 4: Uranium Canada Research | Page 3 of

- Page 5 and 6: Uranium Canada Research | Page 5 of

- Page 7: Uranium Canada Research | Page 7 of

- Page 11 and 12: Uranium Canada Research | Page 11 o

- Page 13 and 14: Uranium Canada Research | Page 13 o

- Page 15 and 16: Uranium Canada Research | Page 15 o

- Page 17 and 18: Uranium Canada Research | Page 17 o

- Page 19 and 20: Uranium Canada Research | Page 19 o

- Page 21 and 22: Uranium Canada Research | Page 21 o

- Page 24 and 25: Canada Research | Page 24 of 87Uran

- Page 26: Canada Research | Page 26 of 87Uran

- Page 30 and 31: Canada Research | Page 30 of 87Uran

- Page 32 and 33: Canada Research | Page 32 of 87Uran

- Page 34 and 35: Canada Research | Page 34 of 87Uran

- Page 36 and 37: Canada Research | Page 36 of 87Uran

- Page 38 and 39: Canada Research | Page 38 of 87Uran

- Page 40 and 41: Canada Research | Page 40 of 87Uran

- Page 42 and 43: Canada Research | Page 42 of 87Uran

- Page 44 and 45: Canada Research | Page 44 of 87Uran

- Page 46 and 47: Canada Research | Page 46 of 87Uran

- Page 48 and 49: Canada Research | Page 48 of 87Uran

- Page 50 and 51: Canada Research | Page 50 of 87Uran

- Page 52 and 53: Canada Research | Page 52 of 87Uran

- Page 54 and 55: Canada Research | Page 54 of 87Uran

- Page 56 and 57: Canada Research | Page 56 of 87Uran

Canada Research | Page 8 of 87<strong>Uranium</strong><strong>Uranium</strong> Market OutlookOverviewDem<strong>and</strong> Resilient in the East. The events at Japan’s Fukushima Daiichi nuclear plant inMarch 2011 had a pronounced effect on the uranium industry that is sure to be longlasting.A few nuclear countries – most notably Germany <strong>and</strong> Japan – decided to phaseoutor reduce nuclear as part of their energy mix, while a h<strong>and</strong>ful of other, non-nuclearstates removed or deferred plans to pursue their first reactors. However, despite whatappears to have been a loss of industry momentum, WNA’s current estimate of planned<strong>and</strong> potential reactors is actually higher now than it was in April 2011, “pre-Fukushima”(489 vs. 478).We believe the build-out of these units will be slower <strong>and</strong> more cautious than originallyplanned (good for the long-term health of the industry, in our view), but global dem<strong>and</strong>for nuclear – particularly in Asia <strong>and</strong> the Middle East – remains resilient on rampingelectricity dem<strong>and</strong>, fossil fuel price volatility, energy supply security concerns, <strong>and</strong> few“green” alternatives to meet baseload requirements. We expect highest growth in Asia<strong>and</strong> the Middle East, where state-owned utilities, resolute despite Fukushima, moreeasily clear the up-front cost, public opinion, <strong>and</strong> regulatory hurdles facing newbuildthan in much of the western world.Exhibit 6: Reactor Counts (January 2008 to June 2012)3503253002752502252001751501251007550250344353636393106142156160222266327322Under Construction Planned ProposedJan-08 Jan-09 Jan-10 Jan-11 Jun-12Source: Raymond James Ltd., WNA329Exhibit 7: Prospective Reactor Counts by Category (current)CanadaS. KoreaVietnamItalyU.K.UkraineU.A.E.S.ArabiaJapanUSARussiaIndiaChina0 20 40 60 80 100 120 140 160 180 200 220Under Construction Planned ProposedSource: Raymond James Ltd., WNADespite some negative headlines,the post-Fukushima outlook fornuclear is strong on the back ofgrowth in Asia <strong>and</strong> the MiddleEastLow Prices Have Delayed Projects. Fukushima’s effect on uranium supply has been evenmore impactful. Although uranium prices seem to have found a firm base in the low-US$50s, uncertainty over the outlook for prices has been blamed, at least in part, fornumerous deferrals or delays of significant, higher cost projects, including Areva’sTrekkopje, Imouraren, Ryst Kuil, <strong>and</strong> Bakouma; Energy Resources of Australia’s (ERA)Ranger heap leach expansion; BHP Billiton’s (BHP) Olympic Dam expansion <strong>and</strong> Yeelirrie;<strong>and</strong> even top producer Kazatomprom said it plans to halt growth until prices recover.We estimate the majority of planned or potential new supply require prices in theupper-US$60s/lb or higher to incentivize positive production decisions.<strong>Supply</strong>, on the other h<strong>and</strong>, hasbeen dealt a significant blow, withmany project deferralsNear-term <strong>Supply</strong> Growth Insufficient. Accordingly, prices today are simply too low tojustify the financing risk of constructing new mines or exp<strong>and</strong>ing existing ones. Thisdampened outlook for new mines compounds a total supply curve that was alreadyinsufficient following years of under-investment in exploration <strong>and</strong> few major, highgradediscoveries, continued struggles at major operating mines (e.g., Ranger, Rossing,etc.) <strong>and</strong> a planned reduction in Russian secondary supplies in 2013E, with the expiry ofthe HEU agreement.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2